- Daily Chartbook

- Posts

- DC Lite #478

DC Lite #478

"We are seeing emergent signs that AI is driving business formations"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Rent growth. National apartment rents declined in October by the most (-0.31% MoM) in over 15 years.

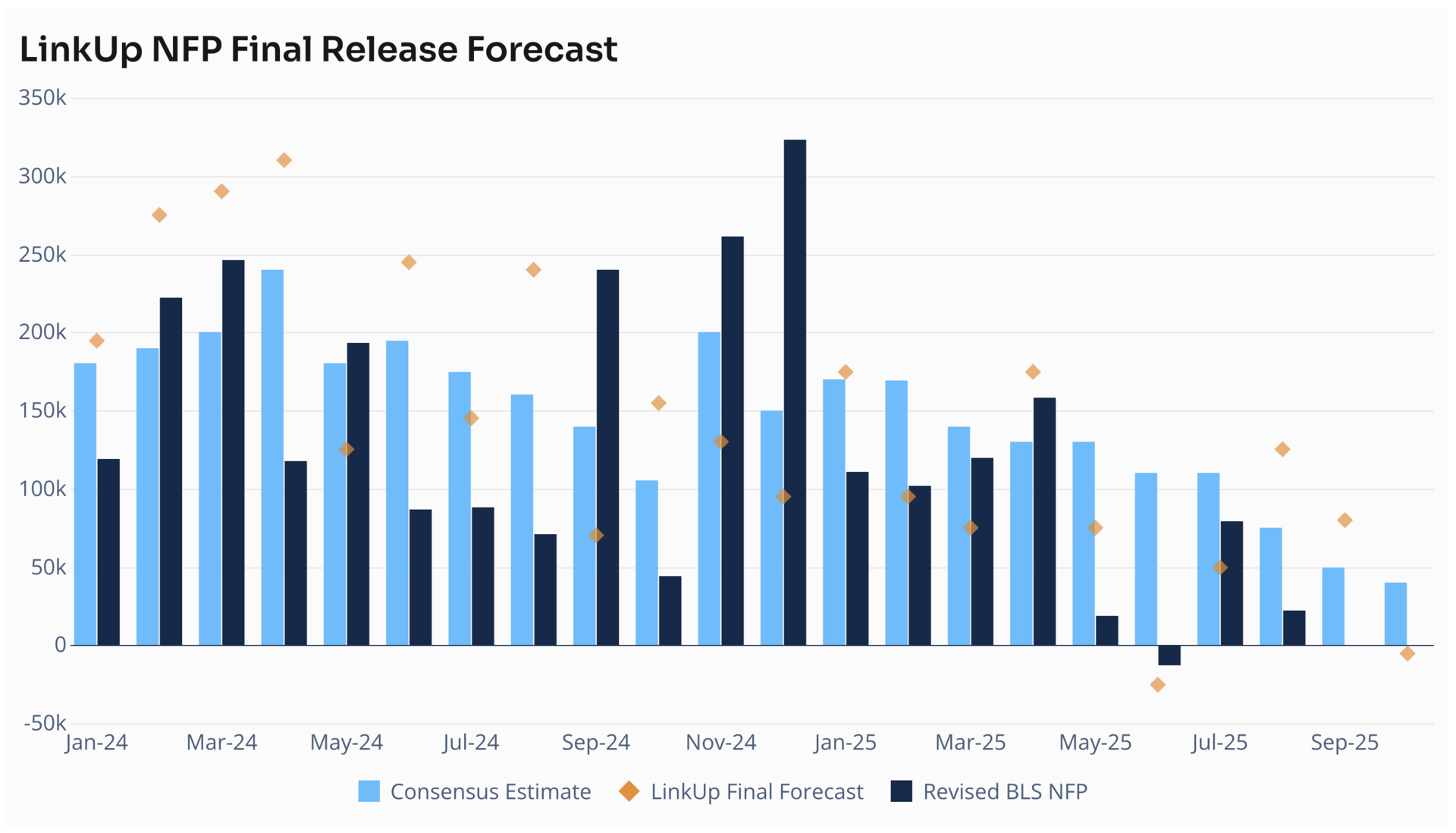

2. AI vs. jobs. "Is AI the cause of labor market weakness? Then why have employment rates been getting weaker and weaker for non-college youth? This is a cyclical slowdown. Not an AI driven slowdown."

3. AI vs. business formation. "We are seeing emergent signs that AI is driving business formations. We also think the worst for firm birth-death model is over. As long as the Fed is willing (I like Mary Daly’s framing—what the Fed decides to do could either fan or choke a 90s style productivity boom) this trend could continue and we see more sustained labor productivity increase next year."

4. Healthcare rally. Healthcare’s 3-month returns suggest the recent rally is extended (+17%, +2Std above mean), but rolling YoY returns imply plenty of upside for the sector over the next 12 months (+5.6%, below mean).

5. Equity risk premium. "These negative risk premium charts circulating again. Reminder: stocks are real assets: EPS, Divs demonstrated they [grow] with inflation over time. Earnings Yields vs TIPs are the right comp. Risks premiums roughly 1/2 last 20 yrs but stocks still better than bonds. Rule of 72 says time to double purchasing power: 39 years in TIPS, 17 years in S&P 500."

Sponsored content:

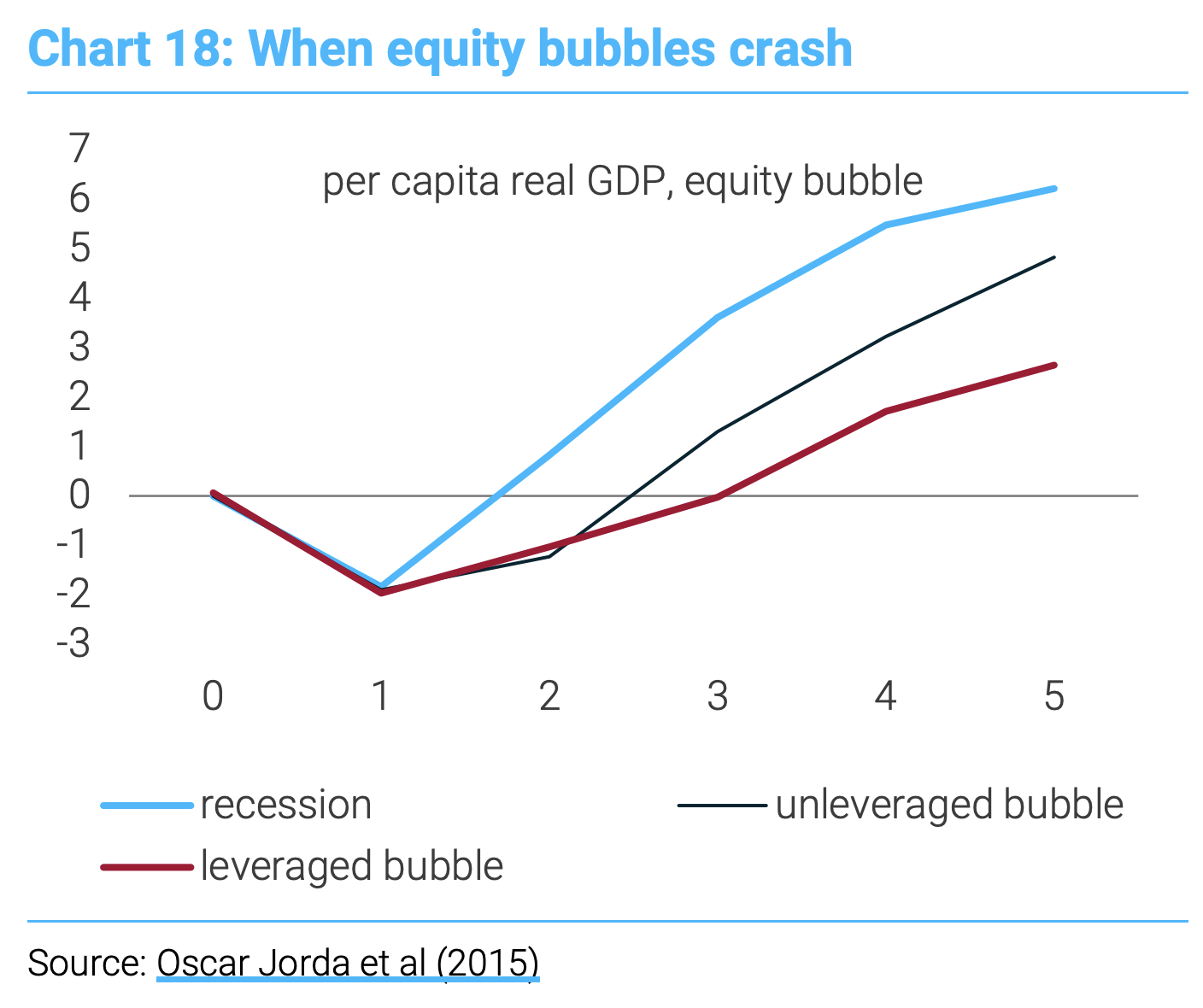

Is the AI Bubble About to Burst? (95.2% Accurate Forecast)

NVIDIA officially reports earnings November 19, but you can get a sneak peek right now.

Not just for NVIDIA, but for dozens of public companies.

On Polymarket, the world's largest prediction market (with verified 95.2% accuracy), you can see what top forecasters believe will happen.

Our new Earnings Markets let you:

See real-time odds of NVIDIA beating estimates

Predict what executives will say on earnings calls

Profit directly from being right, regardless of stock price movement

Trade simple Yes/No outcomes instead of complex options

Will Jensen stun Wall Street again?

Or is the AI trade finally cooling off?

Top forecasters are already positioning.

Reply