- Daily Chartbook

- Posts

- DC Lite #487

DC Lite #487

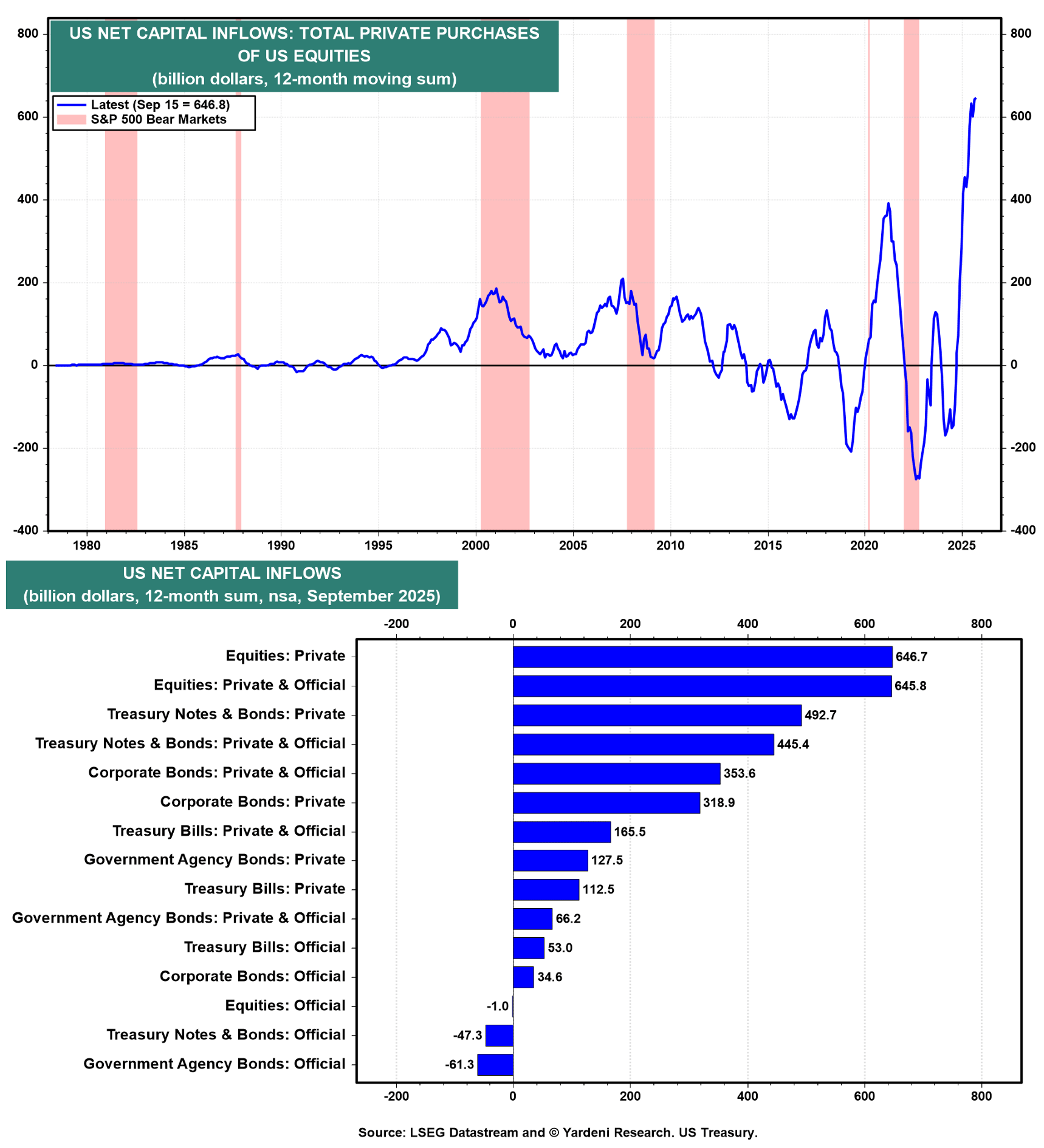

"Over the past 12 months, foreign private purchases of US equities outpaced those of US Treasury notes and bonds"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Rent vs. own. "More US families are renting homes because it’s much cheaper. Pretium estimates that to restore cost parity between owning and renting, mortgage rates would need to drop by about 2.5 percentage points from current levels, from 6.2% to 3.7%, holding other variables constant."

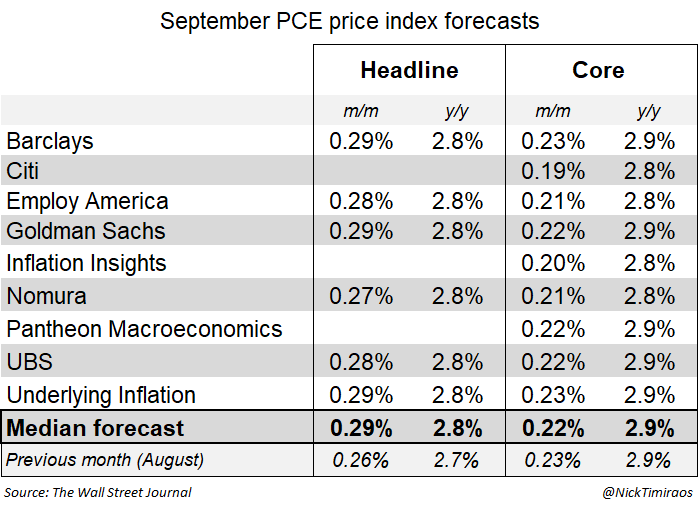

2. PCE forecasts. "With the CPI and PPI now in hand for September, core PCE inflation is tracking at around +0.22%, very close to where core CPI printed for that month. Any lower than this, and the 12-month rate would tick down to 2.8% from 2.9% in August."

3. US net capital inflows. "Foreign private purchases of US equities totaled a record $646.8 billion over the past 12 months. Over the past 12 months, foreign private purchases of US equities outpaced those of US Treasury notes and bonds."

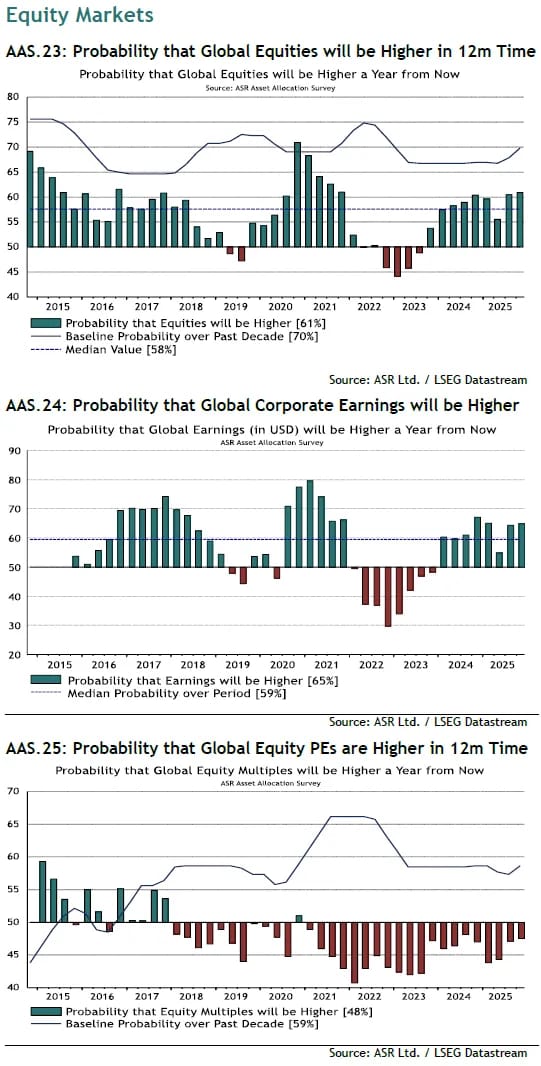

4. Asset allocator survey. "Absolute Strategy Research’s quarterly survey of asset allocators responsible for $9 trillion reveals continuing confidence that global equities will rise over the next year, even though valuations will contract. Much rests on confidence that earnings will continue to increase."

5. Sector re-ratings. "The black dots show where each sector’s forward P/E stood at the S&P 500’s 10/29 short-term peak. The grey dots show where they stood at the 11/20 short-term trough. Valuation compression in 8 of 10 sectors shown, but most notably in Tech."

Sponsored content:

The AI Race Just Went Nuclear — Own the Rails.

Meta, Google, and Microsoft just reported record profits — and record AI infrastructure spending:

Meta boosted its AI budget to as much as $72 billion this year.

Google raised its estimate to $93 billion for 2025.

Microsoft is following suit, investing heavily in AI data centers and decision layers.

While Wall Street reacts, the message is clear: AI infrastructure is the next trillion-dollar frontier.

RAD Intel already builds that infrastructure — the AI decision layer powering marketing performance for Fortune 1000 brands. Backed by Adobe, Fidelity Ventures, and insiders from Google, Meta, and Amazon, the company has raised $50M+, grown valuation 4,900%, and doubled sales contracts in 2025 with seven-figure contracts secured.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Reply