- Daily Chartbook

- Posts

- DC Lite #414

DC Lite #414

"The bull market that started in October 2022 is now 33 months old and good for an 84% gain"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Redbook. Same-store retail sales rose by 6.5% YoY (a 3-month high) in the week ending Aug 2 (4.9% prev).

2. Central banks vs. gold. "Central banks reported 22t of net gold purchases in June … Demand saw a modest m/m increase for the third consecutive month."

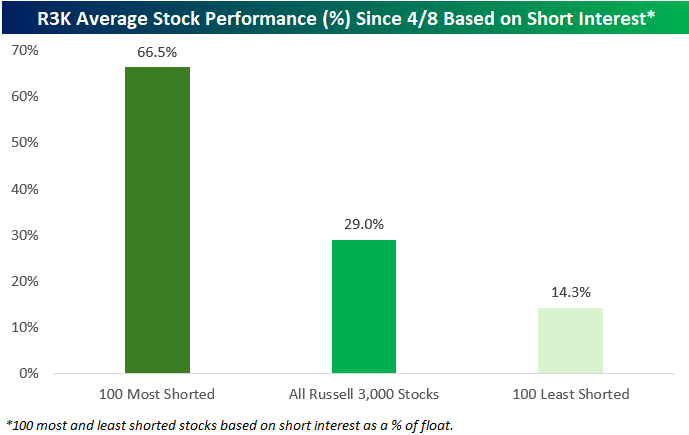

3. Performance vs. short interest. "The 100 most heavily shorted stocks in the Russell 3,000 are now up 66.5% since the 4/8 low versus 29% for all stocks and 14% for the 100 least shorted."

Sponsored content:

Finally, a powerful CRM—made simple.

Attio is the AI-native CRM built to scale your company from seed stage to category leader. Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Join fast growing teams like Flatfile, Replicate, Modal, and more.

4. Buyback announcements. "US companies announced share repurchases totaling $166 billion last month, the highest dollar value on record for July ... For the year, announced buybacks stand at $926 billion, which is $108 billion ahead of the previous year-to-date record set in 2022."

5. Cyclical bulls. "The bull market that started in October 2022 is now 33 months old and good for an 84% gain. The median is 30 months and 90%. That 'bear scare' in April did not knock the trendline off course, even though it sure felt like it at the time."

Sponsored content:

Financial News Keeps You Poor. Here's Why.

The scandalous truth: Most market news is designed to inform you about what already happened, not help you profit from what's coming next.

When CNBC reports "Stock XYZ surges 287%"—you missed it.

What you actually need:

Tomorrow's IPO calendar (not yesterday's launches)

Crowdfunding deals opening this week (not closed rounds)

What real traders are positioning for (not TV talking heads)

Economic data that moves markets (before it's released)

The financial media industrial complex profits from keeping you one step behind.

Stocks & Income flips this backwards. We focus entirely on forward-looking intel that helps you get positioned before the crowd, not informed after the move.

Stop chasing trades that happened already.

Start prepping for the next one.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Reply