- Daily Chartbook

- Posts

- DC Lite #407

DC Lite #407

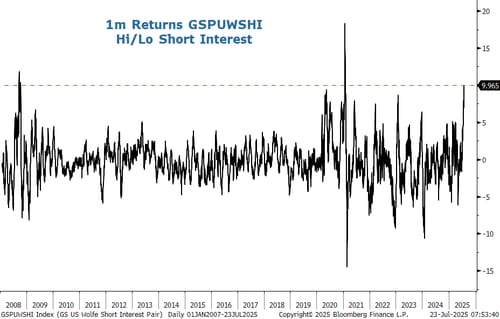

"We may be moving towards later innings of the short covering given the magnitude of these moves"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

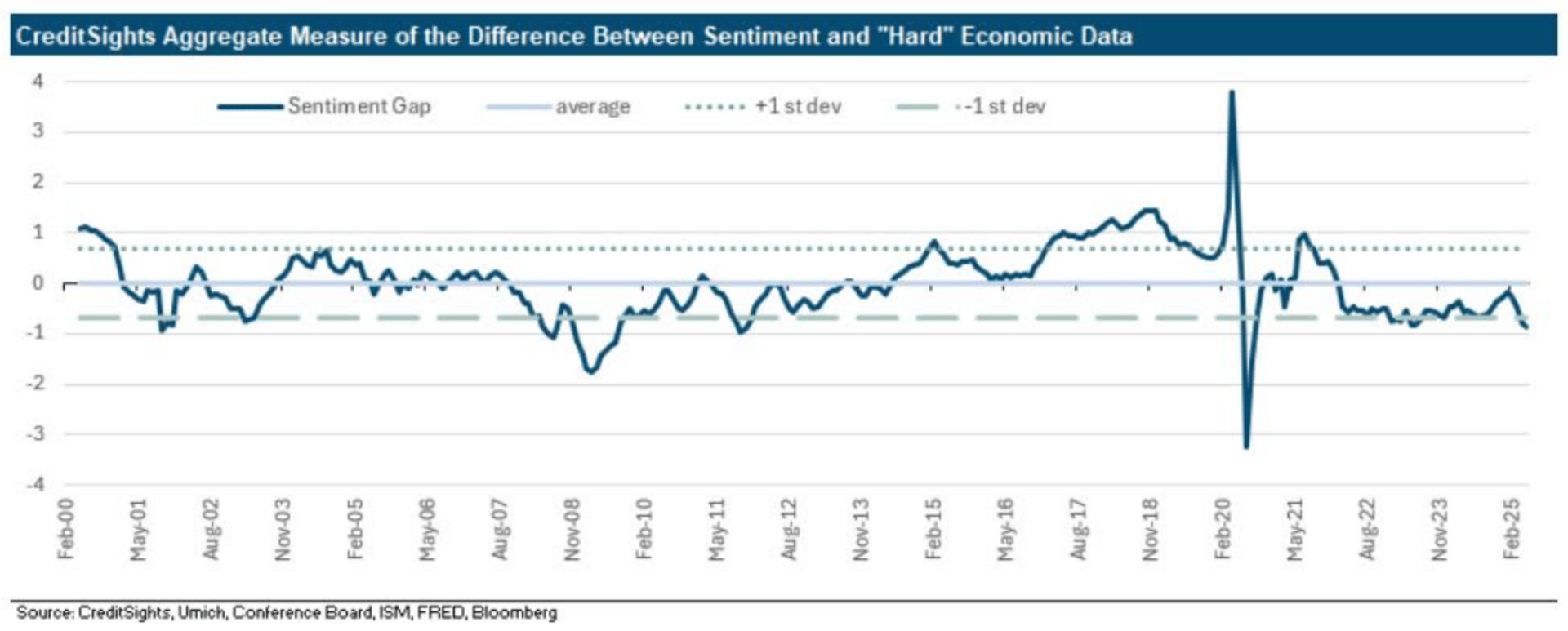

1. Sentiment Gap. "The so-called sentiment gap is now the widest since the pandemic. (If you exclude the pandemic years, it’s the biggest gap since 2011)."

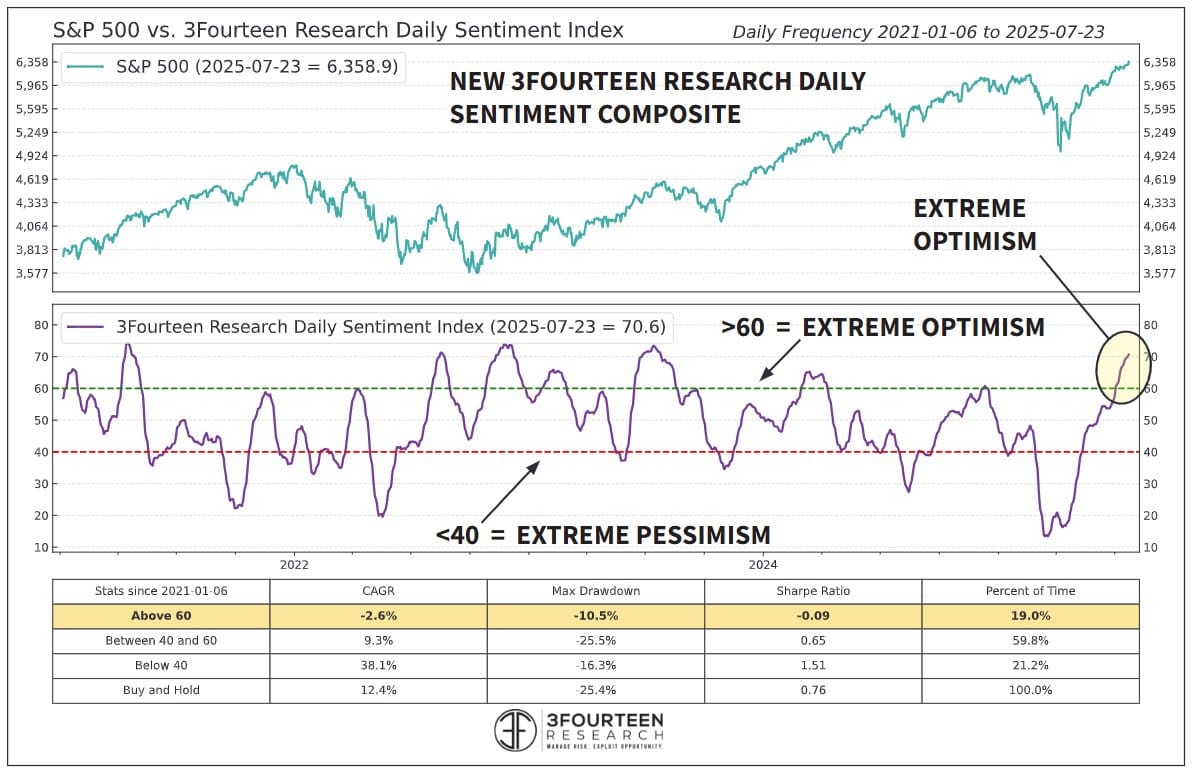

2. Sentiment Composite. "Now touching extreme optimism. Would be logical to see the market cool between mid-August and mid-October."

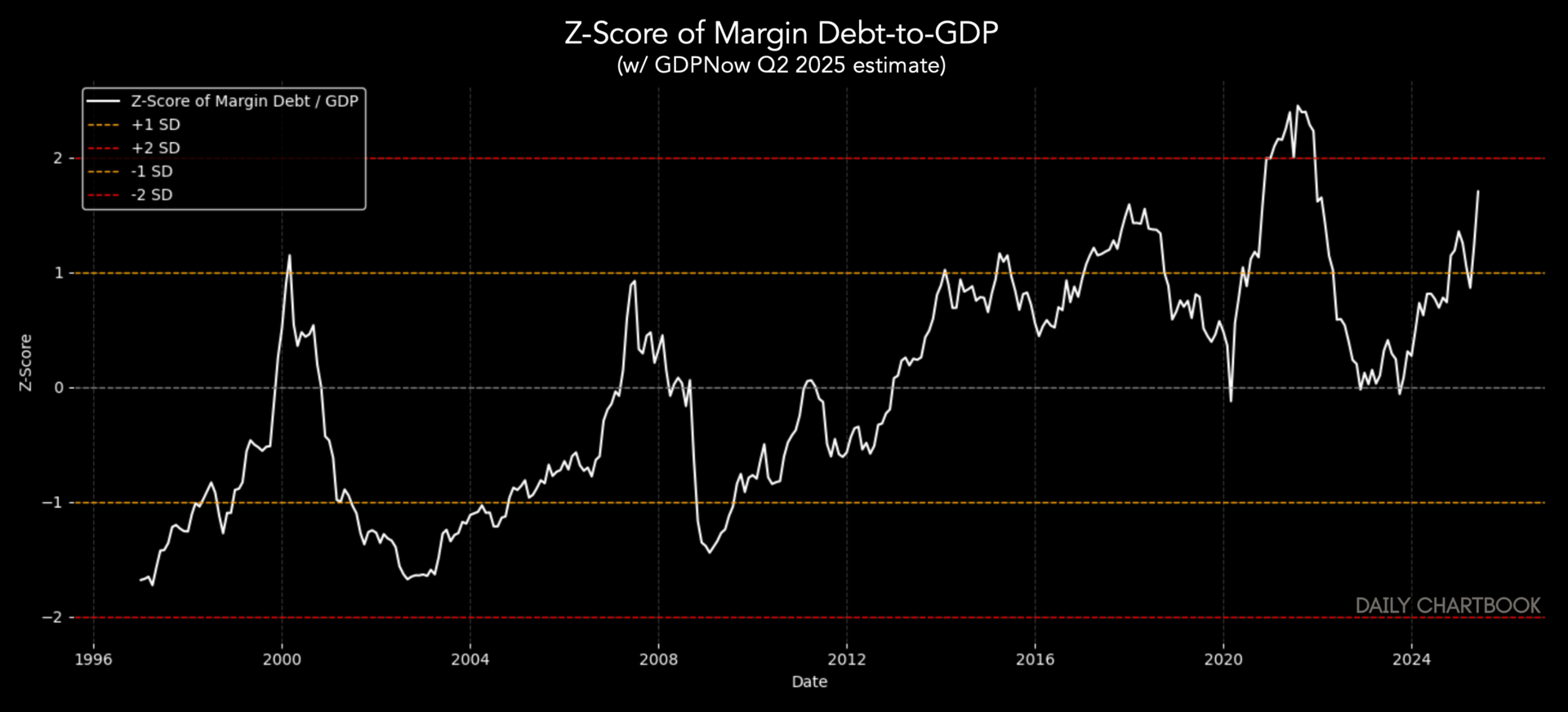

3. Margin debt vs. GDP. FINRA margin debt crossed above the $1 trillion mark in June. Relative to GDP, it remains below the 2021 peak but above Dotcom and GFC levels.

Sponsored content:

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

4. Hi/Lo short interest. "We may be moving towards later innings of the short covering given the magnitude of these moves."

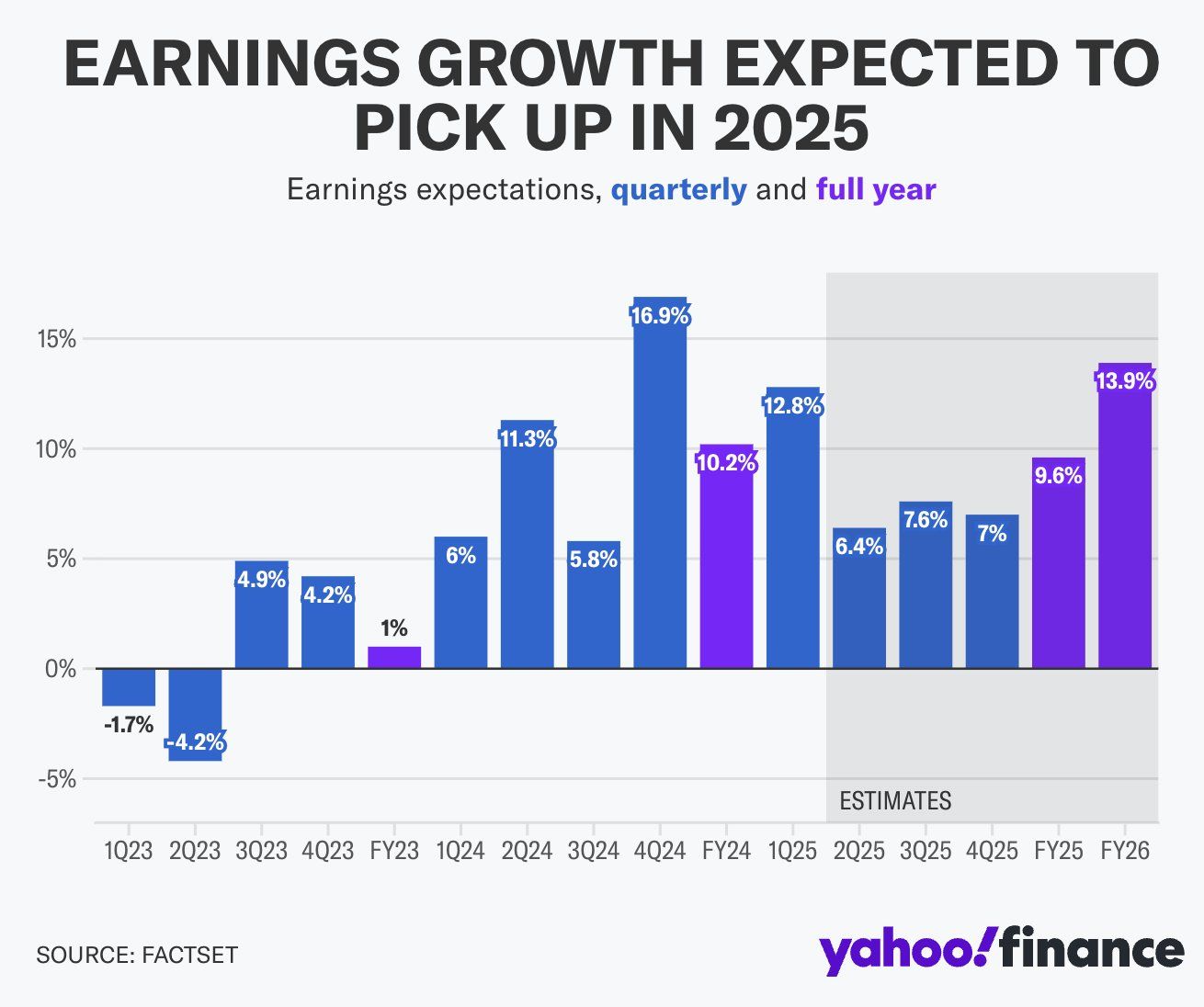

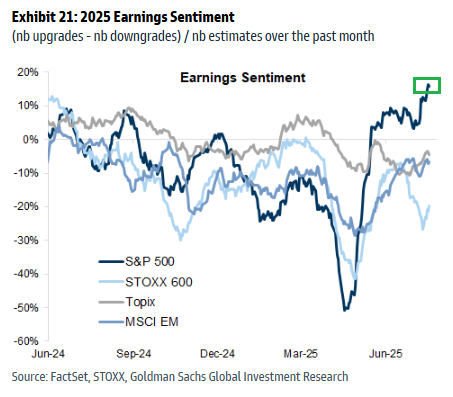

5. Earnings outlook. "Projected eps growth for the second quarter, the rest of 2025, and the full-year 2026 are all up since the end of June."

Sponsored content:

“Big Plastic” Hates Them

From water bottles to shrink wrap, Timeplast has a $1.3T market opportunity with its patented plastic that dissolves in water. But the clock is ticking to invest. You have until midnight, July 31 to become a Timeplast shareholder as they expand globally.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

Reply