- Daily Chartbook

- Posts

- DC Lite #493

DC Lite #493

"The wave of systematic selling has faded, and vol-targeting strategies are starting to re-lever"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Consumer sentiment. Consumer sentiment ticked up in December for the first time in 5 months but remains near record lows.

2. Q3 GDP. The Atlanta Fed's GDPNow model estimate for Q3 GDP growth dropped to 3.5% from 3.8% yesterday.

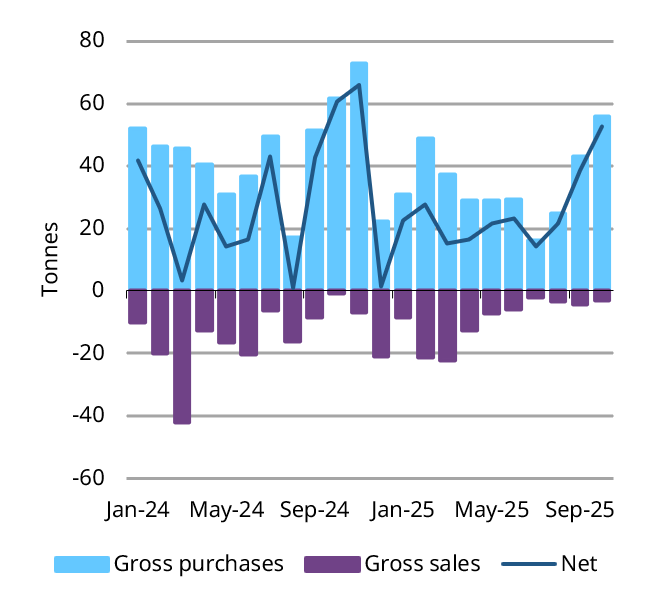

3. Systematics. "The wave of systematic selling has faded, and vol-targeting strategies are starting to re-lever ... After two weeks of steady non-fundamental supply, CTA, Vol-Control, and Risk-Parity strategies have begun to re-add exposure as realized volatility declines."

4. Re-rating. "The S&P 500 is cheaper now vs 10/28. 17 of 25 industries seen re rating lower in Fwd PE. Semis seen highest re rating lower (woah). Healthier market now vs end of Oct IMO."

5. Q4 EPS revisions. During the first two months of a typical quarter, analysts usually reduce earnings estimates. That was not the case in Q3 and it was not the case in the current quarter.

Reply