- Daily Chartbook

- Posts

- DC Lite #503

DC Lite #503

The Tech sector's contribution to S&P 500 operating earnings is expected to rise above 30% by Q4'26

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

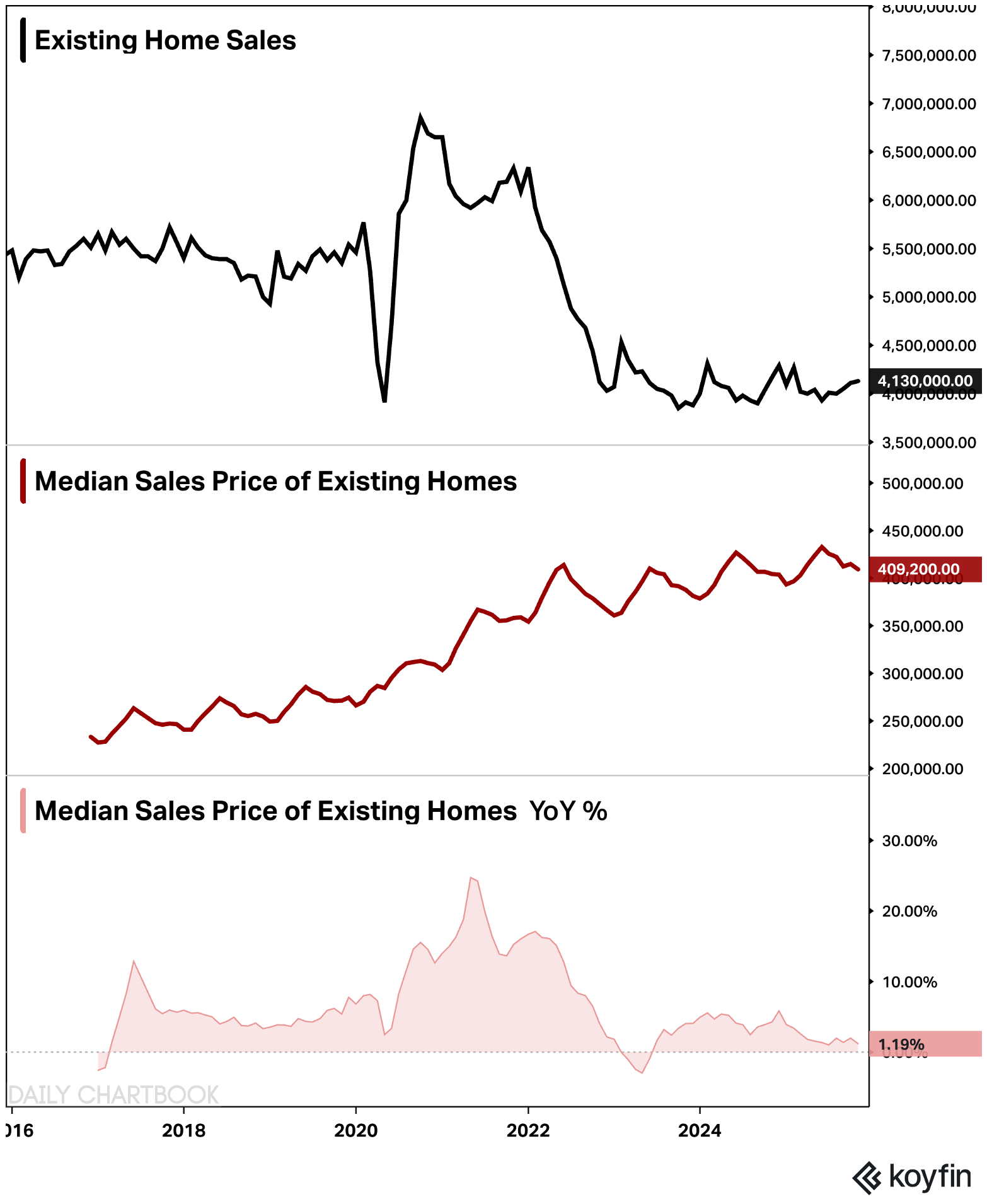

1. Existing home sales. Sales of existing homes rose 0.5% MoM in November to 4.13 million (annualized), marking the third consecutive increase and the most since February. The median sale price increased 1.2% YoY (second slowest pace in +2 years) to $409,200.

2. Unemployment. "Despite the unemployment rate rising for 31 months, this has been one of the slowest increases in unemployment in history. Many factors at play that are contributing to this, and how one would expect a trend of rising unemployment in a k-shaped economy, rather than in a broadly-weak economic backdrop."

3. NDX vs. MOVE. New cycle lows in interest rate volatility (inverted) could pave the way to new highs for stocks.

4. CY26 growth estimates. The S&P 500 is expected to grow its top and bottom lines by 15% and 7.2%, respectively. Both are comfortably above their 10-year trailing average growth rate.

5. Earnings contribution. And finally, the Tech sector's contribution to S&P 500 operating earnings is expected to rise above 30% by Q4'26.

Reply