- Daily Chartbook

- Posts

- DC Lite #428

DC Lite #428

"The tape isn’t just confirming — it’s over-delivering"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Tax refunds. "We will see in an even larger crop of personal income tax refunds early in 2026 than was anticipated when the OBBBA was passed. These higher income tax refunds should work much like a new round of stimulus checks, adding to consumer demand and inflation pressures early next year."

2. Fund favorites. "There are seven 'shared favorites' this quarter: APP, CRH, MA, SCHW, SPOT, V, VRT. The overlap of mutual fund and hedge fund favorites has returned 20% YTD compared with 9% for the S&P 500."

3. Mag 7 vs the rest. "Both ratios have bounced back after a nasty stretch of underperformance, but they remain below prior highs ... as long as these ratios stay under their old peaks, it makes sense to keep hunting for opportunities outside the usual suspects."

Sponsored content:

13 Investment Errors You Should Avoid

Successful investing is often less about making the right moves and more about avoiding the wrong ones. With our guide, 13 Retirement Investment Blunders to Avoid, you can learn ways to steer clear of common errors to help get the most from your $1M+ portfolio—and enjoy the retirement you deserve.

4. Breadth thrusts. "Two key thrusts... both above their averages. Zweig Breadth Thrust (Apr 24) & 20-Day Highs Thrust (May 12). Each thrust is running hotter than history. The tape isn’t just confirming — it’s over-delivering."

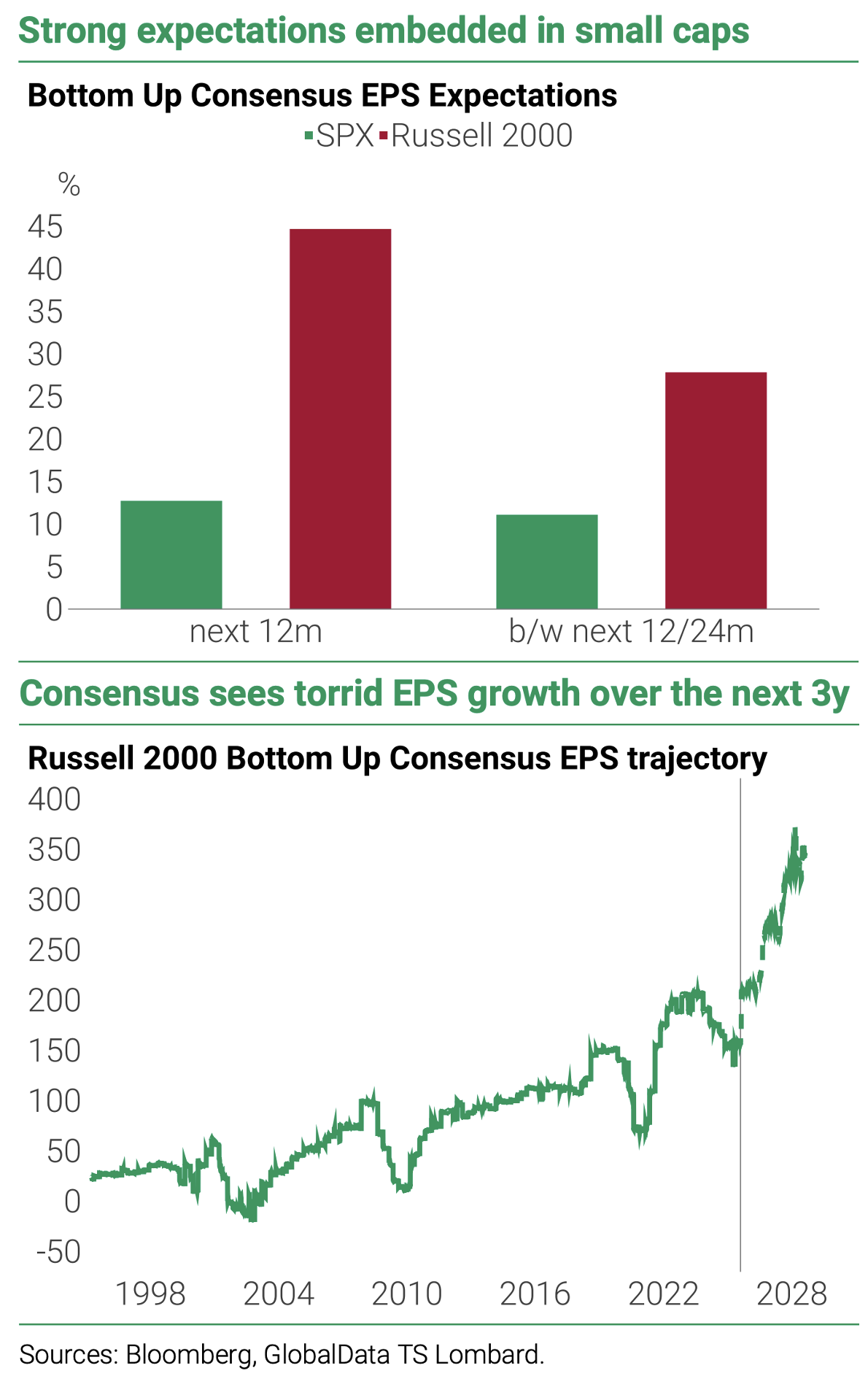

5. EPS outlook. "S&P 500 forward earnings per share rose to yet another new record high during the week of August 21 as industry analysts raised their 2025 and 2026 earnings estimates."

Sponsored content:

Learn from this investor’s $100m mistake

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from the same VCs behind Uber, Venmo, and eBay. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Reply