- Daily Chartbook

- Posts

- DC Lite #521

DC Lite #521

"The crowd is alert, invested, and managing risk"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

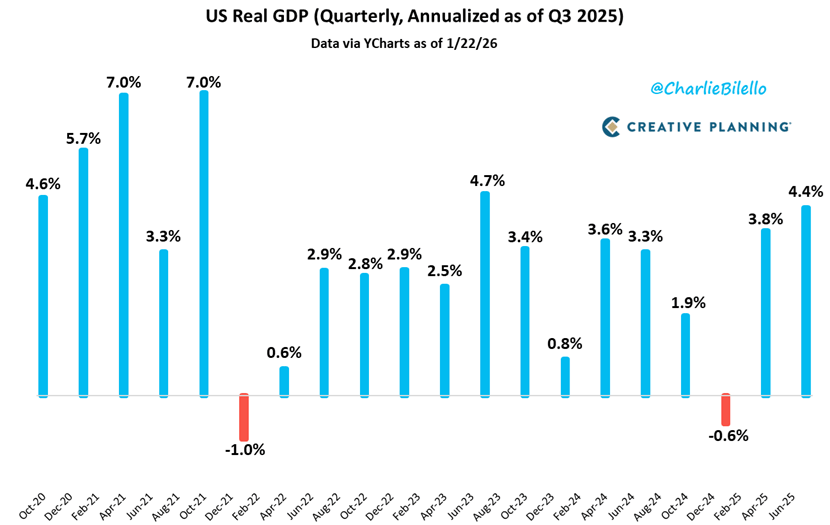

1. Q3 GDP. Final real GDP for Q3 was 4.4% annualized (4.3% prev), the strongest growth in 2 years.

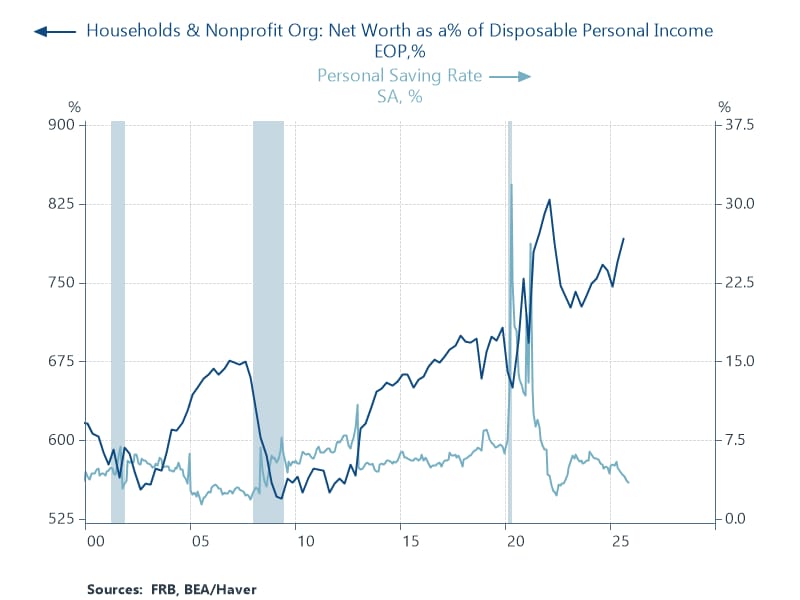

2. Personal saving rate. "The strength in consumption this year linked to a decline in the personal saving rate, which has declined 1.4ppts over the last year. The decline may continue provided we see ongoing appreciation in asset prices. Households see asset growth as a low risk form of income creation."

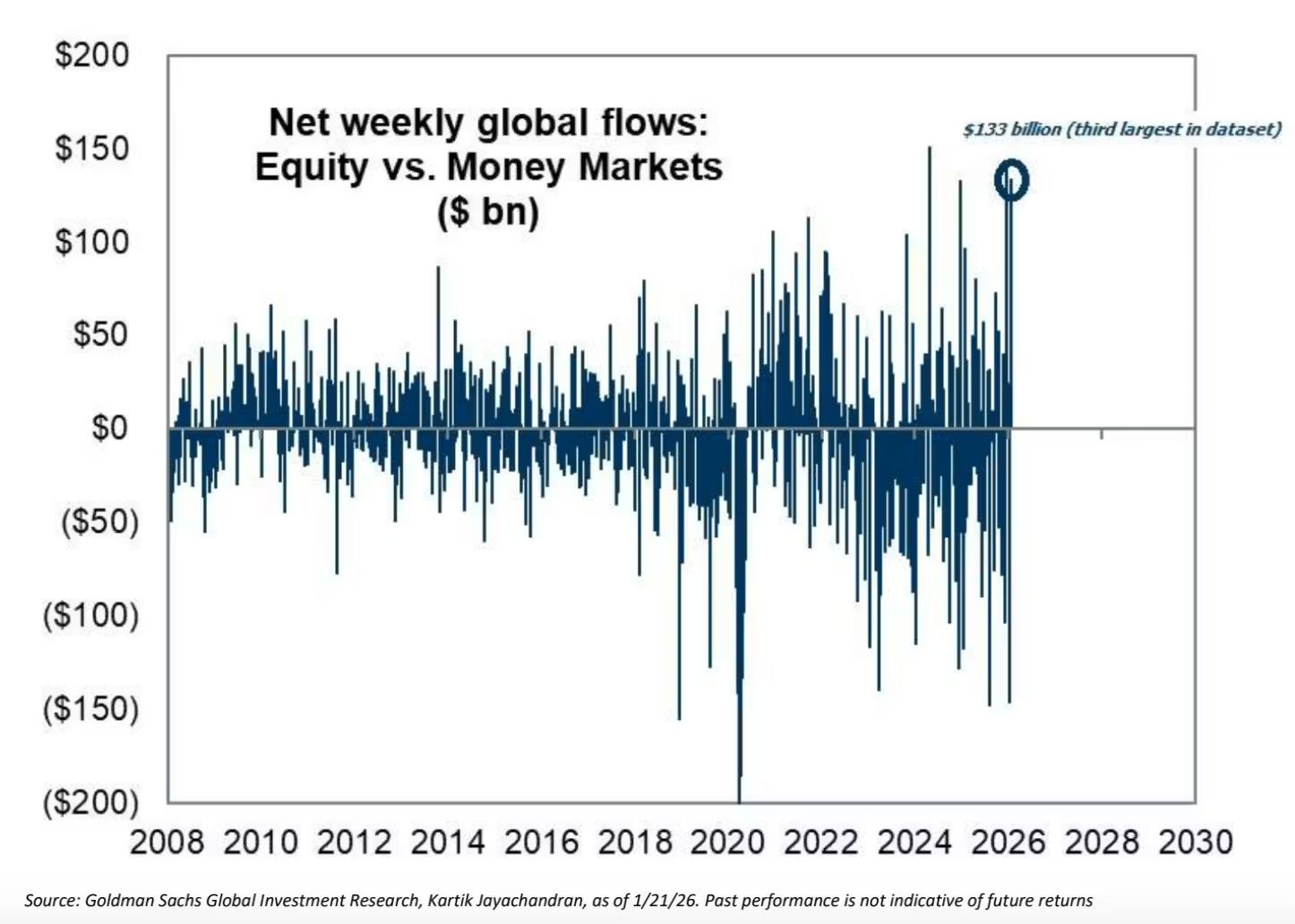

3. Equity vs. money market flows. "We saw strong net flows into global equity funds last week, led by stronger inflows into US and EM equity funds (+$71 billion vs $2 billion in the previous week) — more than 35x-ed the flows ... While equity flows increase, money market fund assets fell by $62 billion. This is the 3rd largest level in our dataset (!)."

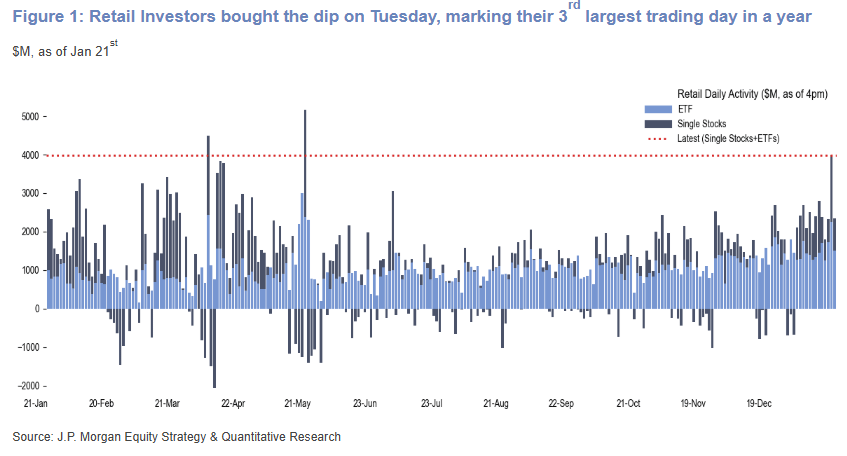

4. Retail BTFD. "As geopolitical developments cast fresh uncertainty over market sentiment earlier this week, retail investors responded by stepping in strongly to buy the dip, marking the 3rd largest single day buying event in a year."

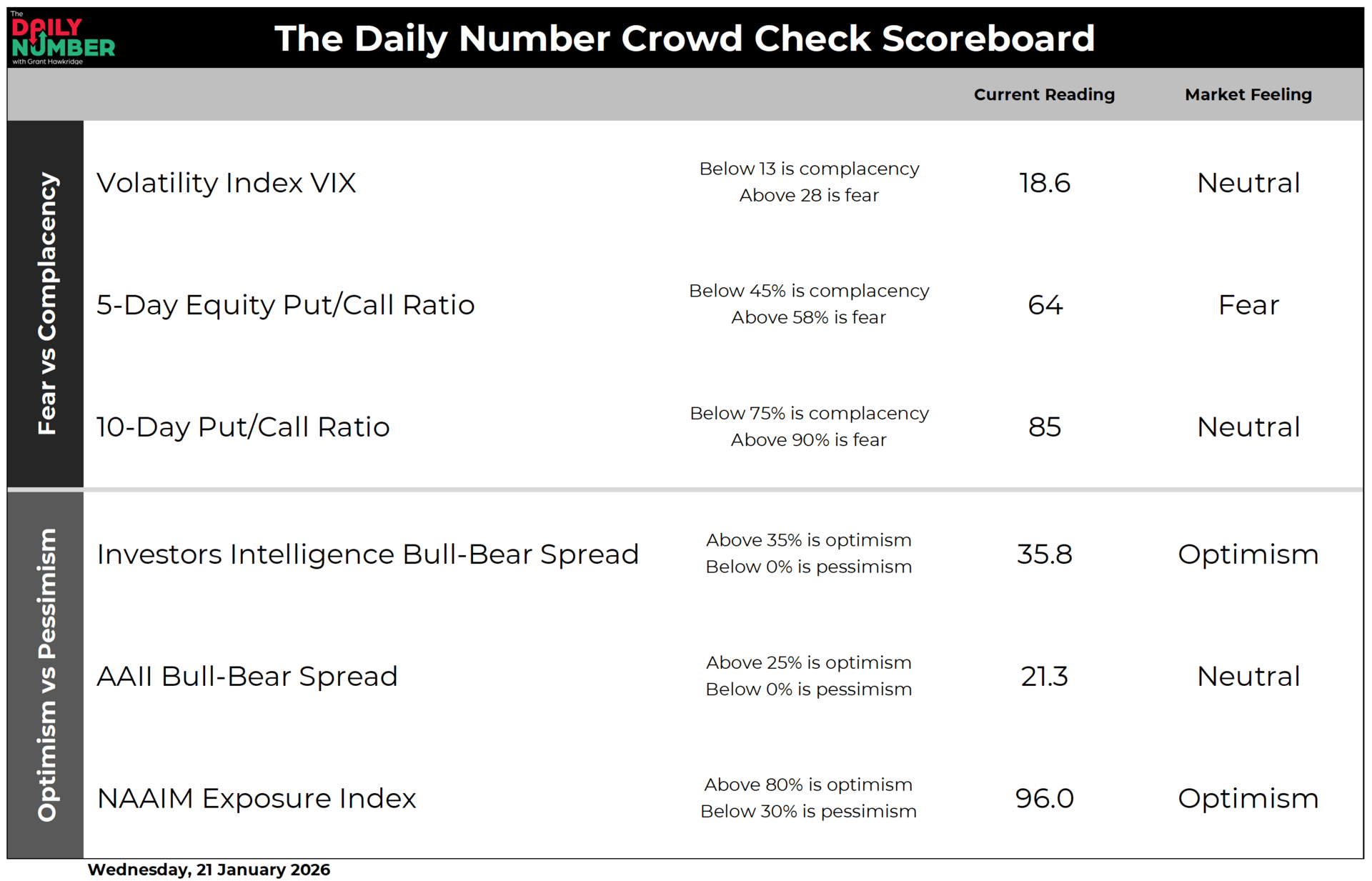

5. Market sentiment. "The crowd is alert, invested, and managing risk. Volatility has returned, but it has not broken behavior. As long as positioning stays engaged and stress remains contained, the primary trend remains intact, even if progress slows."

Reply