- Daily Chartbook

- Posts

- DC Lite #525

DC Lite #525

"One could argue that all commodities are becoming strategic assets in this multipolar world"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Financial conditions. "GS US Financial Conditions Index continues to ease and is back to its cycle low".

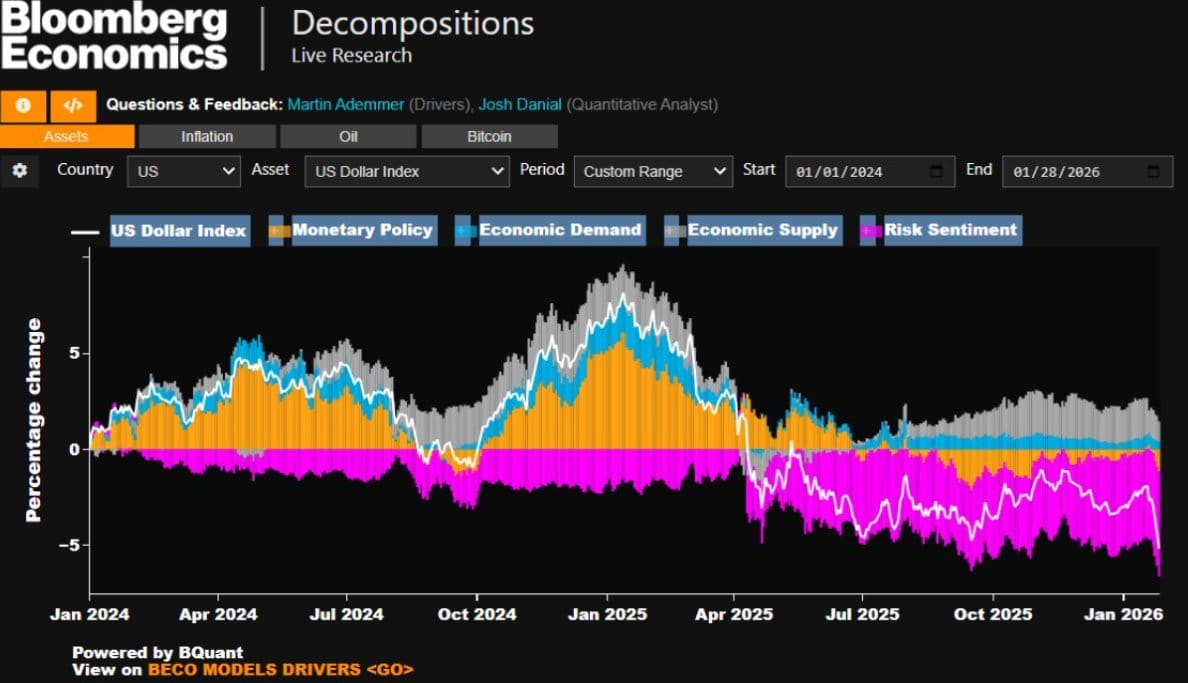

2. Dollar drivers. "USD weakness has been driven primarily by a shift in global risk appetite rather than a fundamental reassessment of US eco prospects."

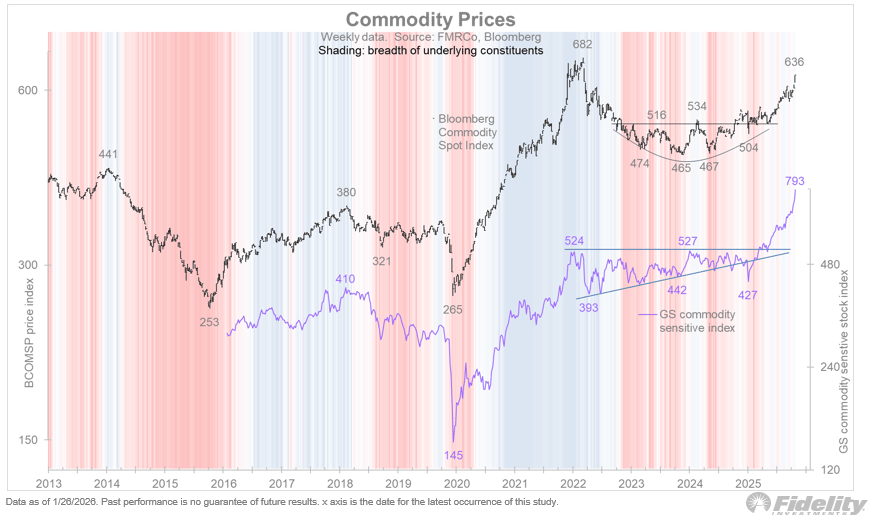

3. Commodity prices. "Tariffs or not, the world order is changing from a dollar-only standard to multiple spheres of influence, and the markets are taking notice. In fact, one could argue that all commodities are becoming strategic assets in this multipolar world. The chart below remains one of the more compelling ones out there."

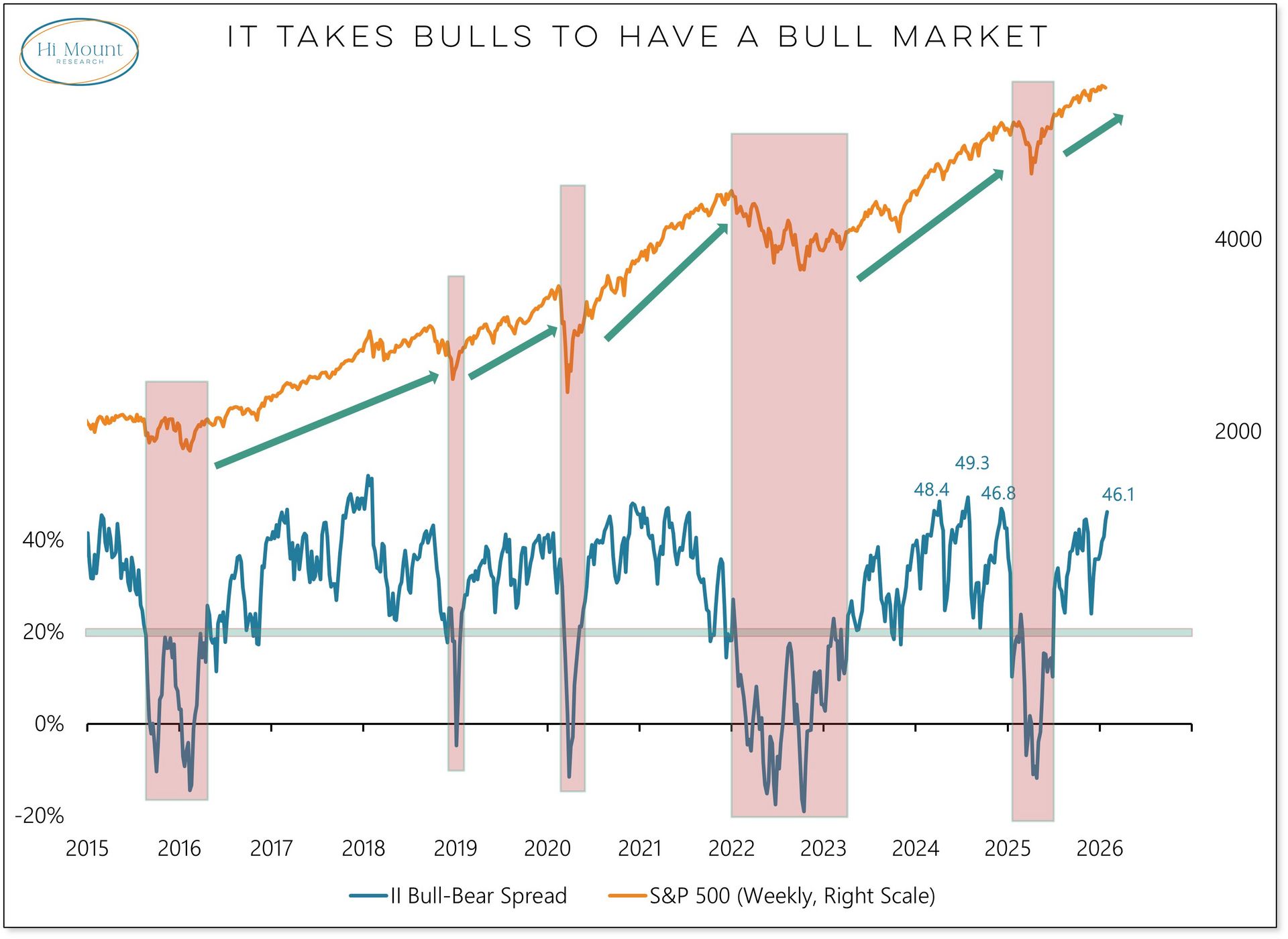

4. Investor Intelligence. "The II bull-bear spread climbed to a new cycle high and is above 45% for the first time since Dec 2024. The risk to equities is not elevated optimism itself but the shift from elevated optimism to outright pessimism. It takes bulls to have a bull market."

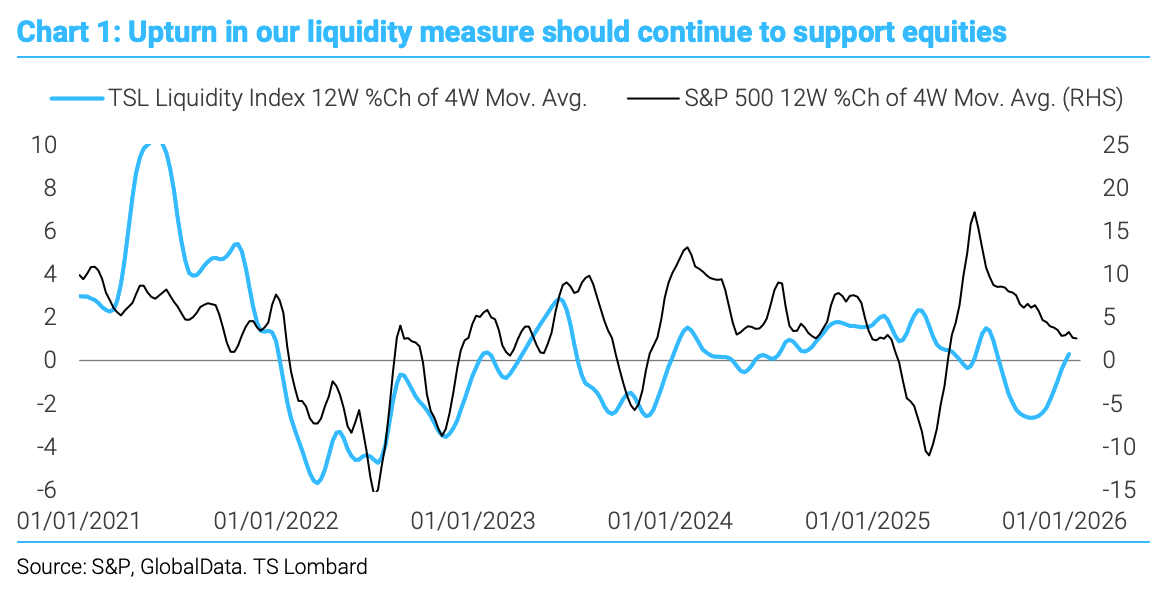

5. SPX vs. liquidity. "Liquidity is improving and this will help the equity market, thanks in part to the Fed’s shift in balance sheet policy. That policy will likely be the biggest change to hit the Fed once Trump has his man at the helm."

Reply