- Daily Chartbook

- Posts

- DC Lite #516

DC Lite #516

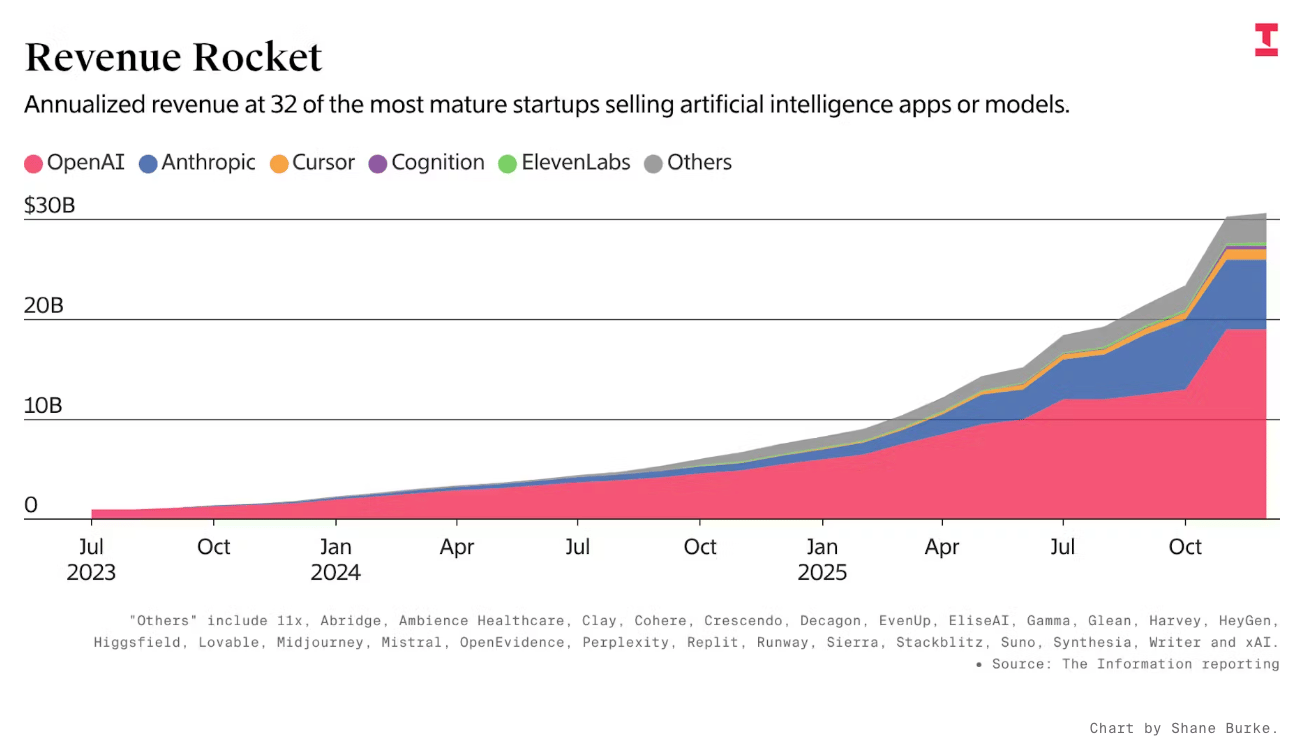

"In just seven months, annualized revenue at 'AI native' companies selling AI models or apps has doubled, from $15 billion to more than $30 billion"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. SCOTUS vs. tariffs. "The next major event that could trigger volatility in the financial markets is the Supreme Court's decision on whether Trump's tariffs are legal. Odds are that SCOTUS will decide that they are not. We estimate that this might force the US Treasury to refund about $150 billion in customs duties." Note: SCOTUS punted today.

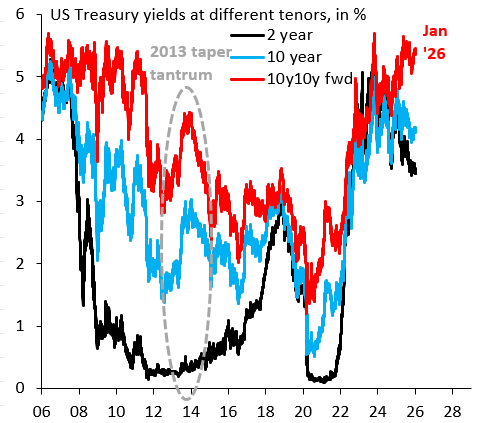

2. Risk premia. "Expectations of further Fed easing are pulling down the 2-year yield, which is also pulling down 10-year. But when you take out this 'front-end' effect, the 10y10y forward yield has risen steadily since Trump came into office and is near its highest level over the past 20 years. Risk premia are building at the very long end of the yield curve."

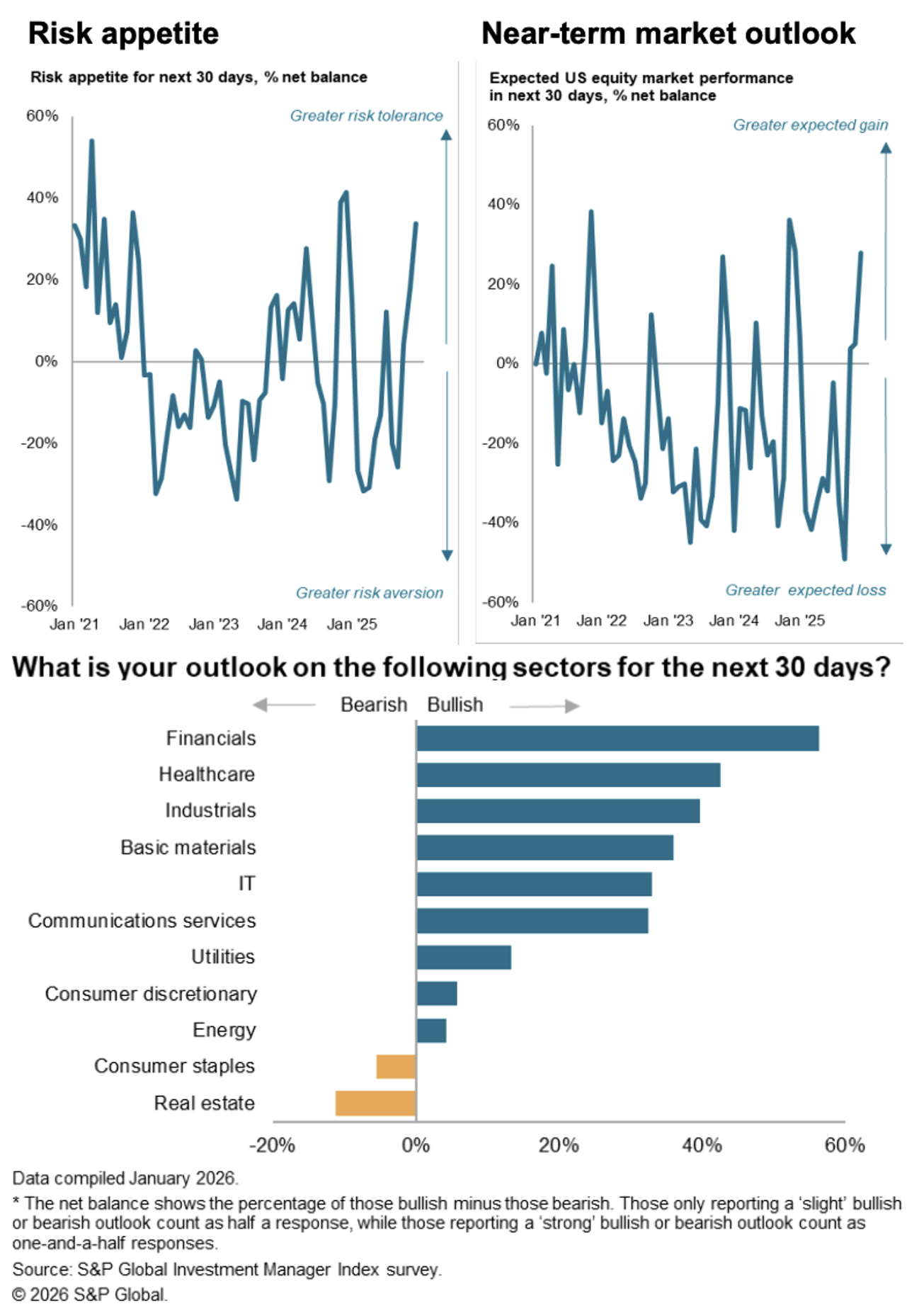

3. Risk sentiment. "Goldman’s Marquee client poll shows bullishness at levels seen only three other times in the past decade — in late 2017, late 2020, and late 2024. In two of those instances, markets experienced a correction within three months."

4. Market concentration. "While the late 1990’s mega cap dominance led to a swift mean reversion (and a 53% bear market), that same dominance persisted for a very long time during the 1930’s, 1940’s 1950’s and 1960’s."

5. AI native revenue. "In just seven months, annualized revenue at 'AI native' companies selling AI models or apps has doubled, from $15 billion to more than $30 billion, according to an analysis of 32 companies ... One problem: OpenAI and Anthropic make up nearly 85% of that revenue."

Reply