- Daily Chartbook

- Posts

- DC Lite #477

DC Lite #477

"Retail investors continue to add into weakness, becoming the new price setters"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

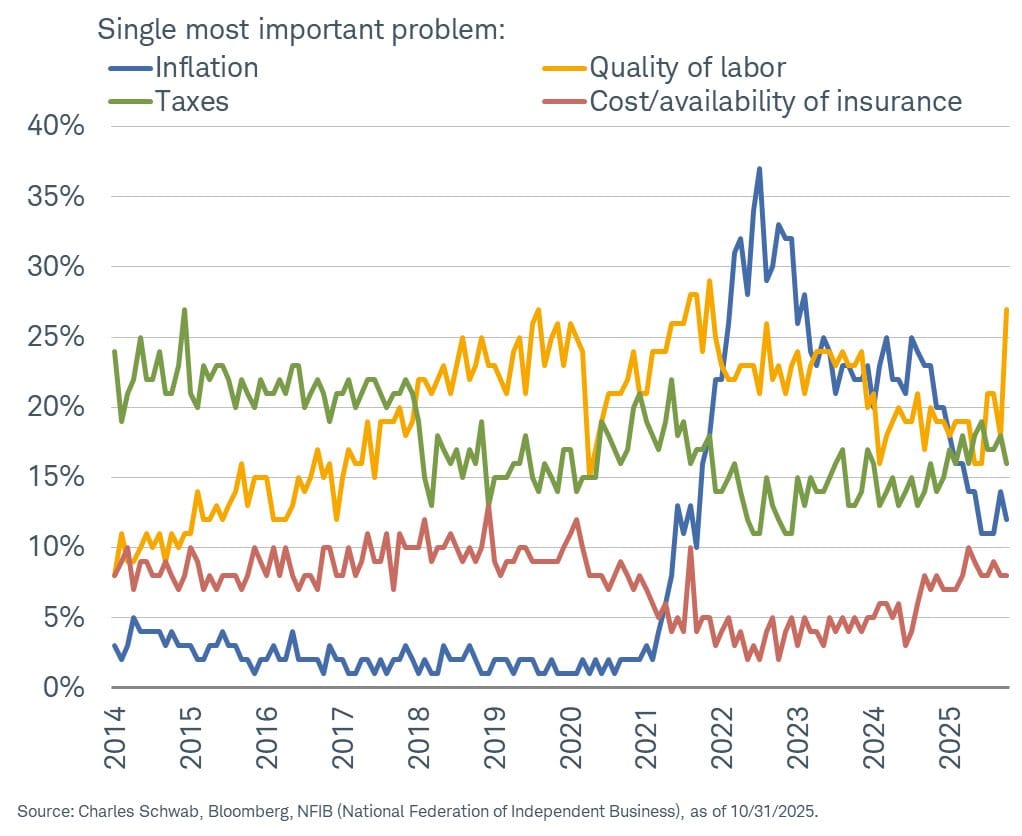

1. NFIB. “Small businesses’ single most important problem in October: quality of labor (massive spike).”

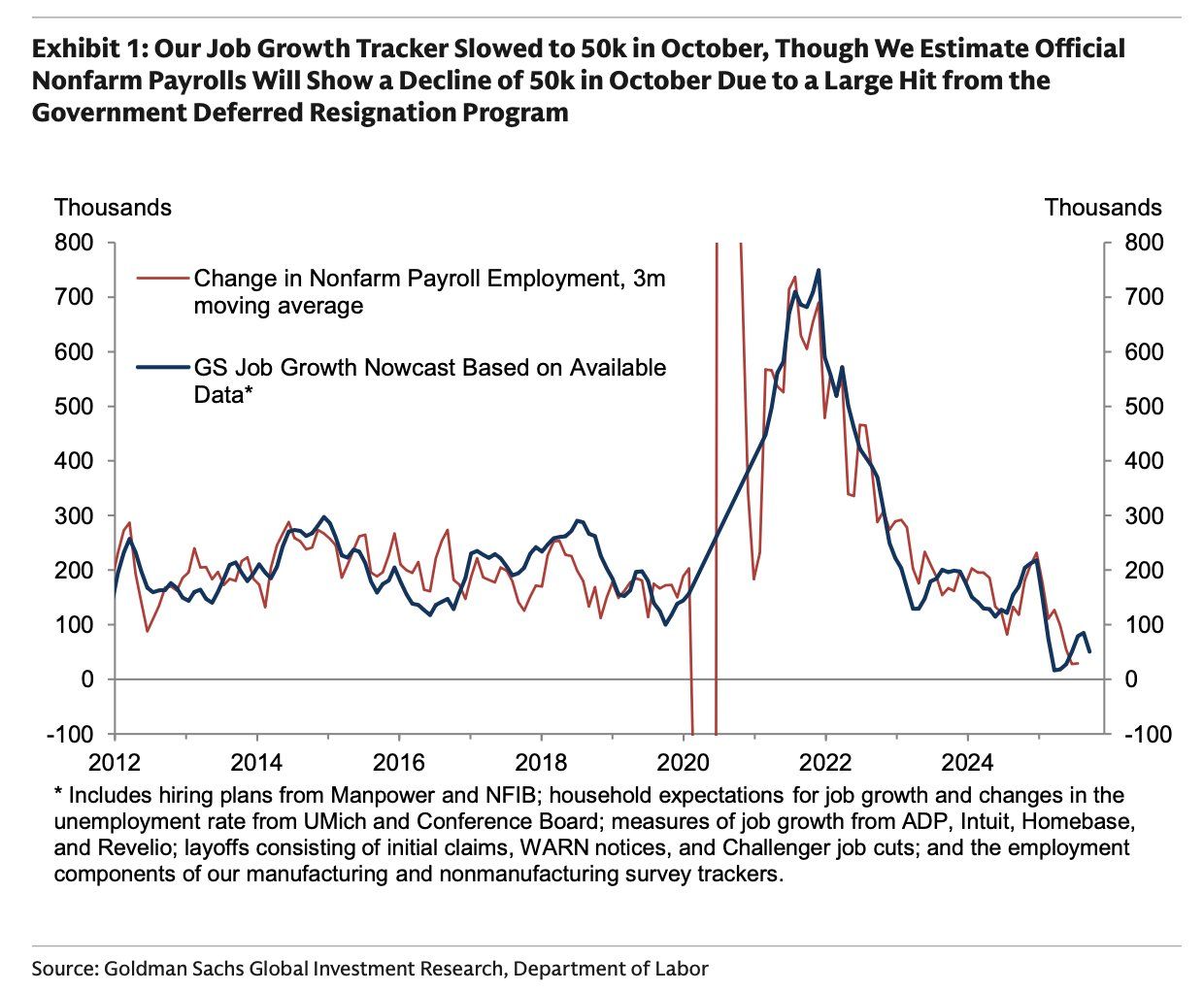

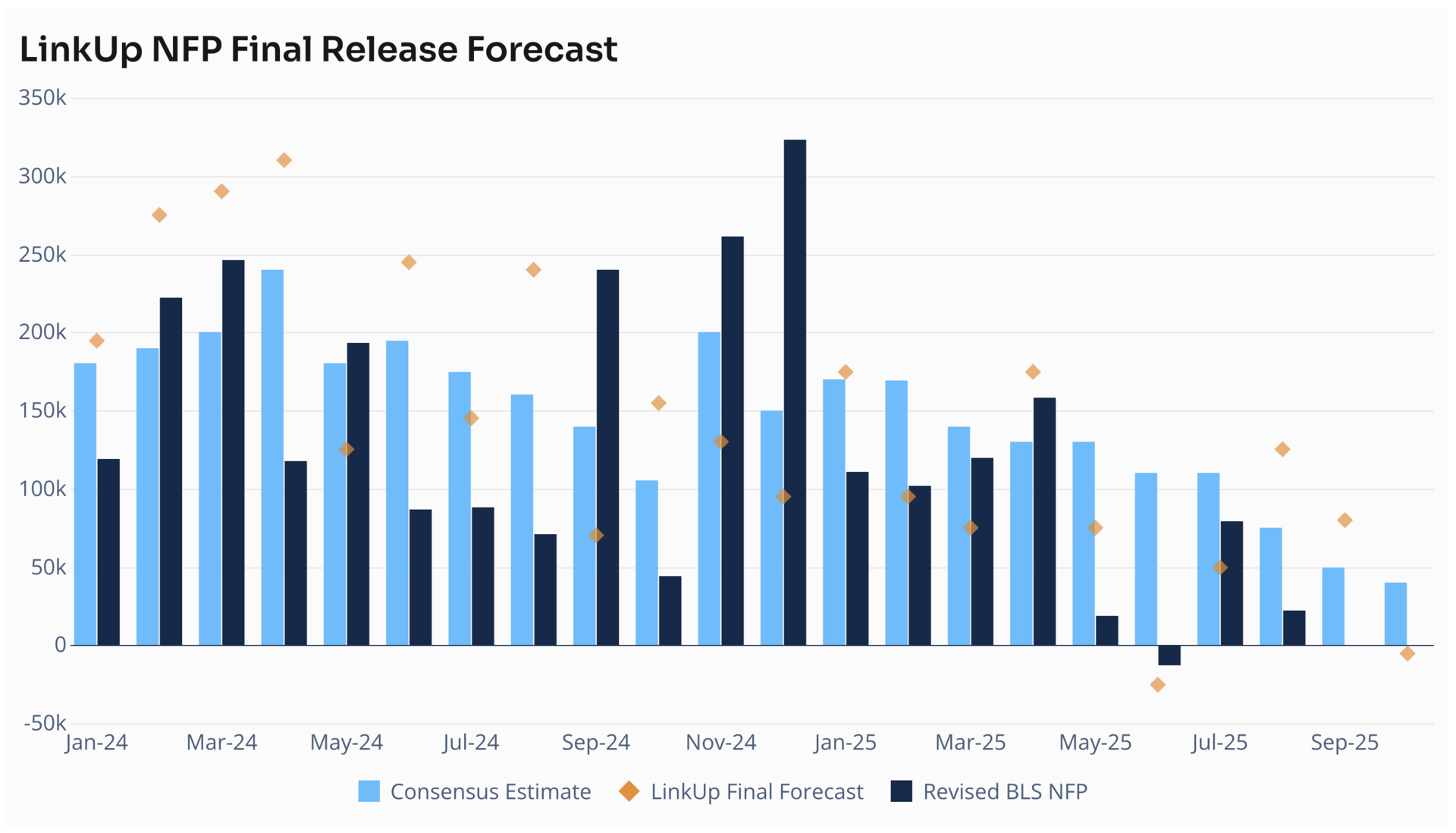

2. NFP. "We expect official nonfarm payrolls to show a 50k decline in October."

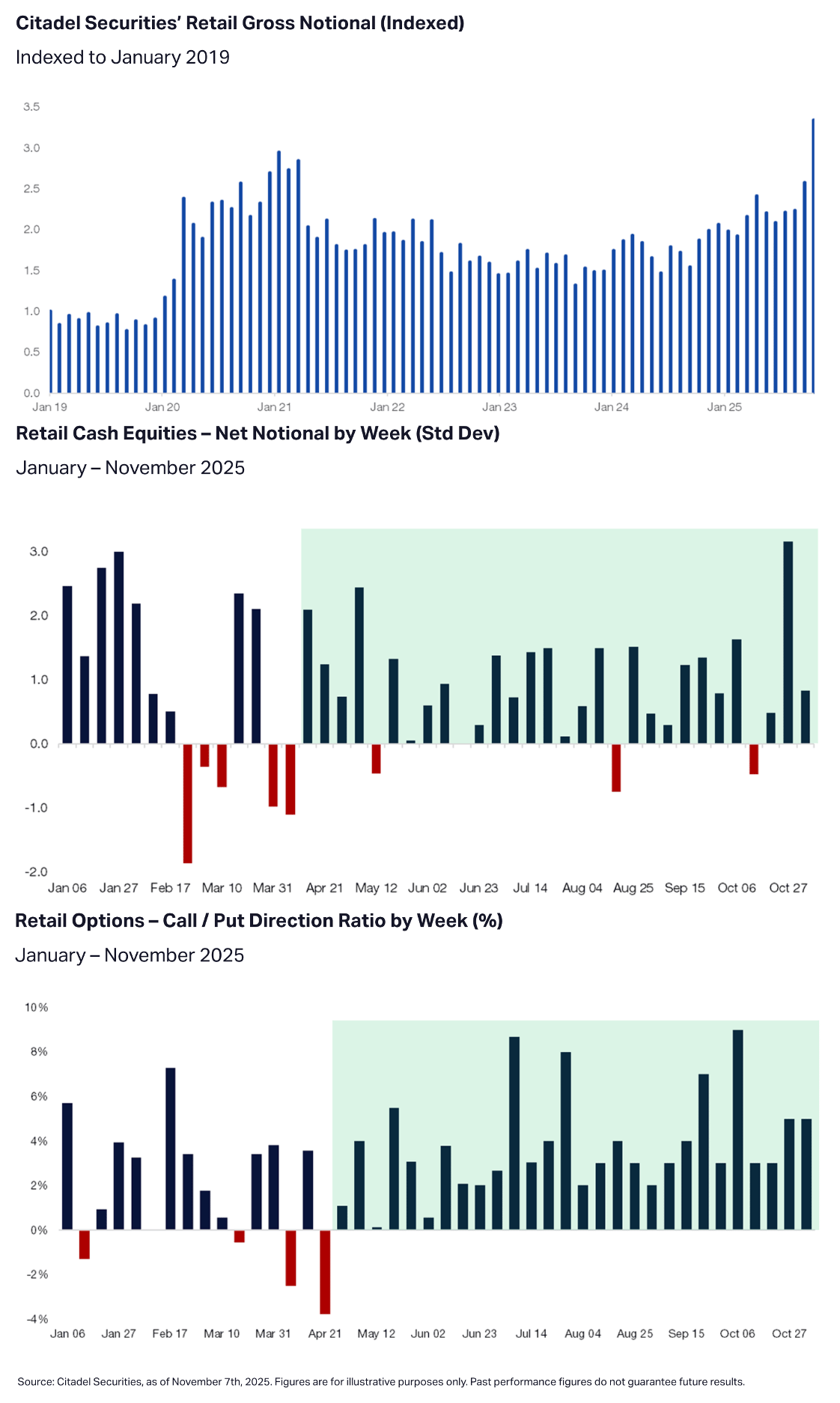

3. Retail BTFD. "Retail investors continue to add into weakness, becoming the new price setters … During the latest pullback, retail flows showed one of the largest 'buy-the-dip' events on record."

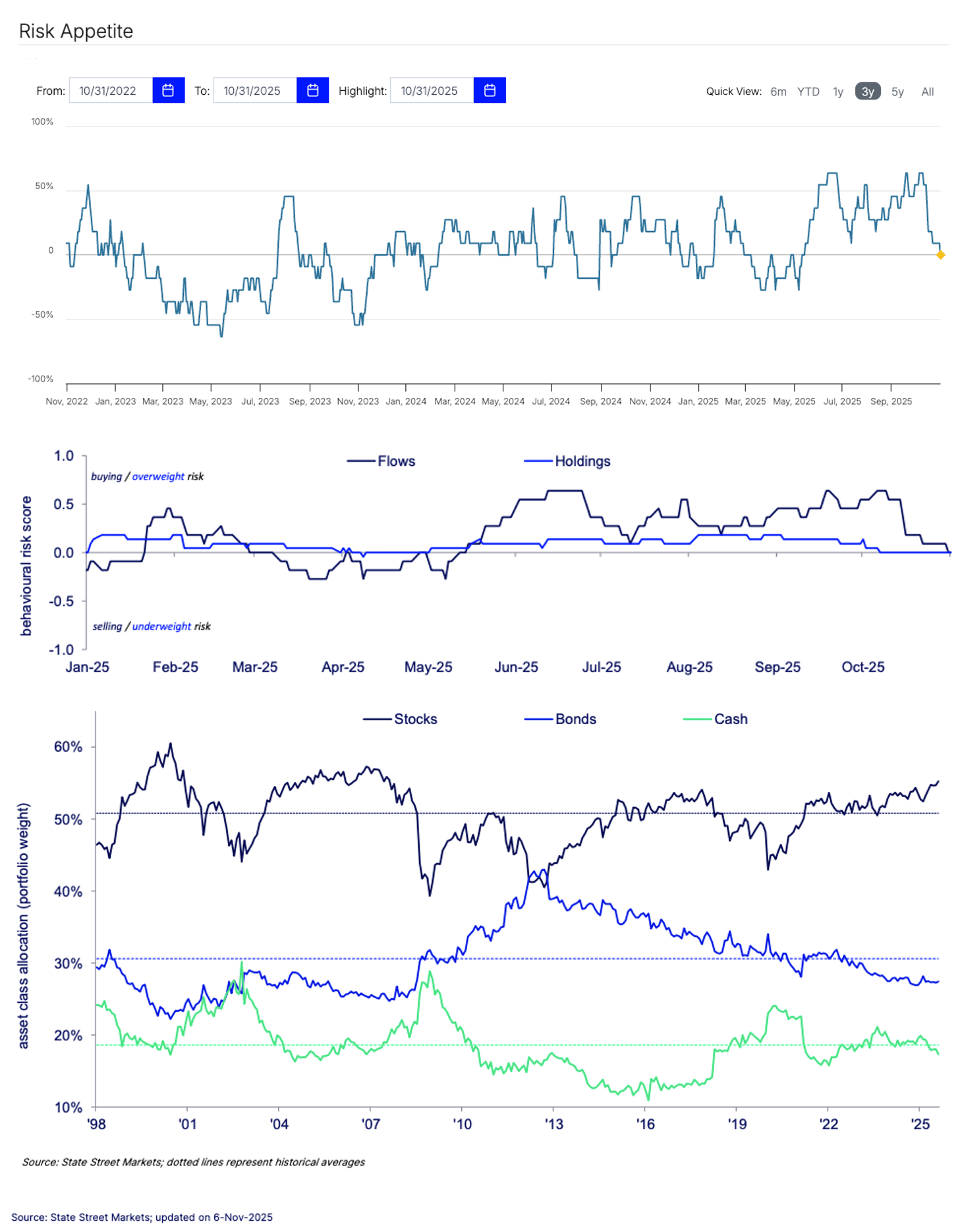

4. Institutional Investor Risk Appetite. "The State Street Risk Appetite Index has taken a step down from the highest level all year to a neutral reading. Institutional investors are not turning risk-averse, instead they have increased their allocation to stocks to 18 years high."

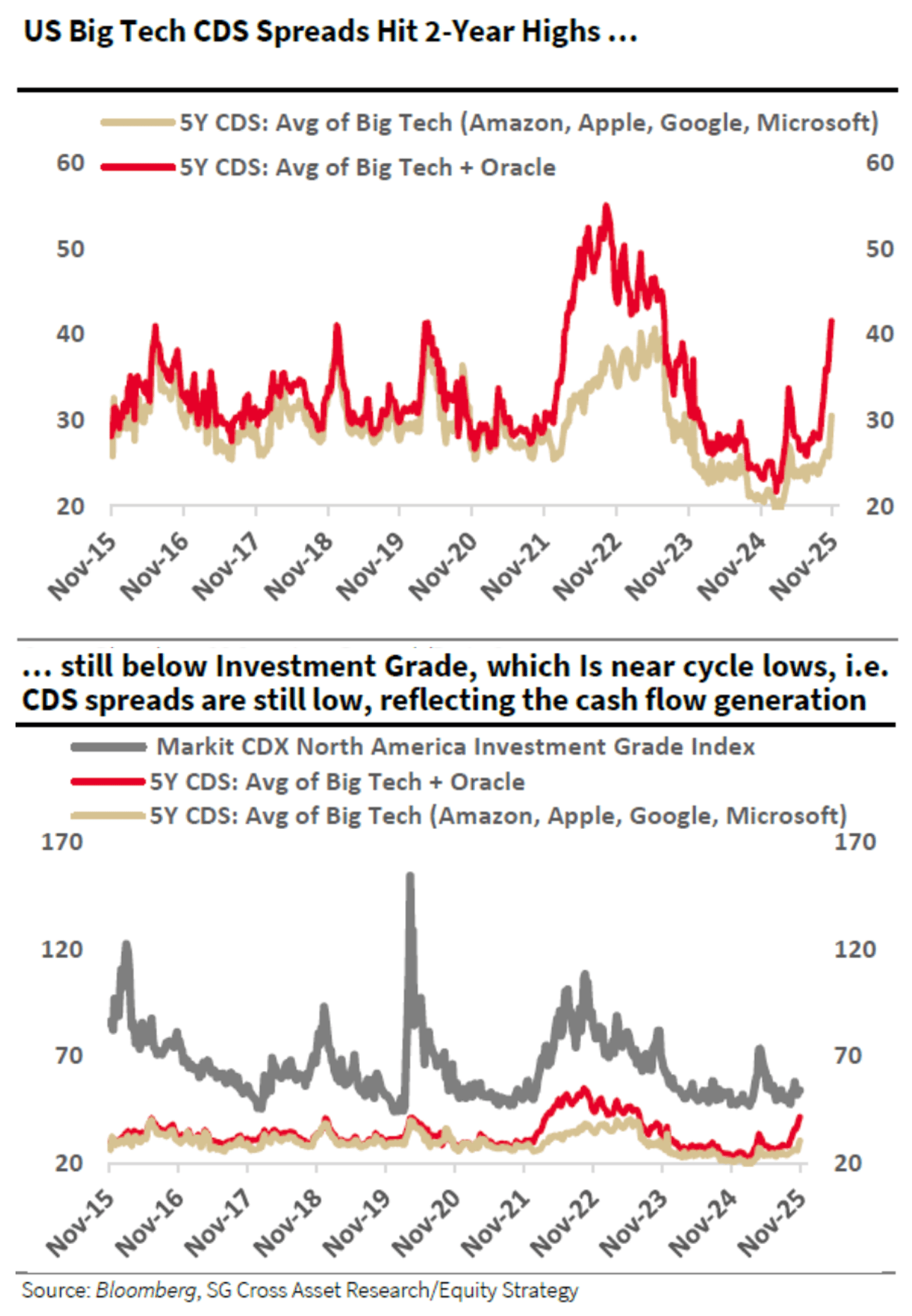

5. Big Tech CDS. "The Big Tech CDS has surged this year with Oracle CDS leading the rise. The big Tech CDS is now highest in over 2 years, rising from cycle-lows. While the standalone chart show concerns, when compared with the broader IG market, the spreads are still below the aggregate Investment Grade credit and that the IG CDS is still near cycle lows."

Sponsored content:

The AI Race Just Went Nuclear — Own the Rails.

Meta, Google, and Microsoft just reported record profits — and record AI infrastructure spending:

Meta boosted its AI budget to as much as $72 billion this year.

Google raised its estimate to $93 billion for 2025.

Microsoft is following suit, investing heavily in AI data centers and decision layers.

While Wall Street reacts, the message is clear: AI infrastructure is the next trillion-dollar frontier.

RAD Intel already builds that infrastructure — the AI decision layer powering marketing performance for Fortune 1000 brands. Backed by Adobe, Fidelity Ventures, and insiders from Google, Meta, and Amazon, the company has raised $50M+, grown valuation 4,900%, and doubled sales contracts in 2025 with seven-figure contracts secured.

Shares remain $0.81 until Nov 20, then the price changes.

👉 Invest in RAD Intel before the next share-price move.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Reply