- Daily Chartbook

- Posts

- DC Lite #473

DC Lite #473

"LinkUp just forecasted that the U.S. economy lost 5,000 jobs in October"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Economic Optimism Index. The November EOI fell by the most in more than 4 years to the lowest since Jun'24. All three of index's components—economic outlook, personal finance outlook, and confidence in economic policies—dropped.

2. NFP forecast. "LinkUp just forecasted that the U.S. economy lost 5,000 jobs in October."

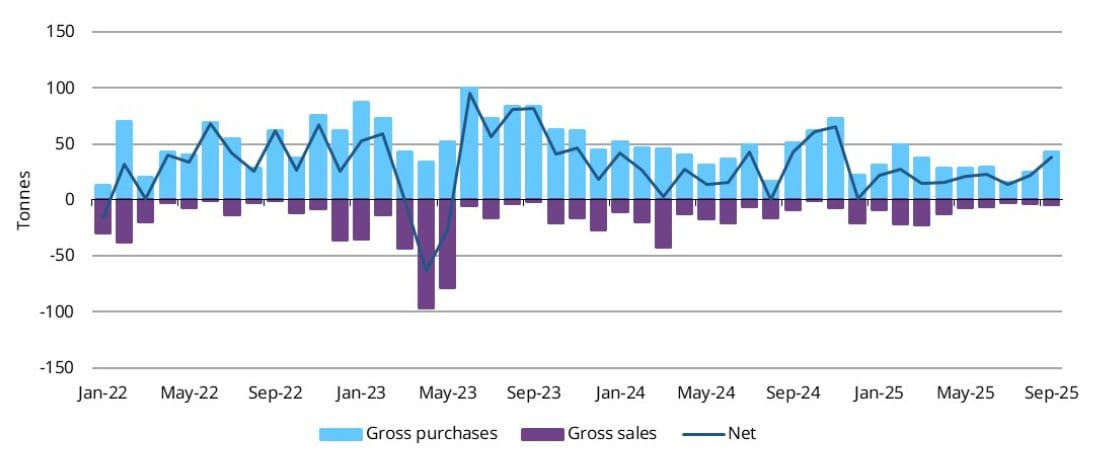

3. Central banks vs. gold. "Central banks' reported net purchases of gold totalled 39 tonnes in September. This buying was up 79% m/m and is the highest month of reported net buying in 2025 so far."

4. Hedge fund flows. "Hedge funds increasingly are balancing long single-stock exposure with index shorts."

5. Concentration. “US consumption (the real non-tech economy) is increasingly tied to the fate of the stock market, which in turn is owned by a smaller and smaller share of the population. When and if the GenAI story at the market’s core bursts, it could expand to many outer layers of the economy, as if reverberating through a set of Russian nesting dolls.”

Sponsored content:

How High-Net-Worth Families Invest Beyond the Balance Sheet

Every year, Long Angle surveys its private member community — entrepreneurs, executives, and investors with portfolios from $5M to $100M — to understand how they allocate their time, money, and trust.

The 2025 High-Net-Worth Professional Services Report reveals what today’s wealthy families value most, what disappoints them, and where satisfaction truly comes from.

From wealth management to wellness, from private schools to personal trainers — this study uncovers how the top 1% make choices that reflect their real priorities. You’ll see which services bring the greatest satisfaction, which feel merely transactional, and how spending patterns reveal what matters most to affluent households.

Benchmark your household’s service spending against peers with $5–25M portfolios.

Learn why emotional well-being often outranks financial optimization.

See which services families are most likely to change — and which they’ll never give up.

Understand generational differences shaping how the wealthy live, work, and parent.

See how your spending, satisfaction, and priorities compare to your peers. Download the report here.

Reply