- Daily Chartbook

- Posts

- DC Lite #535

DC Lite #535

"The market has by no means 'relaxed'"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

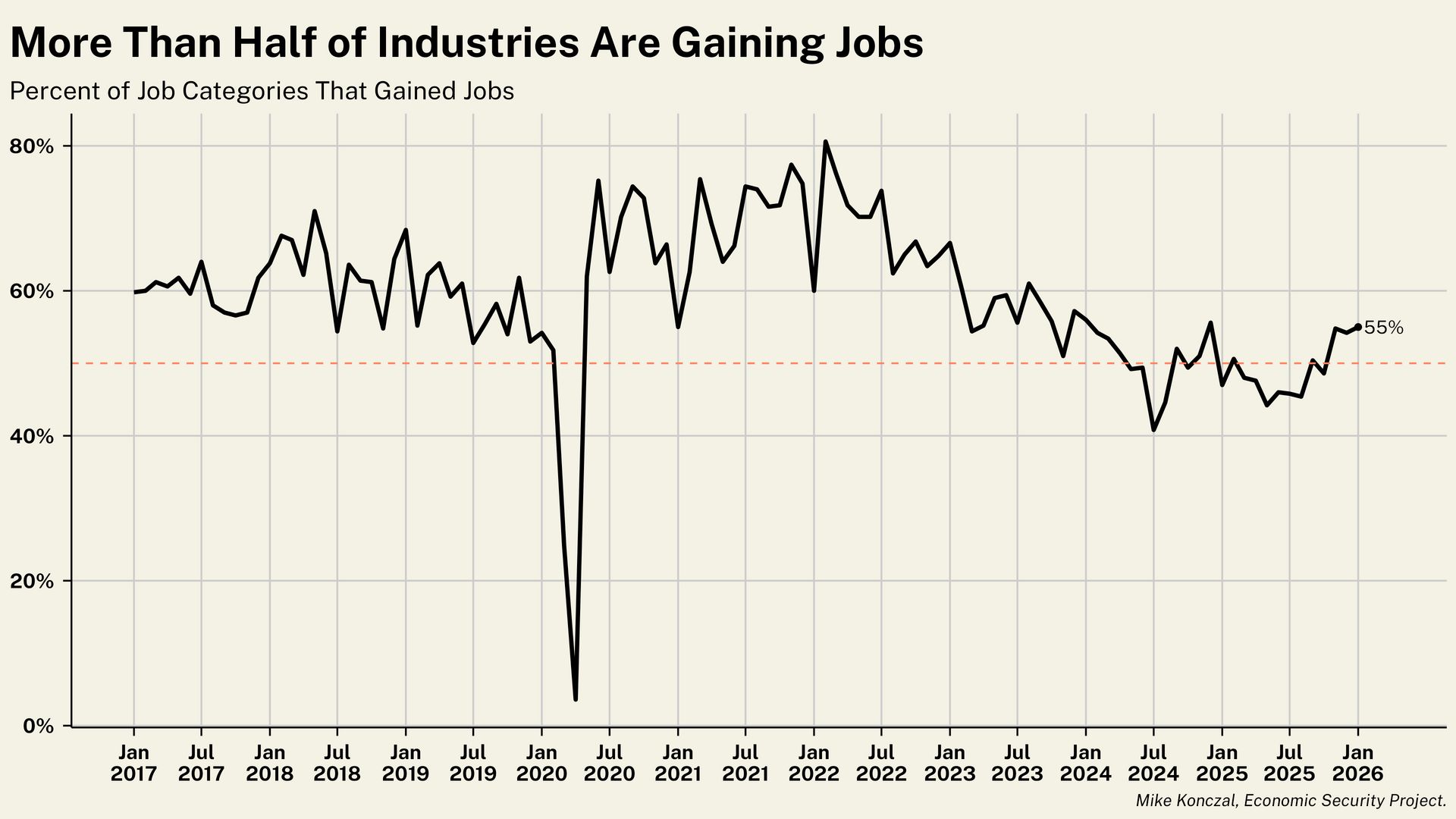

1. NFP. "I watch the diffusion index, the percent of ~250 subindustries that are adding jobs, which was worrying at or below half in 2025. It has had a good few months now. So that's legitimately encouraging."

2. NFP revisions. "Payroll gains for 2025 have been revised down to +181k ... in the full history of payroll data, the only year that has been weaker when it comes to gains is 2003".

3. Unemployment rate. The unemployment rate ticked down to 4.3%. Meanwhile, the prime age participation rate jumped to the highest since 2001.

4. Nasdaq skew. "The market has by no means 'relaxed'. Other pockets continue to show signs of fear and stress - take Nasdaq put-call skew for example... Even with the rally from the recent lows, put-call skew is still near levels not seen since the liberation day drawdown last year."

5. SPX vs. SPW. "From the introduction of ChatGPT in November 2022 through the end of last year, the equal-weight index trailed the S&P 500 by an unusual 41 percentage points. There was a 49-point lag between the beginning of 1997 and the peak of the tech bubble in March 2000-a similar length of time."

Reply