- Daily Chartbook

- Posts

- DC Lite #413

DC Lite #413

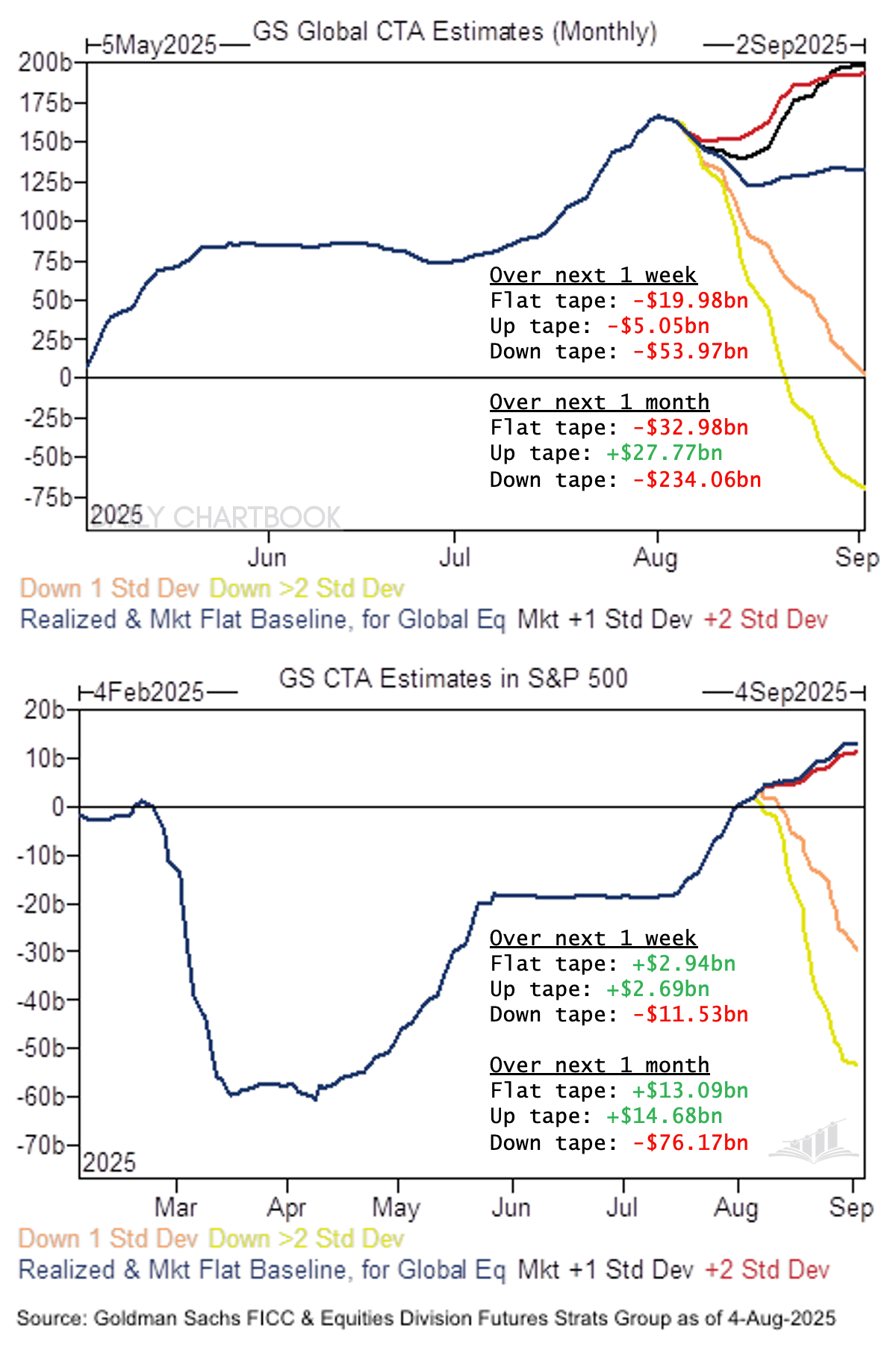

"The systematic community has now purchased over $365bn of global equities over the last 75 trading days, and positioning had been getting closer to full"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Crypto asset flows. "Digital asset investment products saw US$223m in outflows, reversing early-week inflows of US$883m ... Bitcoin led the outflows with US$404m ... Ethereum posted its 15th straight week of inflows (US$133m), while XRP, Solana, and SEI also attracted notable inflows."

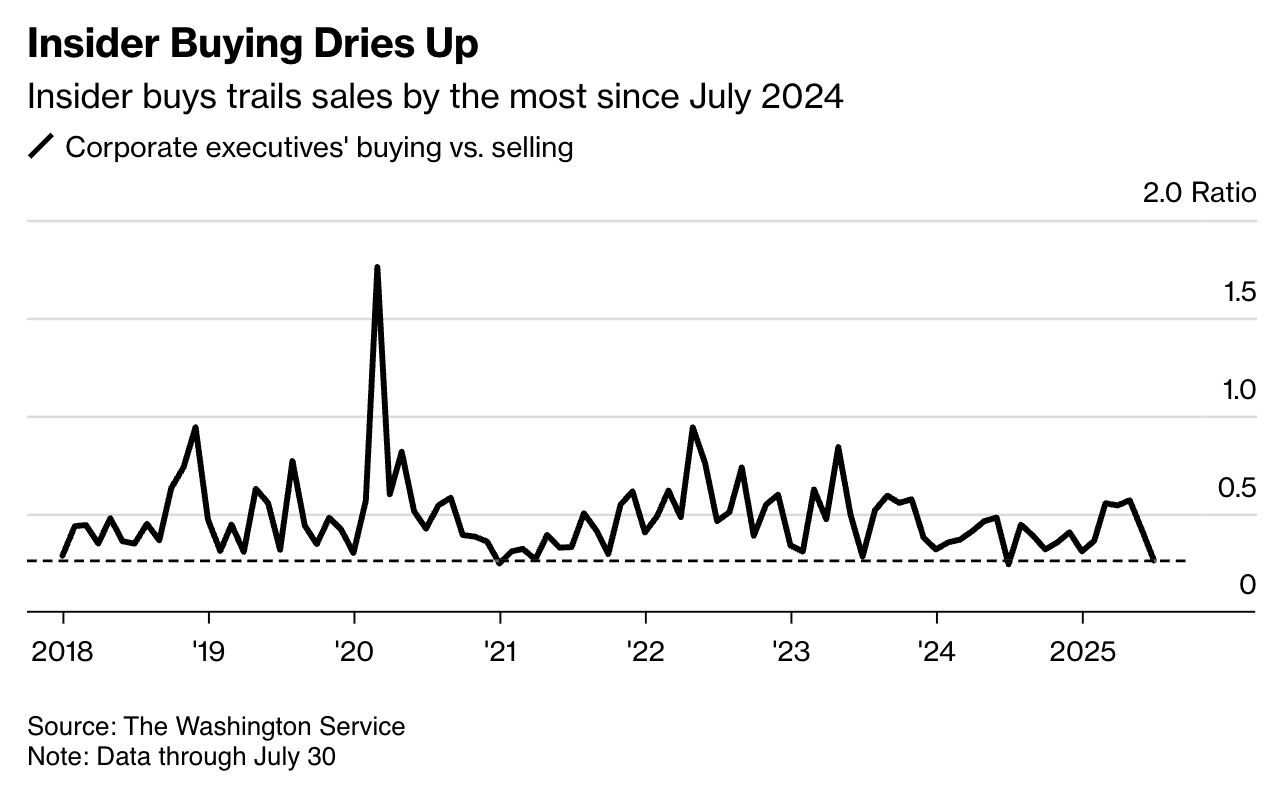

2. Corporate insiders. "Insiders at just 151 S&P 500 companies bought their own stocks last month, the fewest since at least 2018 ... purchases dropped even more, pushing the ratio of buying-to-selling to the lowest level in a year."

3. Systematic positioning. "The systematic community has now purchased over $365bn of global equities over the last 75 trading days, and positioning had been getting closer to full."

Sponsored content:

Daily News for Curious Minds

Be the smartest person in the room by reading 1440! Dive into 1440, where 4 million Americans find their daily, fact-based news fix. We navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet – politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight. Subscribe to 1440 today.

4. CTAs vs. equities. "Estimates over the next week and month are skewed to the downside. We have CTAs as sellers of global equities in every scenario over the next week (concentrated mostly in Europe)."

5. SPX anchored VWAPs. "The one we’re really keeping an eye on right now is the orange VWAP from the May 12 gap ... Because that day was a turning point, where the S&P 500: Gapped above its 200-day moving average, left the dreaded 'meat grinder' zone in the dust, and, triggered a deGraaf Breadth Thrust (not something you see every day)."

Sponsored content:

Learn from this investor’s $100m mistake

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from the same VCs behind Uber, Venmo, and eBay. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Reply