- Daily Chartbook

- Posts

- DC Lite #411

DC Lite #411

"National time on market has now surpassed pre-pandemic norms for the first time"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Time on market. "National time on market has now surpassed pre-pandemic norms for the first time."

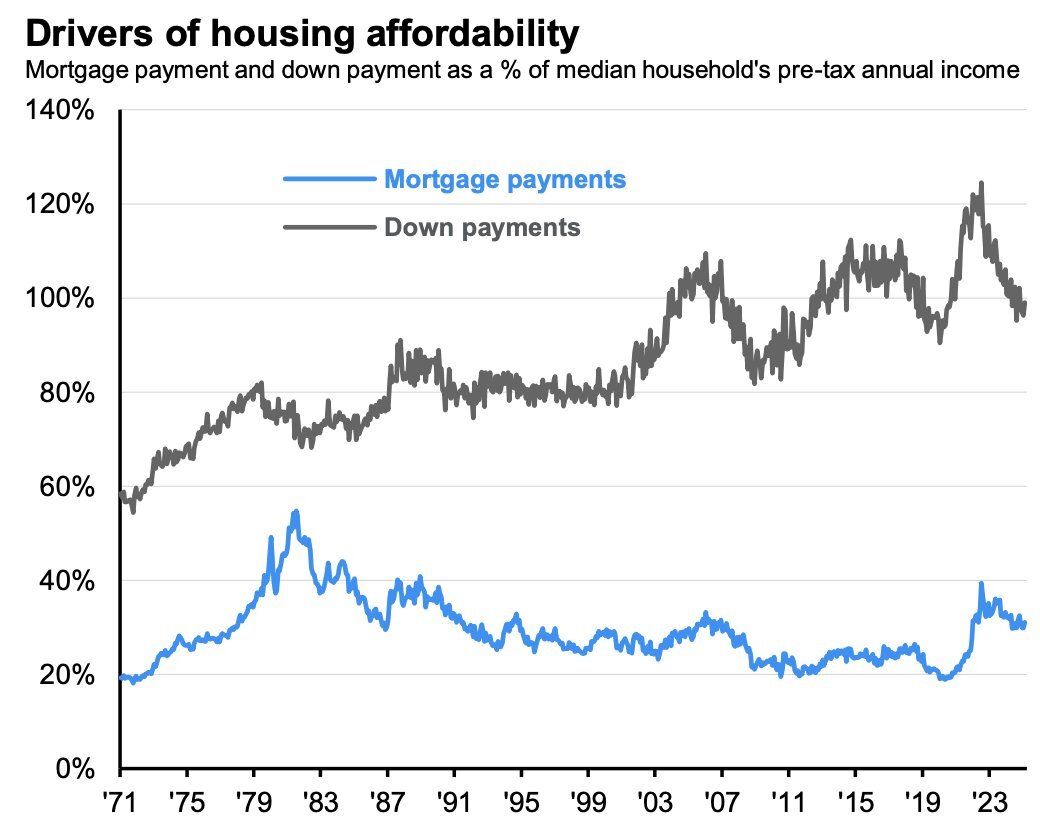

2. Freddie Mac Home Price Index. "This was the 5th consecutive MoM decrease in the SA index. Over the last 3 months, this index has decreased at a 2.4% annual rate and decreased at a 1.1% annual rate over the last 6 months. House prices are under pressure!"

3. PCE. "Something for the hawks and the doves in the PCE data. The above-target rise in core PCE prices would seem to justify a cautious approach to cutting rates, whereas Waller and Bowman will be concerned to see wages and salaries growth slow sharply to just 0.2% m/m in June."

4. Wealth effect. "The correlation between U.S. household wealth and the stock market is the highest in history … Trendlines are shown *by decade*. R-Squared is highest for the 2020s."

5. Big Tech vs. GDP. "Eating all the GDP. Bigger share of massively bigger pie. Hope the pie keeps growing (it won't grow as fast) and hope the rest of the GDP can keep spending on cloud and AI services while continuing to grow earnings."

Reply