- Daily Chartbook

- Posts

- DC Lite #490

DC Lite #490

"Central bank gold buying ramped up in Oct"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Redbook. Same-store retail sales surged by 7.6% YoY for the week ending Nov 29, the most since December 2022.

2. Post-Covid inflation. "Now that post-COVID supply shocks have faded, inflation has settled well above target across all advanced economies ... idiosyncratic stories can’t explain the global shift ... a more likely explanation is that monetary policy on a global level is too loose and the world’s economy is running hot."

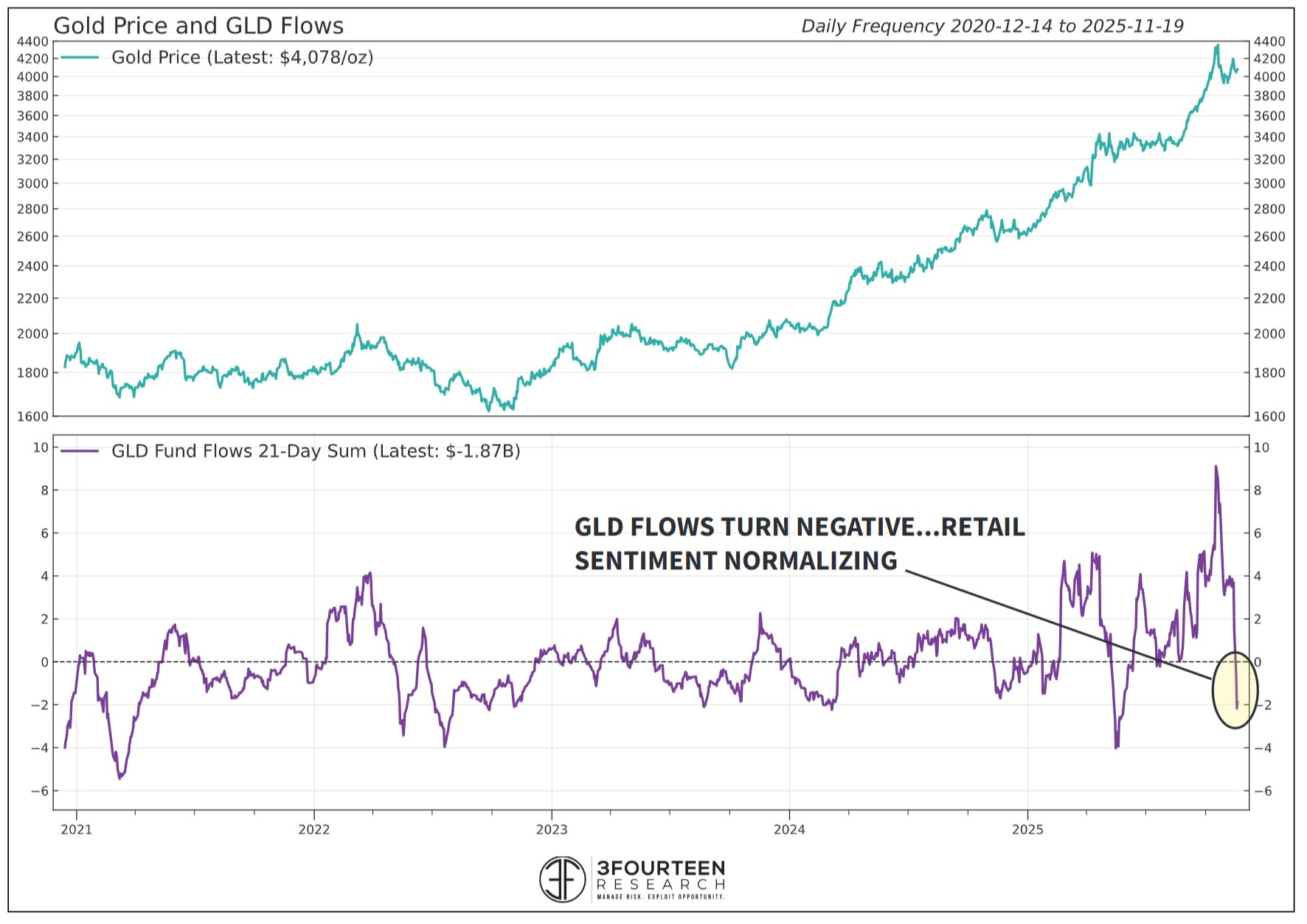

3. Central banks vs. gold. "Central bank gold buying ramped up in Oct at 53 tonnes (+36% m/m). YTD reported net purchases hit 254 tonnes, slower than recent years amid high prices. Emerging-market buying remains strategic, reinforcing gold’s role amid macro uncertainty."

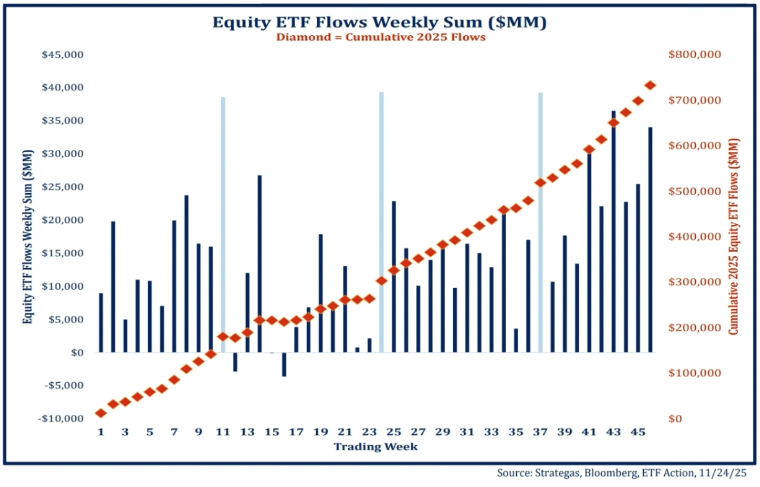

4. Weekly ETF flows. "Three ETF categories with largest inflows for week ended 11/28/2025 were Global ETFs at $4.1B, U.S. Large-cap ETFs at $2.5B, and U.S. Small-cap ETFs at $2.2B; largest outflow was from Consumer Cyclical Sectors ETFs at -$1.4B."

5. Staples insiders. "Well, I hesitate to tout boring Consumer Staples. But industry insiders apparently have no such qualms."

Reply