- Daily Chartbook

- Posts

- DC Lite #450

DC Lite #450

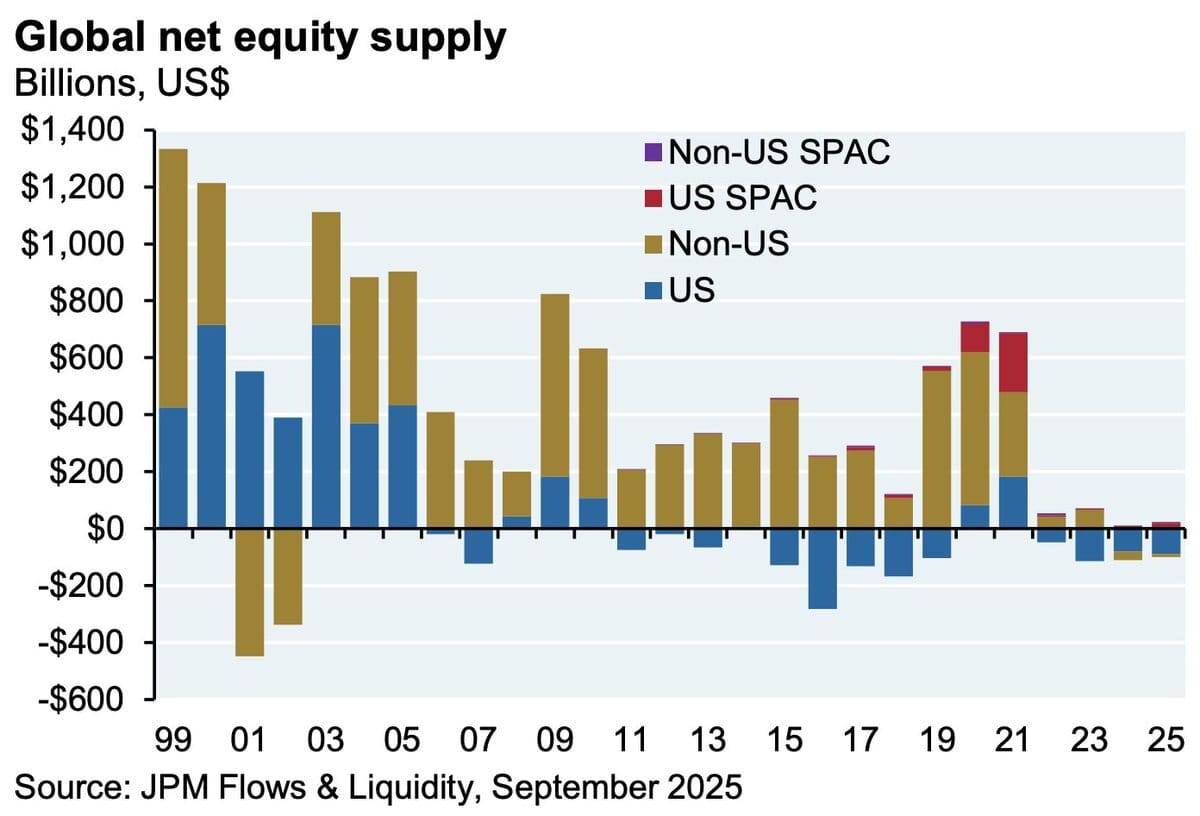

"This chart might be the simplest explanation for US equity market resilience since 2011: limited supply"

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights.

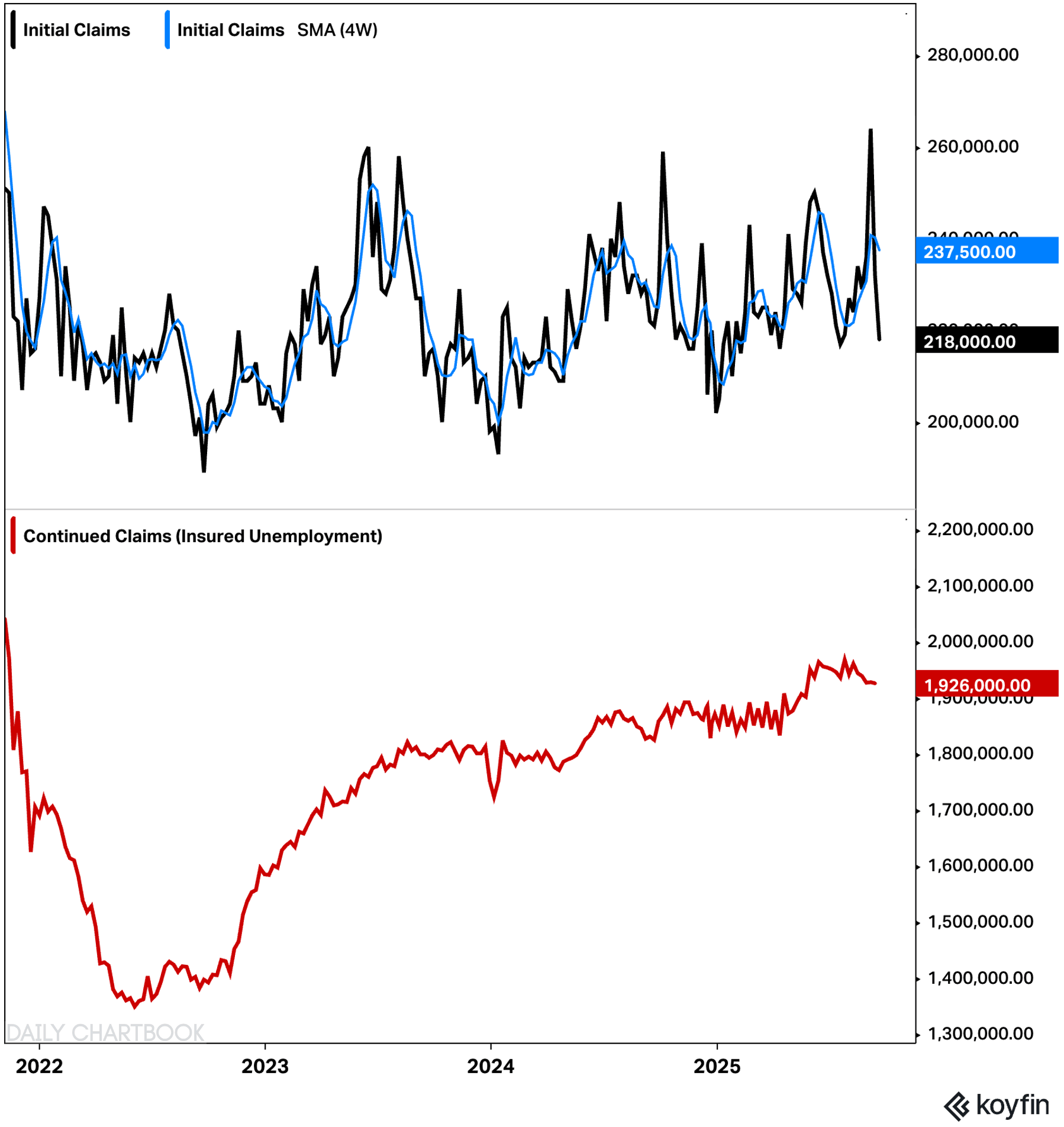

1. Jobless claims. Following the early-month spike, initial claims have now dropped sharply 2 weeks in a row. Continuing claims also declined by more than expected. Both are consistent with a slow-to-hire, slow-to-fire labor market.

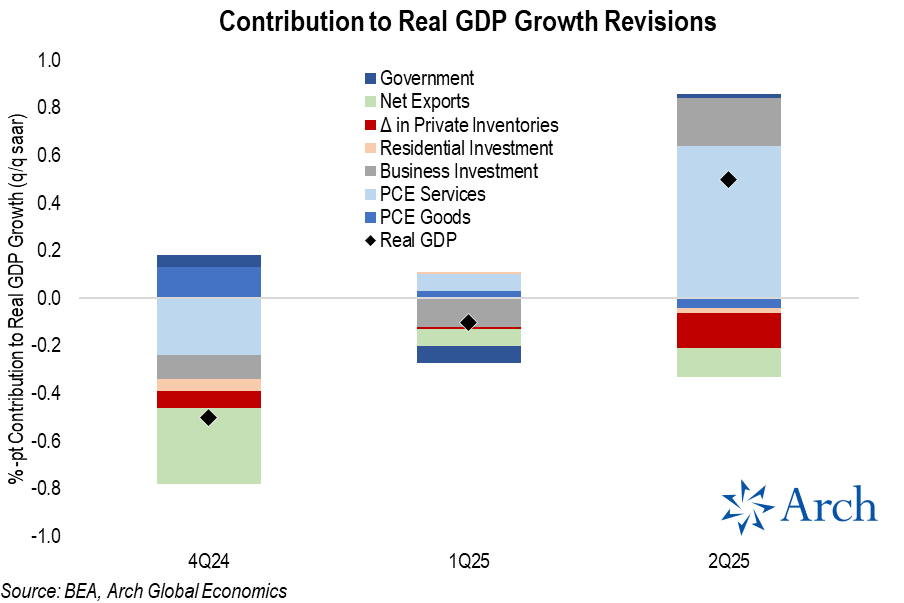

2. GDP. "Pretty notable upward revisions to 2Q25 real GDP growth this morning: up 50bps to 3.8% from 3.3% prior. All of the upward revision was due to stronger than previously reported Consumer spending on of Services, Business Investment and a modest bump to Government consumption."

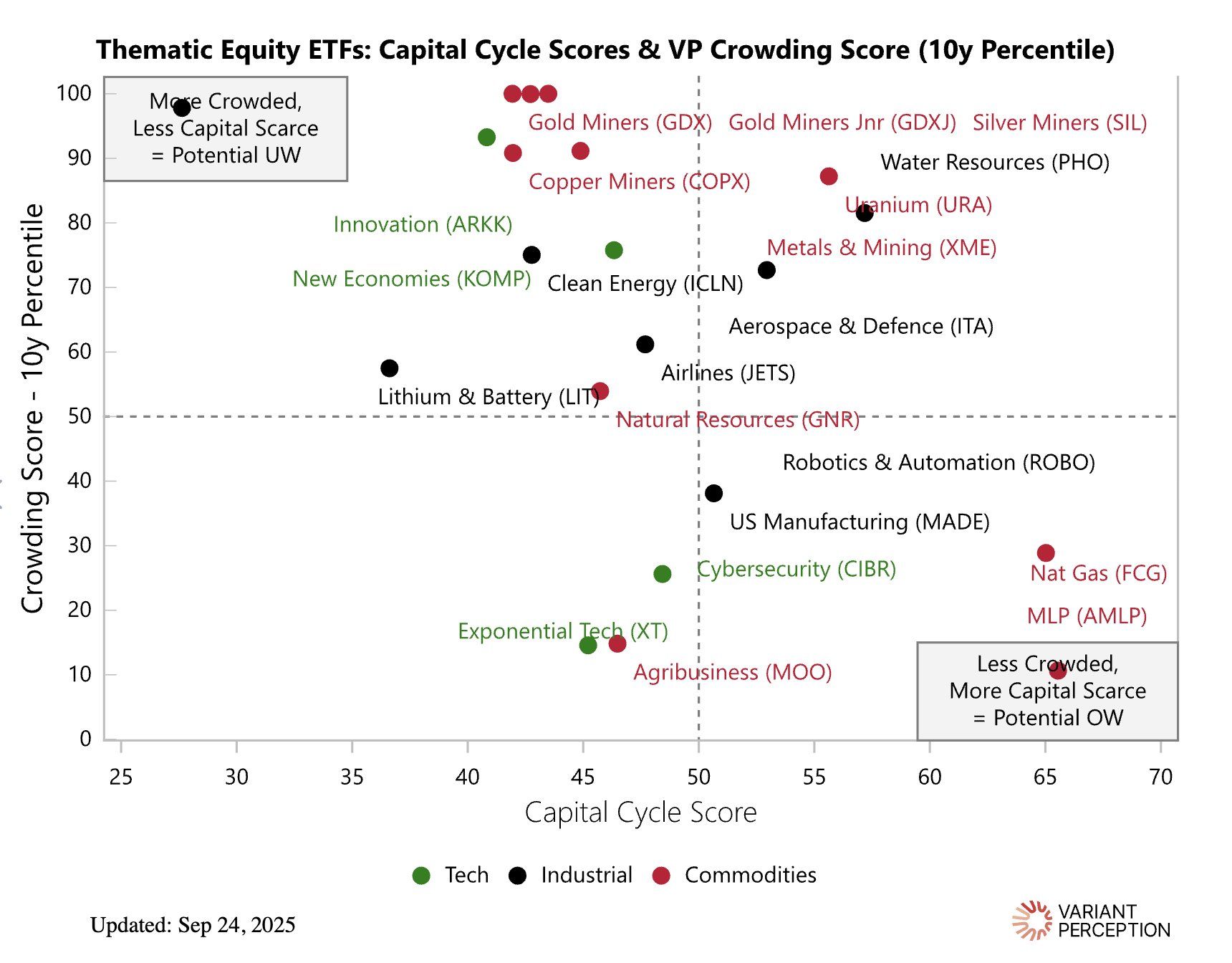

3. Capital scarcity vs. positioning. "Capital cycle and crowding update for thematic ETF's. Noteworthy that robotics and automation remain relatively uncrowded and capital scarce compared to its own 10y history."

Sponsored content:

Where the smartest investors start their day

The Alternative Investing Report (A.I.R.) helps you get smarter on alternative assets from crypto treasury companies to Pre-IPO venture secondaries to private credit and more.

Join 100,000+ investors to get the latest insights and trends driving private markets, a weekly investment pick from a notable investor, and bonus offers to join top private market platforms and managers. And it’s totally free.

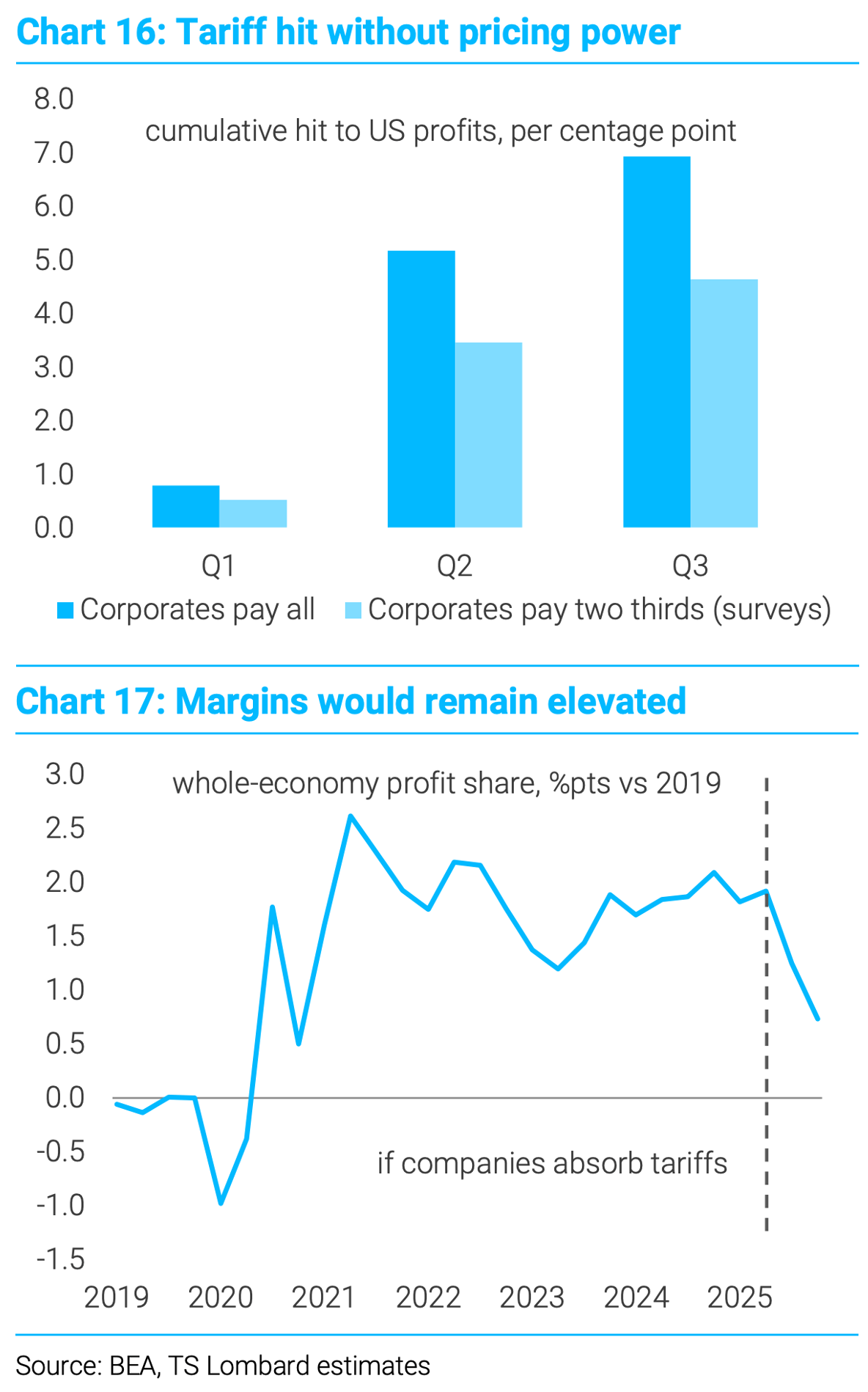

4. Tariffs vs. margins. "Even if we assume the two-thirds burden sticks, that would be a hit to corporate profits – around 5% -- which doesn’t look like an economy-crushing number. In fact, margins would still be above their 2019 levels."

5. Net equity supply. "This chart might be the simplest explanation for US equity market resilience since 2011: limited supply."

Sponsored content:

Earn Your Certificate in Private Equity on Your Schedule

The Wharton Online + Wall Street Prep Private Equity Certificate Program delivers the practical skills and industry insight to help you stand out, whether you’re breaking into PE or advancing within your firm.

Learn from Wharton faculty and industry leaders from Carlyle, Blackstone, Thoma Bravo, and more

Study on your schedule with a flexible online format

Join a lifelong network with in-person events and 5,000+ graduates

Earn a certificate from a top business school

Enroll today and save $300 with code SAVE300 + $200 with early enrollment by January 12.

Program begins February 9.

Reply