Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights. Upgrade to get all 30 charts.

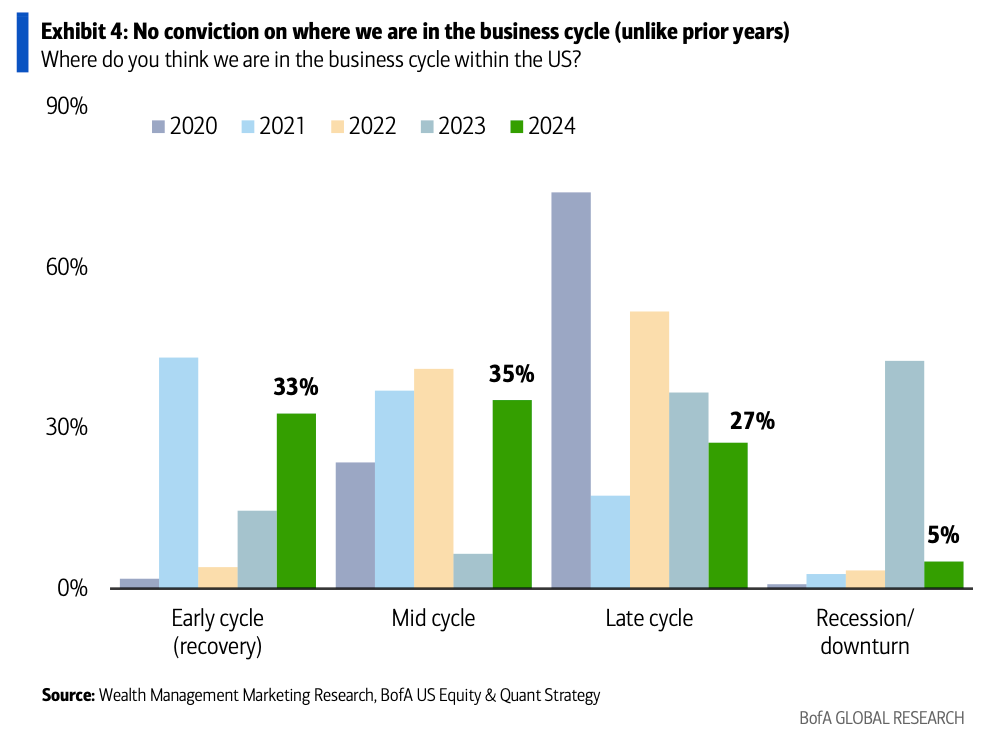

1. Business cycle. Financial advisors have no idea where we are in the business cycle.

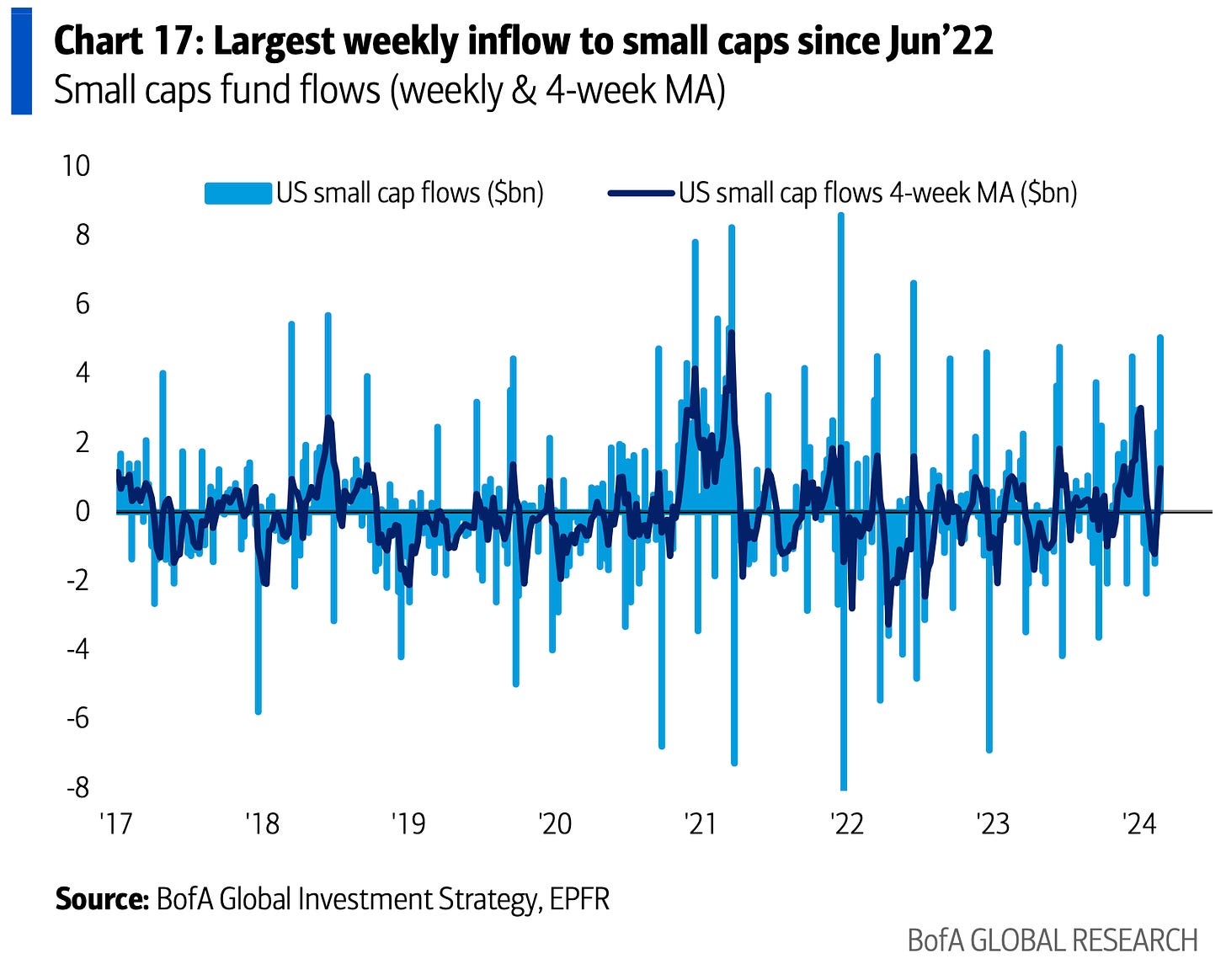

2. Small-cap fund flows. US small-cap funds saw the largest inflow (+$5.1bn) since June 2022.

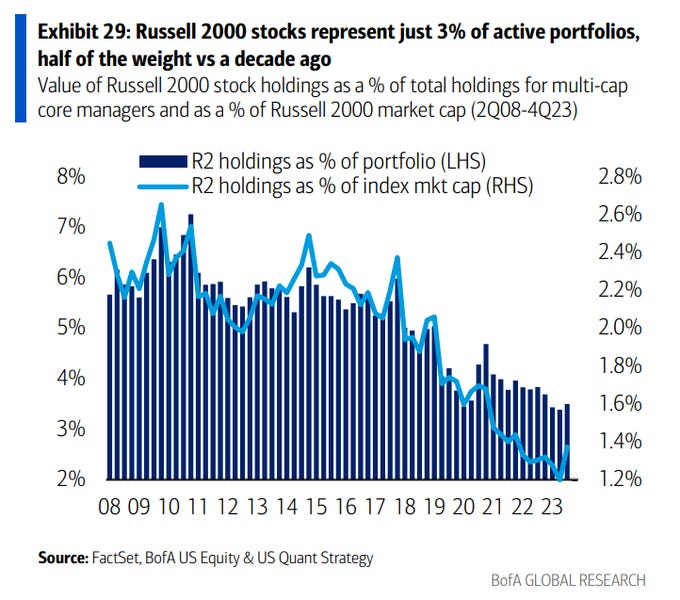

3. Advisors vs. small-caps. "Russell 2000 stocks represent just 3% of active portfolios, half of the weight vs a decade ago."

4. Margin debt. "Unlike most bubbles, this one hasn't been accompanied, at least so far, by obvious signs of high and rising leverage...Margin debt has actually been falling recently. And the ratio of margin debt to the size of the stock market has been doing likewise."

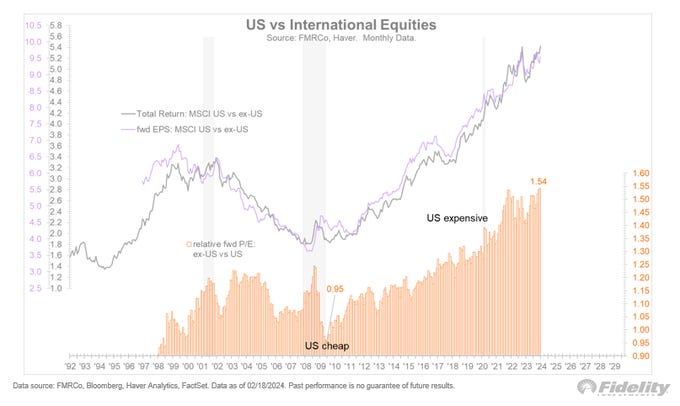

5. US vs. RoW. "The rest of the world can be dirt cheap compared to the US, but if there’s no relative earnings growth, then that valuation gap can persist."

Thanks for reading!