- Daily Chartbook

- Posts

- DC Lite #517

DC Lite #517

"The bond market has never been so quiet"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

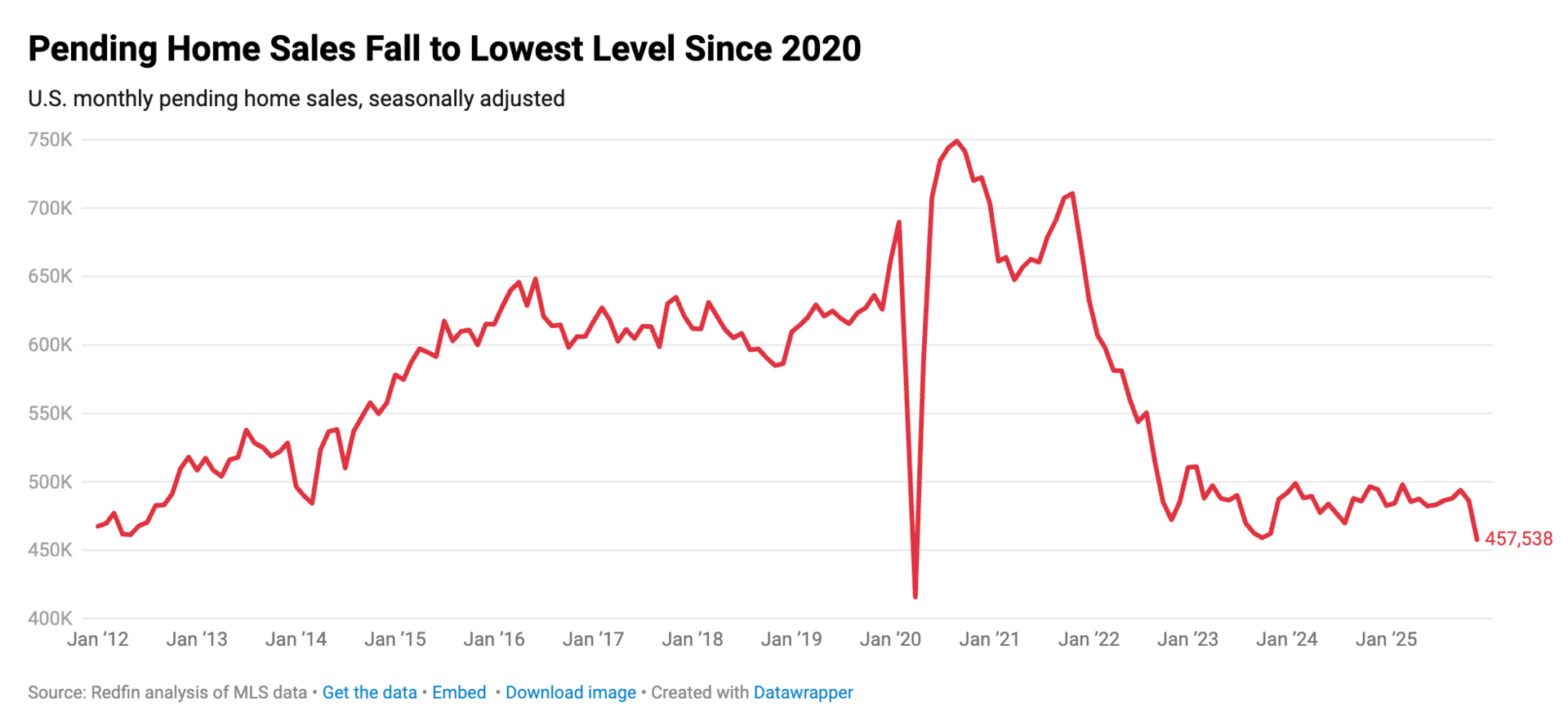

1. Pending home sales. "U.S. pending home sales declined 5.9% month over month in December to the lowest seasonally adjusted level on record except April 2020."

2. US fiscal impulse. "We are moving from 1%pt of GDP tightening in 2025 ... to 1%pt of GDP easing in 2026 ... if [tariff] rebates happen, we could be looking at an even larger fiscal boost, potentially adding another 1.5%pts of GDP to the fiscal impulse."

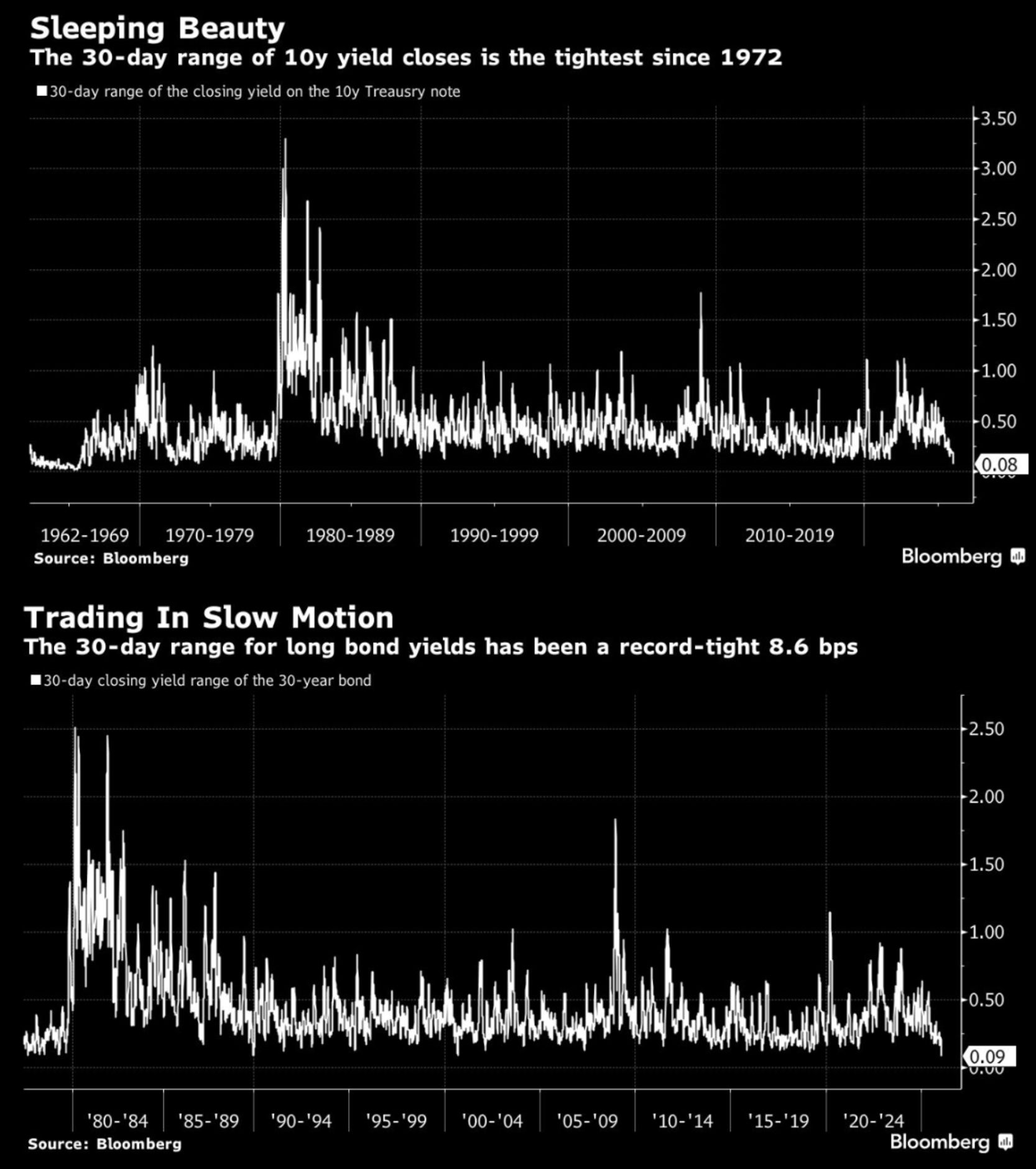

3. Bond market calm. "The bond market has never been so quiet ... the 30-day trading range for the benchmark 10-year US Treasury, which is now the tightest it’s been since the 1970s. Meanwhile, the trading range for the 30-year has reached a record low."

4. Sector vs. 200DMA. "All 11 S&P 500 sectors have climbed back above their 200-day moving averages. Since 1928, the S&P 500 has delivered an annualized return of 11.5% at this level, the highest of any threshold."

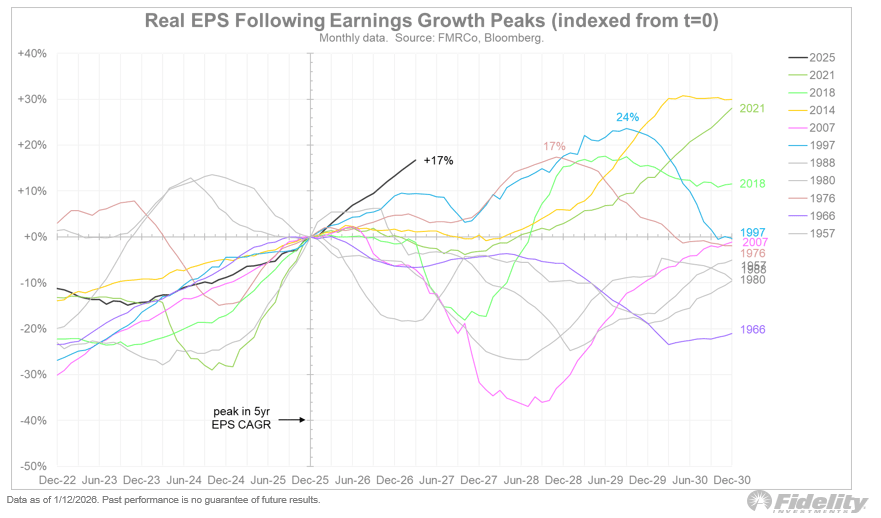

5. Peak earnings. And finally, "peak earnings growth and peak earnings are not always the same thing. Current estimates, suggest earnings could continue to advance higher by 17% over the next 5 quarters. If true, that will be the strongest continuation of earnings growth following a peak ever. Only the 1997 growth peak comes close."

Reply