- Daily Chartbook

- Posts

- DC Lite #405

DC Lite #405

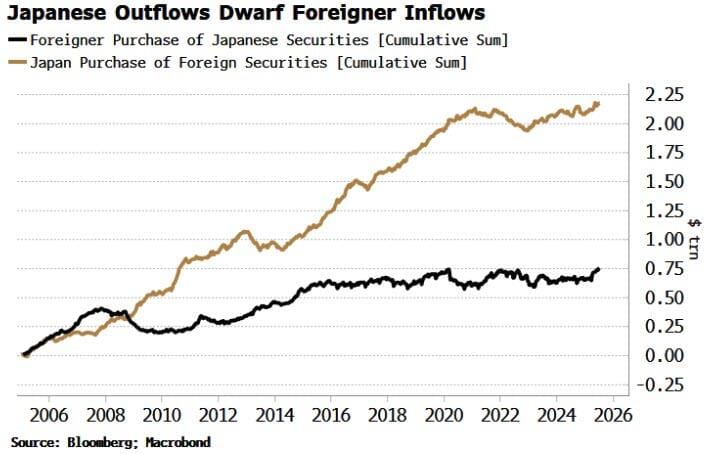

"Japan won’t need to purchase as many Treasuries and other foreign bonds and stocks over the longer term after its trade deal with the US"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

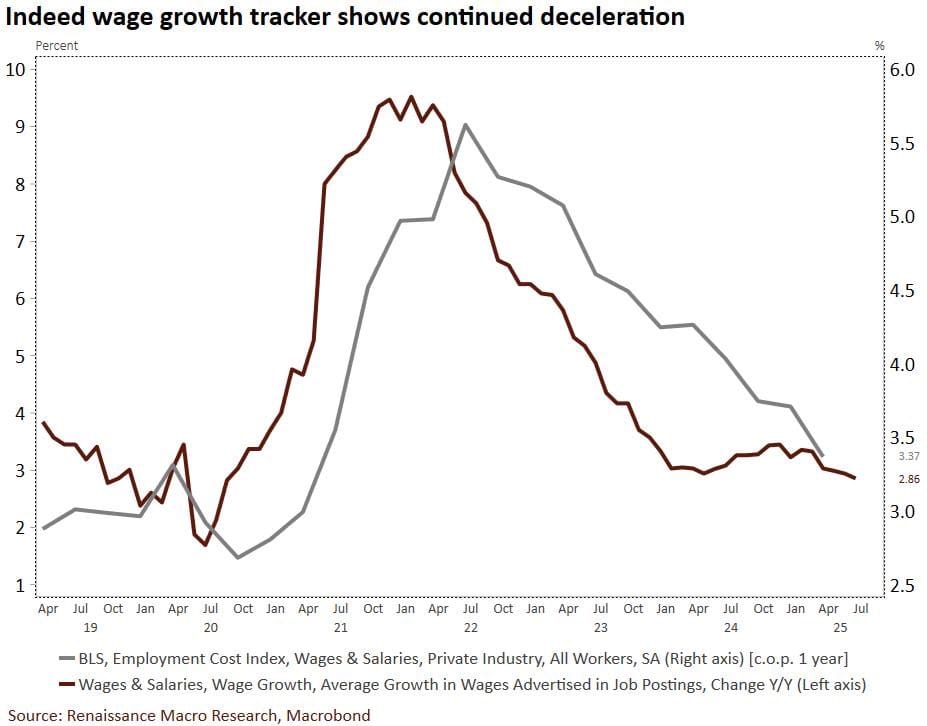

1. Wage growth. "The Indeed Wage Growth Tracker, a measure of wage growth in job postings, slid to 2.86 percent in June, a fresh low. Labor markets remain on a cooling track. This series tends to lead more widely followed measures of wage growth like the Employment Cost Index."

2. Japan vs. Treasuries. "Japan won’t need to purchase as many Treasuries and other foreign bonds and stocks over the longer term after its trade deal with the US … it’s likely going to result in Japan having a smaller trade surplus with the US … That would mean Japan has less capital to recycle abroad."

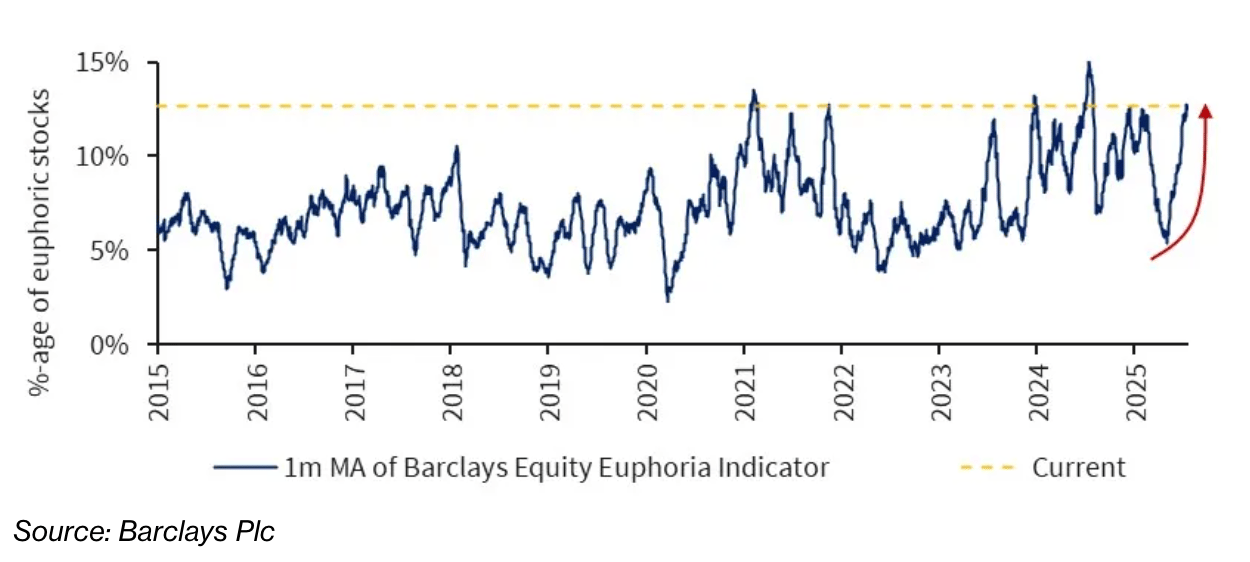

3. Equity Euphoria Indicator. "Last week, the Barclays Equity Euphoria Indicator, which uses options data to quantify investors’ giddiness, jumped to its highest level since late December."

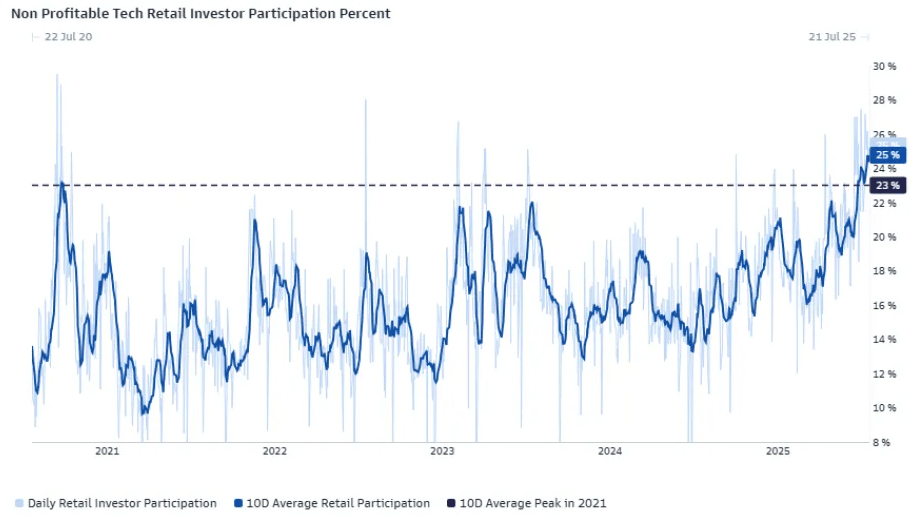

4. Retail vs. non-profitable Tech. "The 10-day average of retail participation in non-profitable technology companies reached 23% — the highest level since a Goldman Sachs trading desk began tracking it — and rose to 25% this week."

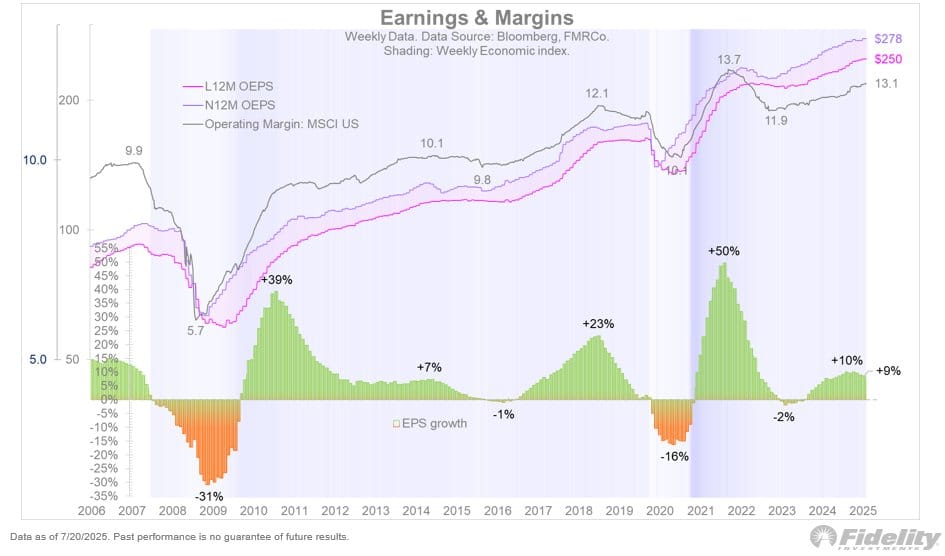

5. Earnings vs. margins. "While the [YoY] growth rate in trailing earnings seems to have peaked at 10%, margins continue to move higher and are now 13.1% (for the MSCI US index). It’s an impressive performance several months into a new tariff regime, and it goes a long way to explain why valuations have rebounded so swiftly."

Reply