- Daily Chartbook

- Posts

- DC Lite #497

DC Lite #497

Both the S&P 500 and the NYSE A-D Lines made new ATHs today

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

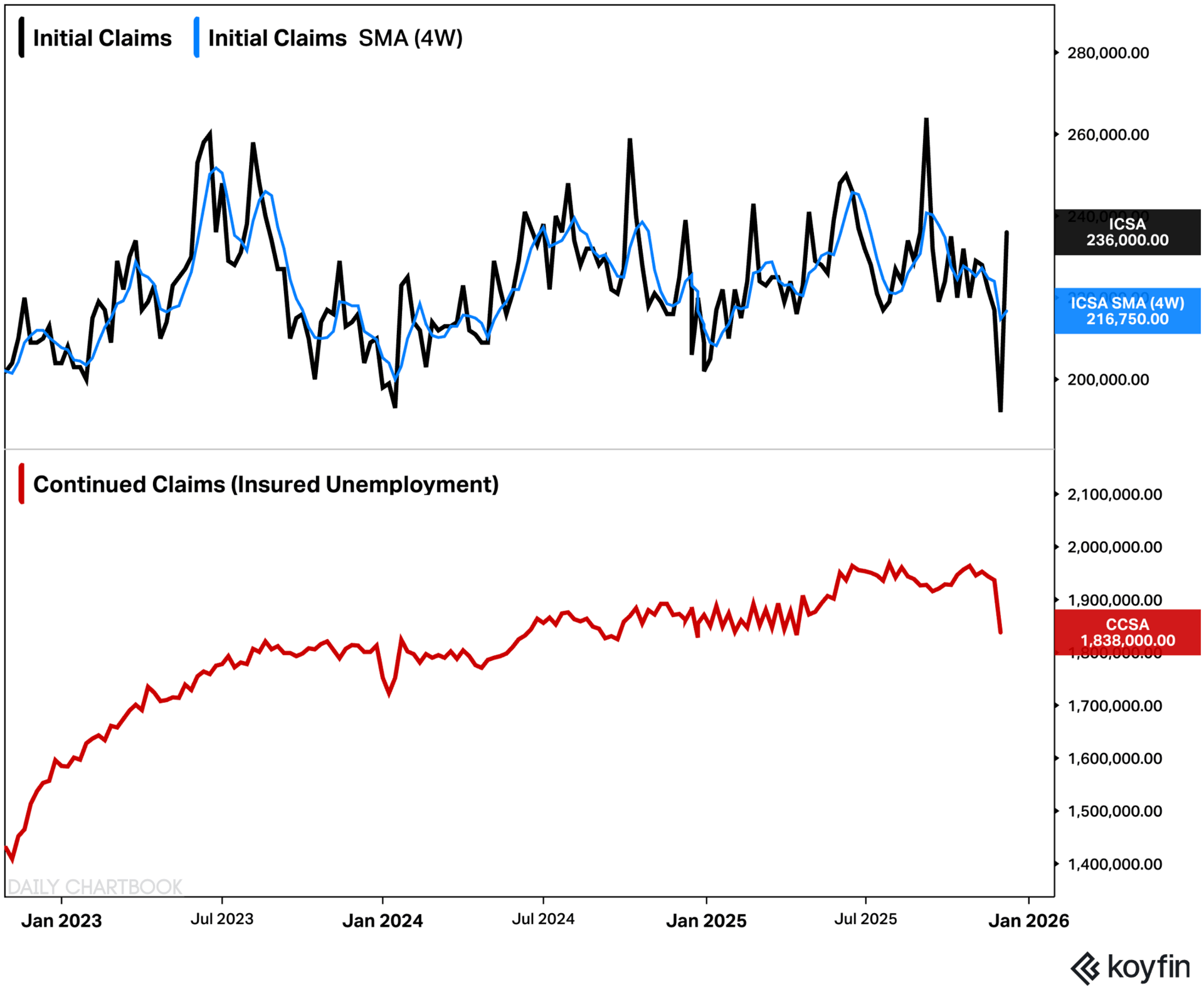

1. Jobless claims. Following the pervious week's big drop, initial claims jumped by the most since March 2020 in the week ending Dec 6. This data series is typically volatile around the holidays. Continuing claims, meanwhile, fell to the lowest since April.

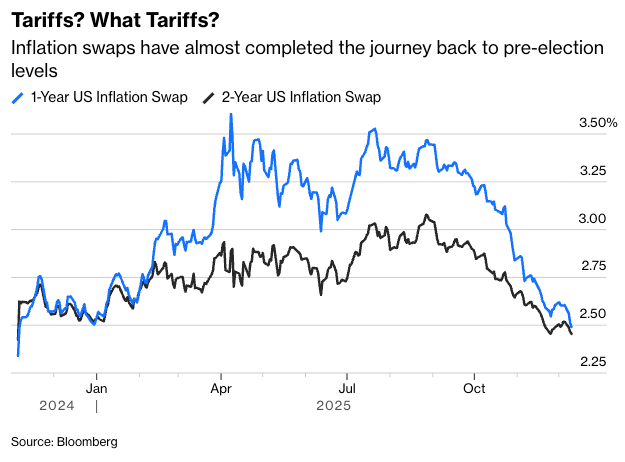

2. Inflation swaps. "Market signals suggest that concern about rising inflation, and in particular the impact of tariffs, has almost evaporated ... The market thinks the one-time price effect of the tariffs will be over a year from now. Market and Fed seem to agree that inflation has been tamed."

3. Tech rally ends. "$XLK is down today after rallying 13 consecutive days. Historically, when $XLK broke a 10+ day winning streak, it rallied 9 out of 10 times, 2 months later."

4. Advance-Decline Lines. Both the S&P 500 and the NYSE A-D Lines made new ATHs today.

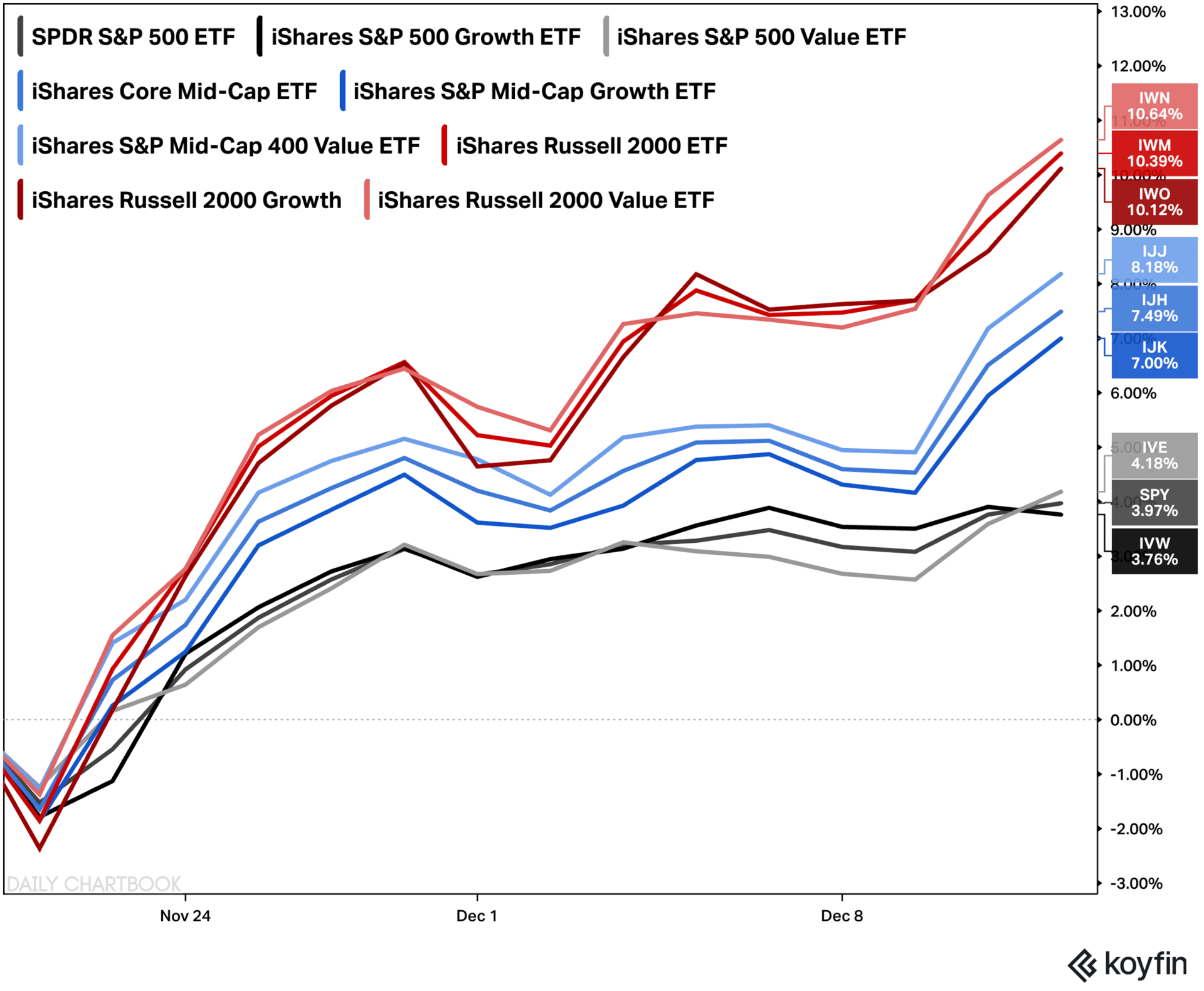

5. Size vs. factor. The theme since Nov 20 (recent bottom): Small > Mid > Large, and Value > Growth.

Sponsored content:

A New way to Earn Income from Real Estate

Commercial property prices are down as much as 40%, and AARE is buying income-producing buildings at rare discounts. Their new REIT lets everyday investors in on the opportunity, paying out at least 90% of its income through dividends. You can even get up to 15% bonus stock in AARE.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

Reply