- Daily Chartbook

- Posts

- DC Lite #520

DC Lite #520

"The US stock market is rebalancing in one of the best ways possible"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Global yields. "Yesterday's spike in Japan's long-term bond yields (red) got a lot of attention, but the reality is that the rise in longer-term yields is a global phenomenon. These yields are rising sharply everywhere. The only exception are safe havens like Switzerland."

2. Small cap ETF flows. "If you look at small cap ETFs, all of them together, over the last year there are still outflows".

3. Ex-US vs. DXY. "The relationship is simple and powerful ... When the U.S. Dollar Index (DXY) is rising, the blue line falls. That tells us international equities are underperforming U.S. stocks. When the dollar rolls over and starts to weaken, that relationship flips."

4. SPX broadening. "The US stock market is rebalancing in one of the best ways possible. The mega caps seem to be taking a rest while the rest of the market breaks out. For now, the broadening is not a zero sum game."

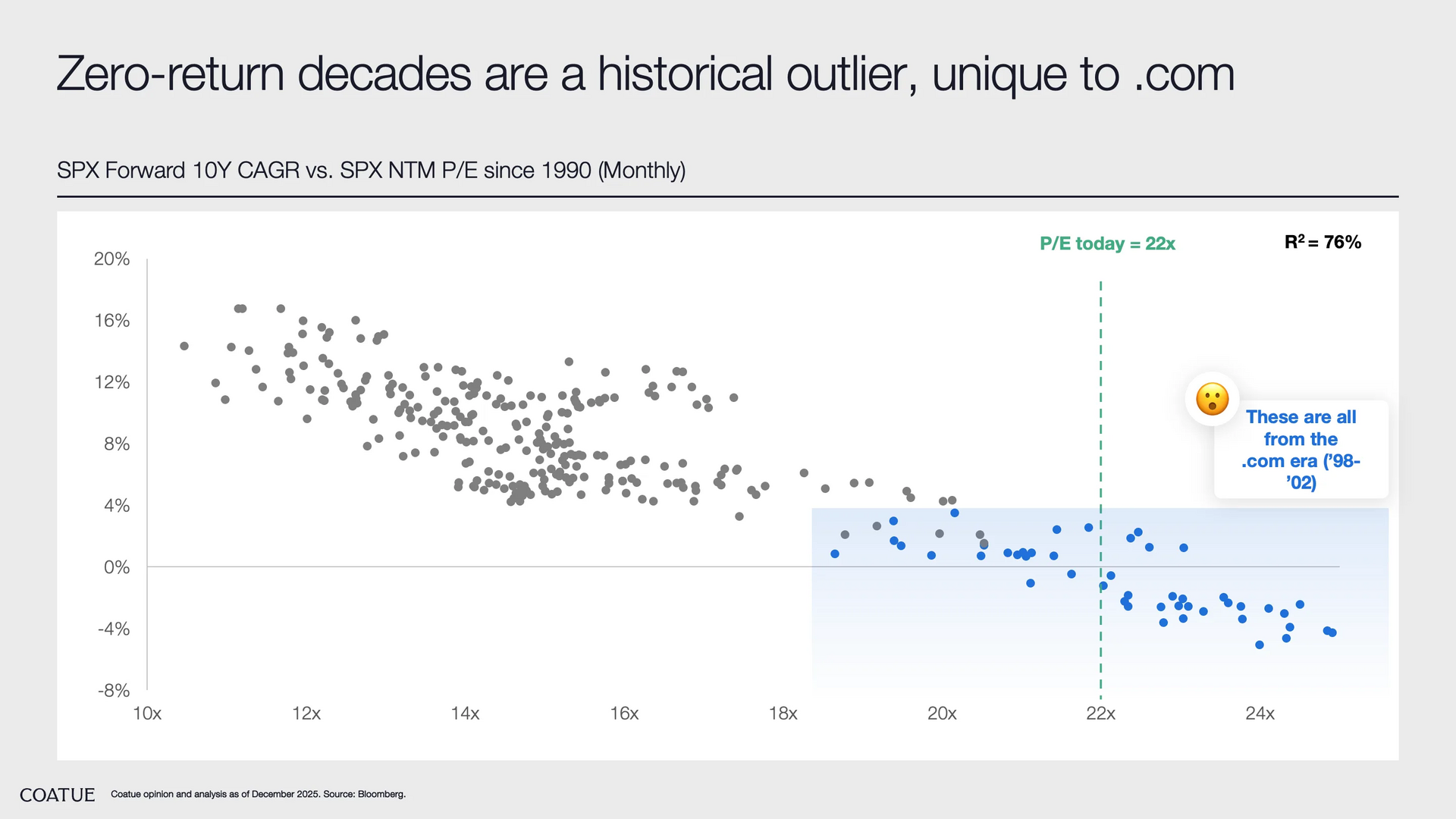

5. Valuation vs. profitability. "The scatter plot below shows the forward P/E multiple against forward net margins for the S&P 500 index, broken into four-year intervals going back to 2005. The relationship is remarkably consistent: as margins expand, multiples drift higher."

Reply