- Daily Chartbook

- Posts

- DC Lite #410

DC Lite #410

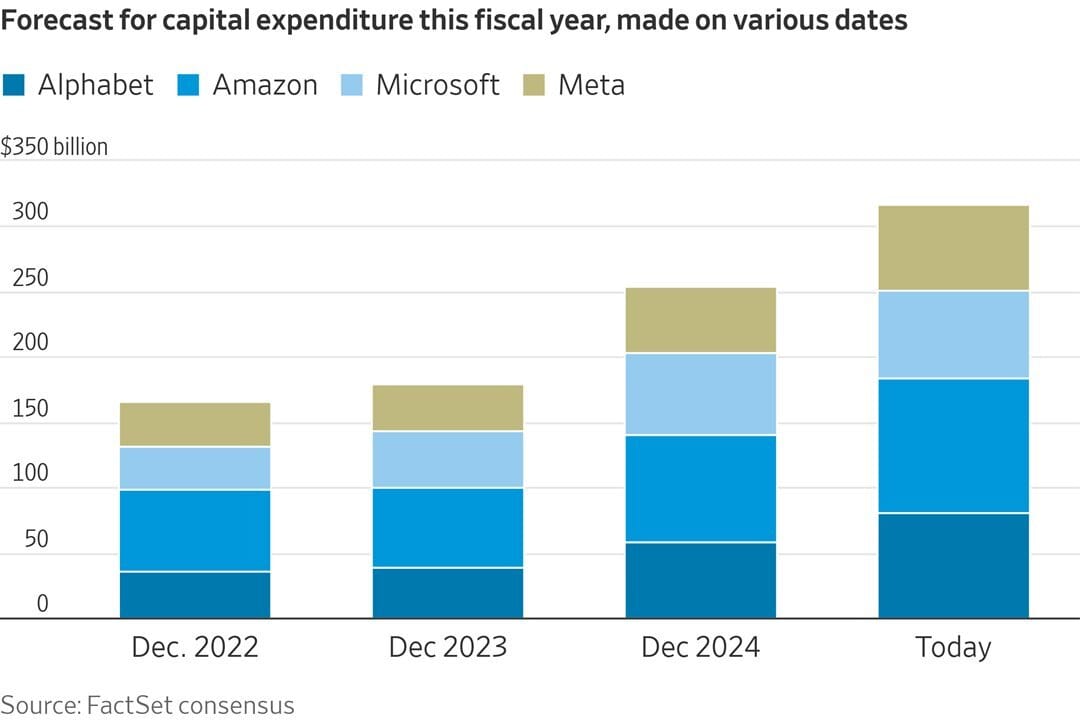

"Earnings season is no longer just about earnings for these tech behemoths"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

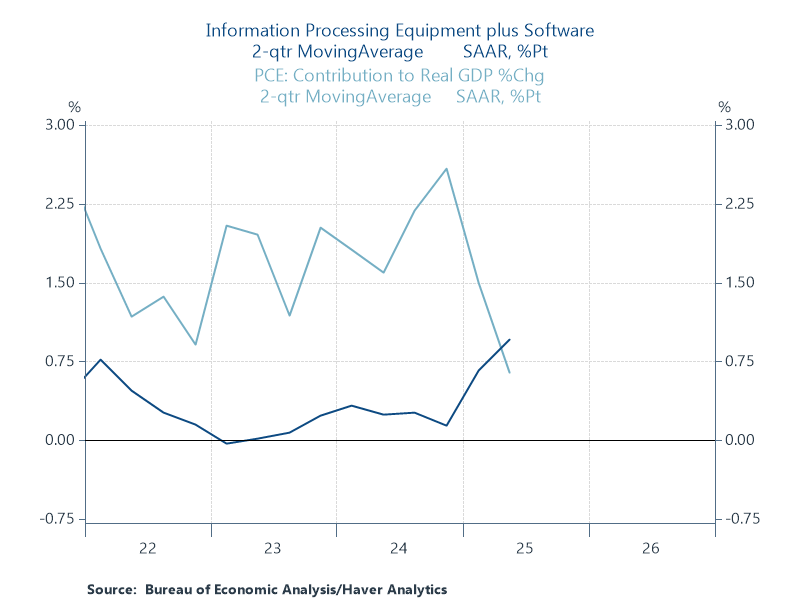

1. Q2 GDP. "So far this year, AI capex, which we define as information processing equipment plus software has added more to GDP growth than consumers' spending."

2. Megacap capex. "Earnings season is no longer just about earnings for these tech behemoths."

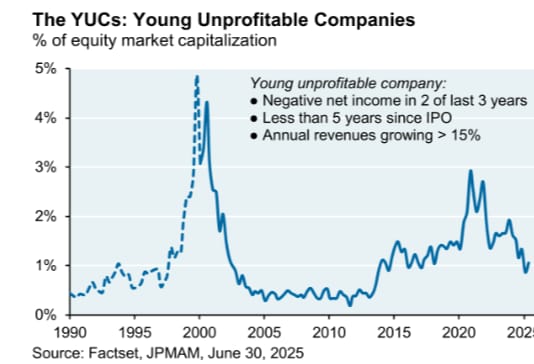

3. YUCs. Young Unprofitable Companies account for just 1% of equity market cap, well below levels seen during the Dotcom bubble and 2021 meme mania.

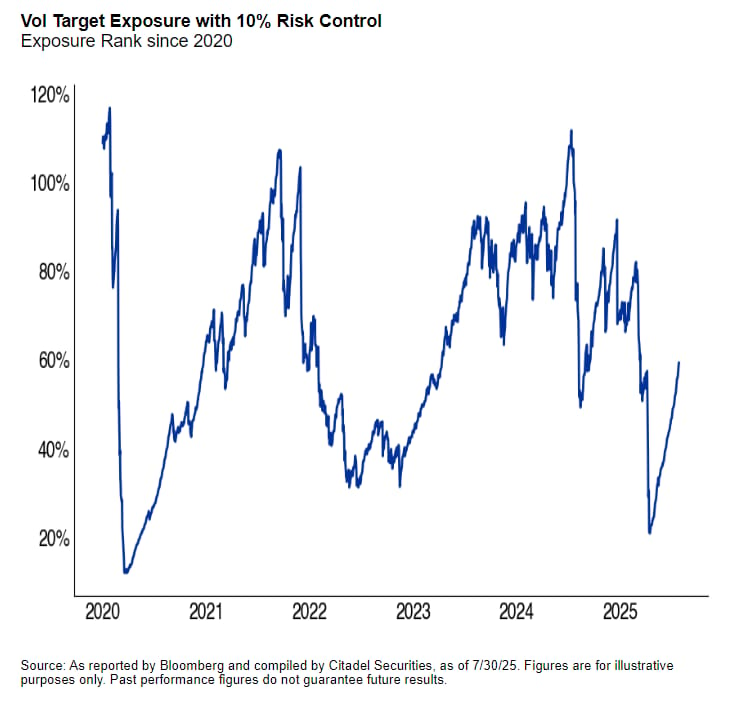

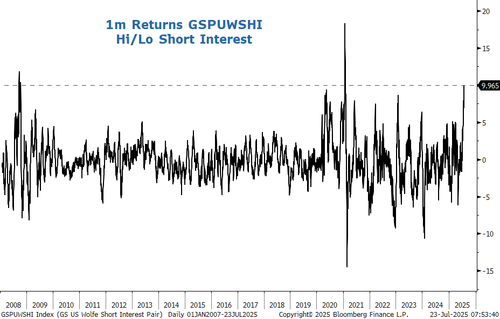

4. Systematics. Citadel's Scott Rubner "argues that systematic funds have plenty of firepower left to buy equities and will likely keep doing so if volatility stays subdued ... [He] warns that systematic positioning could max out in September and may be vulnerable to any downside shocks across US equities."

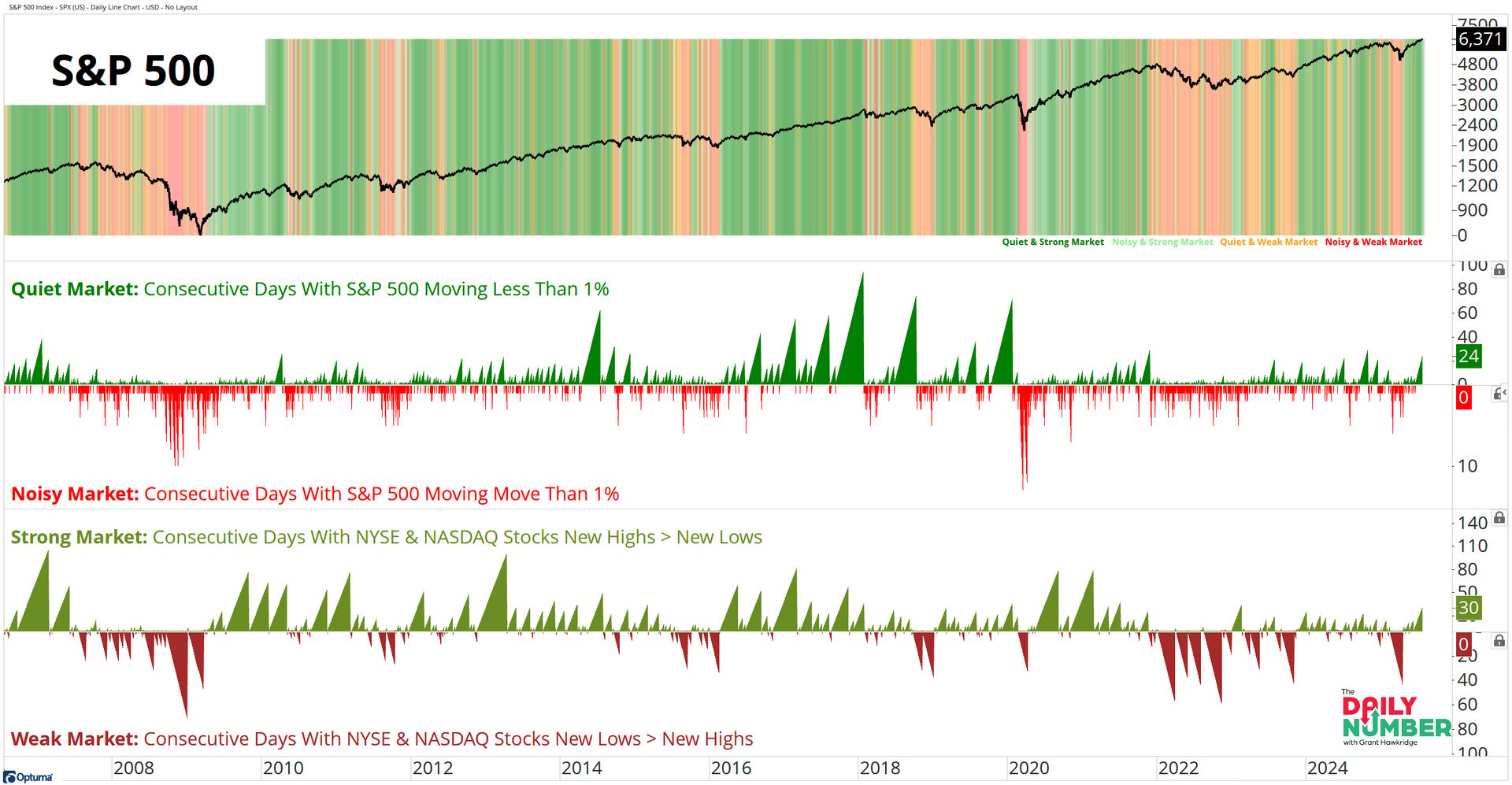

5. Quiet strength. "The market has 4 regimes. And right now, we’re in the most bullish one: Quiet & Strong. [25] straight days without a ±1% move. 30 straight days of net new highs. That’s not luck — that’s trend confirmation."

Reply