- Daily Chartbook

- Posts

- DC Lite #463

DC Lite #463

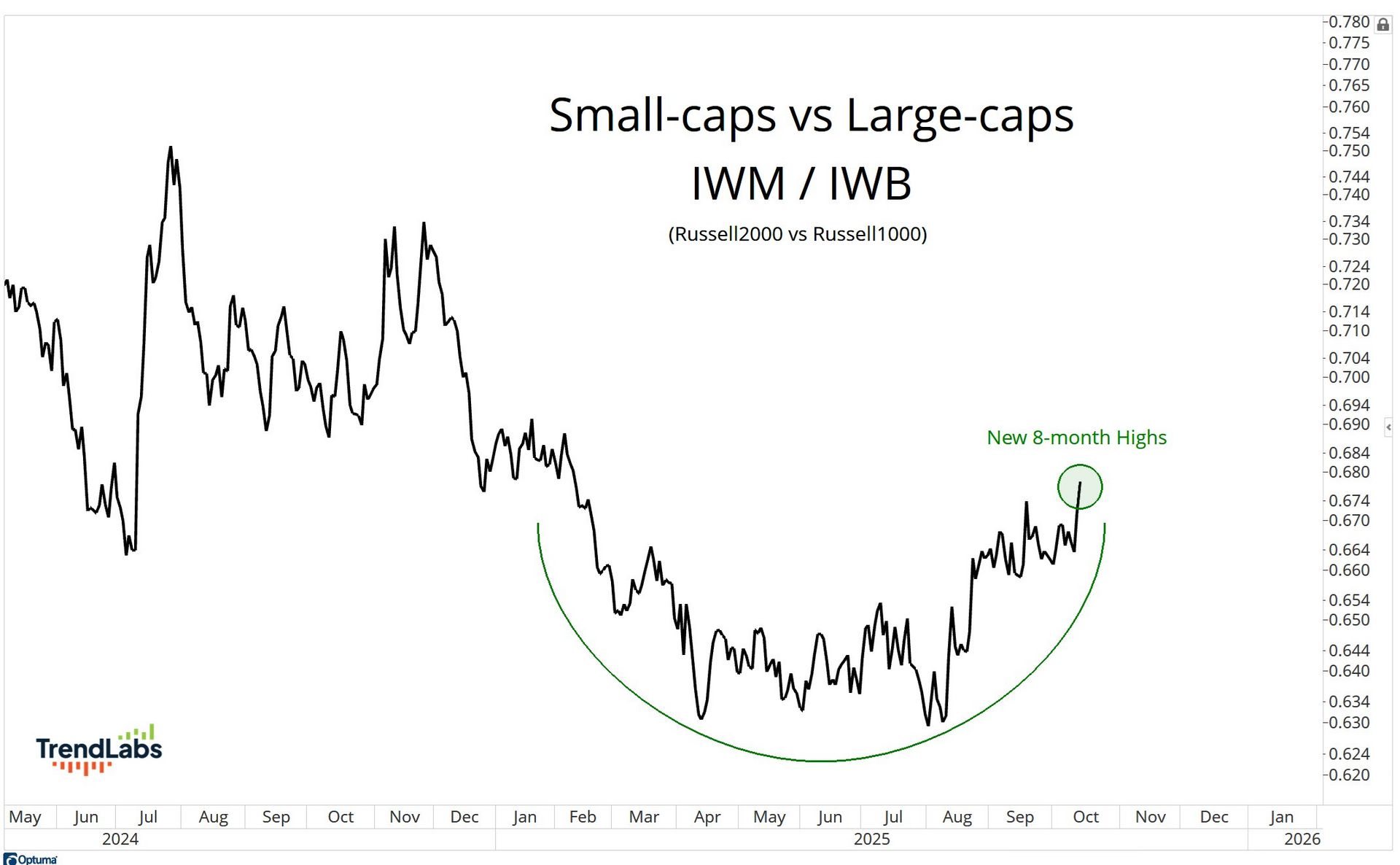

"Small-caps today are hitting the highest levels since February relative to Large-caps"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

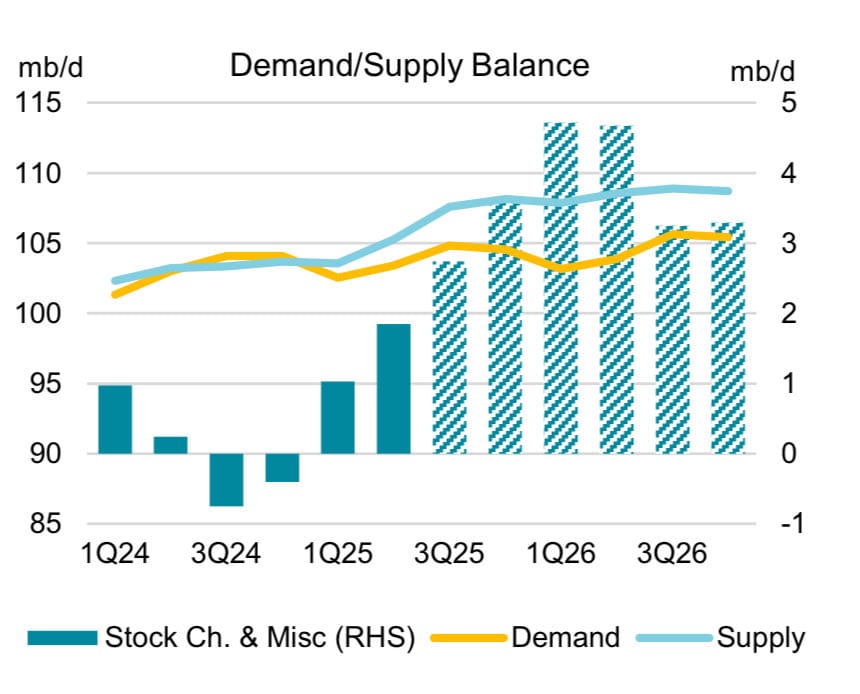

1. Oil supply vs. demand. The IEA "sees a huge oversupply in 2026, with two quarters when production exceeds demand by >4m b/d. Even if the agency is off, directionally it’s clear that the global oil market is heading toward a surplus that requires lower prices and contango."

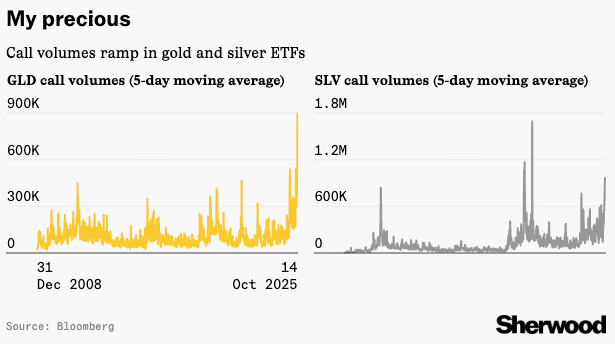

2. Precious metals ETFs. "The five-day average for call volumes in GLD recently hit a record, while those for its silver peer are at their highest since 2021."

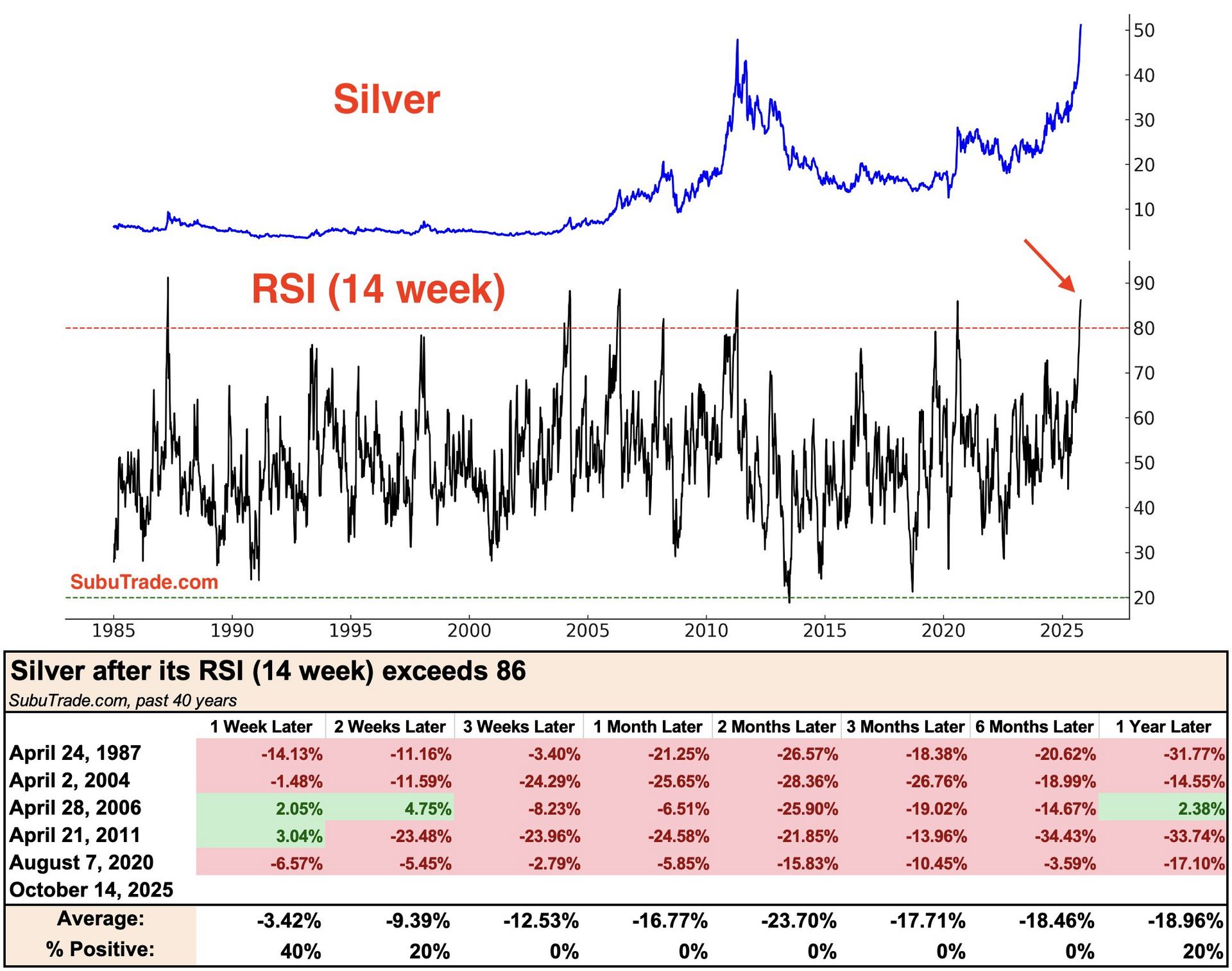

3. Silver RSI. "Silver's weekly RSI is at 86, one of the highest readings ever. Here's what silver did after similar spikes."

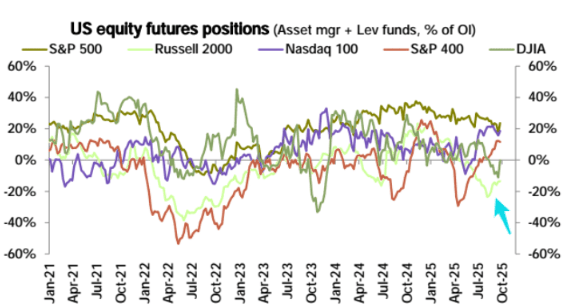

4. Equity futures positioning. "Russell is the main outlier when it comes to US equity positioning among asset managers and leveraged funds."

5. Small vs. Large. "Small-caps today are hitting the highest levels since February relative to Large-caps."

Reply