- Daily Chartbook

- Posts

- DC Lite #412

DC Lite #412

"If not for collapsing labor force participation since April, unemployment would've climbed to 4.9% today instead of 4.25%"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. NFP. "The -253K 2M downward revision to payroll employment is the largest since at least 1979, other than April 2020."

2. Unemployment rate. "If not for collapsing labor force participation since April, unemployment would've climbed to 4.9% today instead of 4.25%."

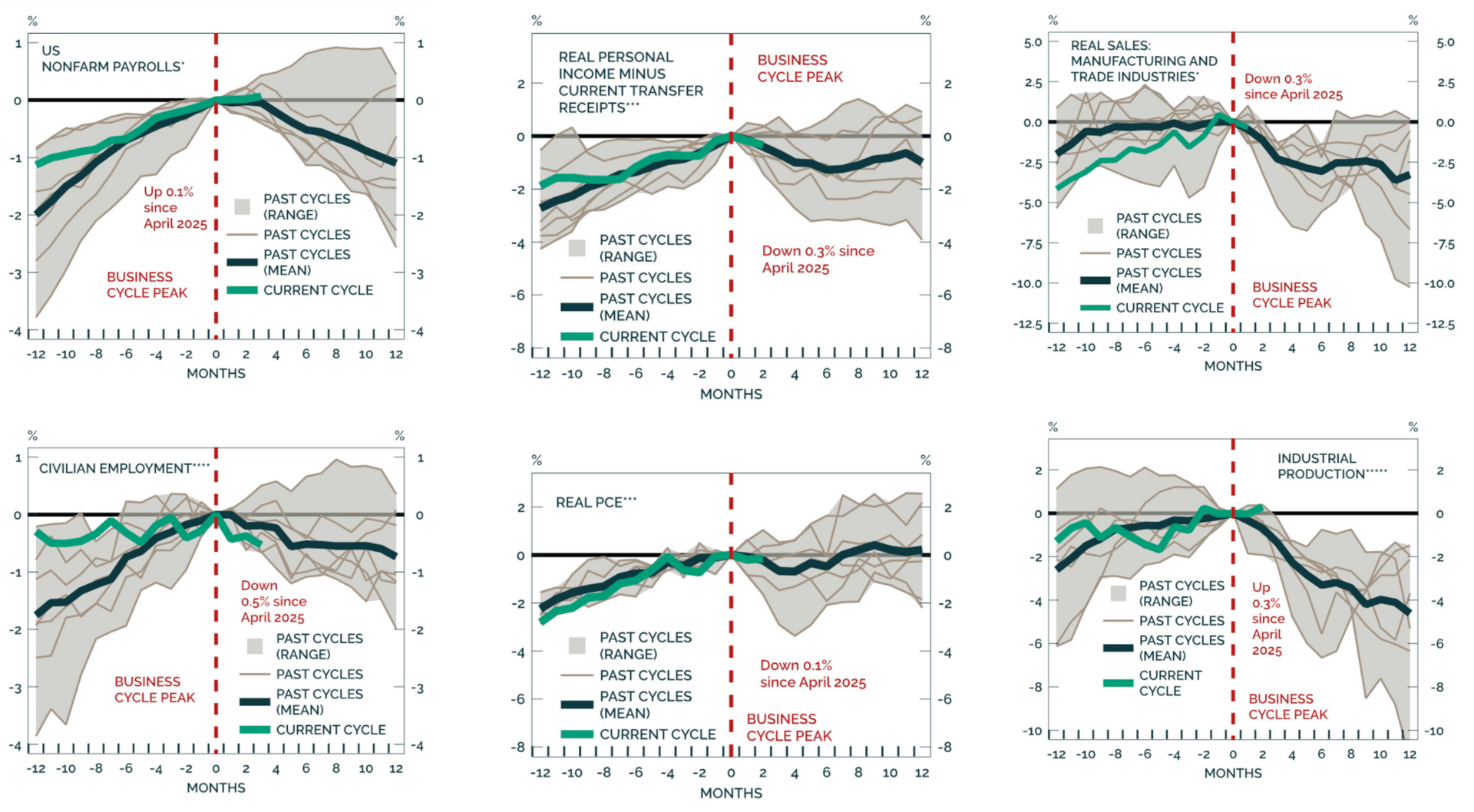

3. NBER indicators. "Here are the 'Big 6' indicators the NBER tracks to determine whether the US has entered a recession. I don’t think we’re quite there yet, but it’s a close call."

Sponsored content:

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

4. AAII asset allocation. In July, retail investors' allocation to stocks rose to the highest (68.3%) since January while bond (15.7%) and cash (16.0%) allocations fell to 4- and 7-month lows, respectively.

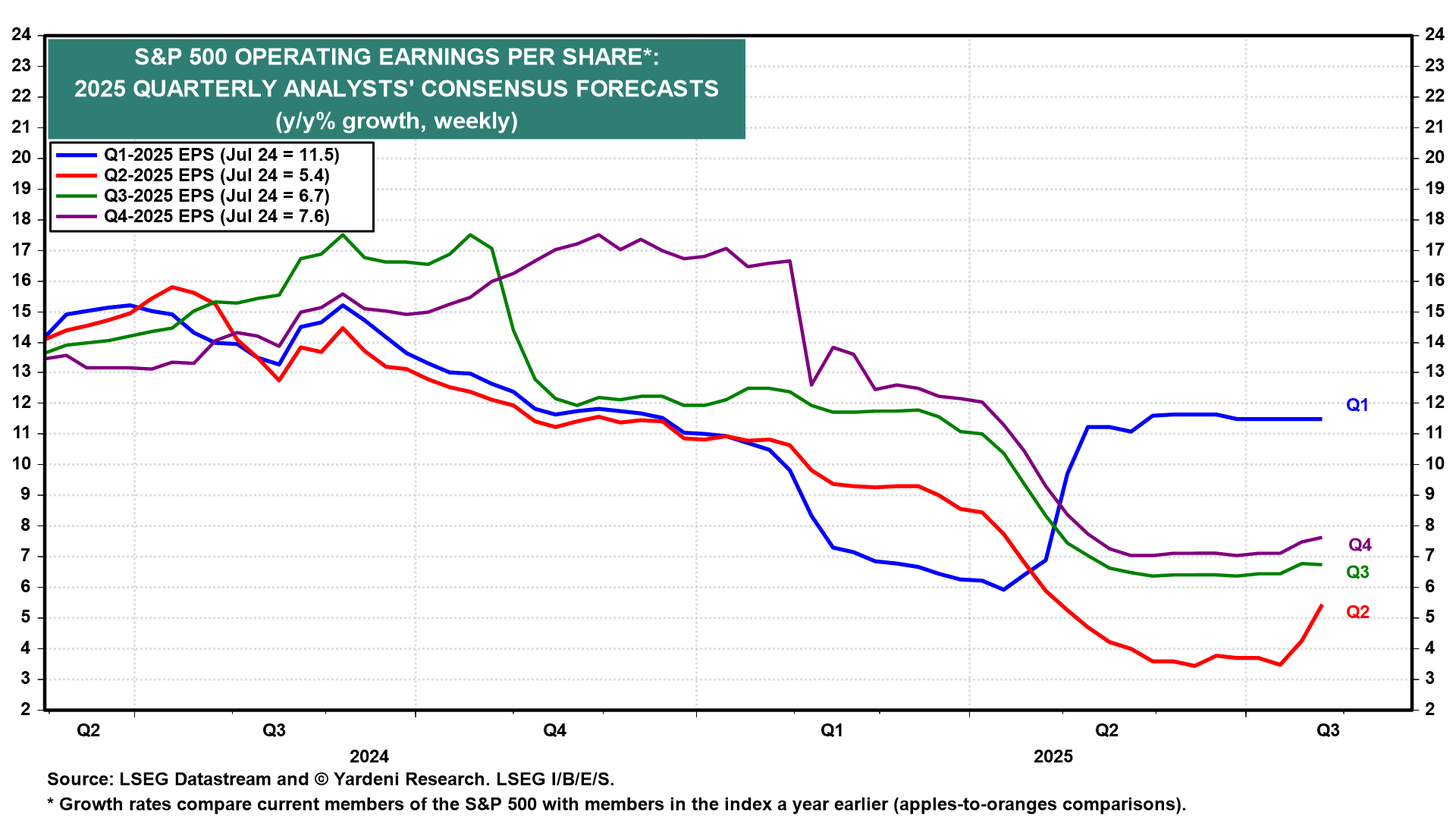

5. Q3 estimates. "During the month of July, analysts slightly increased EPS estimates for S&P 500 companies for the third quarter ... In a typical quarter, analysts usually reduce earnings estimates during the first month of a quarter."

Sponsored content:

The Real Traders Aren't on CNBC

Your current options for finding stock trades:

Option 1: Spend 4 hours daily reading everything online

Option 2: Pay $500/month for paywalled newsletters and pray

Option 3: Get yesterday's news from mainstream financial media

All three keep you broke.

Here's where the actual edge lives:

Twitter traders sharing real setups (not TV personalities)

Crowdfunding opportunities before they go mainstream

IPO alerts with actual timing

Reddit communities spotting trends early

Crypto insider takes (not corporate PR)

The problem? You'd need to be terminally online to track it all.

Stocks & Income monitors every corner where real money gets made. We send you only the actionable opportunities. No fluff, no yesterday's headlines.

Five minutes daily. Walk away with stock insights you can actually act on every time.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Reply