- Daily Chartbook

- Posts

- DC Lite #541

DC Lite #541

Retail flows into single stocks this week were the weakest in at least 2 years

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. GDP. "US Real GDP came in at a 1.4% annualized growth rate in Q4 2025. Consumption & investment increased, net exports rose, and government output shrank. Nominal GDP growth (unadjusted for inflation) came in at 5.1% annualized".

2. PCE. "Take out housing and financial imputations, and core services inflation has been tenaciously above 2018/19 norms (right). Add in core goods, and it's now the highest non-pandemic read since at least 2000 (left)."

3. SCOTUS vs. tariffs. "With the Supreme Court ruling the IEEPA tariffs imposed by President Trump illegal, the administration now faces up to $170B in potential tariff refunds. Over 1,500 companies have already filed trade court claims to secure their place in line."

4. Crude oil futures. "The entire decline off the recent highs stopped almost precisely at the 61.8% retracement of the rally from the COVID-19 lows ... Now look at momentum. Weekly RSI never reached oversold conditions during the decline. That's classic bullish regime behavior."

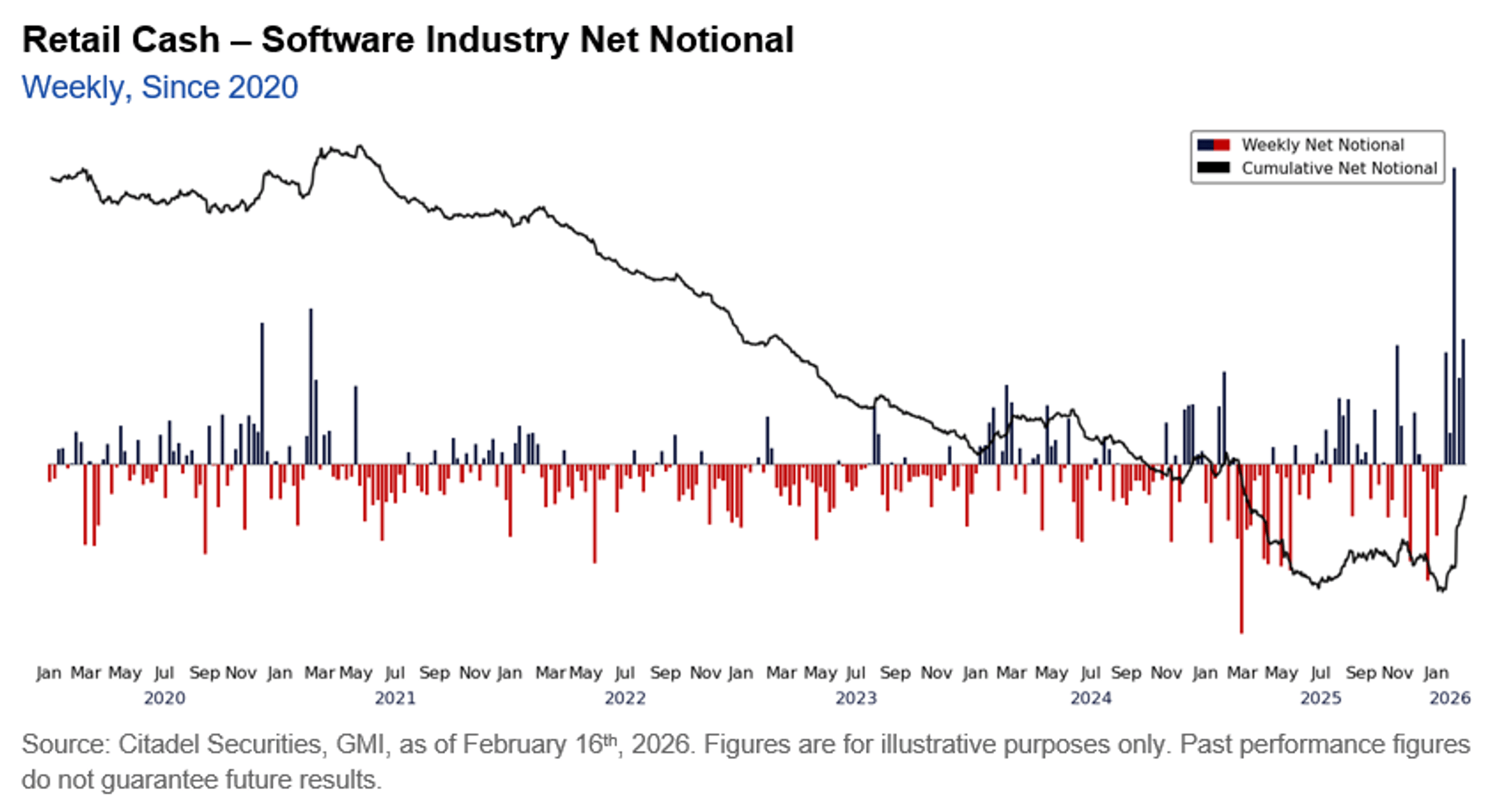

5. Retail flows. According to Vanda, retail flows into single stocks this week were the weakest in at least 2 years.

Reply