- Daily Chartbook

- Posts

- DC Lite #402

DC Lite #402

"There are good reasons to expect weaker corporate earnings in the months ahead"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

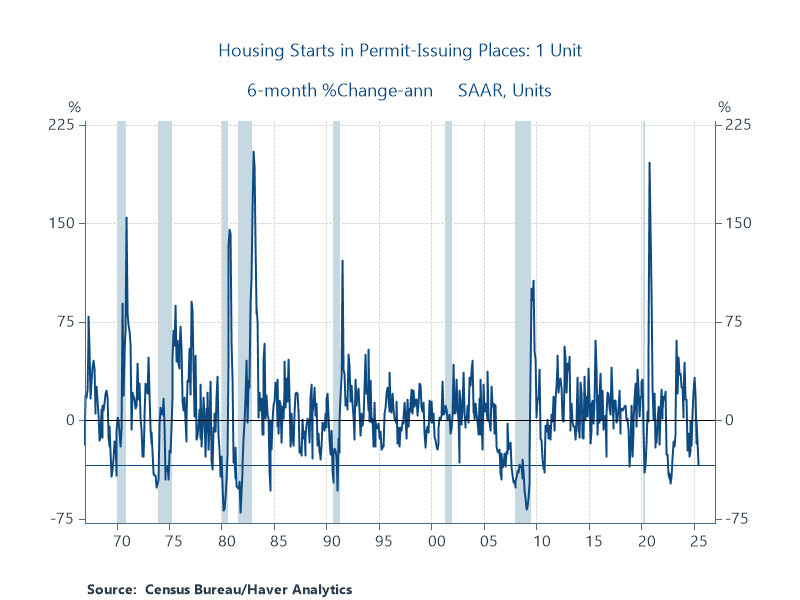

1. New construction. "Homebuilders are going to be doing less. Single-family building permits continue to decline. In June, single-family housing permits fell 5%, the 3rd decline in the last four months. This year, so six months, single-family permits have declined at a 33.6% annualized rate."

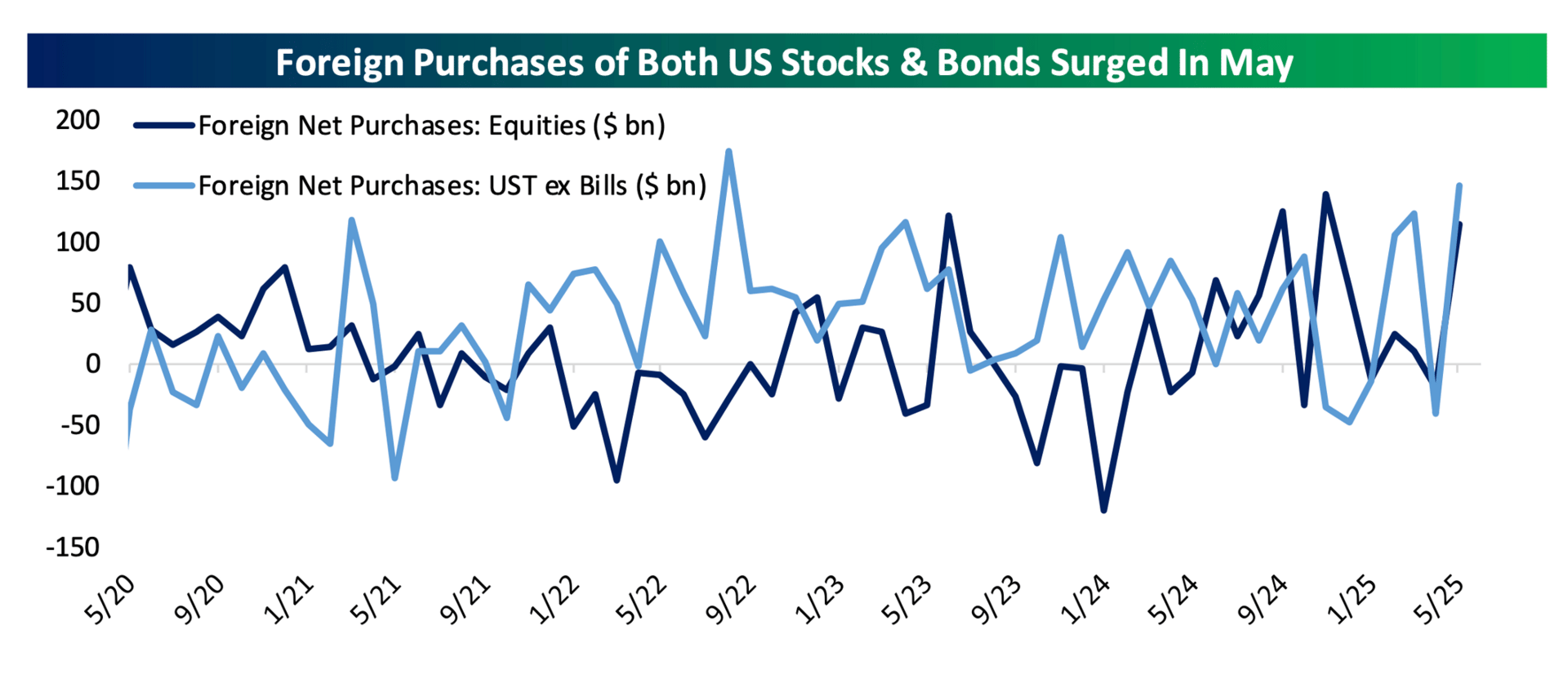

2. Foreign capital flows. "Yesterday the US Treasury reported the largest inflow of foreign capital to that market (net purchases) since 2022, obliterating the narrative that foreign investors are fleeing Treasuries (or US equities) due to political risks."

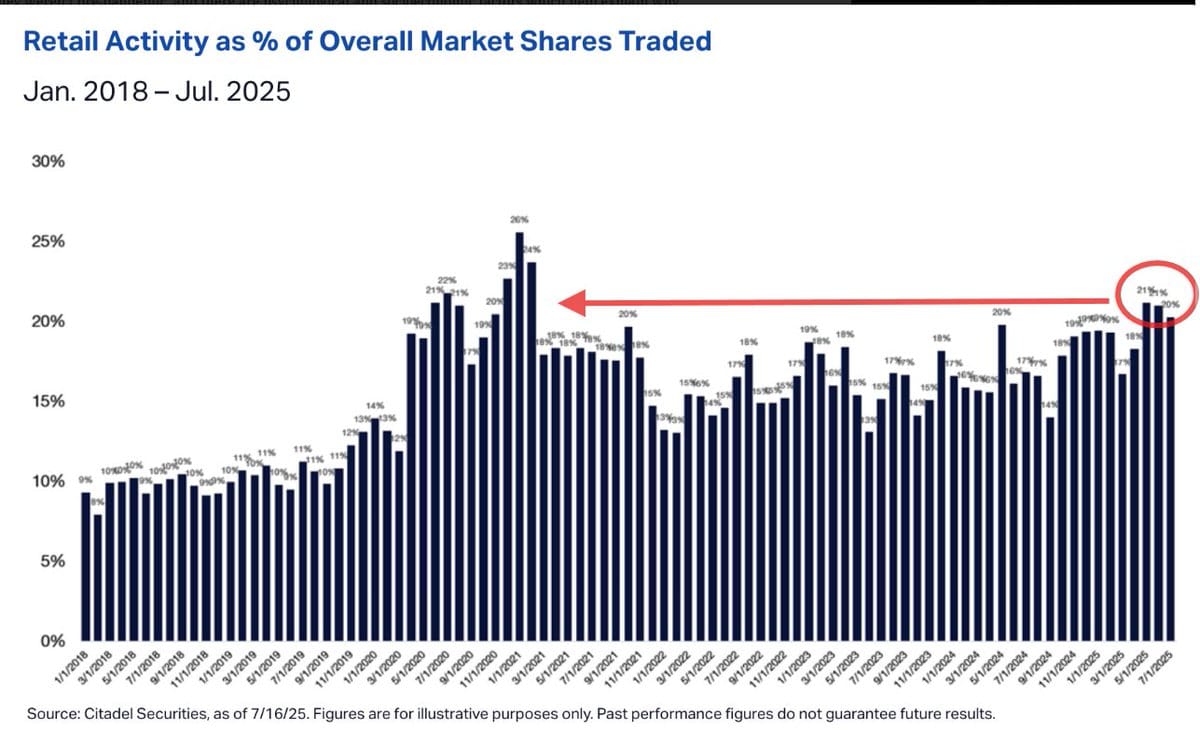

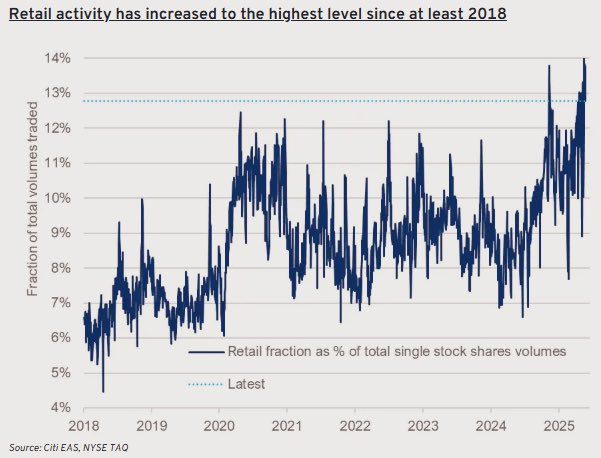

3. Retail activity. "Retail's share of trading volume has gotten back to above 20% recently which it hadn't done outside of immediately after the pandemic and the 2021 meme-stock craze."

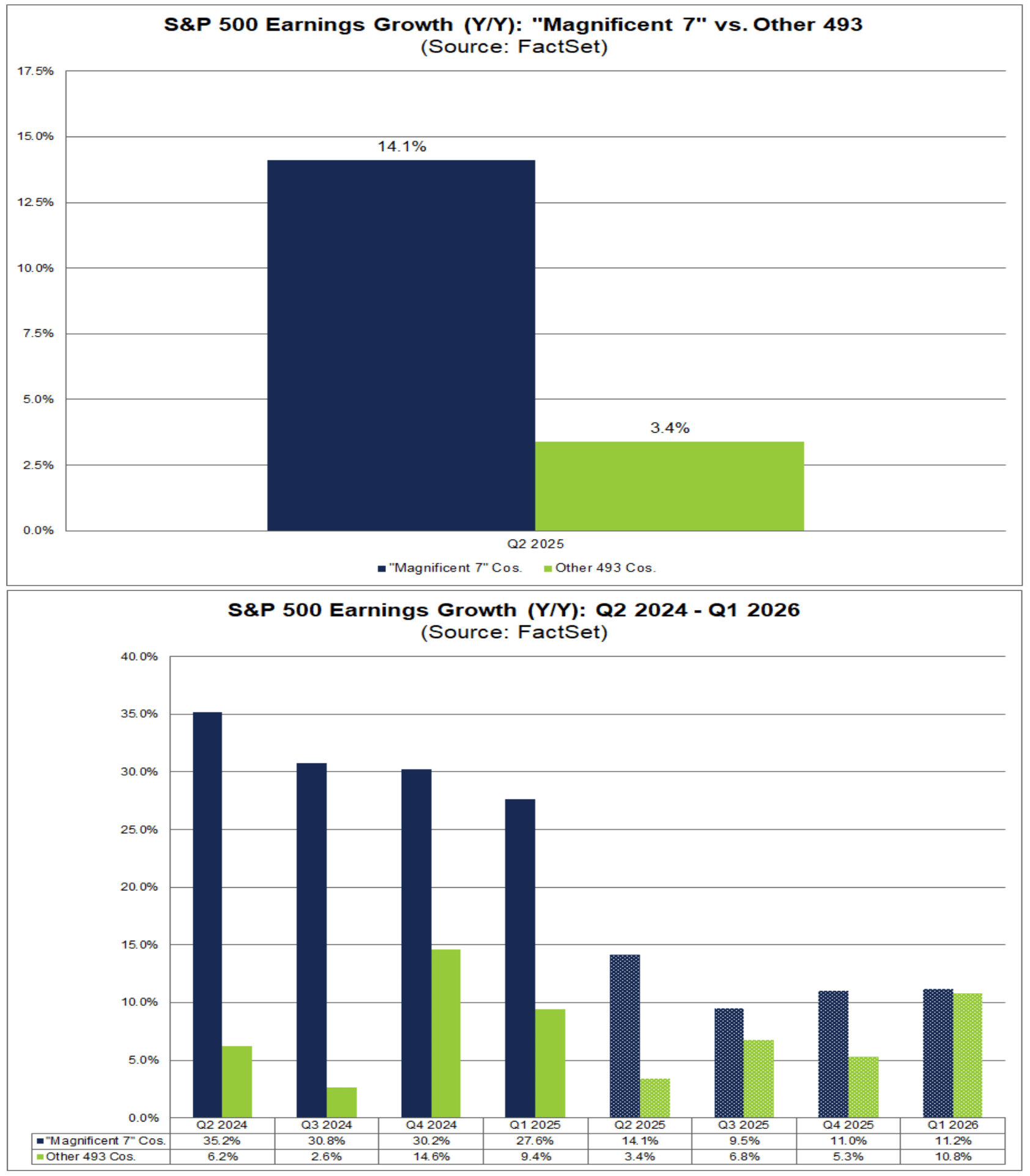

4. Magnificent 7 vs. Bottom 493. Analysts expect 14.1% YoY EPS growth in Q2 for the Mag 7 in aggregate and just 3.4% for the Bottom 493. The latter is expected to close the gap over the coming quarters.

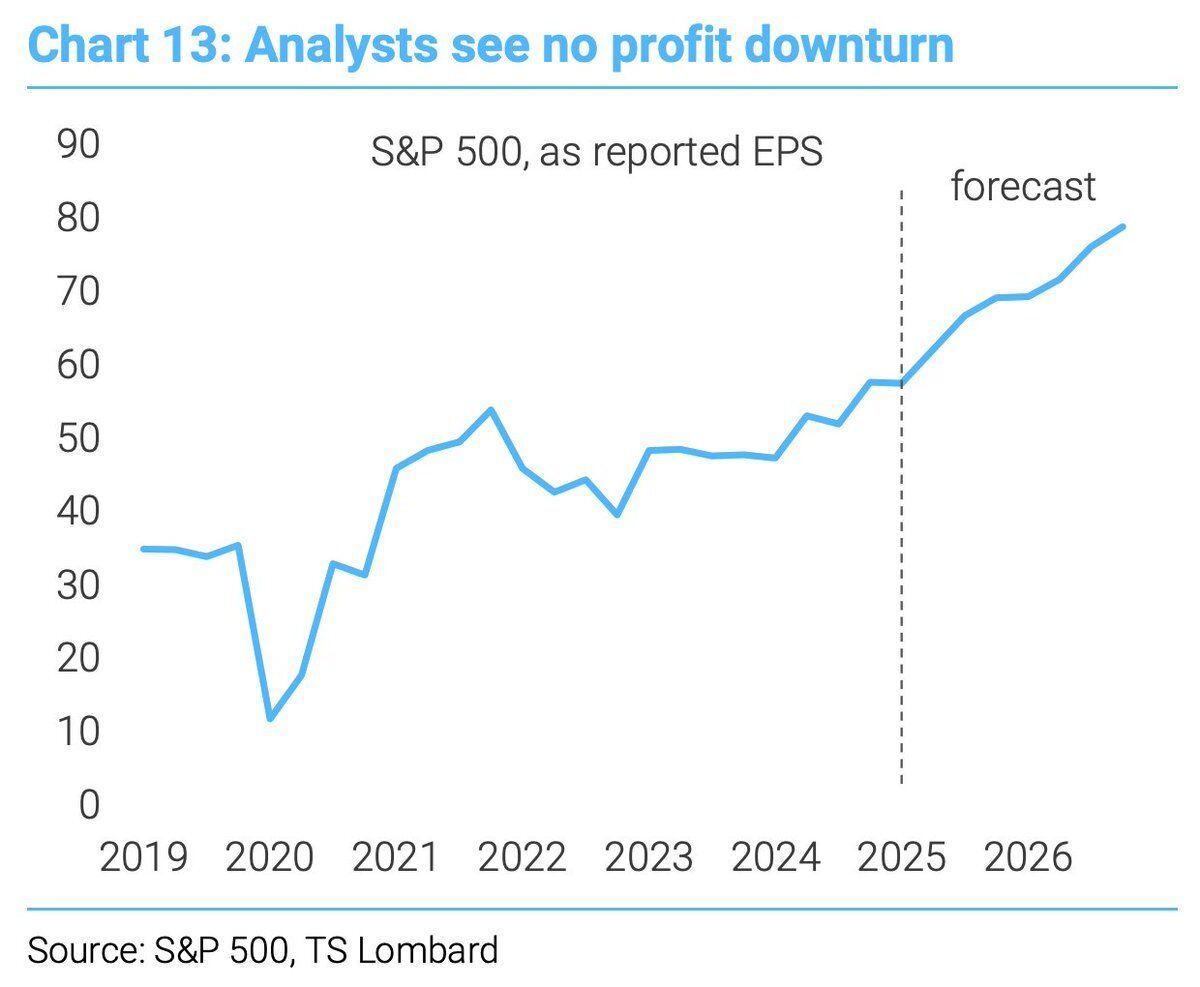

5. EPS outlook. "There are good reasons to expect weaker corporate earnings in the months ahead. Tariffs will either squeeze margins or raise prices (reducing sales); either way, there is a good chance that profits will go down."

Reply