- Daily Chartbook

- Posts

- DC Lite #529

DC Lite #529

"Global equities dominated last week in terms of fund flows"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

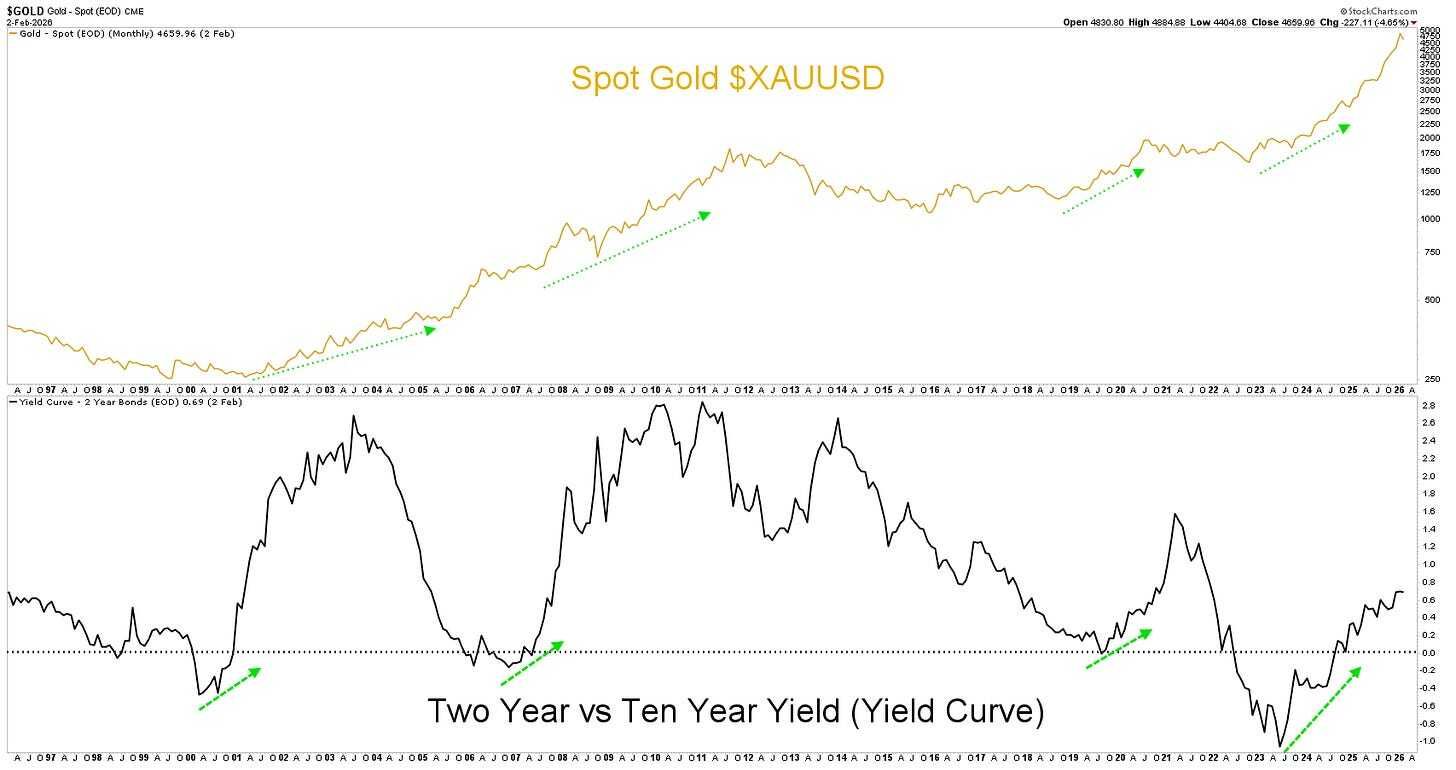

1. Gold vs. yield curve. “A curve that’s transitioning, steepening, or shifting off extremes has historically been a tailwind for precious metals. Until that structure meaningfully changes, the broader backdrop remains supportive. That doesn’t mean straight up. It means the path of least resistance remains higher over time.”

2. BTC supply in profit. “44% of Bitcoin supply is now underwater.”

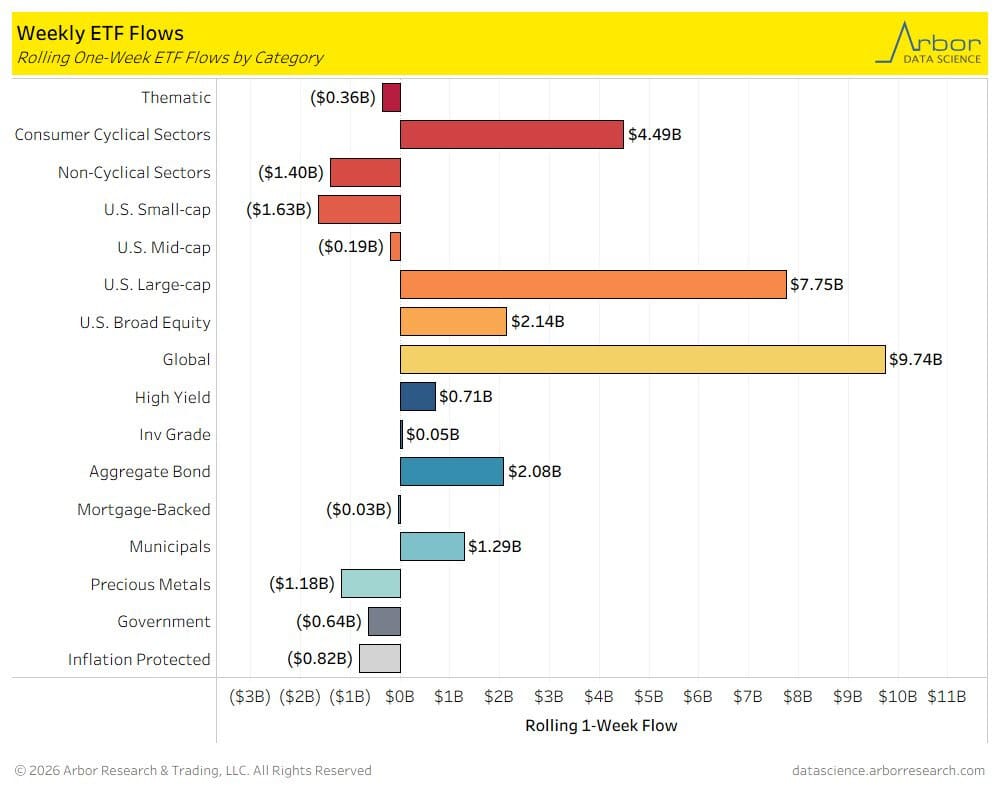

3. Weekly ETF flows. “Global equities dominated last week in terms of fund flows ... U.S. large caps saw a bounce back, followed by consumer cyclicals ... U.S. small caps led to downside, followed by non-cyclicals and precious metals.”

4. Retail activity. “Historically, retail cash activity at Citadel Securities has tended to moderate from January into February, with seasonal patterns since 2017 showing a consistent decline in net notional following the early-year surge.”

5. Staples vs. Tech. Staples gained more than 1.5% today while Tech fell more than 2%, the second time that’s happened in the last 3 trading sessions. Outside of Q1’25, the only other times we’ve seen this was during the early 2000s.

Reply