- Daily Chartbook

- Posts

- DC Lite #427

DC Lite #427

"When Core CPI is above 3% AND rising, the Fed has only cut rates one time"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Data surprise. "My takeaway from Powell's speech today is that a September cut is still really down to forecasting the data -- the CPI and the NFP. True, the bias is somewhat in the direction of a cut, but I don't think the sureness in the market pricing accurately reflect the risk."

2. Fed cut vs. CPI. "When Core CPI is above 3% AND rising, the Fed has only cut rates one time (red vertical lines below). If August CPI prints above 3%, then a September cut would be the second case. The only other time the Fed cut under these conditions: Dec 2024."

3. Mag 7 vs. Bottom 493. "Balanced YTD returns for the Mag 7 and S&P 500 ex-Mag 7."

Sponsored content:

Your Daily Edge in the Markets

Want to stay ahead of the markets without spending hours reading?

Elite Trade Club gives you the top stories, trends, and insights — all in one quick daily email.

It’s everything you need to know before the bell in under 5 minutes.

Join for free and get smarter about the markets every morning.

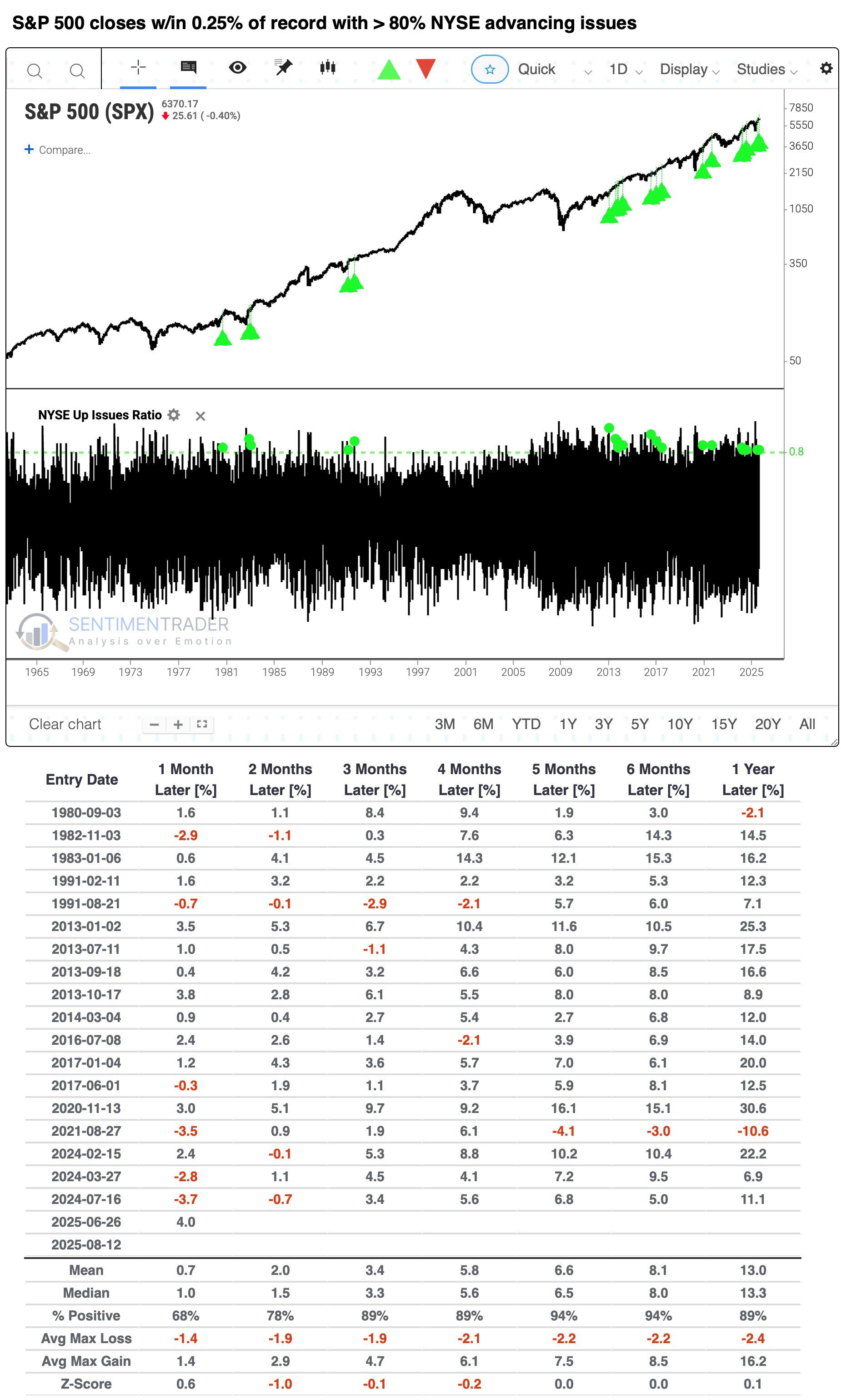

4. SPX breadth. Short-term breadth has broken out while longer-term breadth has made new YTD highs.

5. SPX vs. breadth. "RIP bears."

Sponsored content:

How A Small Crypto Investment Could Fund Your Retirement

Most people think you need thousands to profit from crypto.

But this free book exposes how even small investments could transform into life-changing wealth using 3 specific strategies.

As markets recover, this may be your last chance to get positioned before prices potentially soar to unprecedented levels.

Reply