- Daily Chartbook

- Posts

- DC Lite #458

DC Lite #458

"The current advance is youthful if counted from April 2025 but mature if counted from Oct 2022"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Consumer credit. Total US consumer credit rose by just $363 million in August, the slowest pace in 6 months and well below expectations of a $14bn rise. Revolving credit dropped by $5.96bn, reversing much of the previous month's increase, while non-revolving rose by $6.32bn.

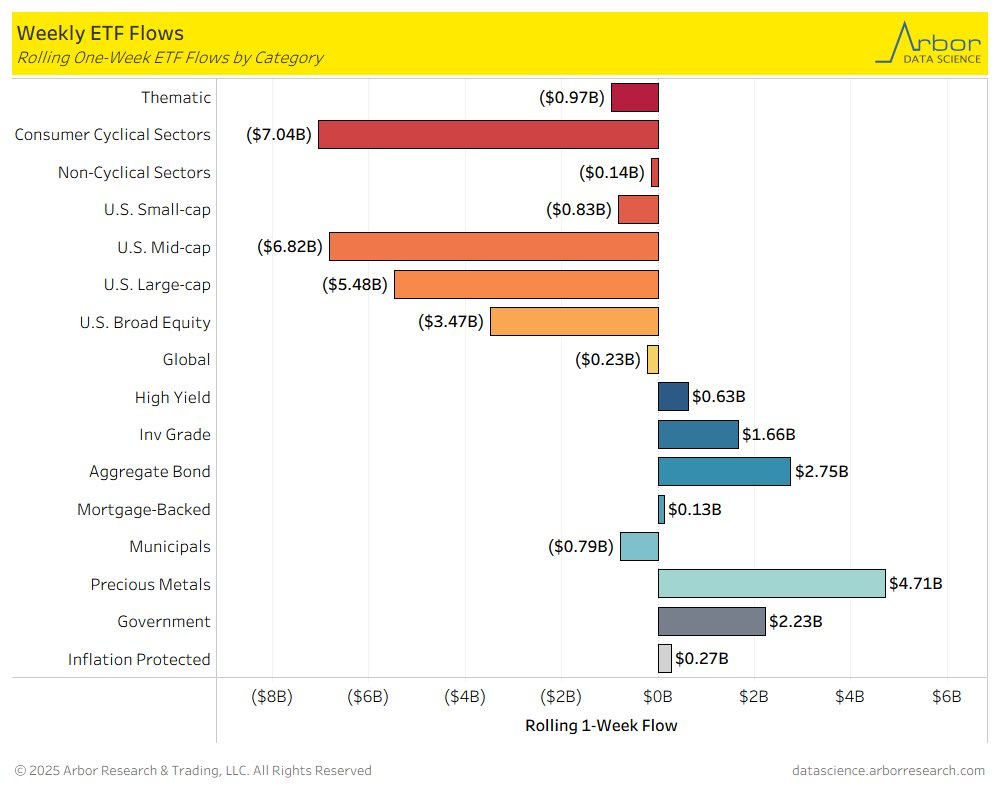

2. Gold forecast. "We raise our Dec2026 gold price forecast to $4,900/toz (vs. $4,300 prior) because the inflows driving the 17% rally since August 26th—Western ETF inflows and likely central bank buying—are sticky in our pricing framework, effectively lifting the starting point of our price forecast."

3. SMH vs. IGV flows. Flows to/from Semis and Software stocks—as proxied by SMH and IGV—have mirrored each other over the past year.

Sponsored content:

Earn your PE certificate online. Build an MBA-style network.

The Wharton Online + Wall Street Prep Private Equity Certificate Program gives you the knowledge and tools top professionals use to analyze investment opportunities.

Learn from senior leaders at top firms like Carlyle, Blackstone, and KKR.

Get direct access to Wharton faculty in live office hours where concepts become clear, practical, and immediately applicable.

Study on your schedule with a flexible online format

Plus, join an active network of 5,000+ graduates from all over the world.

Enroll today and save $300 with code SAVE300 + $200 with early enrollment by January 12.

Program begins February 9.

4. Cyclical reset. "The current advance is youthful if counted from April 2025 but mature if counted from Oct 2022. A near-classic sequence of breadth washout, breadth thrust, price momentum, and breadth recovery suggest that April 2025 was in fact a cyclical reset. What would negate this thesis?"

5. Nasdaq vs. ChatGPT. "The tech-heavy NASDAQ is now up 100% since the initial release of OpenAI’s ChatGPT model in late November 2022—the event that sparked the recent AI-driven rally."

Sponsored content:

What do Carlyle, Blackstone, and KKR all have in common?

Leaders from Carlyle, Blackstone, and KKR are among the guest speakers in the Wharton Online + Wall Street Prep PE Certificate Program.

Over 8 weeks, you will:

Learn directly from Wharton faculty

Get hands-on training with insights from top firms

Earn a respected certificate upon successful completion

Save $300 with code SAVE300 at checkout + $200 with early enrollment by January 12.

Program starts February 9.

Reply