- Daily Chartbook

- Posts

- DC Lite #537

DC Lite #537

"US exceptionalism is turning into global rebalancing"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. CPI. "All of the services factors that drove pandemic CPI inflation have receded back to historical norms, maybe even a bit below. All of the excess 12-month CPI inflation as of January is being fueled by higher-than-normal price growth in core goods."

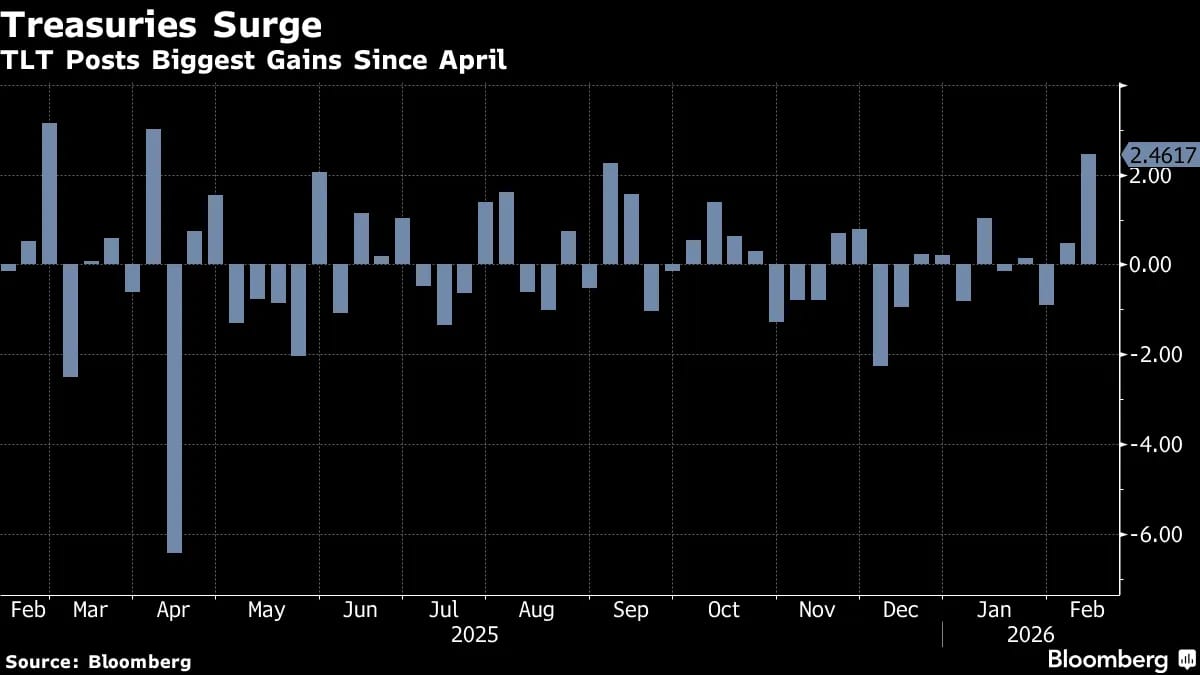

2. TLT. "I think it's notable that for the first time in awhile, people are piling back into Treasuries as a safe haven play. The popular TLT Treasury ETF is having its best week since the violent market reactions around Liberation Day last April."

3. DM YTD flows. "US exceptionalism is turning into global rebalancing ... Stock funds in Europe, Japan and other international developed markets have drawn $104 billion this year vs the $25 billion that's flowed into US funds."

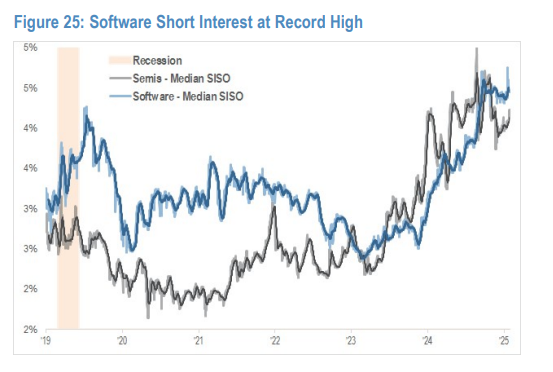

4. Hedge funds vs. Mag 7. "Positioning across the Mag 7 trade is at all-time highs-which suggests that the incremental buyer might not have much dry powder left".

5. SPX revenue growth. While the S&P 500 is reporting the strongest revenue growth since Q3'22 thus far in Q4, analyst expect a deceleration in 2026.

Reply