- Daily Chartbook

- Posts

- DC Lite #481

DC Lite #481

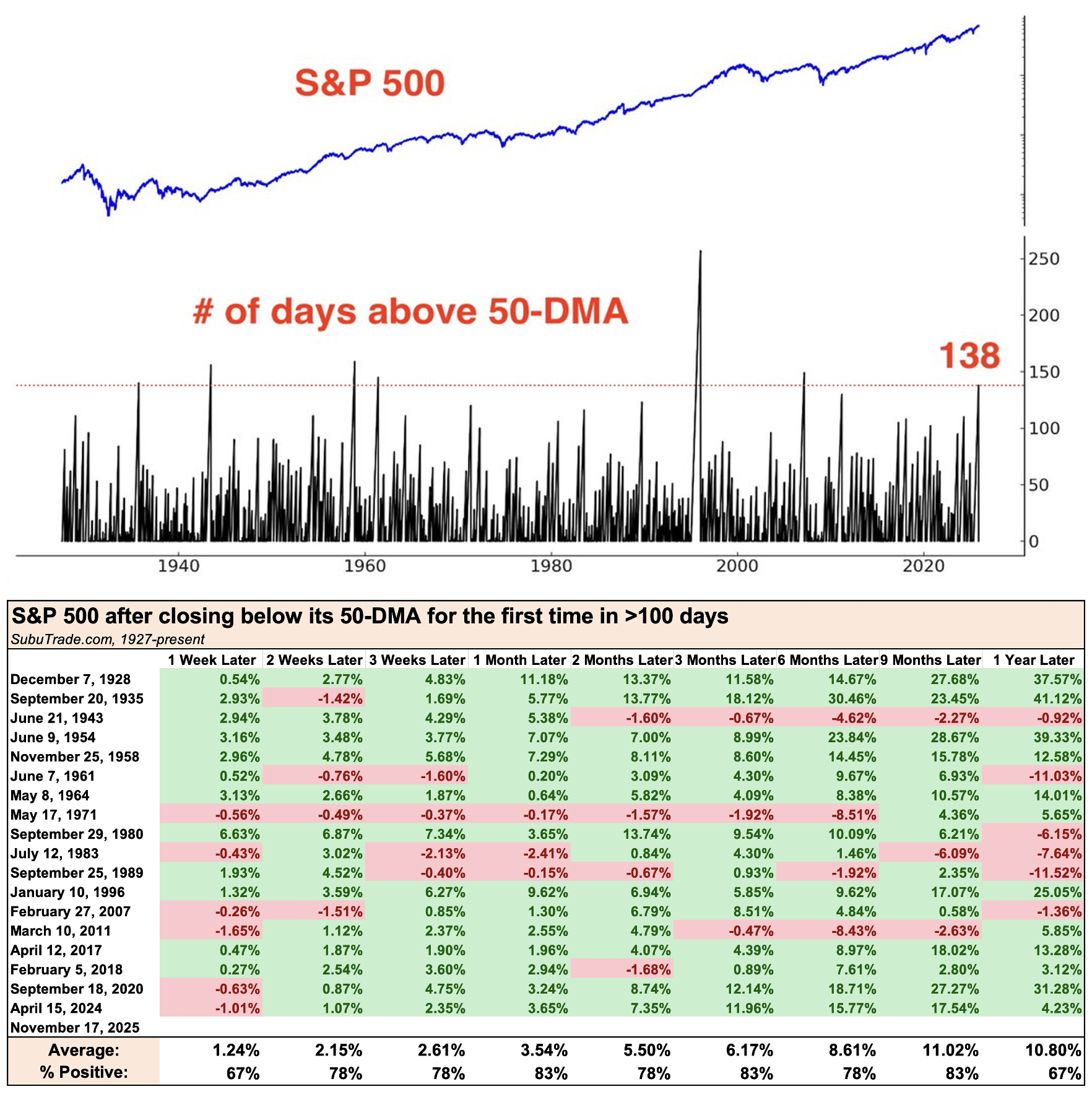

"SPX finally closed below its 50 day moving average, after 138 days"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

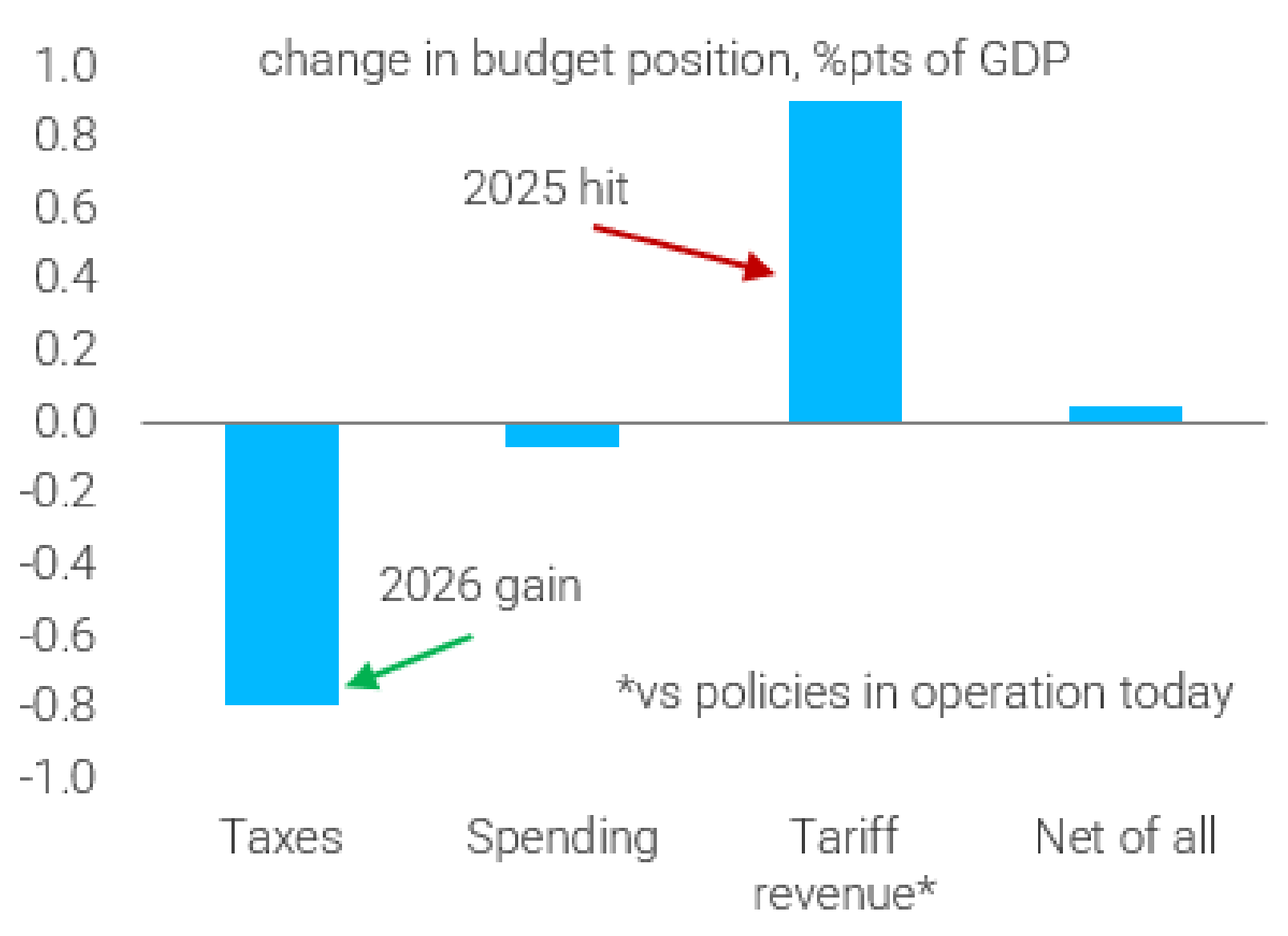

1. Fiscal impulse. "Tariffs were a fiscal tightening worth 1% of GDP. The big beautiful budget bill was an easing worth 1% of GDP. 'Net net' that’s no change. But the tariffs happened in 2025, whereas the tax cuts arrive in 2026. The fiscal impulse will swing from -1% of GDP to +1%, or 2%pts."

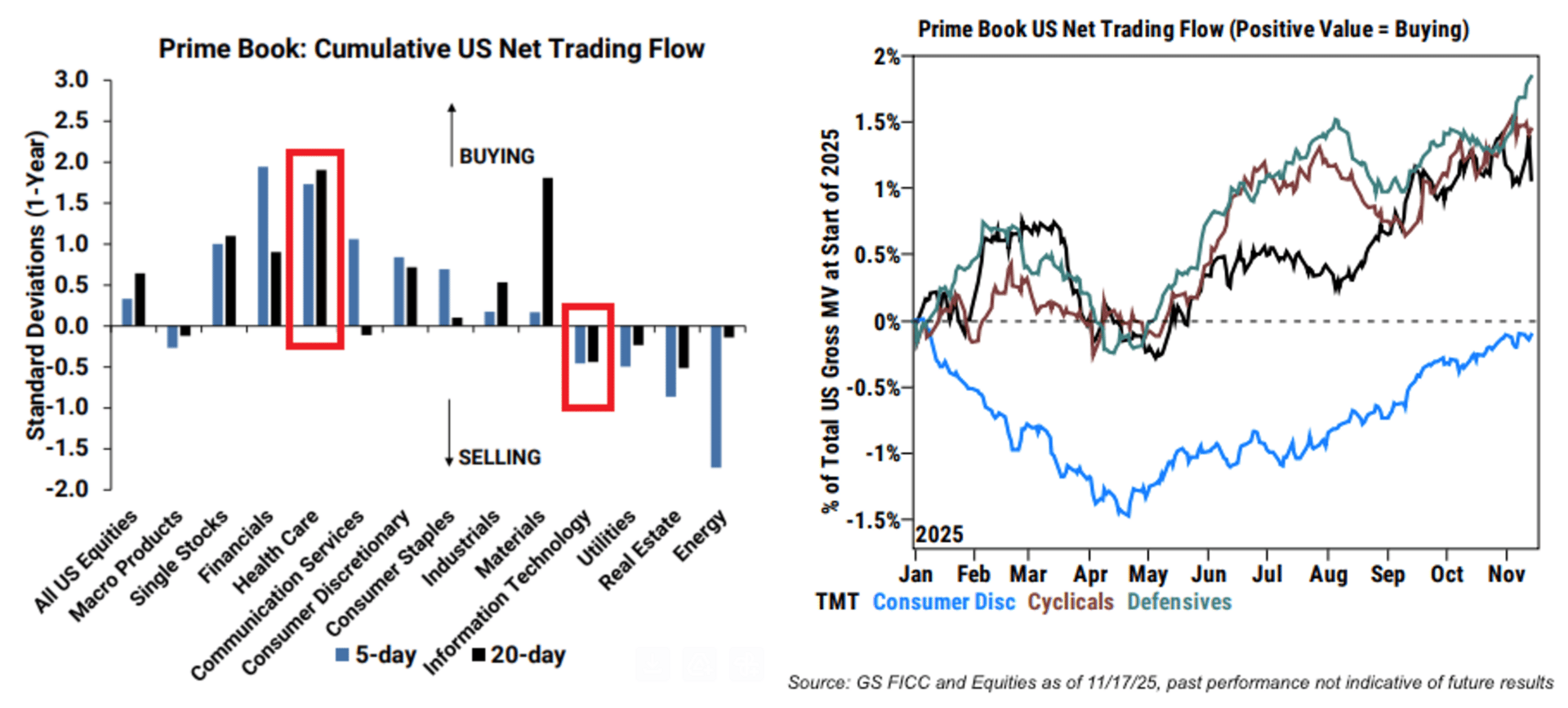

2. Hedge fund trading flow. "While US equities were net bought on the week (+0.3 SDs one-year), our PB team noted a continued rotation into defensive sectors with short sells outpacing long buys in TMT and long buys outpacing shorts in healthcare and staples last week."

3. SPX vs. 50DMA. "$SPX finally closed below its 50 day moving average, after 138 days! Here's what $SPX did next after such long rallies ended."

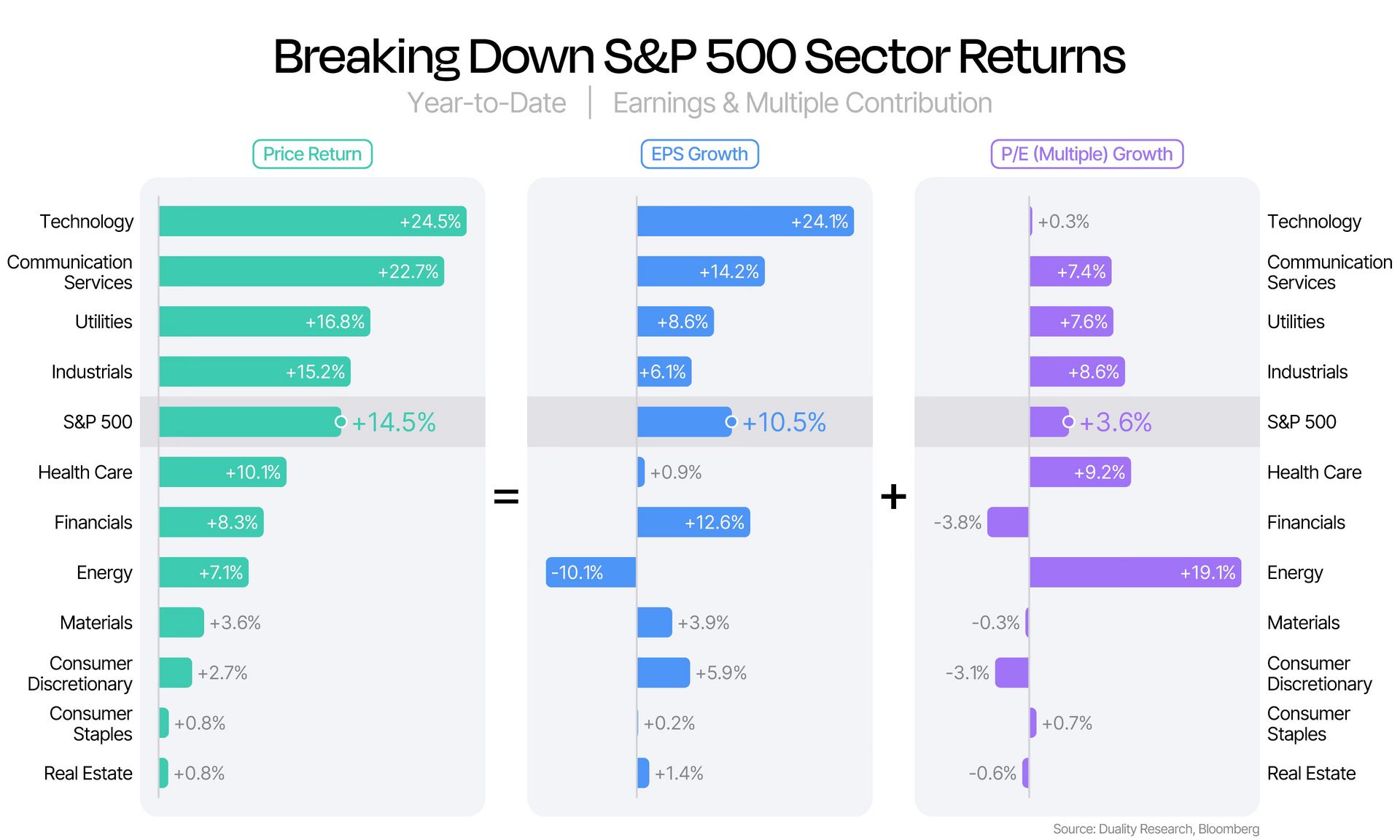

4. Sector returns. Virtually all of the Tech sector's 24.5% YTD gain has been driven by earnings growth.

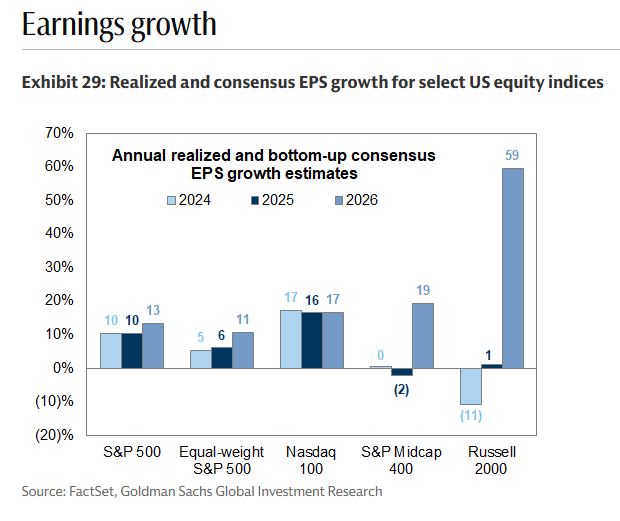

5. Index earnings growth. "Russell 2000 EPS growth now expected to be 59% in 2026 (revised up from 42% in recent weeks)."

ICYMI

**

Reply