- Daily Chartbook

- Posts

- DC Lite #466

DC Lite #466

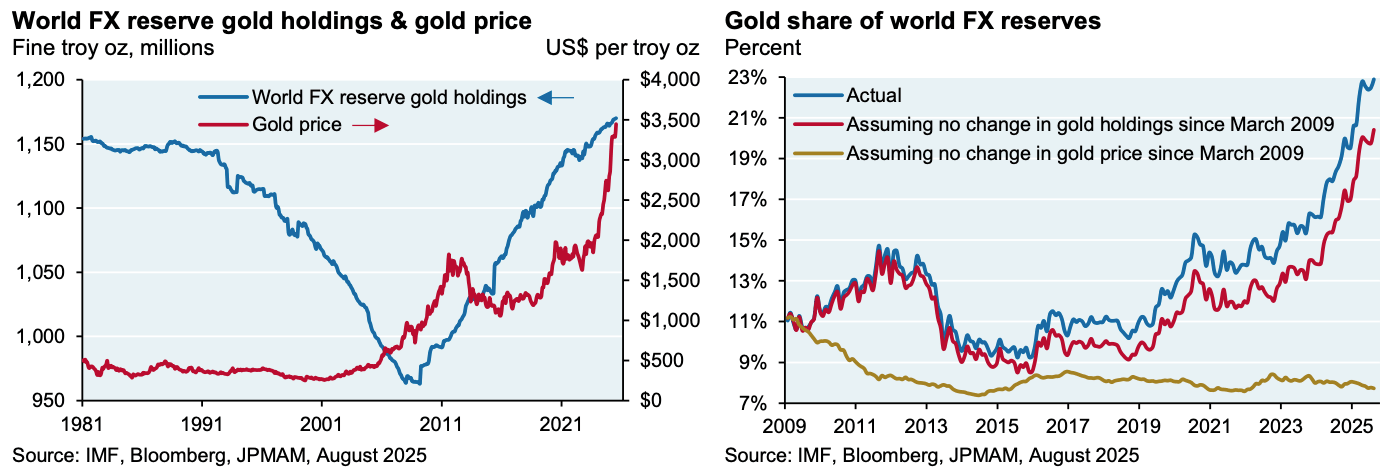

"Almost the entire increase in the gold share of reserves since 2009 is a function of the rising market price of gold itself"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

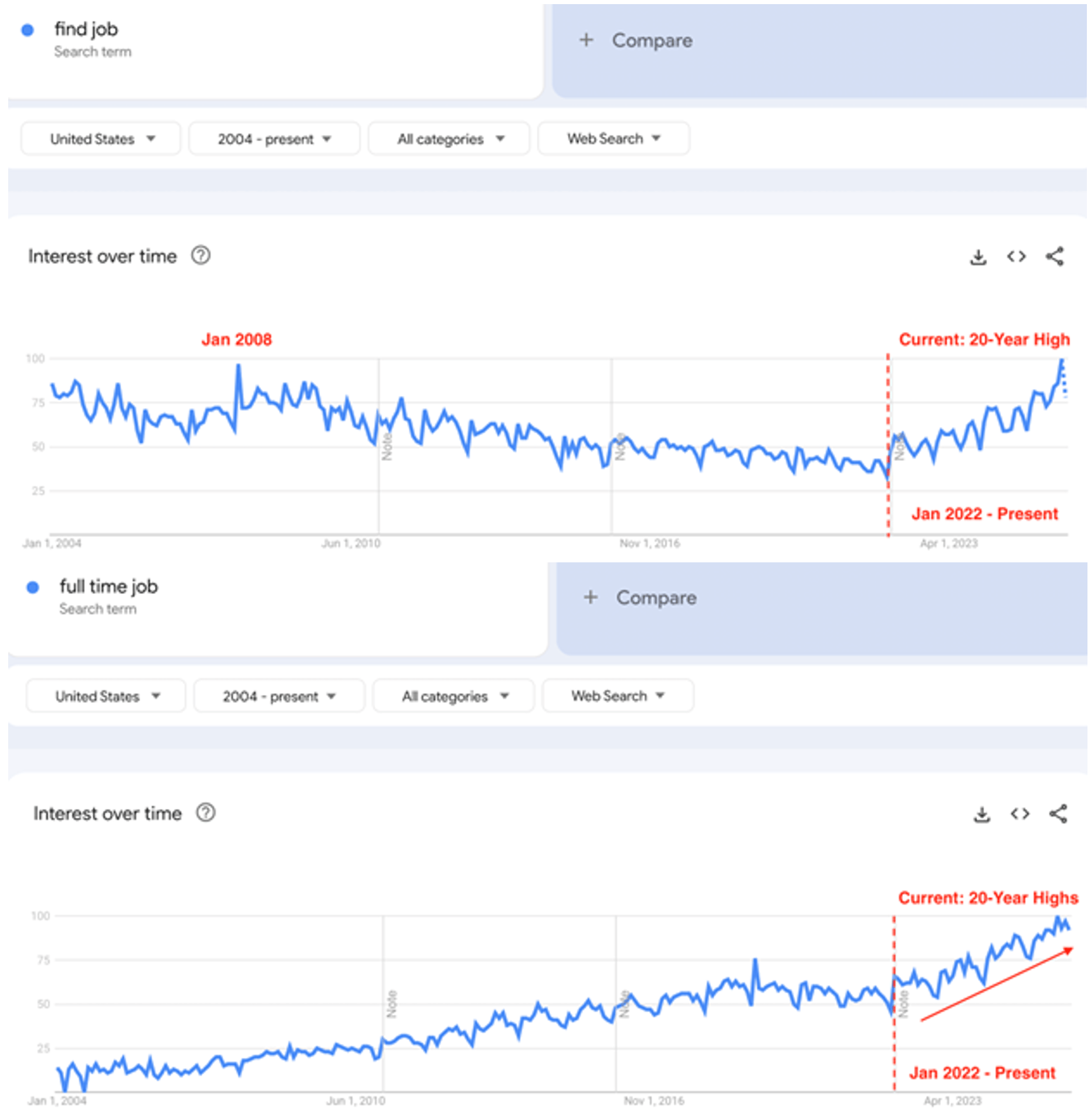

1. Google job search trends. "This data shows why Chair Powell is so concerned about the current 'low hire, low fire' labor market environment. Americans are searching for jobs at recessionary levels, so a pickup in layoffs would surely increase unemployment."

2. Q3 GDP. The Atlanta Fed's GDPNow model estimate for Q3 GDP growth ticked up to 3.9% from 3.8% on Oct 7.

3. Central banks vs. gold. "Almost the entire increase in the gold share of reserves since 2009 is a function of the rising market price of gold itself. As shown on the right, if we ... keep gold prices flat at 2009 levels and use actual central bank gold holdings, the gold share of reserves actually falls to 8%."

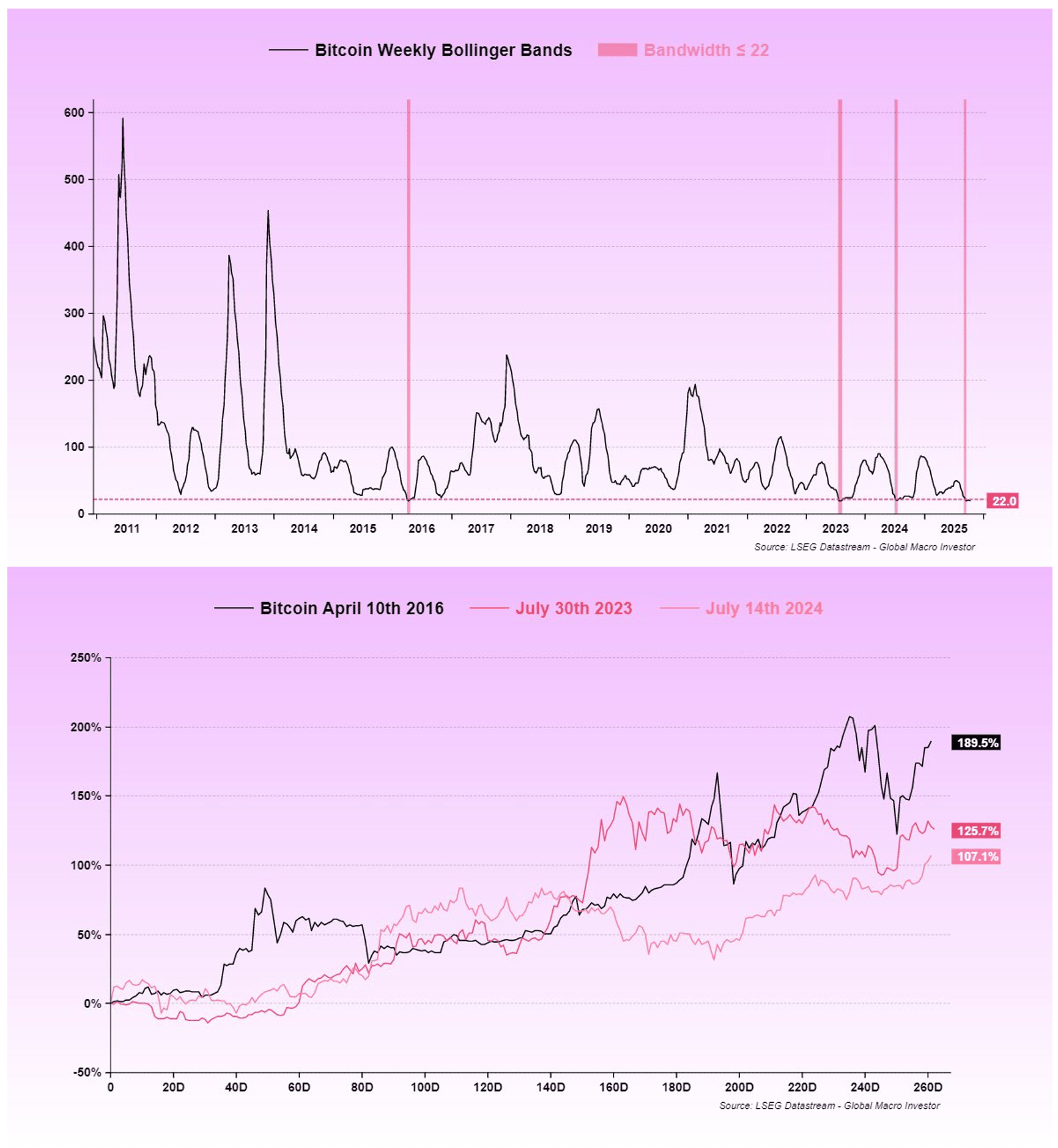

4. BTC Bollinger Bands. "Bitcoin’s Bollinger Bands have only been this tight three other times in its entire history ... The sample size is small, but the results have been extremely positive ... It’s the classic beach-ball-underwater dynamic."

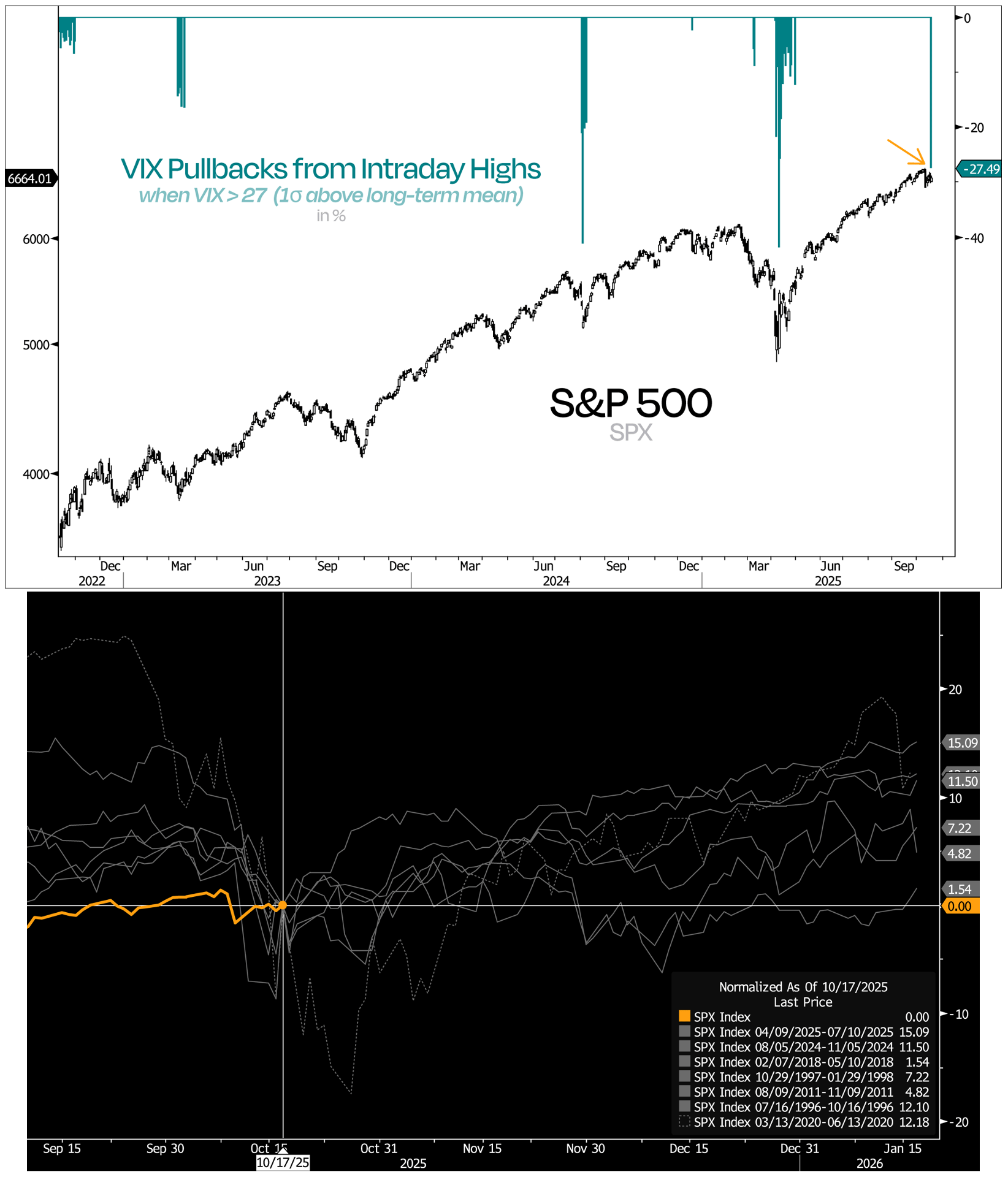

5. SPX vs. VIX. "The VIX Index just crashed more than 25% from its intraday highs today. Similar pullbacks — when the VIX was above 27 (about one standard deviation above its long-term average) — have typically coincided with market lows in the S&P 500 ... On average, the S&P 500 gained 9.21% over the next three months when the intraday VIX drawdown exceeded 25%."

Reply