- Daily Chartbook

- Posts

- DC Lite #485

DC Lite #485

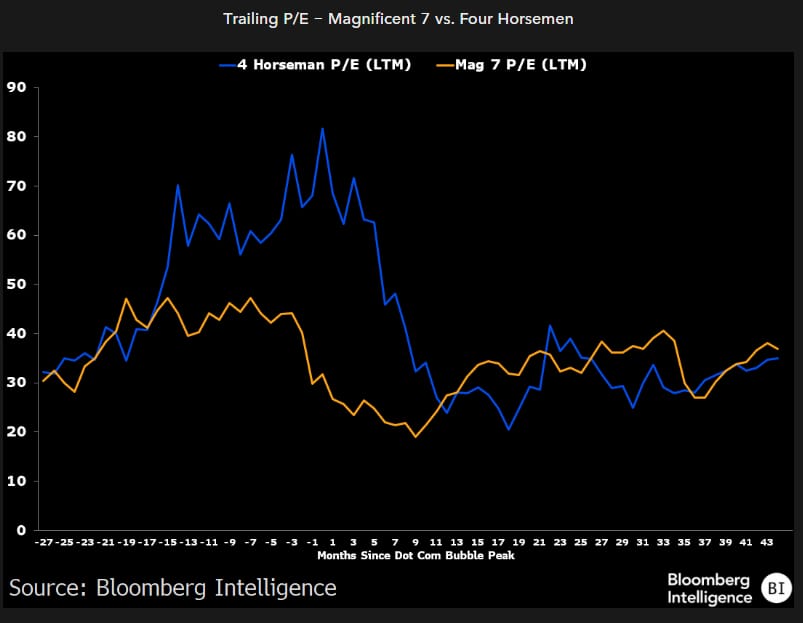

"The P/E ratios of the Mag 7 today are elevated nowhere near the Four Horseman of the '90s"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

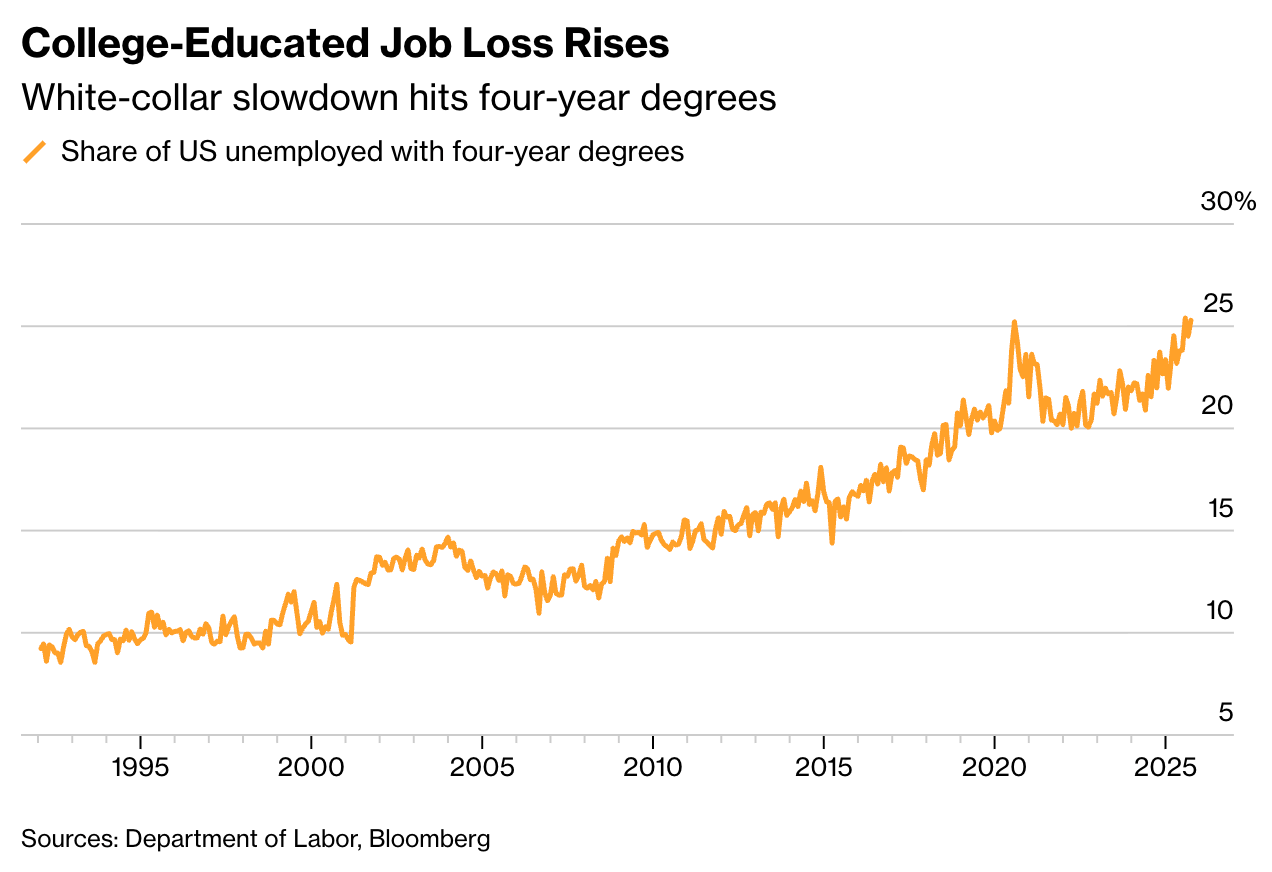

1. College-educated unemployment. "Americans with four-year college degrees now comprise a record 25% of total unemployment, underscoring a sharp slowdown in white-collar hiring this year."

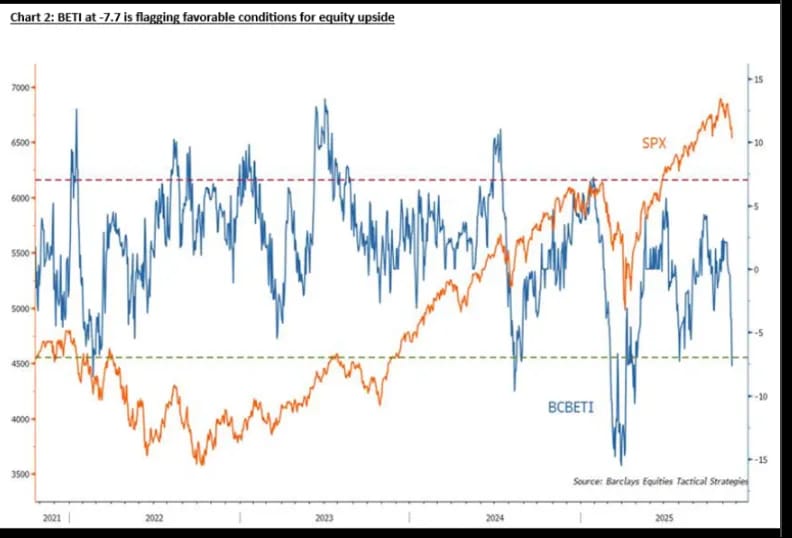

2. Barclays Equities Timing Indicator. BETI "fell below -7 for the first time since Aug. 4 ... The index has returned an average of 6.6% over the following 42 days and posted median gain of 5.1% with a 90% hit rate since 2015 when BETI drops to between -7 and -8."

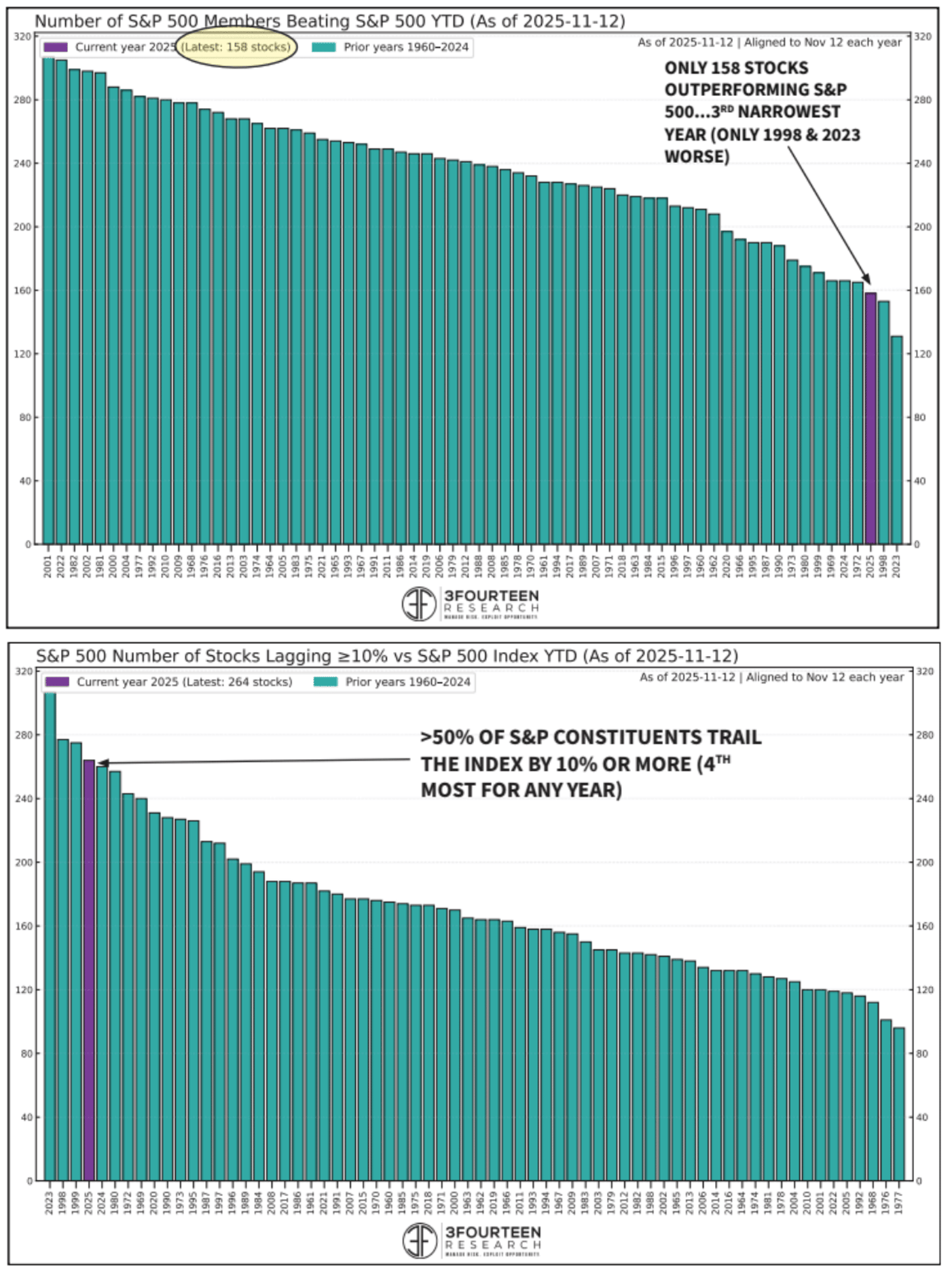

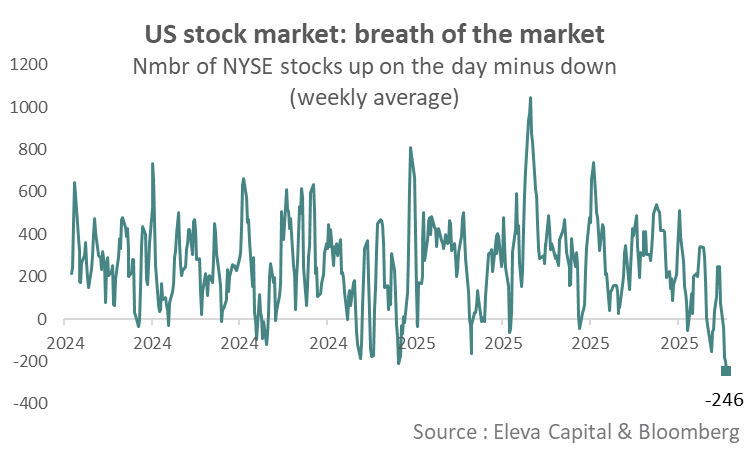

3. Narrow rally. The number of SPX stocks outperforming the index is the third-lowest since 1960. The share trailing by at least 10% is the fourth-most.

4. Mag 7 vs. Four Horseman. "The P/E ratios of the Mag 7 today are elevated nowhere near the Four Horseman of the '90s (Cisco, Msft, Dell, Intel). Mag 7 is trading at 36.8x earnings, below the 47.3x in 2021 and well below the 80x(!) of the Four Horseman pre-dot com crash."

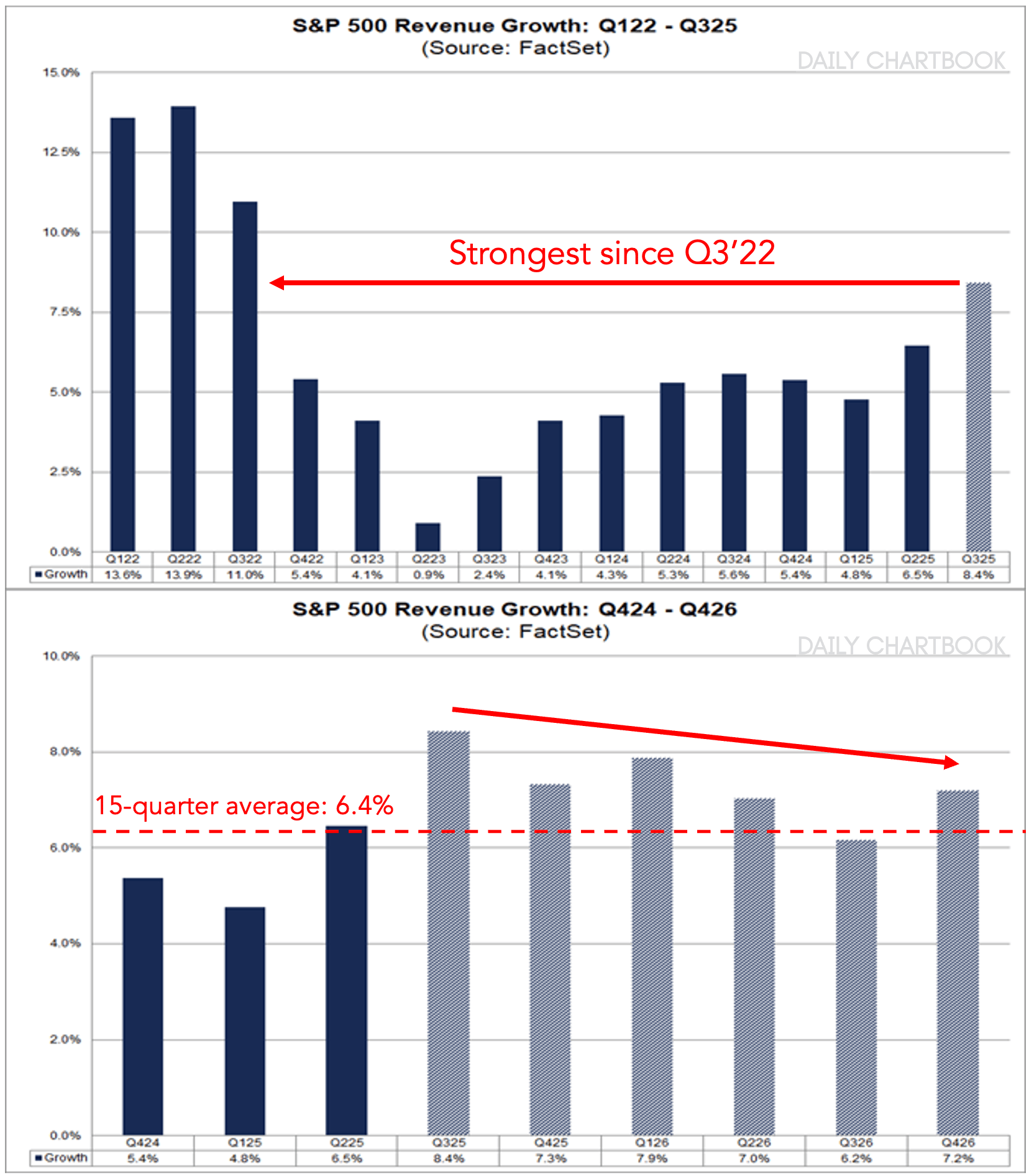

5. Q3 sales growth. The S&P 500 is reporting the strongest revenue growth in 3 years. While this strength is expected to fade over the coming quarters, analysts are still penciling in mostly above-average growth.

Reply