- Daily Chartbook

- Posts

- DC Lite #416

DC Lite #416

"Historically, margin debt tends to rise with equities, supporting bullish trends rather than derailing them. The real risk comes when leverage starts to unwind"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Home asking prices. "The median U.S. asking price rose just 2.3% year over year during the four weeks ending August 3, one of the smallest increases in two years. Sellers have started pricing lower in response to the buyer’s market; Redfin economists predict sale prices will fall 1% by the end of the year."

2. Margin debt vs. Wilshire 5000. "Historically, margin debt tends to rise with equities, supporting bullish trends rather than derailing them. The real risk comes when leverage starts to unwind. We would worry if margin debt declines while the SPX rallies, a pattern that preceded major market peaks in 2000, 2007, 2018, 2019, and late 2021."

3. NAAIM Exposure Index. Active managers increased exposure to US equities by the most in 3 months.

Sponsored content:

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

4. Implied vs. realized vol. "Investors are jumpy ... markets expect higher volatility than what we’ve seen lately."

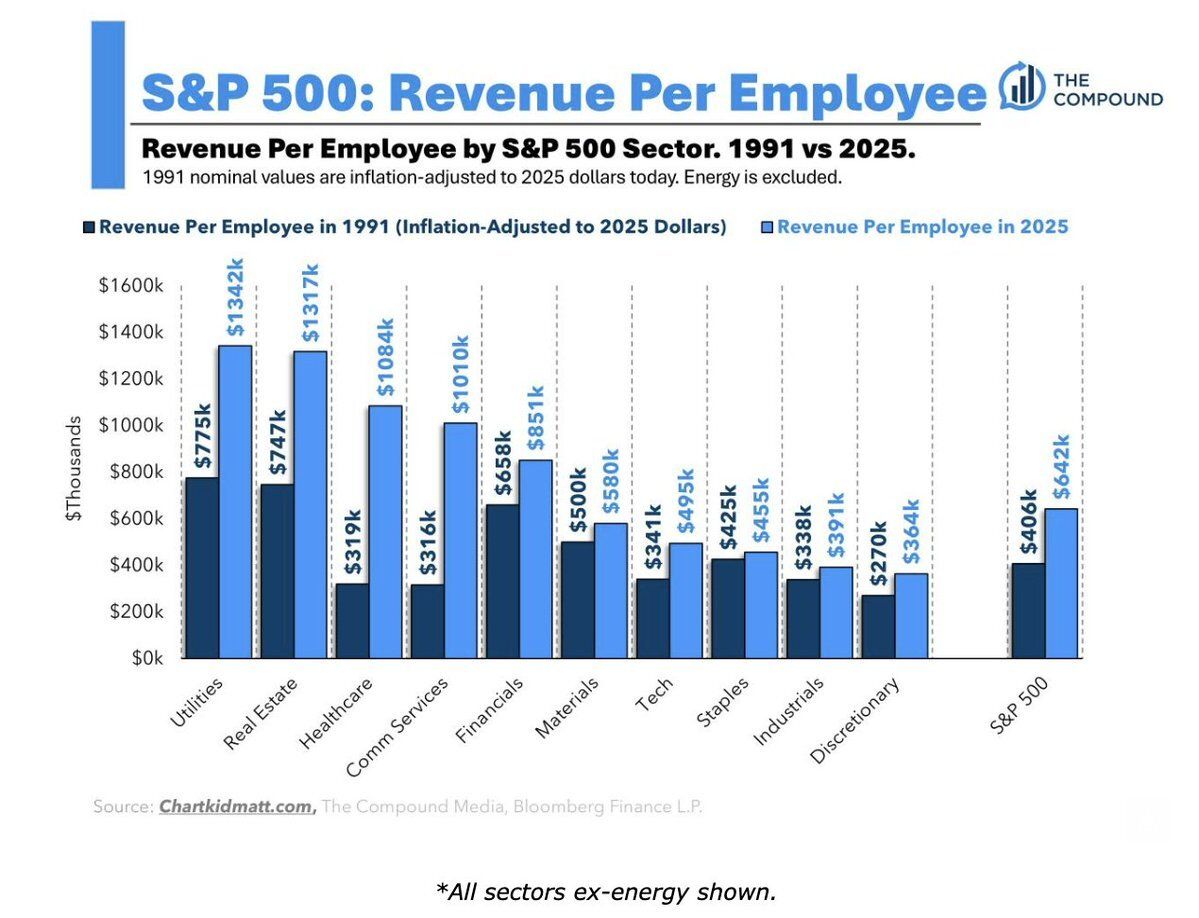

5. Revenue per employee. "It takes 1.55 employees for S&P 500 companies to generate a whopping $1 million dollars of revenue today ... In 1991, to generate that same $1 million of (inflation-adjusted, don’t come at me) revenue, it took 2.46 employees."

Sponsored content:

From Italy to a Nasdaq Reservation

How do you follow record-setting success? Get stronger. Take Pacaso. Their real estate co-ownership tech set records in Paris and London in 2024. No surprise. Coldwell Banker says 40% of wealthy Americans plan to buy abroad within a year. So adding 10+ new international destinations, including three in Italy, is big. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Reply