- Daily Chartbook

- Posts

- DC Lite #536

DC Lite #536

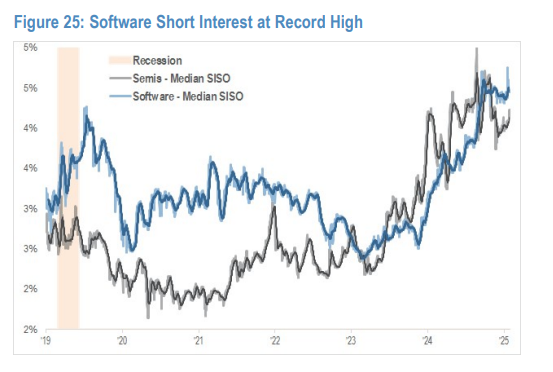

"Tech sector $XLK Short Interest is at the highest level of this decade"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Correlation switch. "You'd think yesterday's upside surprise and the rise in 2-year yield would lift the Dollar, but that didn't happen ... I see this as a sign that we're on our way to the correlation switch, whereby the Fed is seen as increasingly politicized, causing markets to sell the Dollar on strong data."

2. AAII Sentiment Survey. "Even though the S&P 500 has been flat over the past month, the AAII Bull-Bear Spread just saw its biggest 4-week drop in almost a year."

3. EM flows. "In January, non-resident portfolio flows into EM assets, including equities and debt, climbed to nearly $100 billion. That's the second highest in the last two decades, topped only by one month post-Covid reopening in 2021 ... A year ago, inflows were only $16.2 billion."

4. Tech shorts. "Tech sector $XLK Short Interest is at the highest level of this decade. Short-tech and software is a crowded trade".

5. Sector leadership. "A broadening market is positive. But, leadership is transitioning to an unhealthy place (Energy and Staples). Tech, Comm Services, Financials must get back into gear."

Reply