- Daily Chartbook

- Posts

- DC Lite #512

DC Lite #512

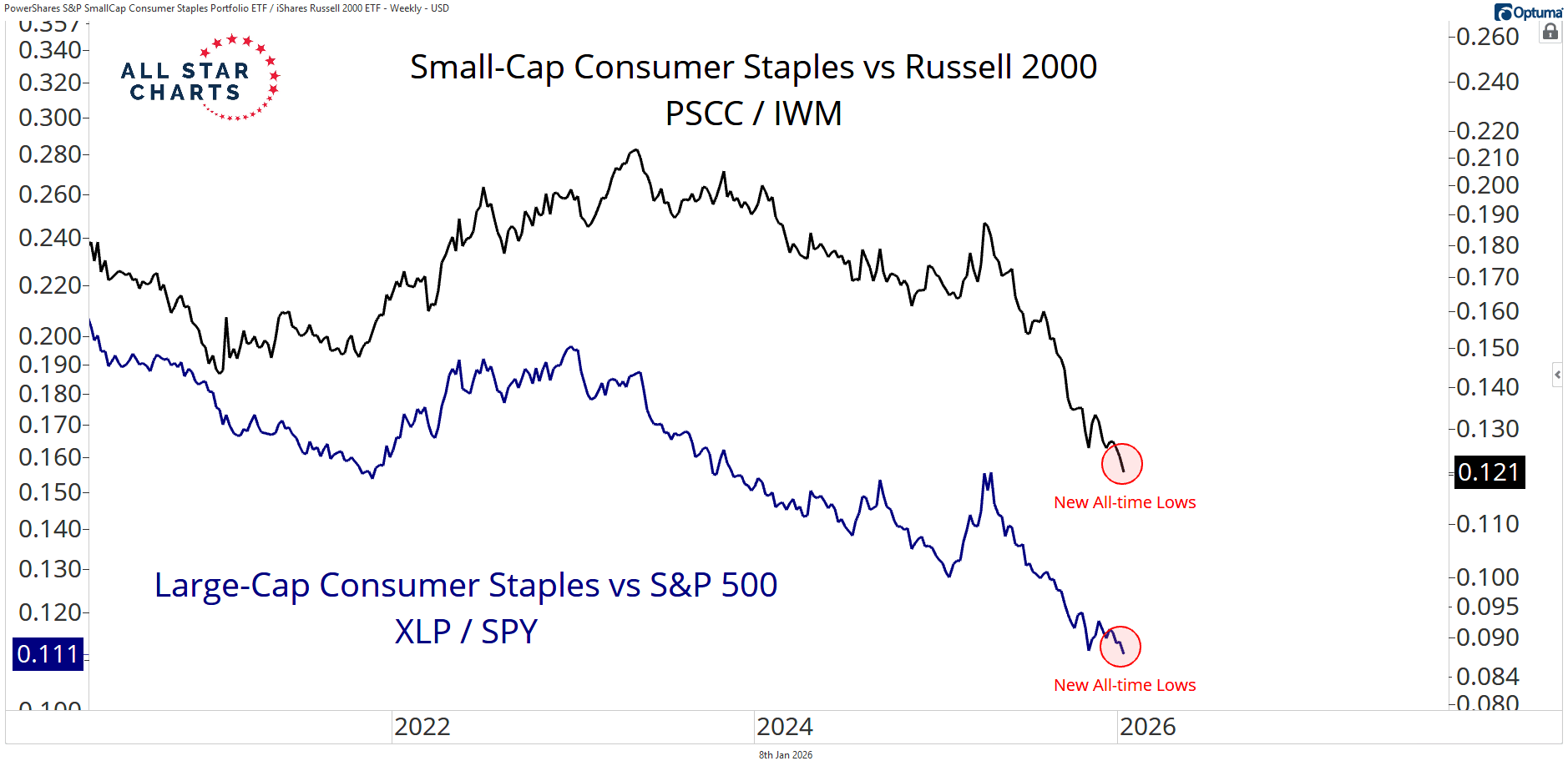

"Seeing these two lines break down like this is about as bullish as it gets"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Survey of Consumer Expectations. "More stress: % of consumers thinking they won't be able to make a minimum debt payment in the next 3 months rose sharply in December to 15.27% ... that is a new post-pandemic high."

2. U3 unemployment. "No-one is predicting a US recession in 2026 despite this simple indicator having a 100% track record of success. This time may well be different, but you've got to have a bloody good reason to ignore this. Are you feeling confident?"

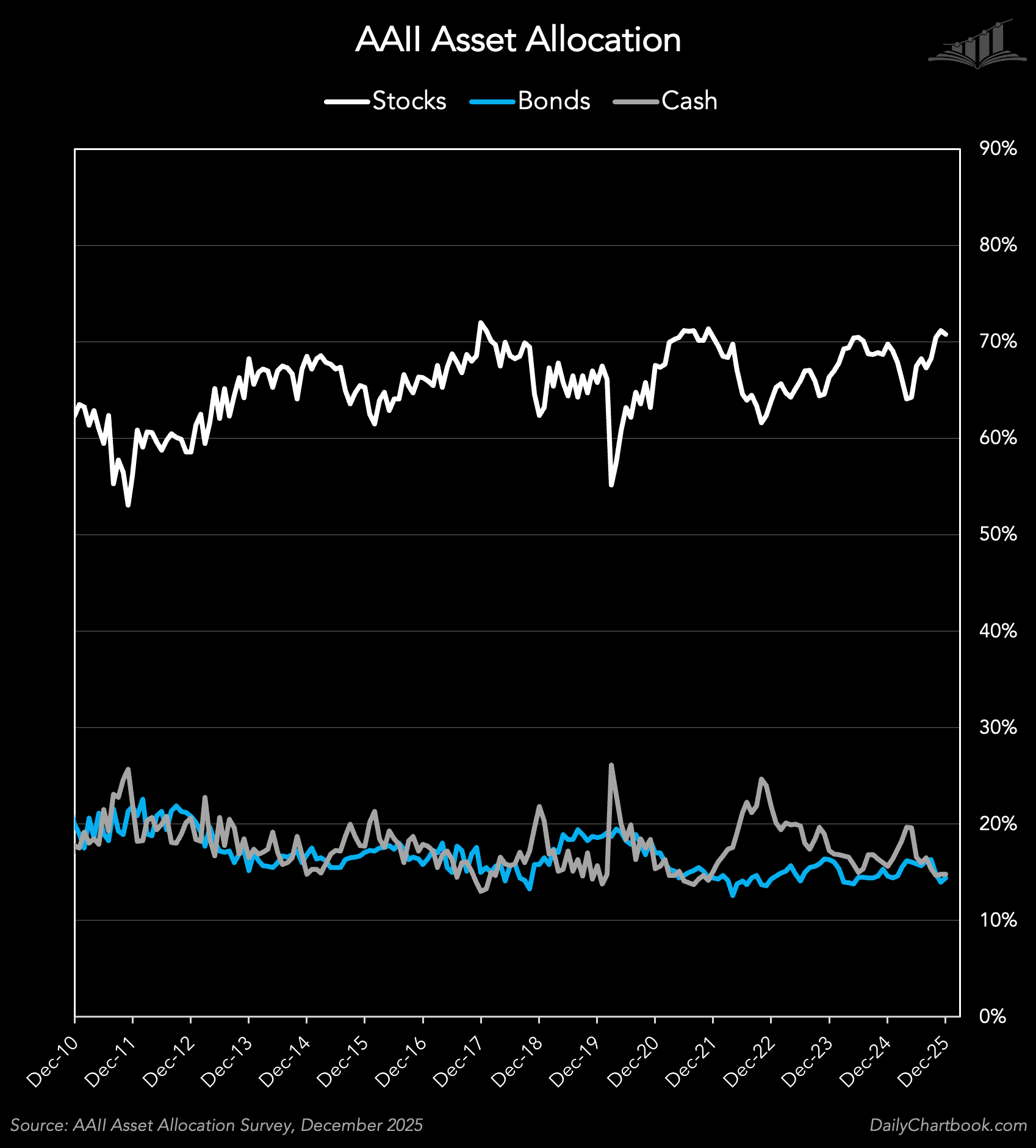

3. AAII Asset Allocation. AAII allocation to stocks ticked down in December but remains near multi-year highs. Bond and cash allocations remain low.

4. NAAIM Exposure Index. Active managers increased exposure to US equities over the past week. The index has held above 90 for 6 consecutive weeks, a streak seen just 9 other times since 2006.

5. Risk-off ratios. "From where I’m sitting, this is still very much a risk-on market … Seeing these two lines break down like this is about as bullish as it gets."

Reply