- Daily Chartbook

- Posts

- DC Lite #539

DC Lite #539

"Retail investors have leaned aggressively into the weakness"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Global growth outlook. "The breadth in global consensus GDP growth forecasts is still improving, global manufacturing and services PMIs strengthened in January and global export volumes are making new highs, while Taiwanese and Korean exports are surging".

2. Landing scenarios. The share of fund managers expecting "no landing" crossed above 50% for the first time since BofA started asking the question in 2023.

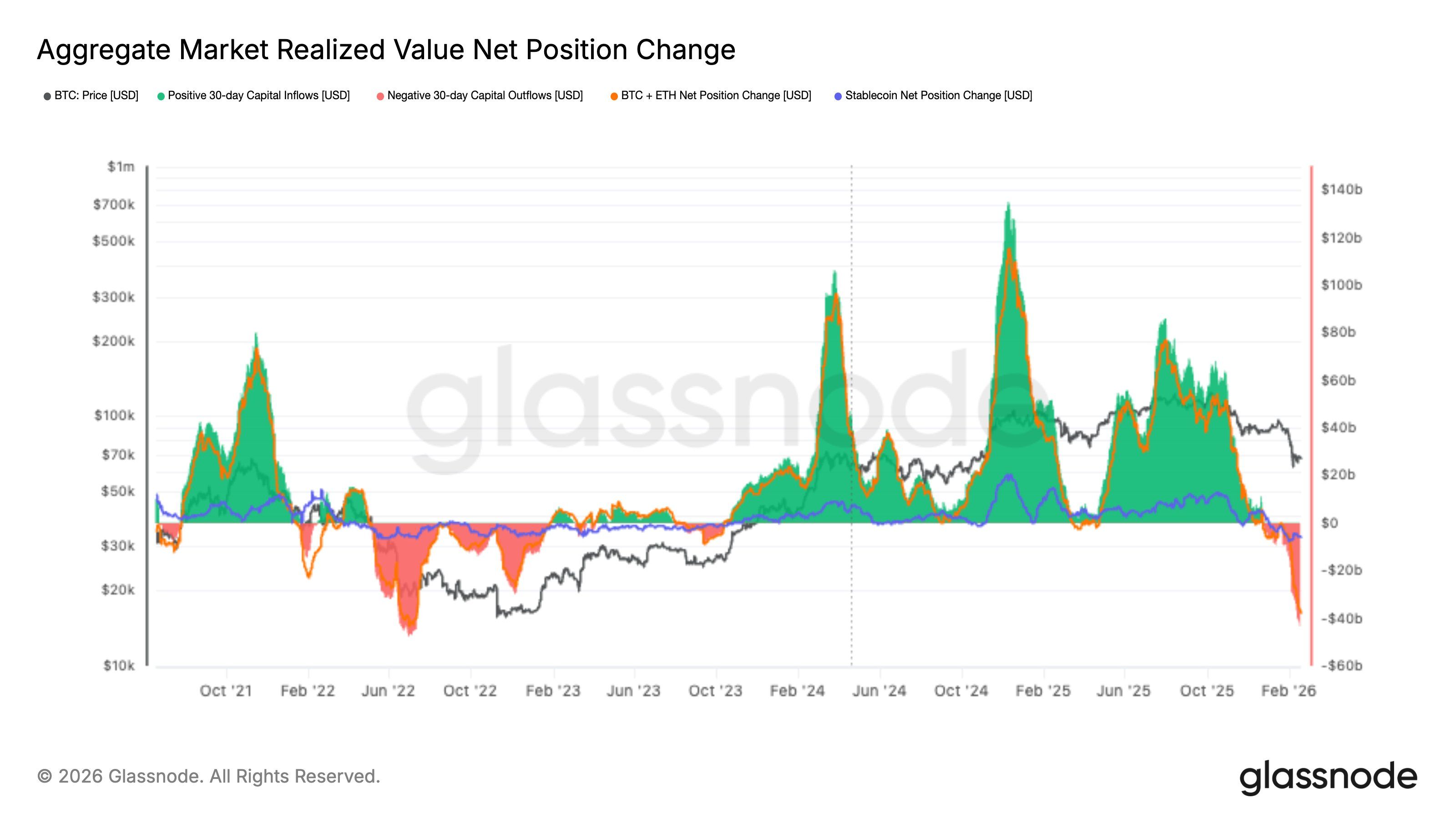

3. Crypto flows. "Crypto sees biggest outflow since 2022. Money is leaving the market at one of the fastest rates since the last bear market."

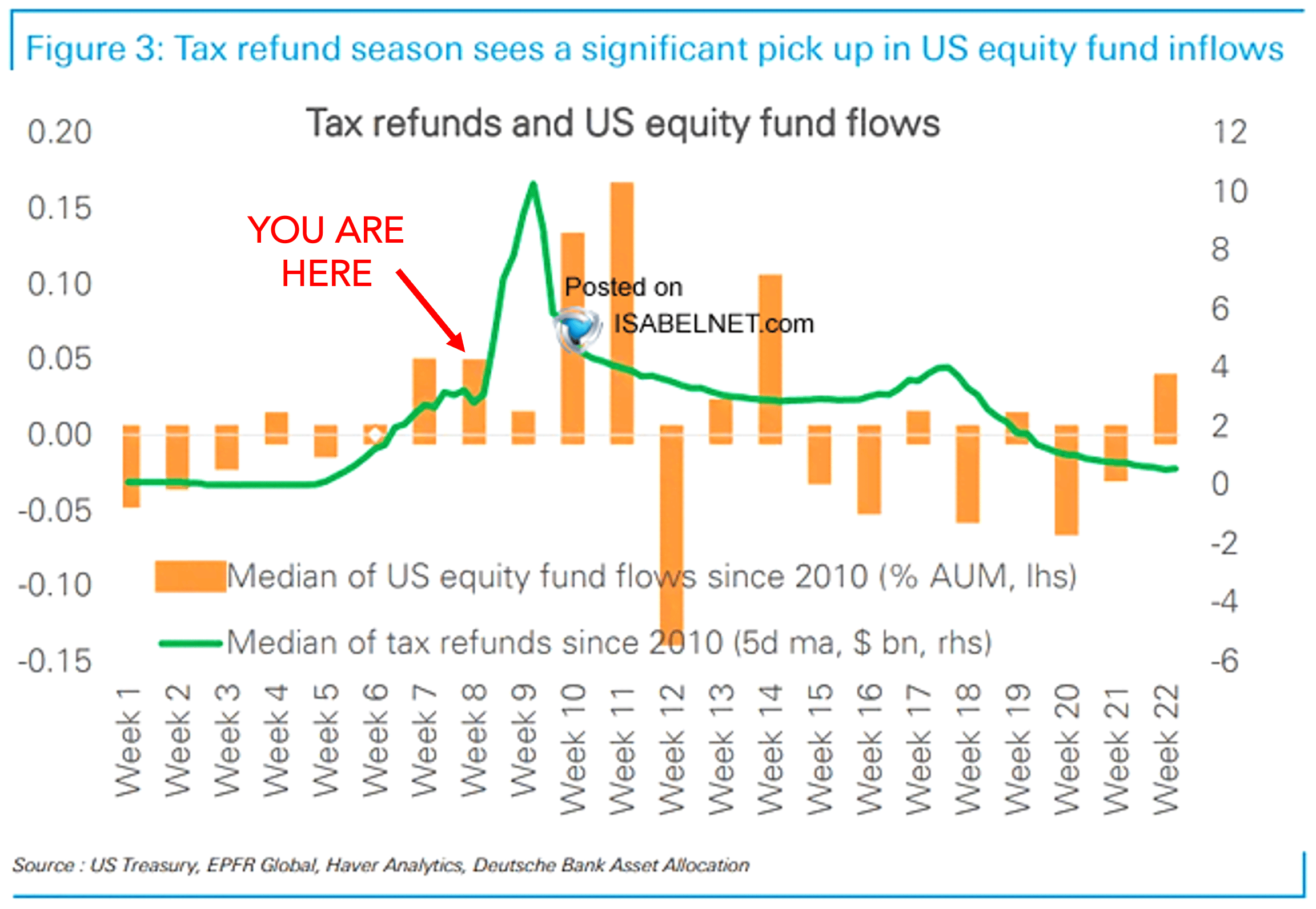

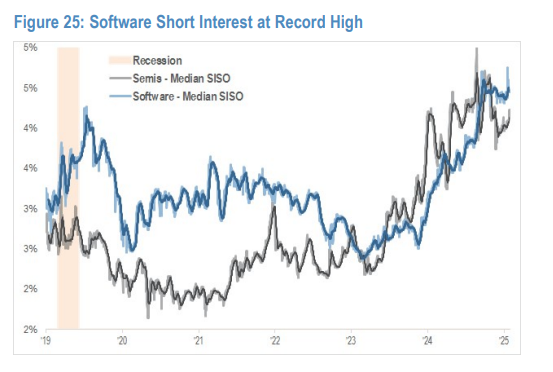

4. Retail vs. Software. "Retail investors have leaned aggressively into the weakness ... buying has reached historically extreme levels. The magnitude of recent inflows already amounts to roughly two-thirds of the total net flow seen across all of 2025 - despite that year ultimately ending with retail as a strong net seller of the group."

5. Irrational exuberance vs. ChatGPT launch. "Earnings-led, unlike then."

Reply