- Daily Chartbook

- Posts

- DC Lite #501

DC Lite #501

"When governments ramp up military spending, gold tends to sparkle"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. CFO Survey. "When asked between Nov. 11 and Dec. 1 to rate optimism about the overall U.S. economy on a scale from 0 to 100, the average rating from CFOs was 60.2, a slight dip from 62.9 in the third quarter of the year."

2. Gold vs. military spending. "When governments ramp up military spending, gold tends to sparkle. Rising geopolitical risks and looser fiscal policy weaken paper currencies and revive inflation worries, sending investors back to bullion."

3. BTC whales. Over the last 30 days, Bitcoin whales have accumulated 269,822 BTC worth $23.3bn, the most in 13 years.

4. SPX vs. CPI. "Options traders are betting the S&P 500 Index will swing 0.7% in either direction ... That’s sharply lower than the 1% average realized move spurred by the 12 reports delivered through September."

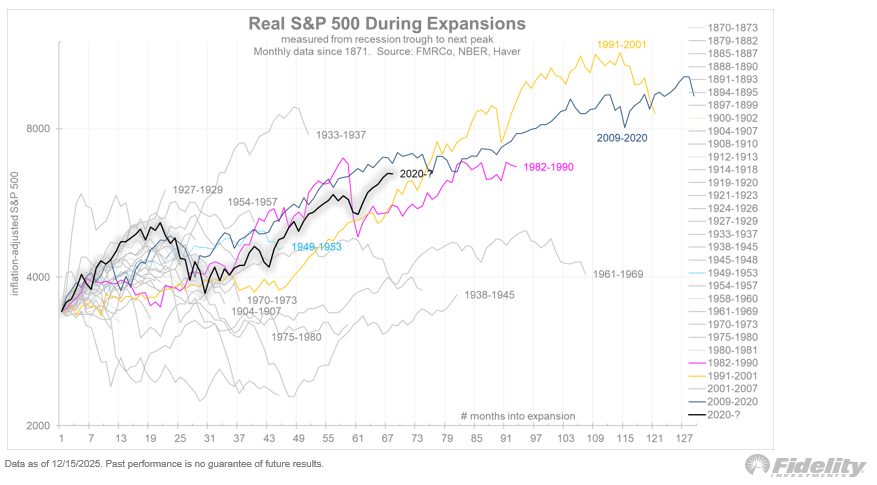

5. SPX vs. expansions. "The current US economic expansion is now approaching its 6th year … There have been 30 business cycles since 1871 and if we measure the gain in the S&P 500 from the start of the current expansion, the cycle is well above average and eclipsed only by 2009-2020, 1991-2001, and 1982-1990."

Reply