- Daily Chartbook

- Posts

- DC Lite #494

DC Lite #494

"The sharp decline in funding spreads over the past week suggests professional investors sold into recent strength"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Survey of Consumer Expectations. "The share of households who think their financial situation will be better in a year matched a new 2-year low in Nov. Fewer than 26.5% of households expect their situation to improve. We were at this level in May 2025 after 'Liberation Day.'"

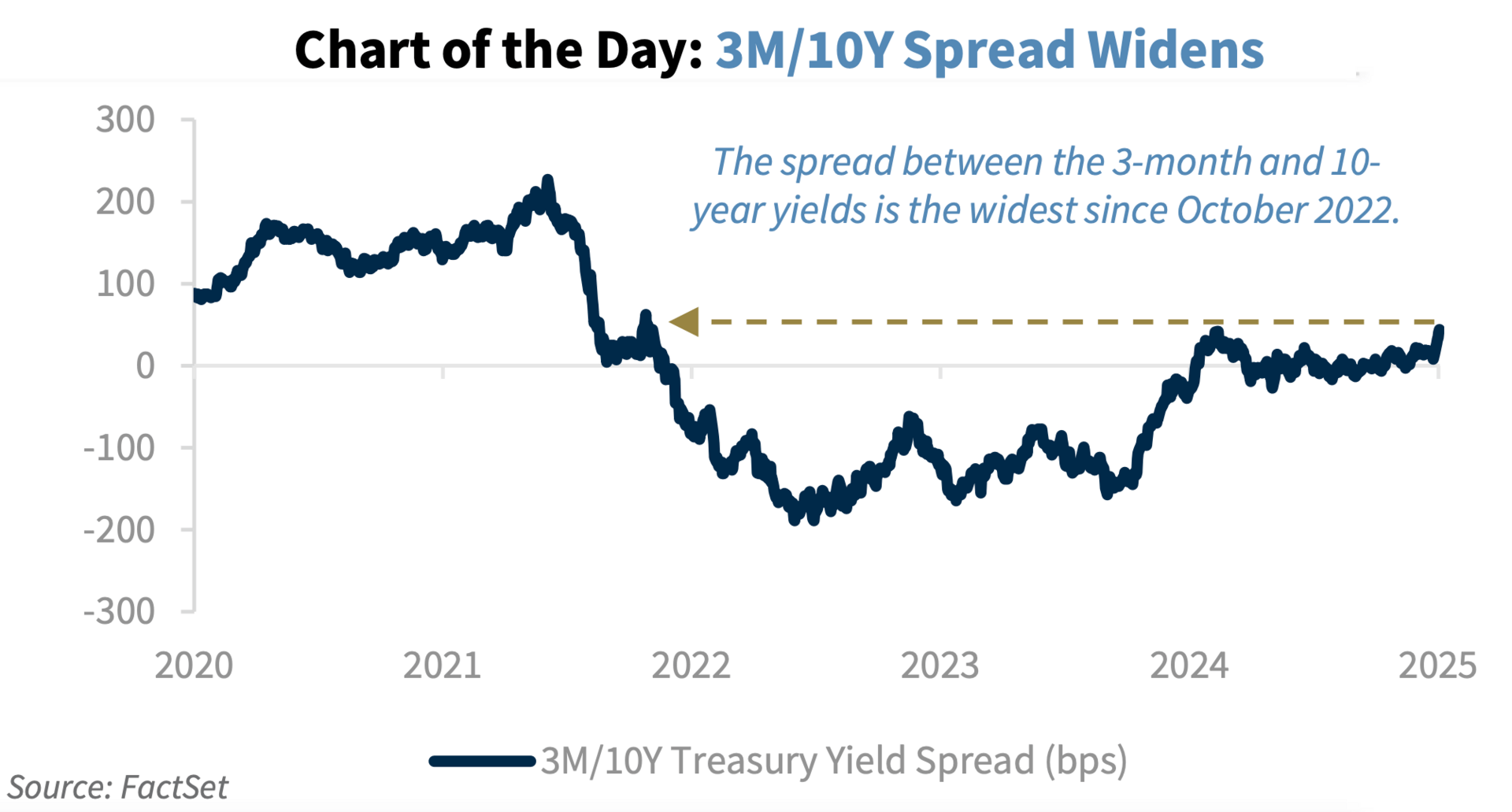

2. Yield curve. "The Treasury curve continues to steepen, with the spread between the 3-month and 10-year yields at its widest level, 58 bps, since Oct. 2022."

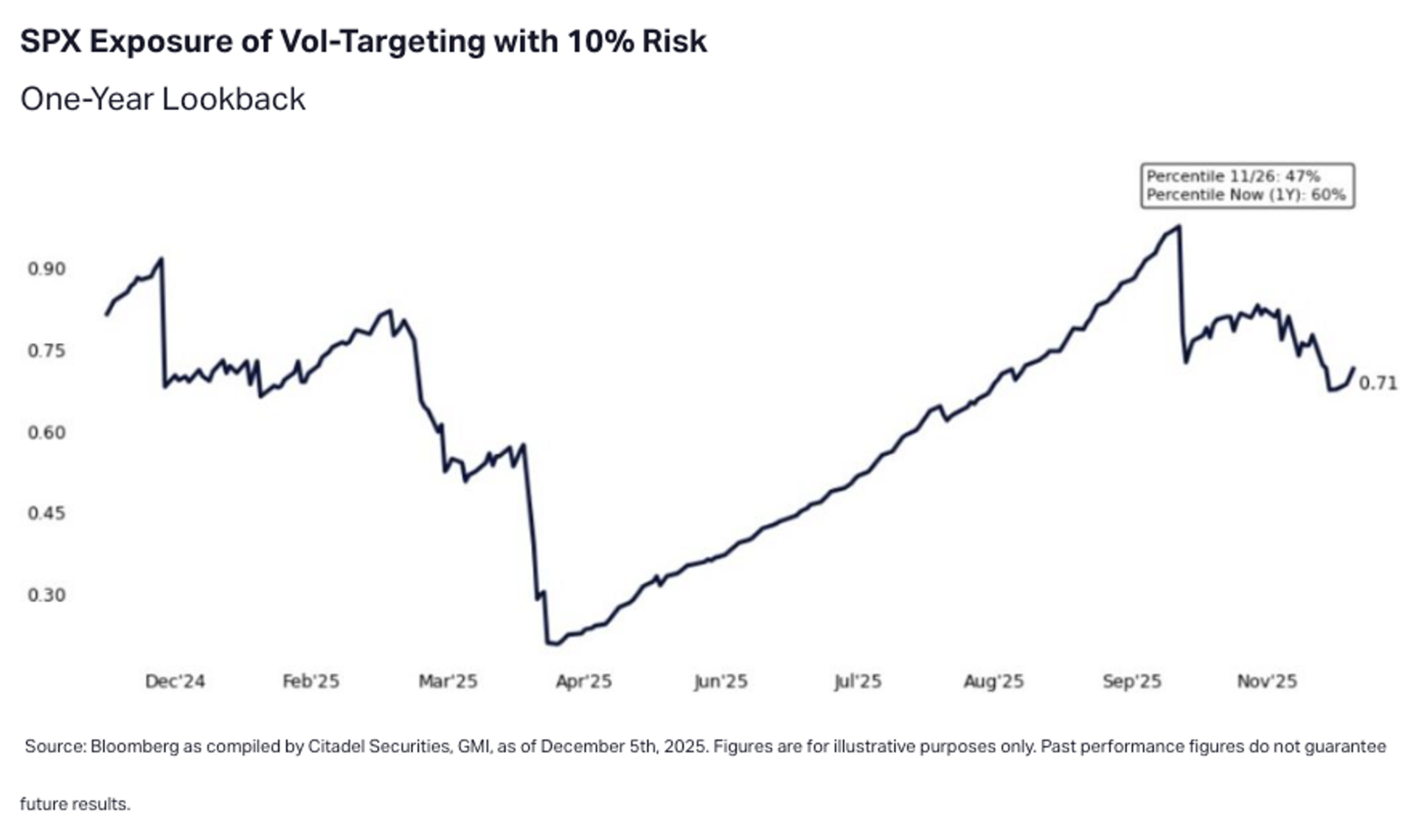

3. Funding spreads. The sharp decline in funding spreads over the past week suggests professional investors sold into recent strength.

4. XMOMO. "SG Cross Asset Momentum Signal (XMOMO) is positive for the 2nd week by jumping to 100%, i.e. 11 out of 11 key cross-asset signals are now positive, first time since July’23 ... XMOMO typically stays positive over coming weeks at these levels, with S&P 500 up >70% of the time over 4–6 weeks. A 100% reading is rare (<4% historically) and usually centres around shift in Fed sentiment."

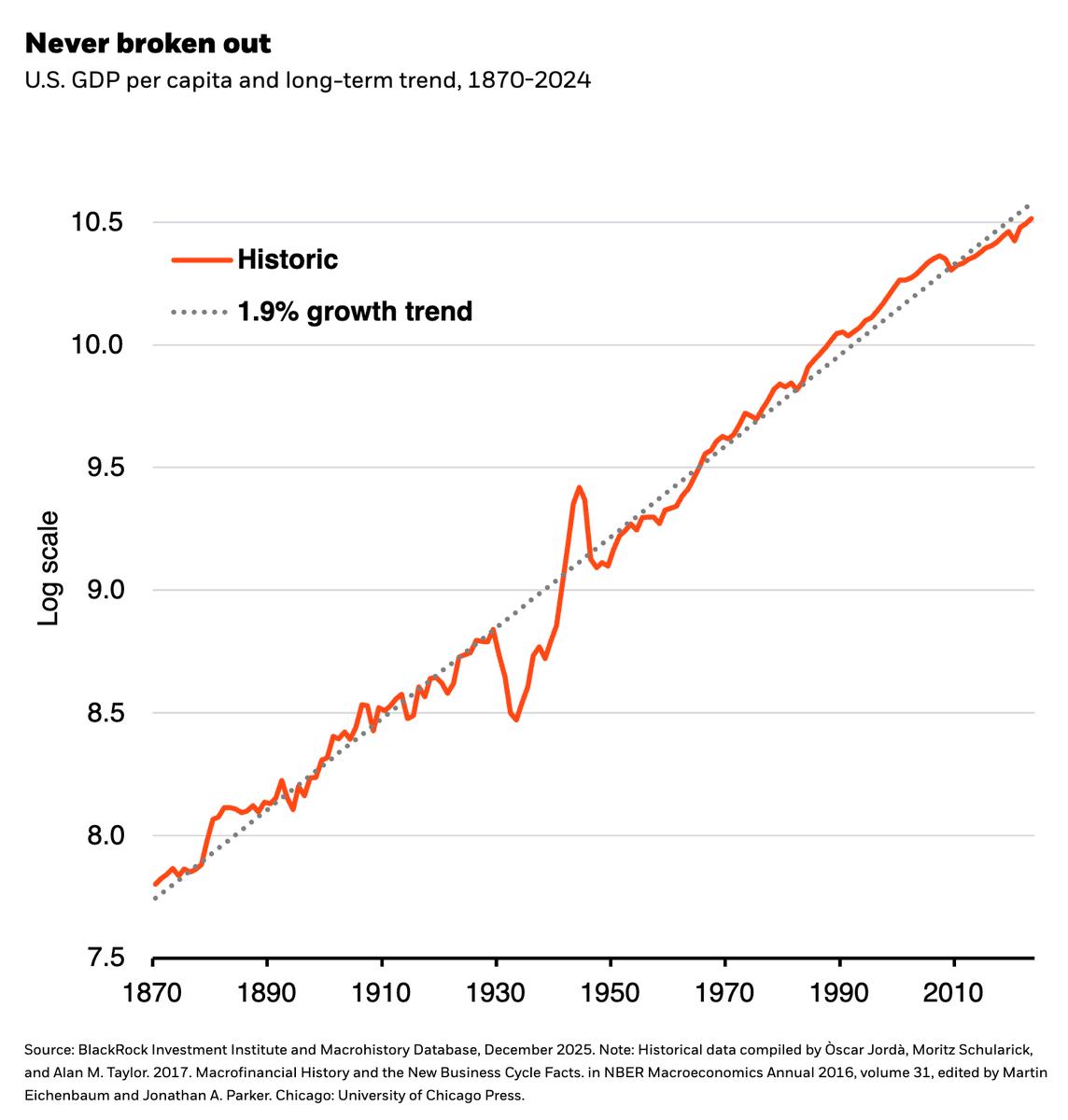

5. Tech vs. GDP. "All major innovations of the past 150 years – steam, electricity and the digital revolution – were enough to keep U.S. growth at its 2% trend, not break it ... Something more is needed, and AI could deliver it."

Sponsored content:

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Reply