- Daily Chartbook

- Posts

- DC Lite #476

DC Lite #476

"Market-based inflation expectations falling like a rock"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

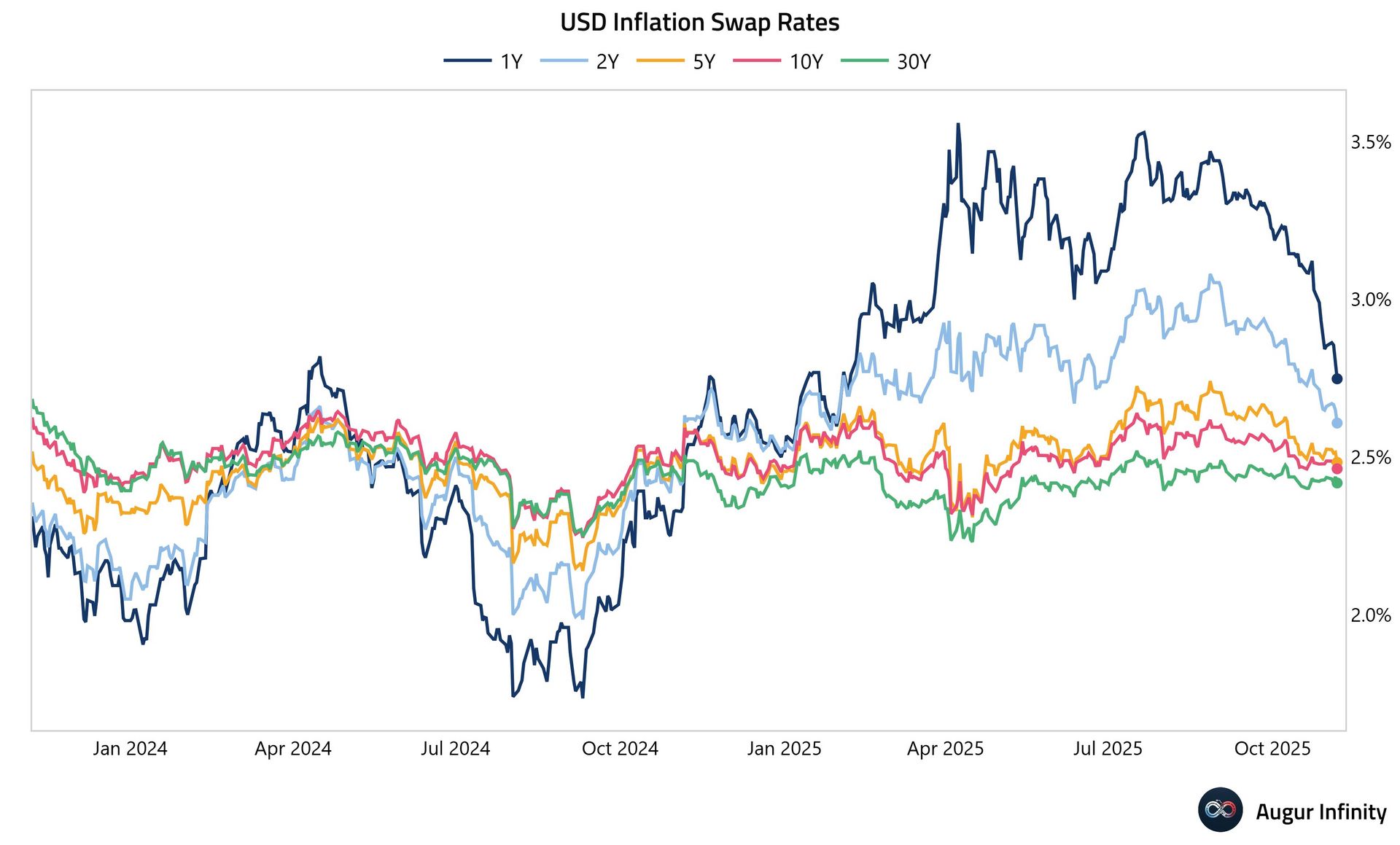

1. Market-based inflation expectations. "Market-based inflation expectations falling like a rock: 1yr inflation swap now under 2.75% for the first time since early February."

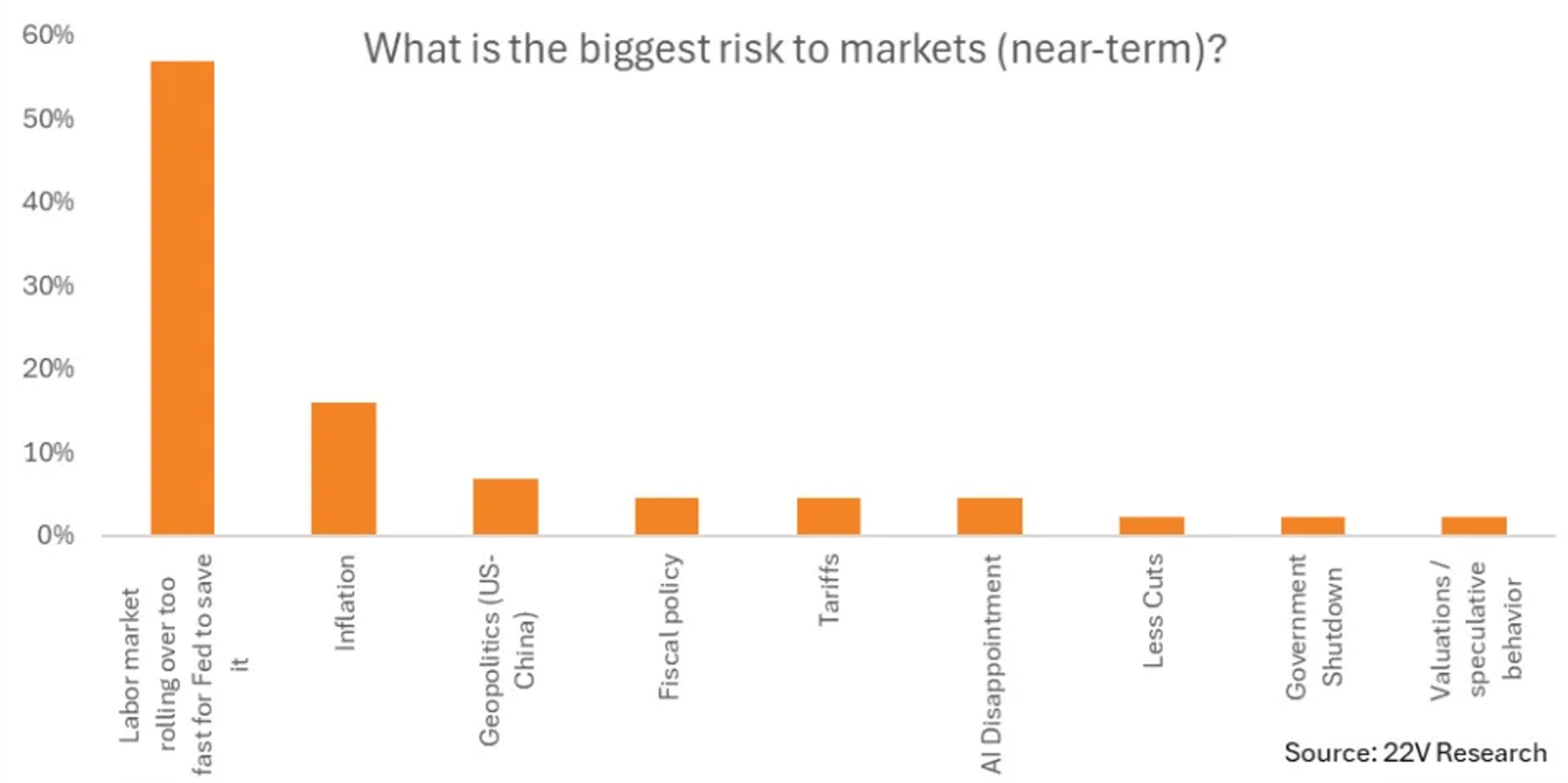

2. Biggest risk. "A survey conducted by 22V Research showed that a labor-market unwind is the biggest risk to trading. That explains why risk assets and bond yields have been unusually sensitive to any news data on that front."

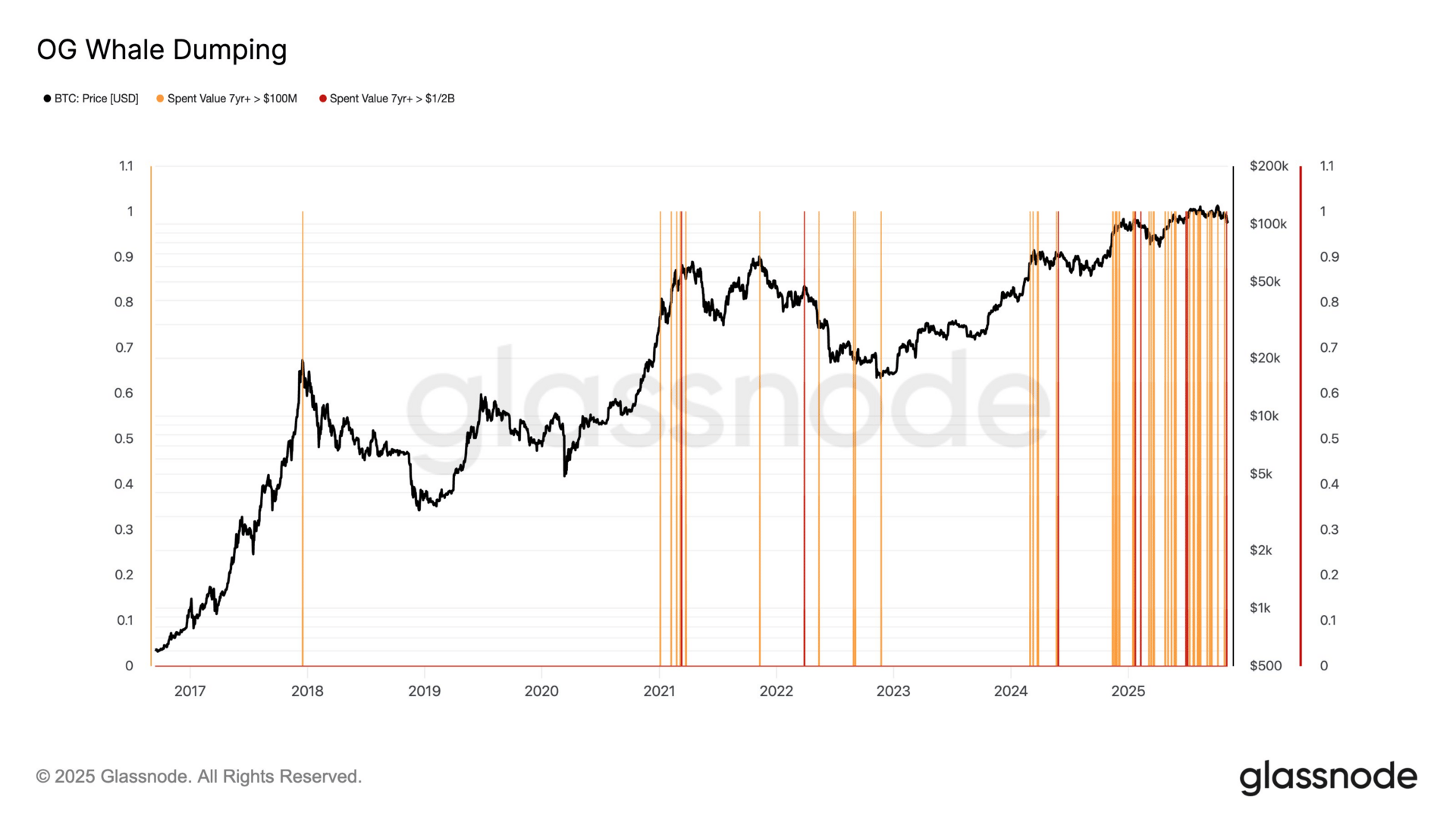

3. BTC whales. "OG Bitcoin whales are dumping. This chart gives a good visual of how many super whales are cashing out of Bitcoin. All lines here are 7+ year on-chain spends from pre-2018 era OG Bitcoin Hodlers. Orange = $100M OG dumps. Red = $500M OG dumps."

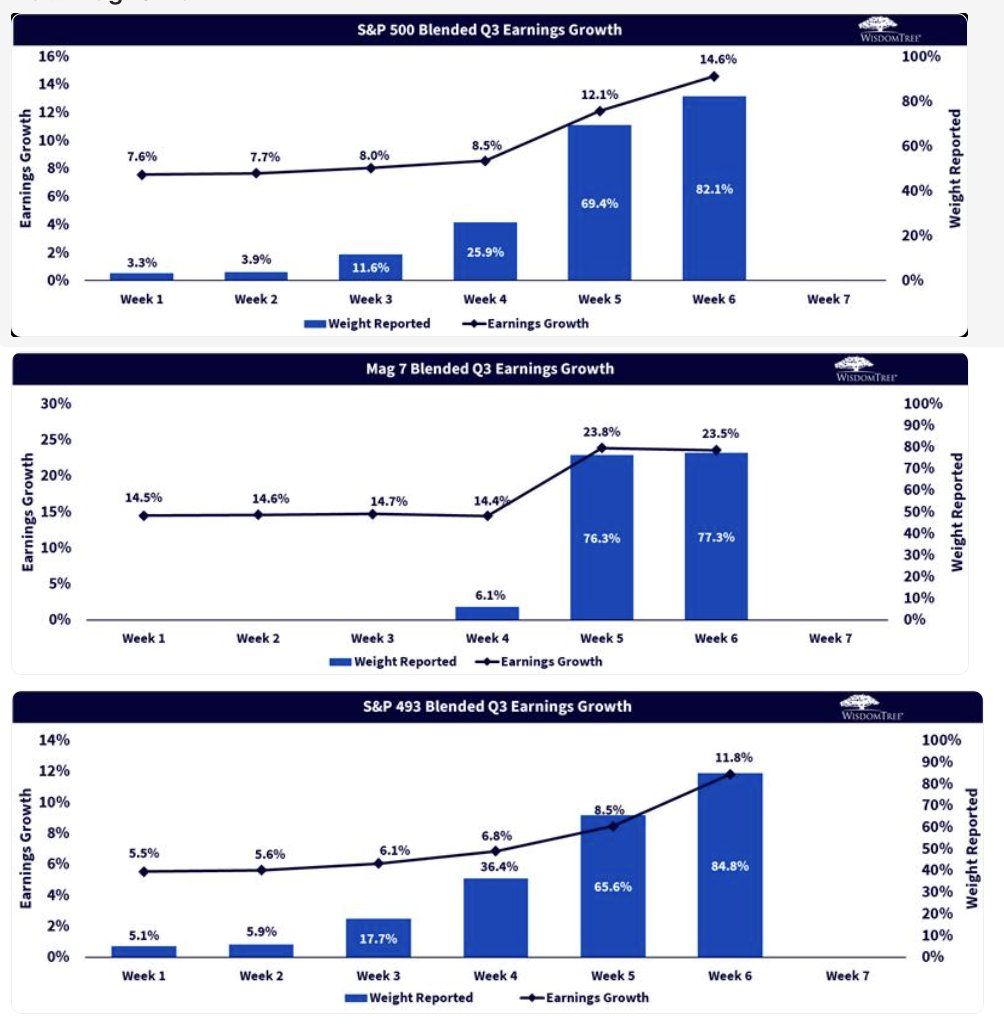

4. Q3 EPS growth. "A nice look at how Q3 EPS growth ramping over last 5 week as companies reported. Mag7 leading but not only positive story! Mag7 EPS expected 14.5% 5 weeks ago now at 23.5%. S&P 493: up from 5.5% to 11.8% w/ 85% reported. Overall Q3 up from 7.6% to now 14.6%. Bottom Line: EPS trending well".

5. Market cap vs. earnings. And finally, "I understand why the dark blue line makes folks uncomfortable, and it certainly invites questions of sustainability. At the same time, however, I’m not looking to pick a fight with the light blue line today (even if that day will come)."

Reply