- Daily Chartbook

- Posts

- DC Lite #496

DC Lite #496

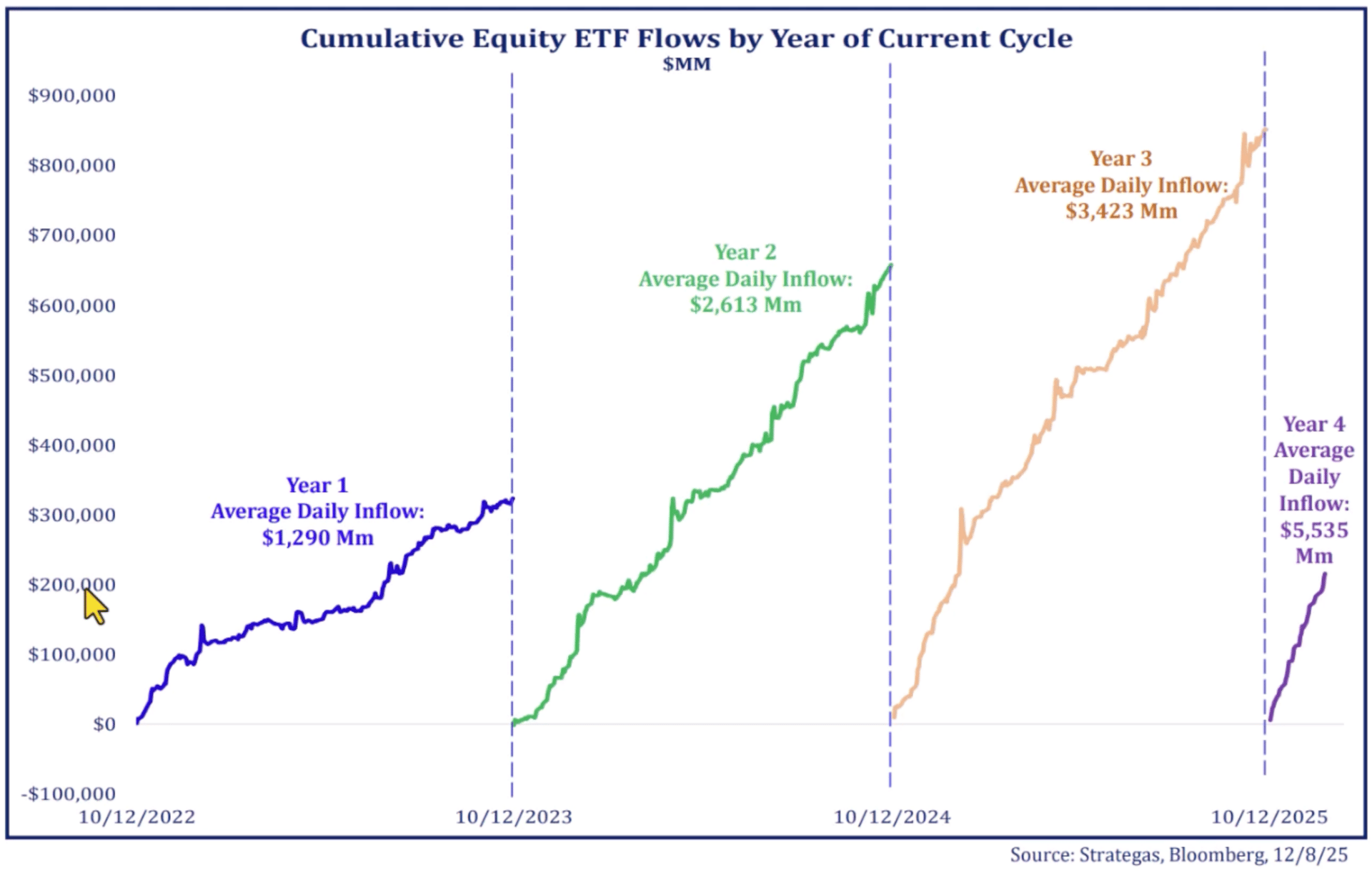

"We've done over $300bn in equity ETFs over the last 3 months"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

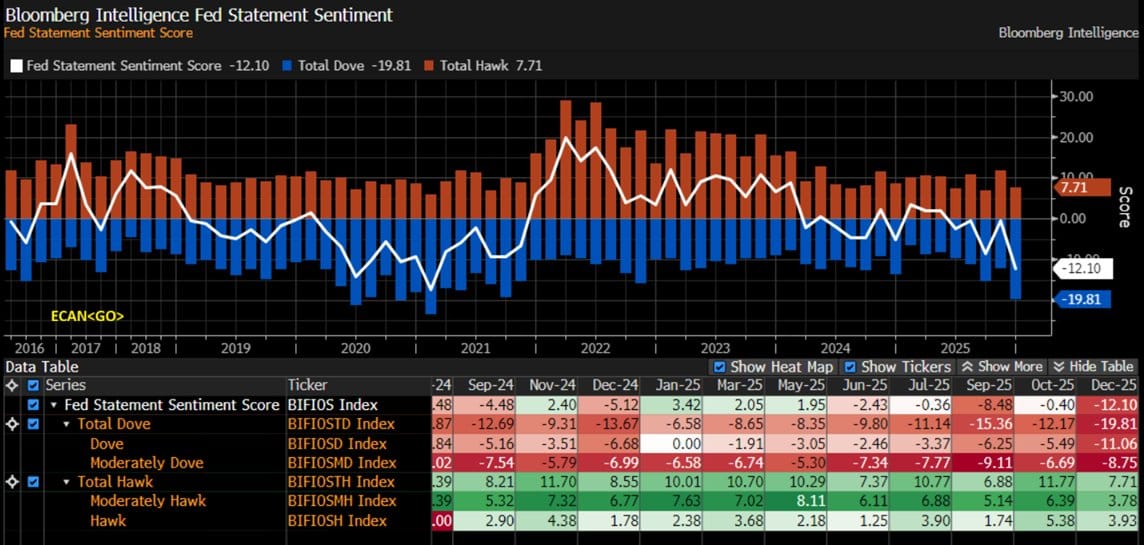

1. Fed sentiment. "Bloomberg Intelligence’s sentiment index shows the Fed at its most dovish posture, at least on paper," since early 2021.

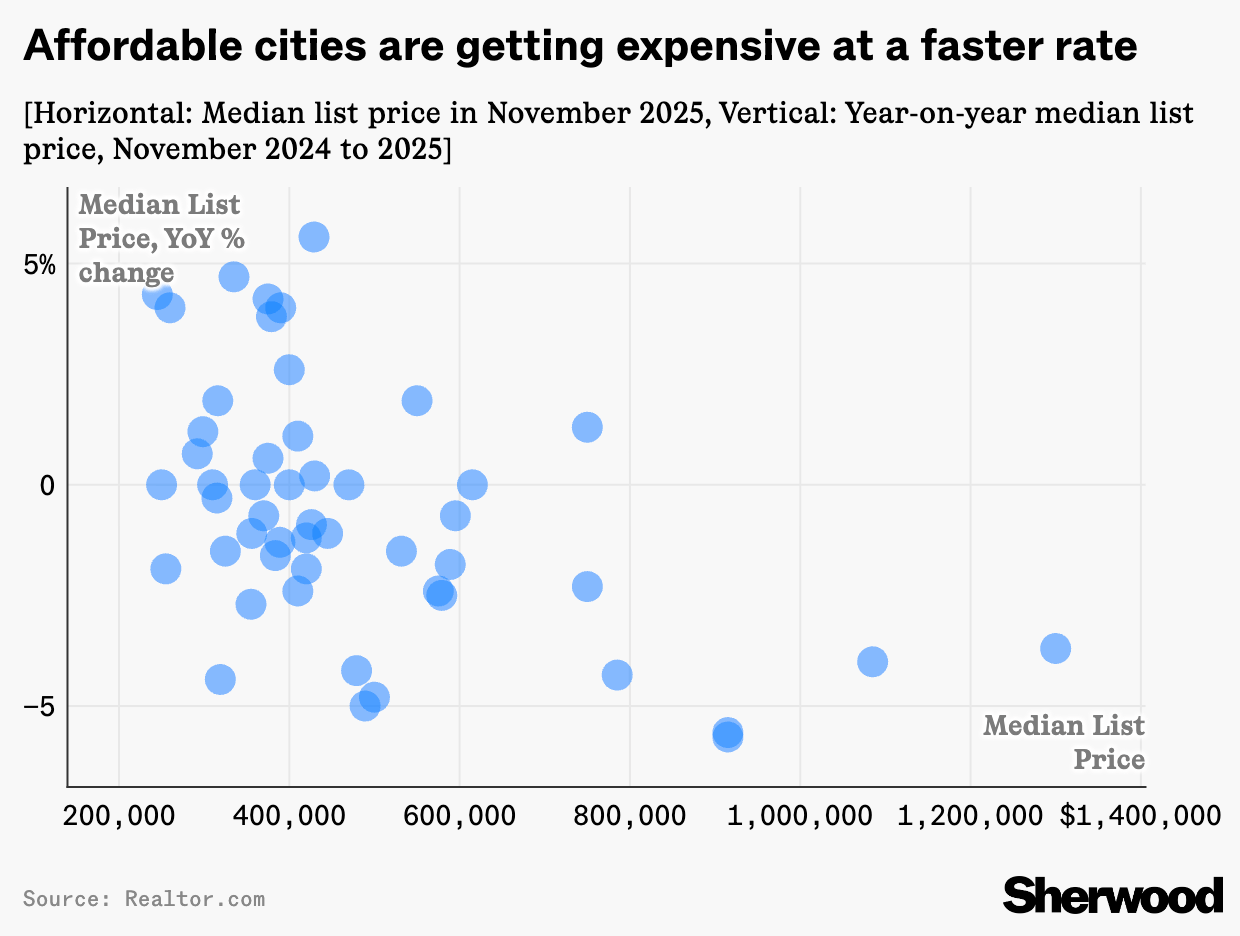

2. Home prices. "In a reversal of longer trends, prices are rising in cheaper cities and dropping in America’s most expensive metros."

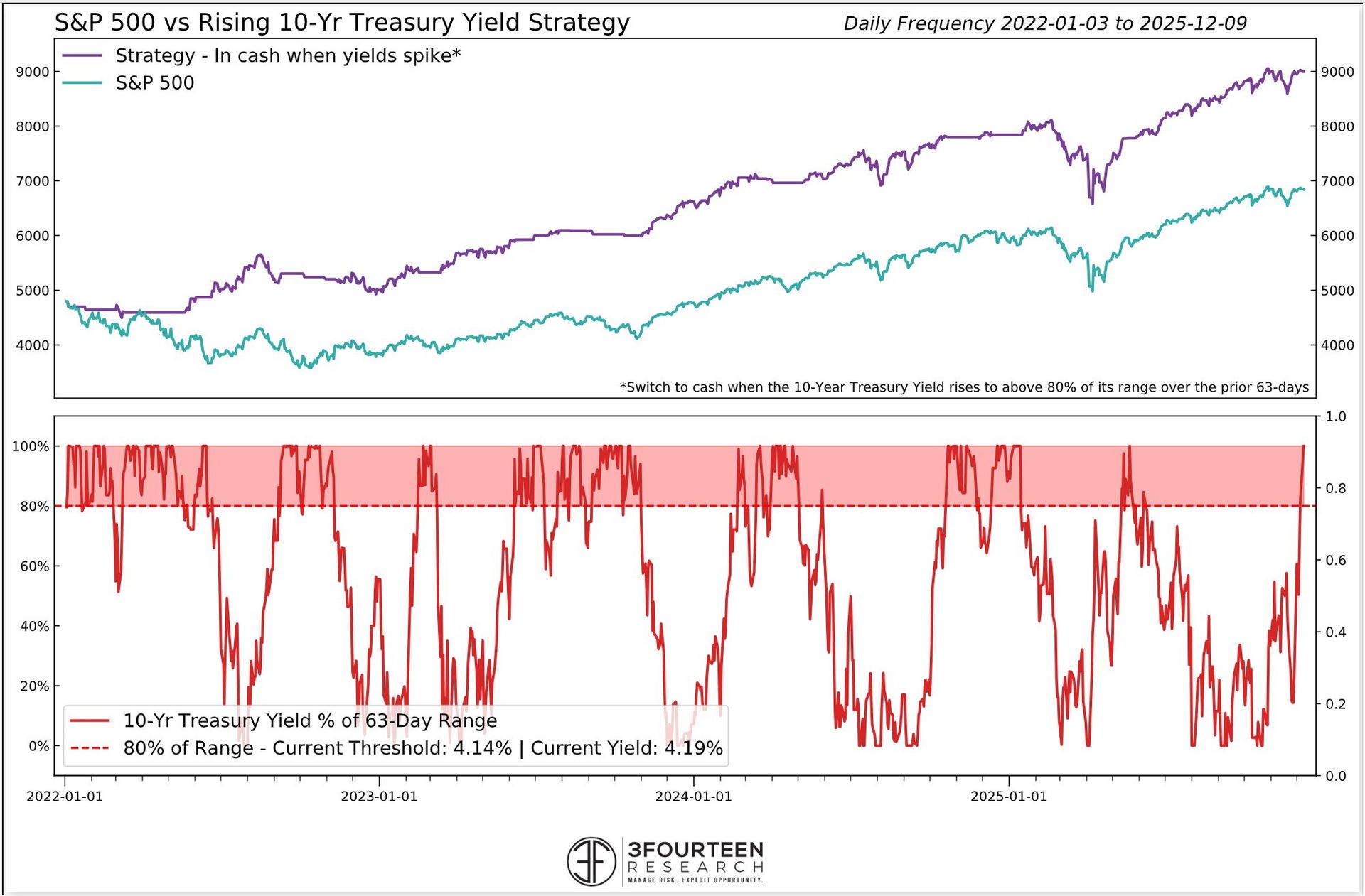

3. SPX vs. 10-year. "Recent 10-year yield rise approaching levels that could cause equity indigestion. Last few years equities have not responded well when yields increase too quickly."

4. Equity ETF flows. "We've done over $300bn in equity ETFs over the last 3 months, that's only the second time that's happened in history. Another way to look at this ... year 1 ... Oct'22 to Oct'23, only did about $1.3bn per day ... we're now up to about $5.5bn per day for Year 4".

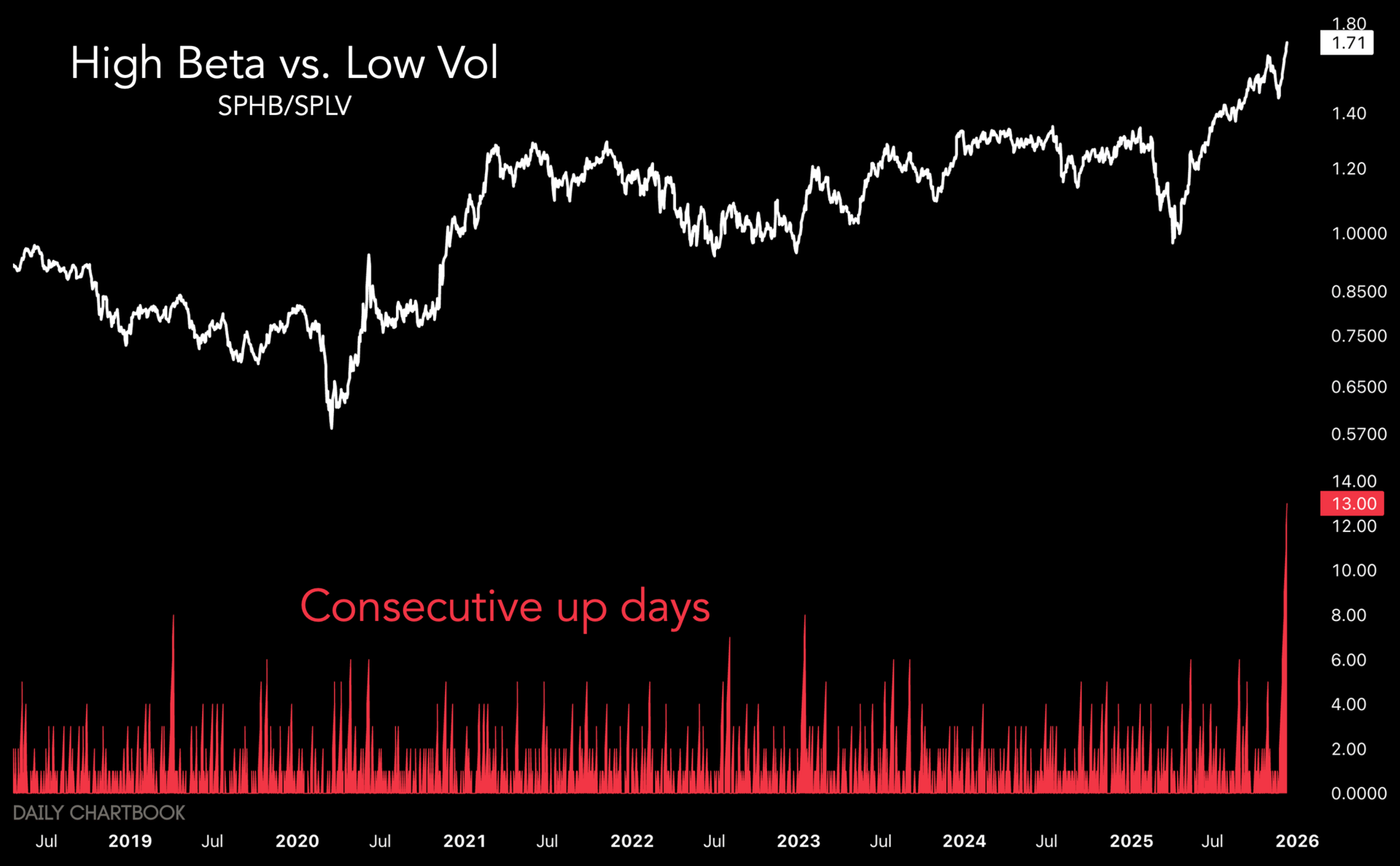

5. High Beta vs. Low vol. High beta stocks (SPBH) have now outperformed their low volatility counterparts (SPLV) for a record 13 consecutive sessions. The previous record was 8 sessions.

Sponsored content:

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

Reply