- Daily Chartbook

- Posts

- DC Lite #480

DC Lite #480

The blended net profit margin for the index is 13.1%, the highest since at least 2009

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Home prices. Home prices rose 2.4% YoY, the largest increase in 6 months. During this time of the year in 2022-24, prices were flat to down.

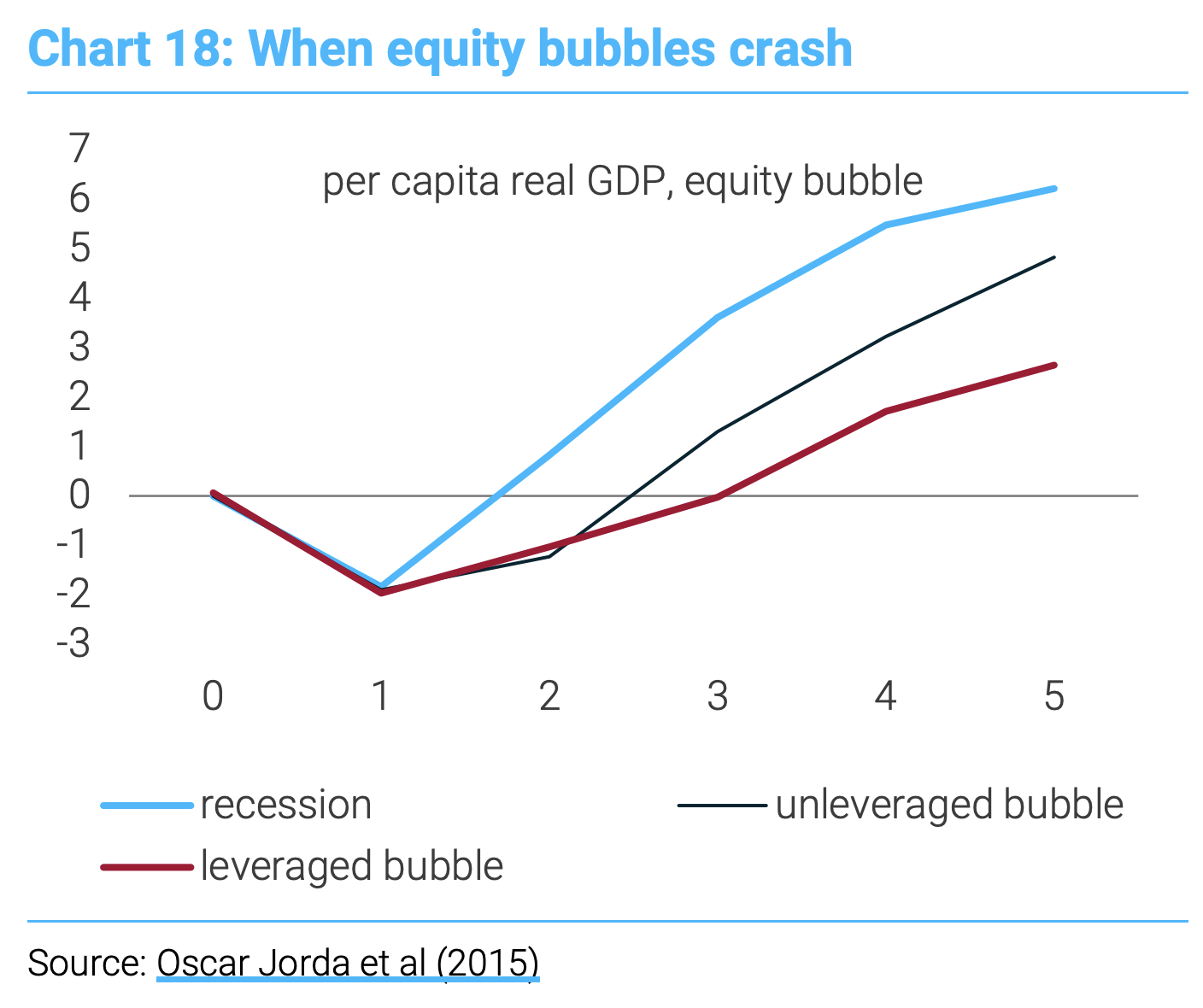

2. Excess retirees. "2.5 million excess American retirees are keeping the US economy afloat by spending their booming 401 (k)s and wealth. So, the greater risk in 2026-27 is not that a recession triggers a market crash, but that a market crash crushes this group's spending, and thereby the economy."

3. Insiders. "What is catching my eye is that while sentiment is leaning bullish among retail investors and Wall Streeters, corporate insiders are selling at the highest level since 2000 ... They have all kinds of reasons to sell shares ... but given the conversation about valuation and bubbles and loft earnings goals, the current 25:1 sell/buy ratio is something that gives me pause."

4. Retail vs. mutual funds. "For all the churn this week, the SPX clawed back to end the week flat. The movements under the hood perhaps suggest some risk appetite is getting scorched for the time being — but for all the fear, it’s not like the selloffs set the index unraveling."

5. Profit margin. The Q3 blended net profit margin for the index is 13.1%, the highest since at least 2009. For the next 3 quarters, analyst expect continued strength with margins of 12.8% (Q4'25), 13.3% (Q1'26), and 13.7% (Q2'26).

Reply