- Daily Chartbook

- Posts

- DC Lite #526

DC Lite #526

"Gold VIX recently spiked to a level rarely seen before"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Q4 GDP. The Atlanta Fed's GDPNow model estimate for Q4 GDP growth dropped to 4.2% from 5.4% on Jan 26, primarily due to net exports.

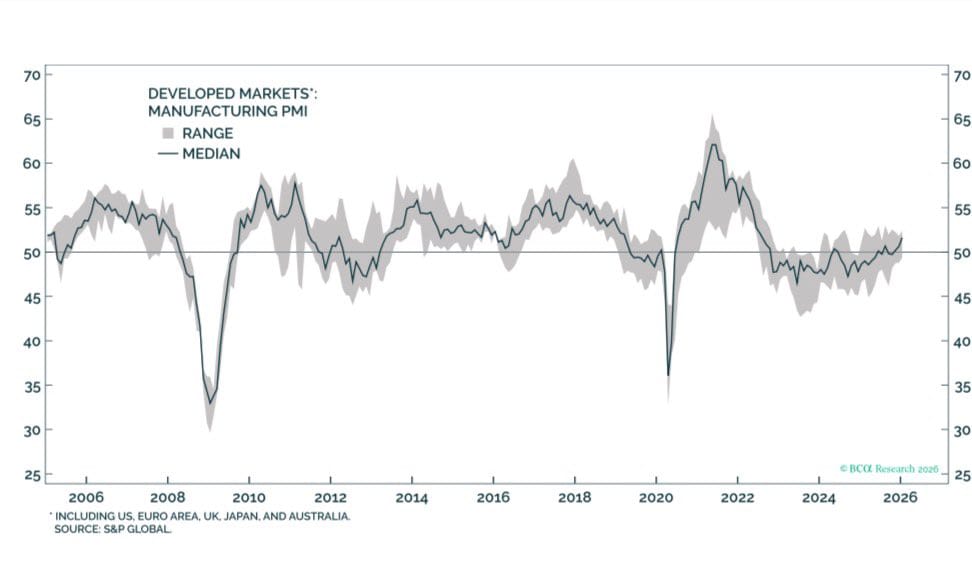

2. Developed Markets Manufacturing PMI. "I think one boring but underrated reason behind the weakness in the dollar and the strength in metals and international stocks is that we are in the middle of a cyclical reacceleration."

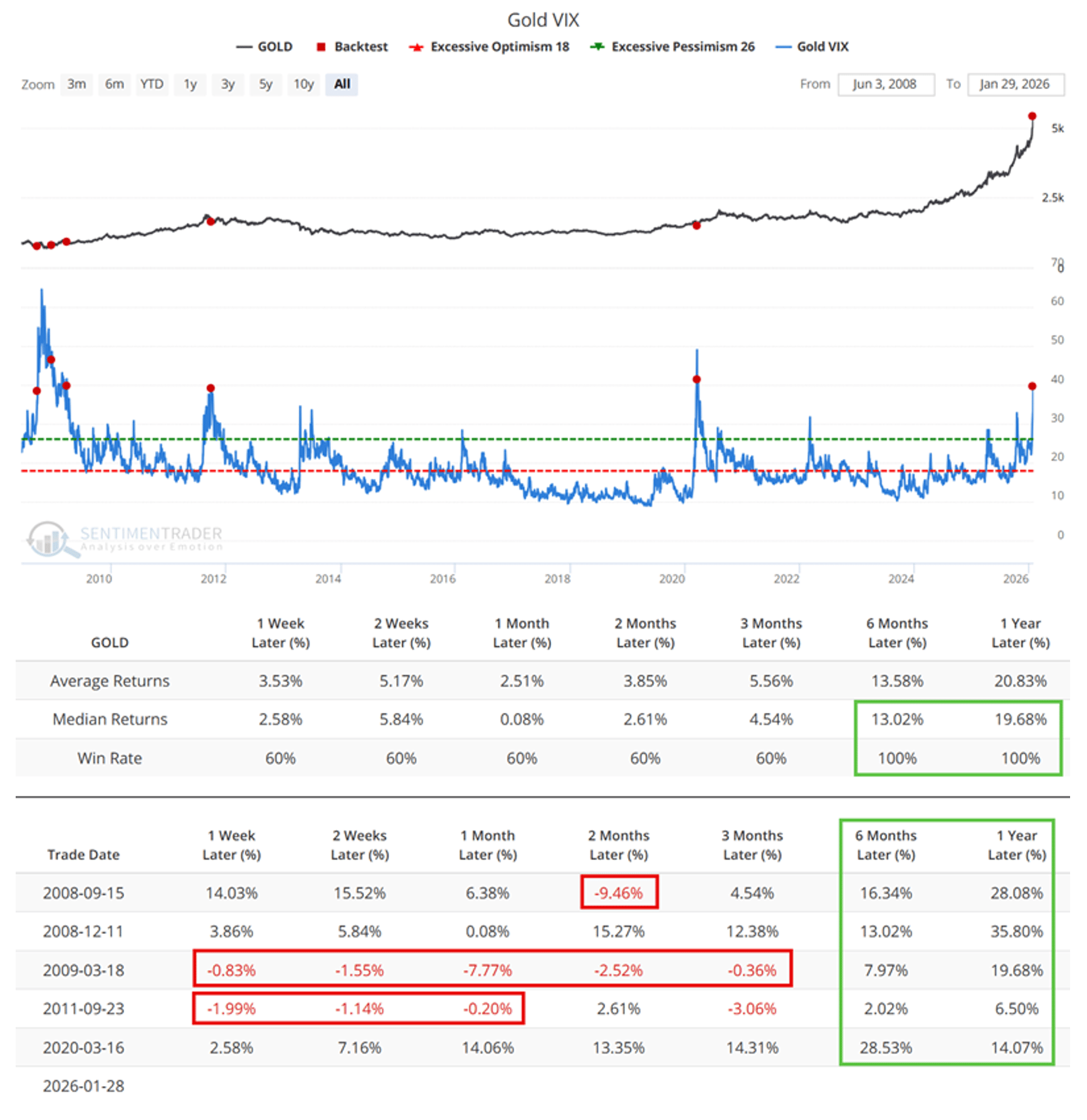

3. Gold VIX. "Gold VIX recently spiked to a level rarely seen before. The chart below highlights, with a red dot, the rare occasions when the Gold VIX crossed above 38 for the first time in three months ... The sample size is so small that it may be dangerous to attempt to draw conclusions."

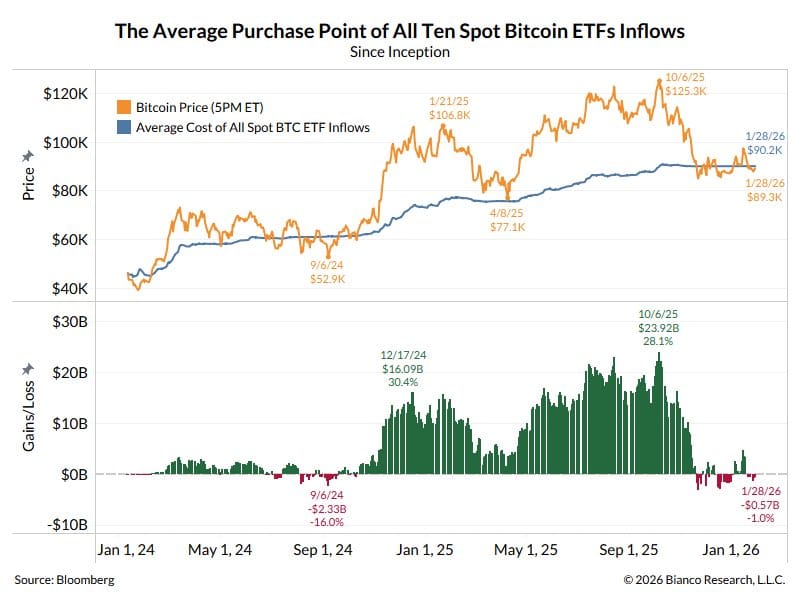

4. BTC ETF average cost. "The average purchase for all the flows into all the spot $BTC since inception (January 2024) is $90,200. With today's plunge, the AVERAGE $BTC ETF holder is about $5,000 (or ~7% underwater)."

5. Software vs. SPY. "The last time the S&P 500 Software & Services industry group was down at least 20% over a 63-session stretch while [SPY] was positive happened to be June 12, 2000."

Reply