- Daily Chartbook

- Posts

- DC Lite #492

DC Lite #492

AAII investors increased their allocation to stocks to the highest since November 2021

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Challenger job cuts. US employers announced 71k job cuts in November (vs. 57k a year ago and 153k in October). Notably, the 12-month moving average of cuts has crossed above 100k. Hiring plans, meanwhile, were the lowest in 3 months (9k).

2. Gas prices. "Gas prices fall below $3 a gallon for the first time in 4 years."

3. AAII Asset Allocation. AAII investors increased their allocation to stocks to the highest since November 2021 (71.2%). Cash allocation remains near 4-year lows (14.8%).

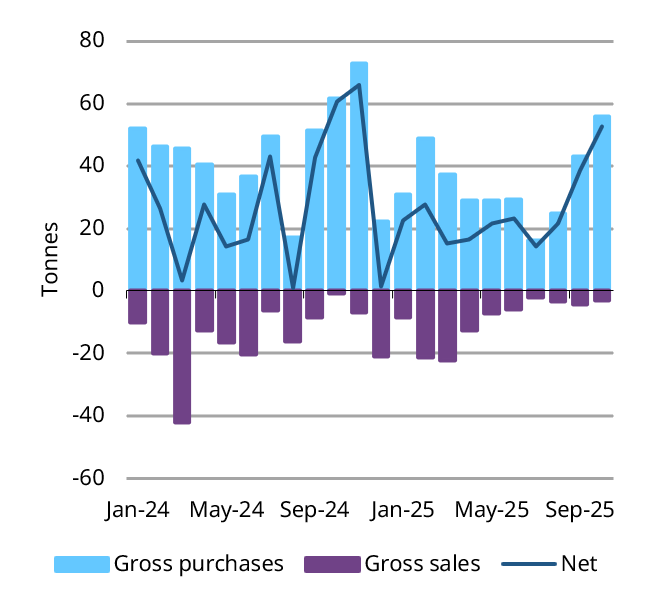

4. Hedge fund concentration. "The average fund holds 70% of its long portfolio in its top 10 positions, close to the highest concentration on record. Similarly, hedge fund crowding in a small number of positions is also at elevated levels."

5. Cash burn. "OpenAI may continue to attract significant funding and could ultimately develop products that…revolutionize the world. But at present, no start-up in history has operated with expected losses on anything approaching this scale. We are firmly in uncharted territory."

Reply