- Daily Chartbook

- Posts

- DC Lite #439

DC Lite #439

"Defense Sentiment is at one of the lowest levels of 2025"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

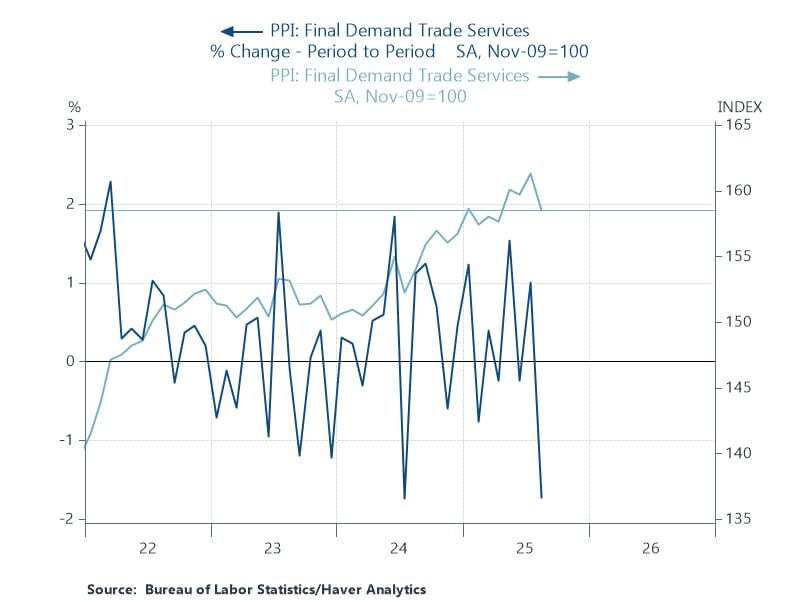

1. PPI. "The PPI margins index fell 1.7% in August to its lowest level since April. This would tend to indicate weaker direct pass-through to consumer prices with tariffs likely being absorbed by the firms themselves."

2. STAX. "Schwab clients became more enthusiastic buyers [in August] … Clients tracked by STAX remained large net-sellers of info tech shares overall but continued buying big names like Nvidia (NVDA) and Palantir (PLTR). They also gravitated toward sectors like financials and health care during August and generally showed more willingness to look beyond the mega-caps."

3. Sector sentiment. "Sentiment Spread has remained elevated despite the fall in both Offense and Defense Sector Sentiment. Defense Sentiment is at one of the lowest levels of 2025."

Sponsored content:

Daily News for Curious Minds

Be the smartest person in the room by reading 1440! Dive into 1440, where 4 million Americans find their daily, fact-based news fix. We navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet – politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight. Subscribe to 1440 today.

4. AI vs. SPX. "The 30 or so AI stocks in S&P 500 have a combined 43% of market cap. Even more compelling, these names have driven almost all of the returns and most of earnings growth since ChatGPT / Nov 2022."

5. SPX operating margin vs. GDP. "If nominal GDP growth slows further, margins are likely to come under increasing pressure, with rate cuts only likely to provide limited support."

Sponsored content:

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Reply