- Daily Chartbook

- Posts

- DC Lite #519

DC Lite #519

"Some believe market valuations are highly predictive of forward returns. We’re skeptical"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Cross-asset selloff. "Stocks, bonds and the dollar fell after President Donald Trump threatened tariffs on various European countries before high-level meetings in Davos amid a growing standoff over his ambitions to take over Greenland. Bitcoin plunged. Gold hit all-time highs."

2. Credit spreads. "On headline-driven days like today, zoom out and focus on what actually matters. Nothing really bad happens when investment grade spreads are below 100!"

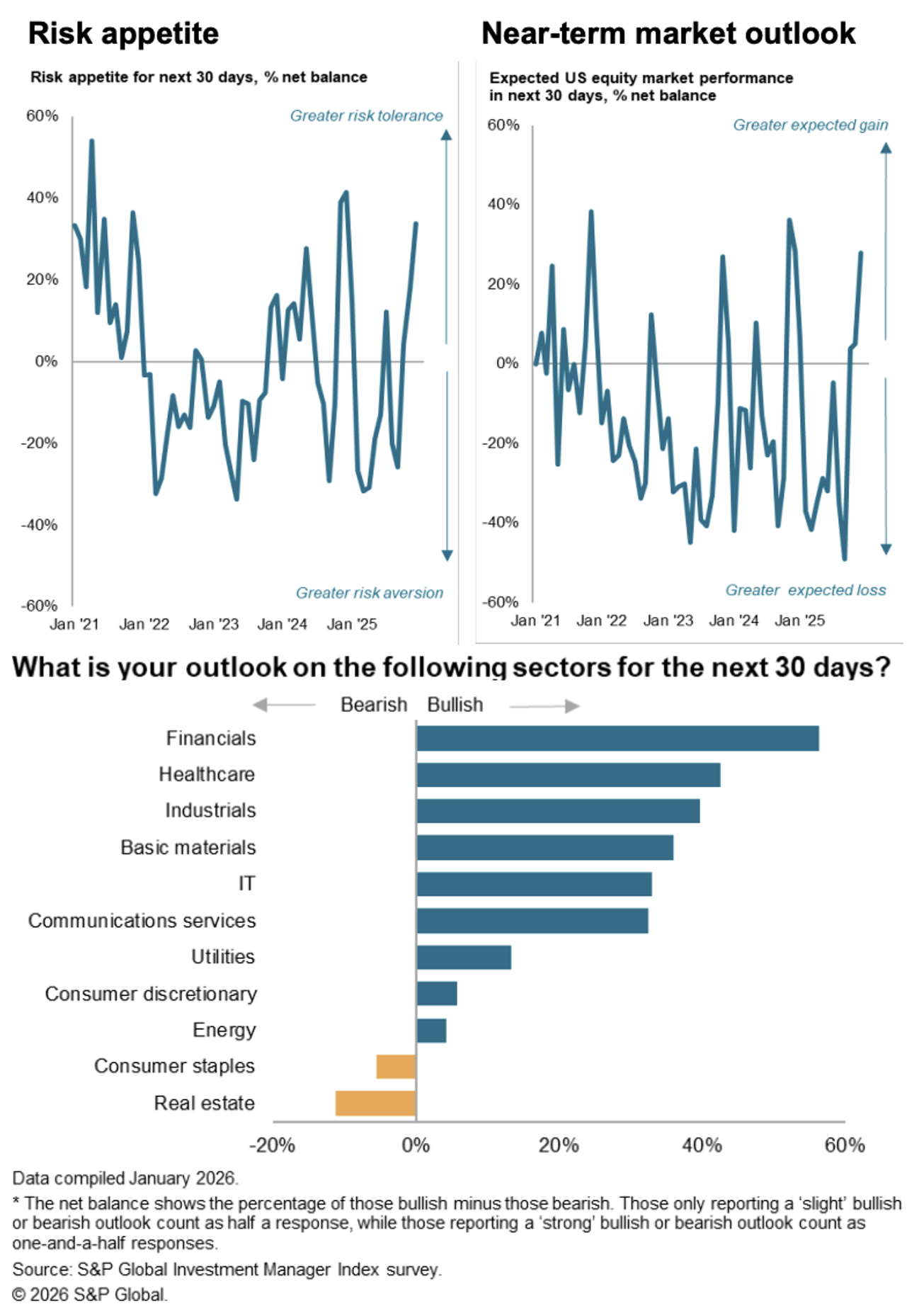

3. Capital cycle vs. crowding. "The best time to invest is when a sector is uncrowded while being aligned to the capital cycle … There has been a big jump in crowding for cyclical sectors like Banks, Industrials, and Materials … Surprisingly, tech remains relatively unloved."

4. Global breadth. "This is now the strongest global Bull Market since 2021".

5. Valuation vs. returns. "Some believe market valuations are highly predictive of forward returns. We’re skeptical ... In our own work, we found the underlying data to be heavily influenced by a single extreme outlier: the dot-com era from 1998-2002."

Reply