- Daily Chartbook

- Posts

- DC Lite #426

DC Lite #426

"The Nasdaq Comp continues to eerily track its mid-1990s bull run"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

1. Jobless claims. Both initial and continuing claims rose by more than expected. The former remains within its recent range but the latter made new cycle highs.

2. Flash PMIs. S&P Global's Flash Composite PMI rose to an 8-month high driven by renewed improvement in Manufacturing PMI, which signaled the best factory business conditions since May 2022. Job gains in the sector reached the highest since March 2022.

3. Retail activity. "Retail investor behavior changed during the Tech selling in the past 2 days, breaking their 2-mo long daily buying streak (+$1B avg/day) to become net sellers (-$140M) on Tuesday. They prioritized profit taking in single stocks, while buying the dip in broad-based market ETFs."

Sponsored content:

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

4. Nasdaq: 1990s vs. today. "The Nasdaq Comp continues to eerily track its mid-1990s bull run, up more than double (106%) since its low in December 2022, close to the index’s 111% gain over the same period from the start of 1995."

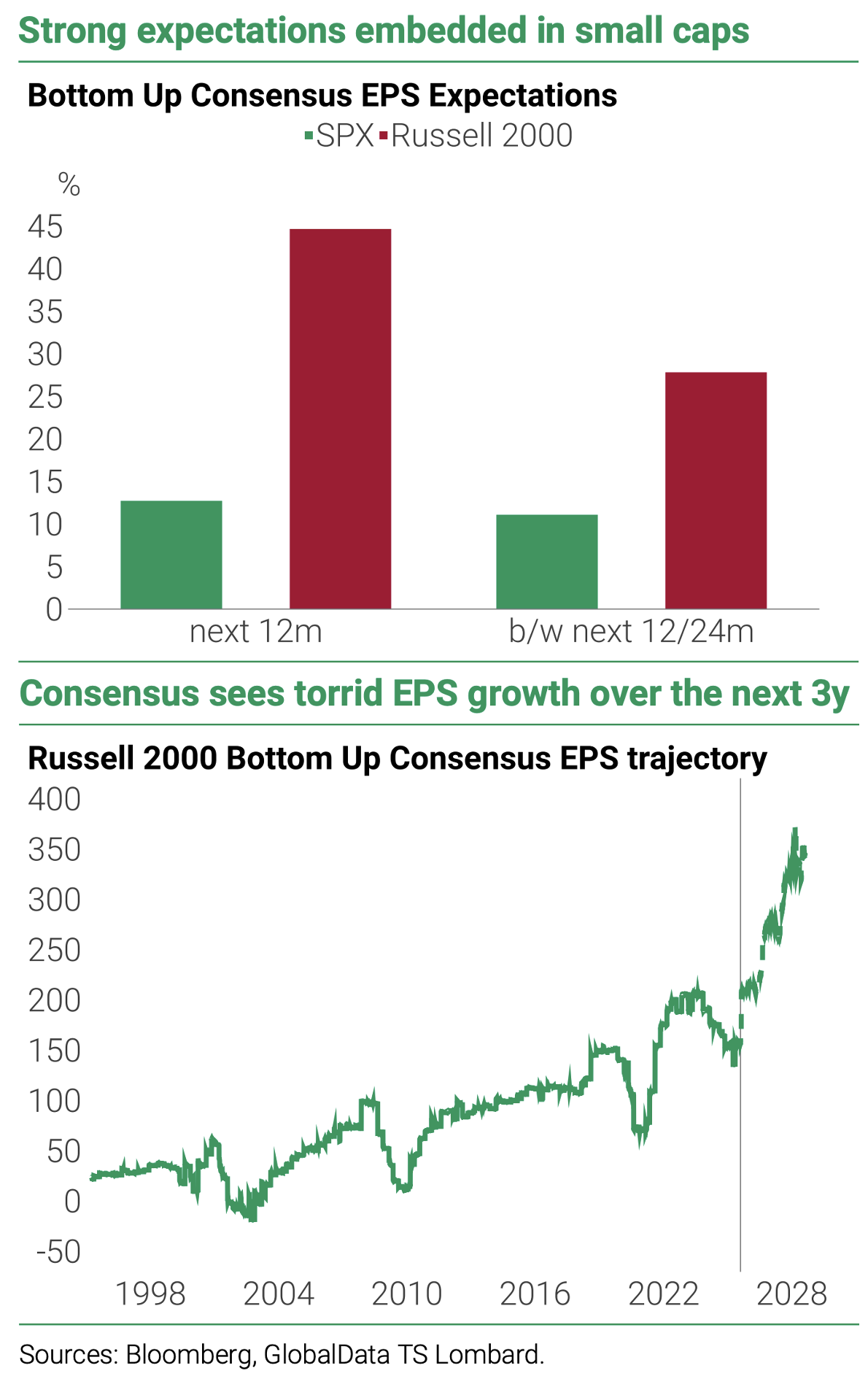

5. R2K EPS revisions. "Earnings momentum has turned. EPS revisions just went positive for the first time since late 2022 and before that, 2020. Both times, small caps ripped higher."

Sponsored content:

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

Reply