- Daily Chartbook

- Posts

- DC Lite #498

DC Lite #498

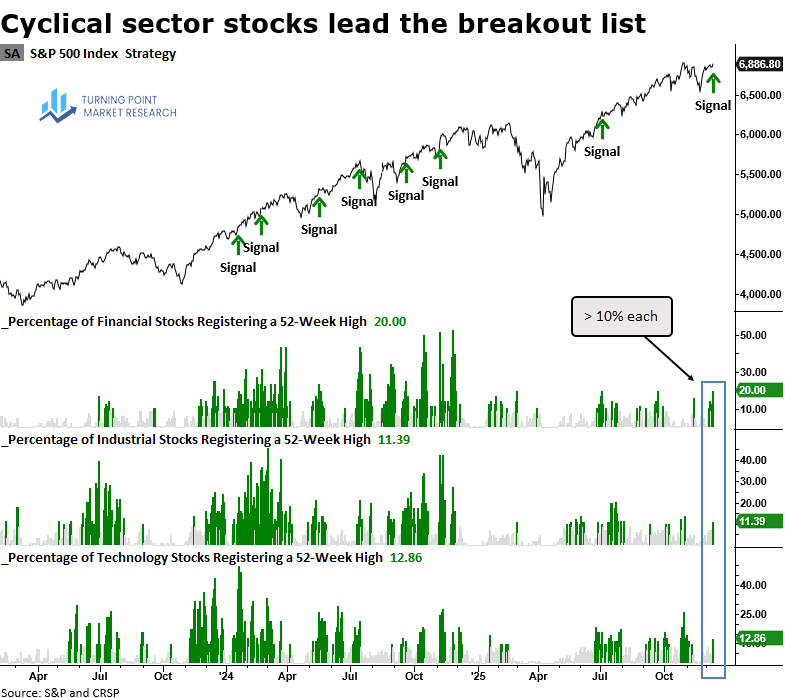

"Cyclical sectors are leading the breakout list"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

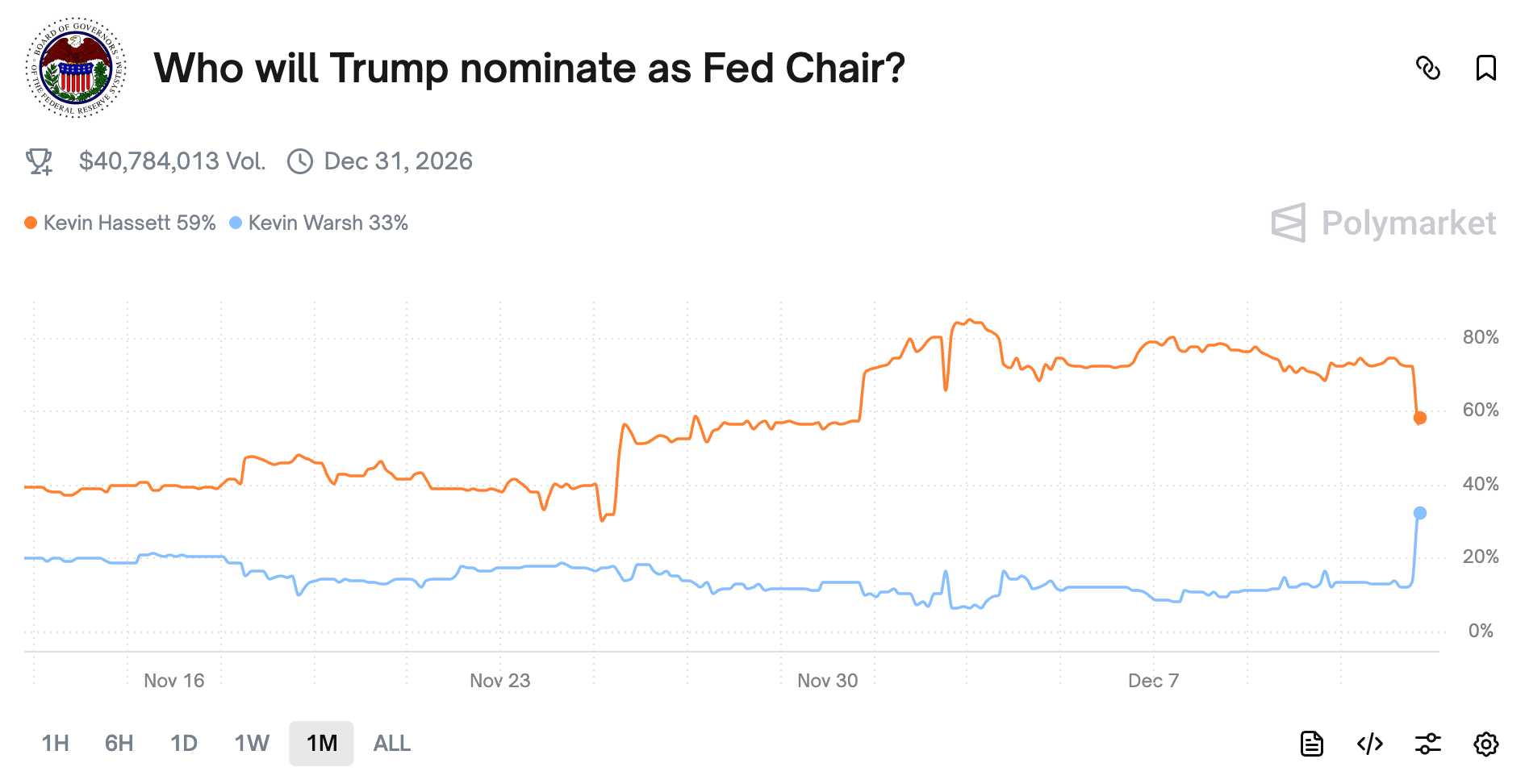

1. Next Fed chair. Following comments from Jamie Dimon ("Warsh would make a great chairman") and President Trump (”I think the two Kevins are great”), betting markets no longer see Hassett as a done deal.

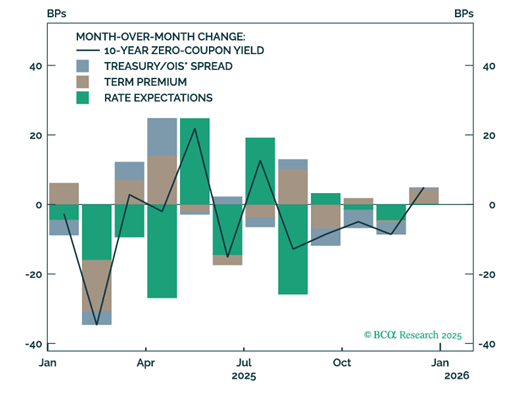

2. Hassett premium. “The 10-year is struggling with the "Hassett premium." The bond market may require a sacrifice at the altar of CB independence... even if I think that's kind of unfair to Hassett.”

3. Cyclicals breakout. "Cyclical sectors are leading the breakout list. For the first time since July, financials, industrials, and technology simultaneously saw at least 10% of their stocks hit 52-week highs."

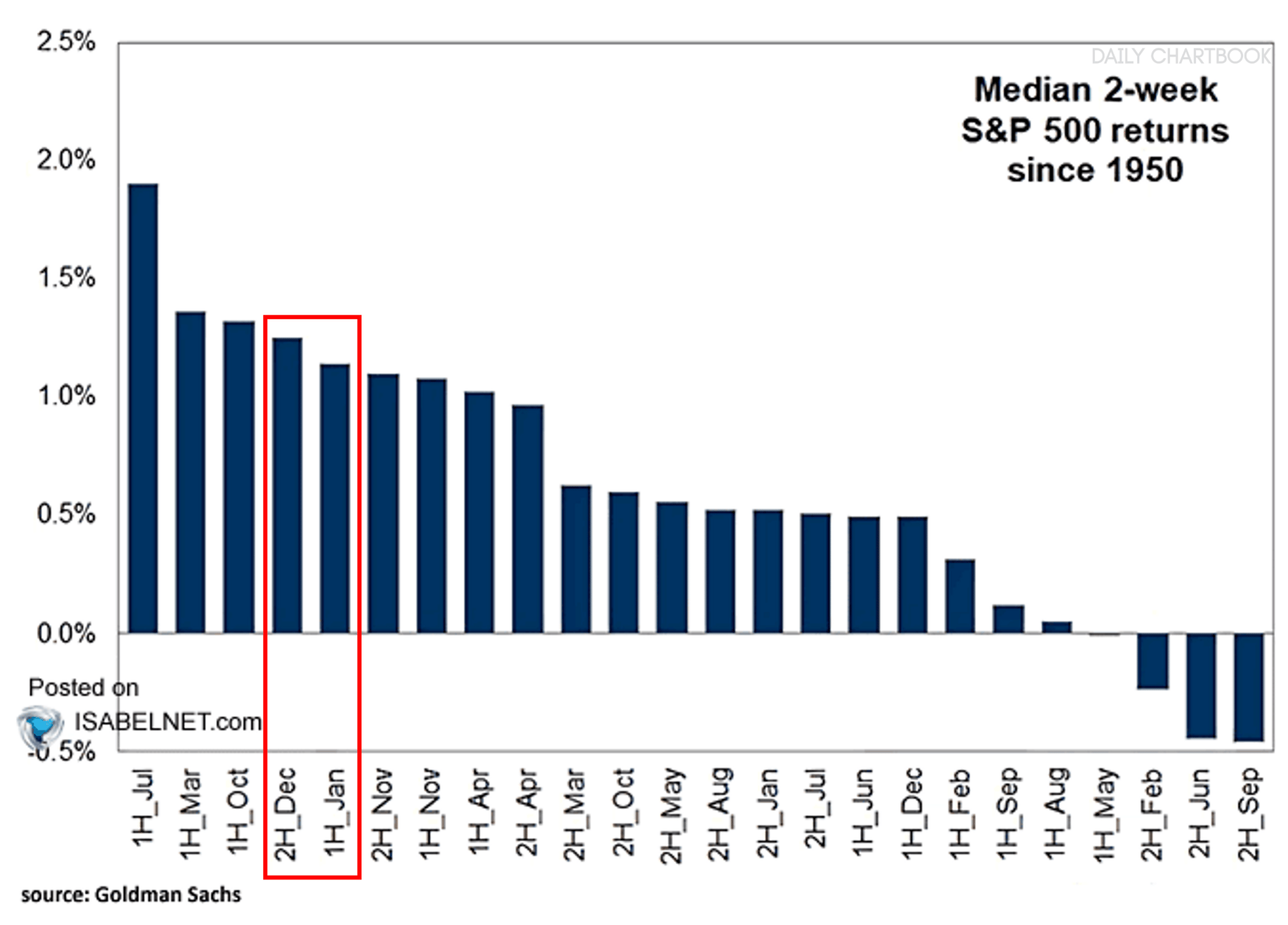

4. Seasonality. The second half of December ranks as the fourth-best half-month period of the year. The first half of January ranks fifth.

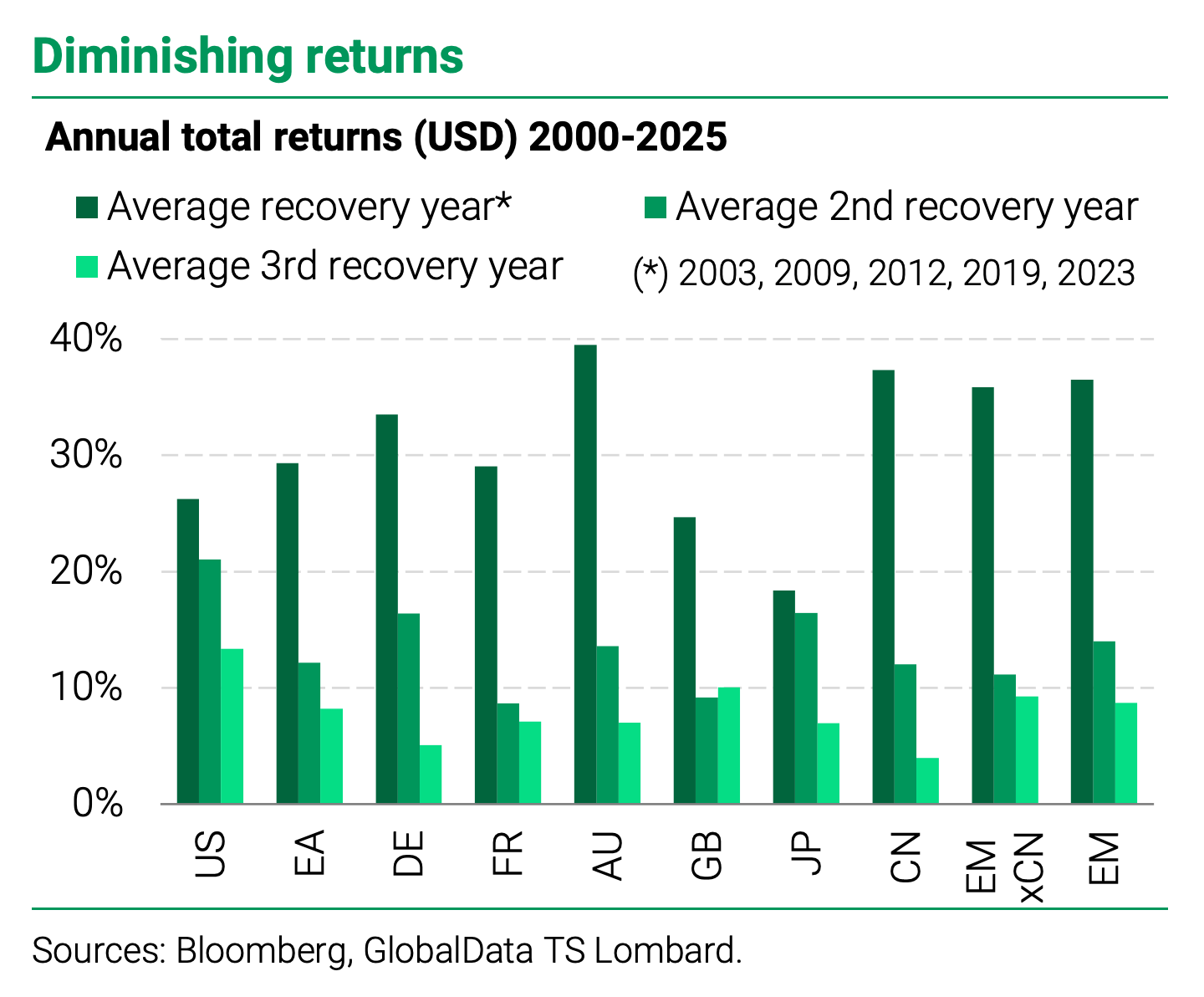

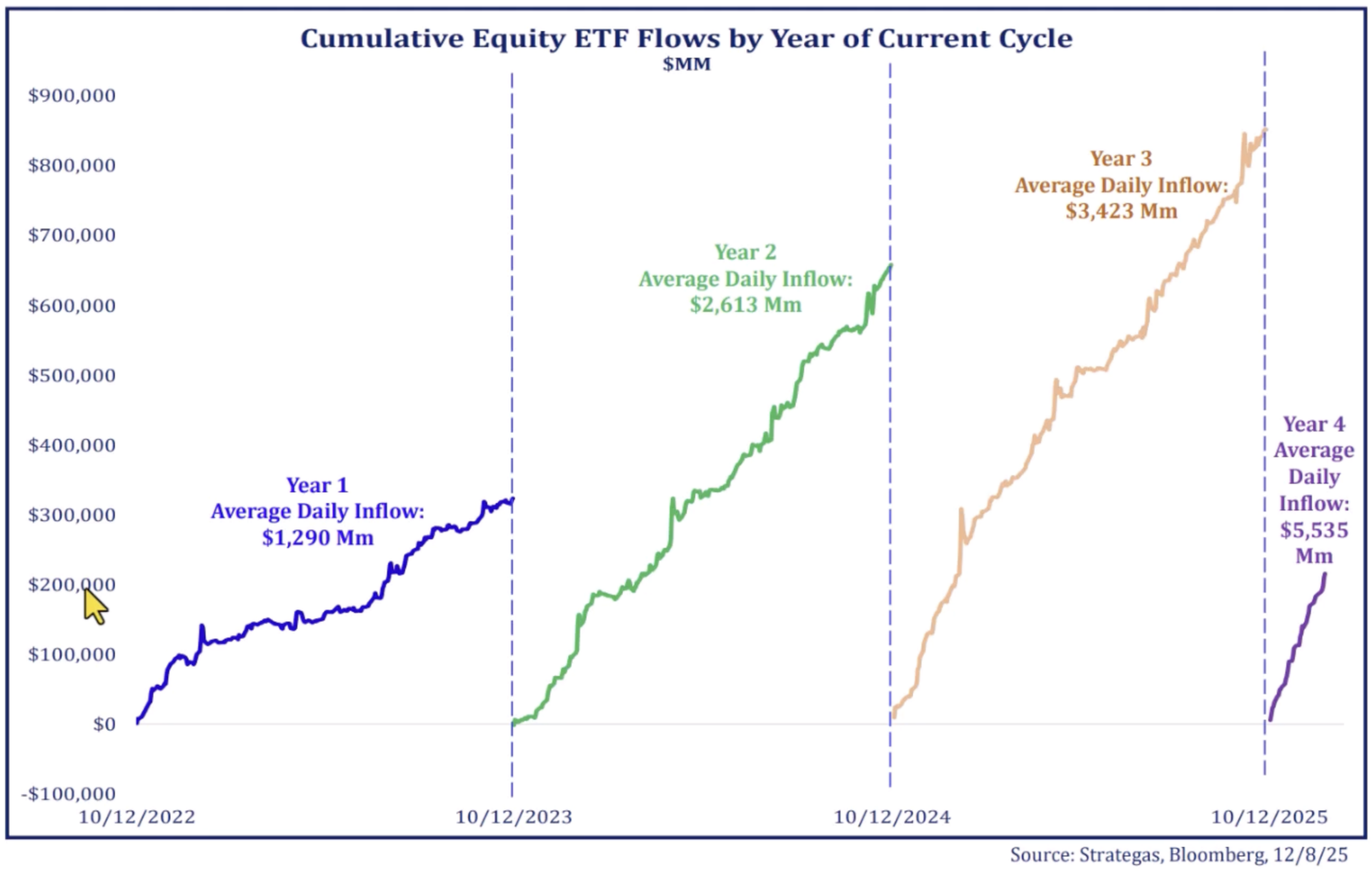

5. Recovery year. "Typically, returns tend to be strongest in the first year after a major drawdown and fade meaningfully by the third year of recovery. As 2026 will be the fourth 'recovery year' from the 2022 selloff, history suggests that, absent major shocks, equities returns are likely to be in the 5–10% range."

Sponsored content:

7 Actionable Ways to Achieve a Comfortable Retirement

Your dream retirement isn’t going to fund itself—that’s what your portfolio is for.

When generating income for a comfortable retirement, there are countless options to weigh. Muni bonds, dividends, REITs, Master Limited Partnerships—each comes with risk and oppor-tunity.

The Definitive Guide to Retirement Income from Fisher investments shows you ways you can position your portfolio to help you maintain or improve your lifestyle in retirement.

It also highlights common mistakes, such as tax mistakes, that can make a substantial differ-ence as you plan your well-deserved future.

Reply