Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights. Upgrade to get all 30 charts.

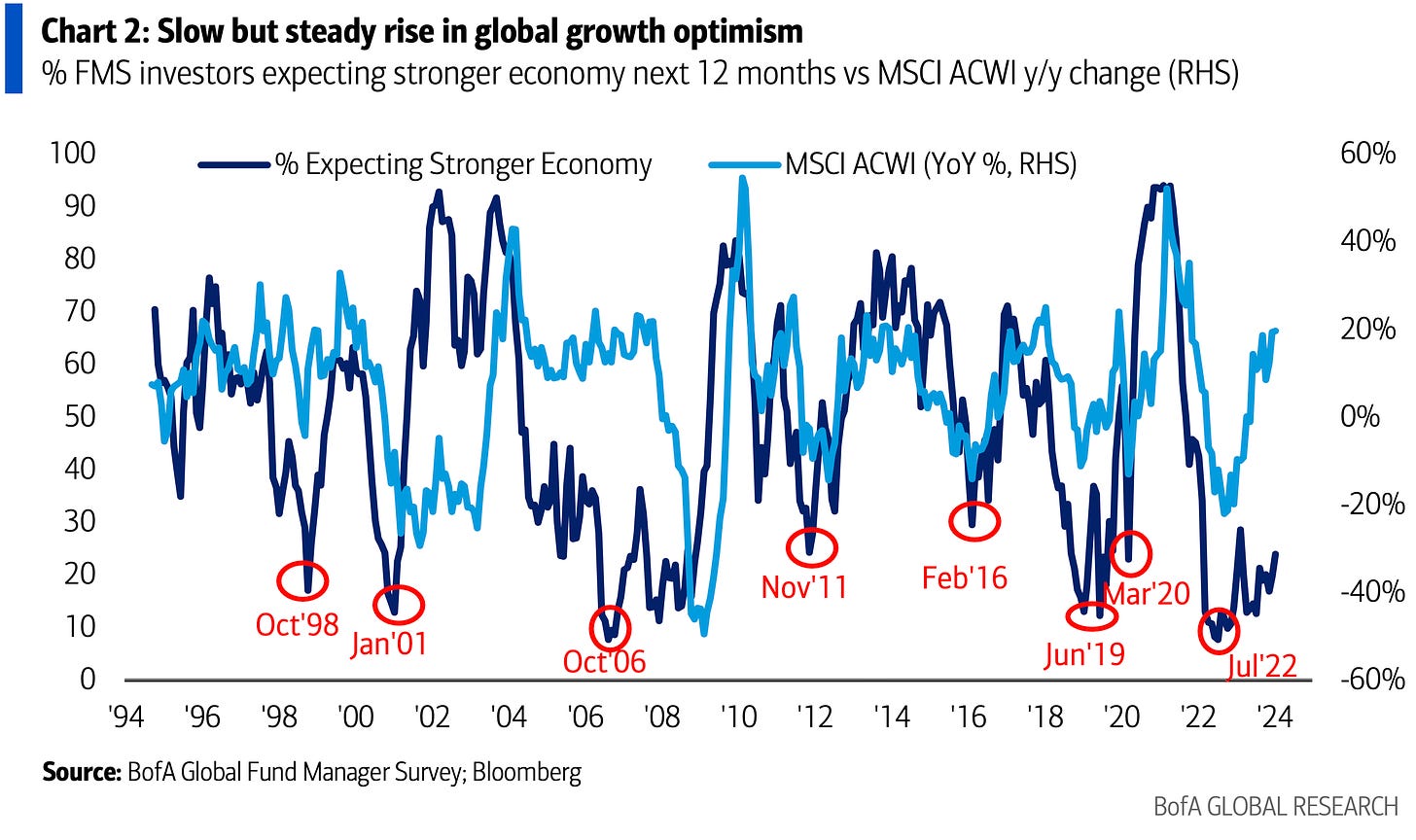

1. Global growth optimism. The percentage of FMS investors expecting a stronger economy in the next year is at a 12-month high.

2. Yield curve vs. business cycle. "These 3 lines all measure the same thing – the maturity of the business cycle (**and turning points**). On all 3 counts they say the cycle is long in the tooth, and turning."

See: Topdown Charts, Topdown Charts Professional

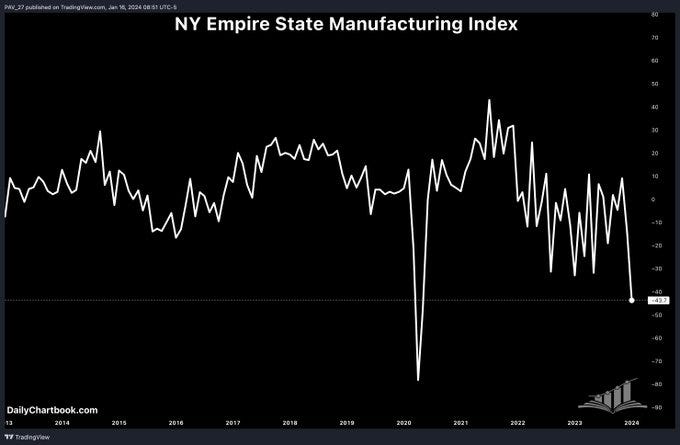

3. Empire State Manufacturing (I). The NY Empire State Manufacturing Index dropped to its lowest reading ever (ex-Covid) in January driven by sharp declines in new orders and shipments.

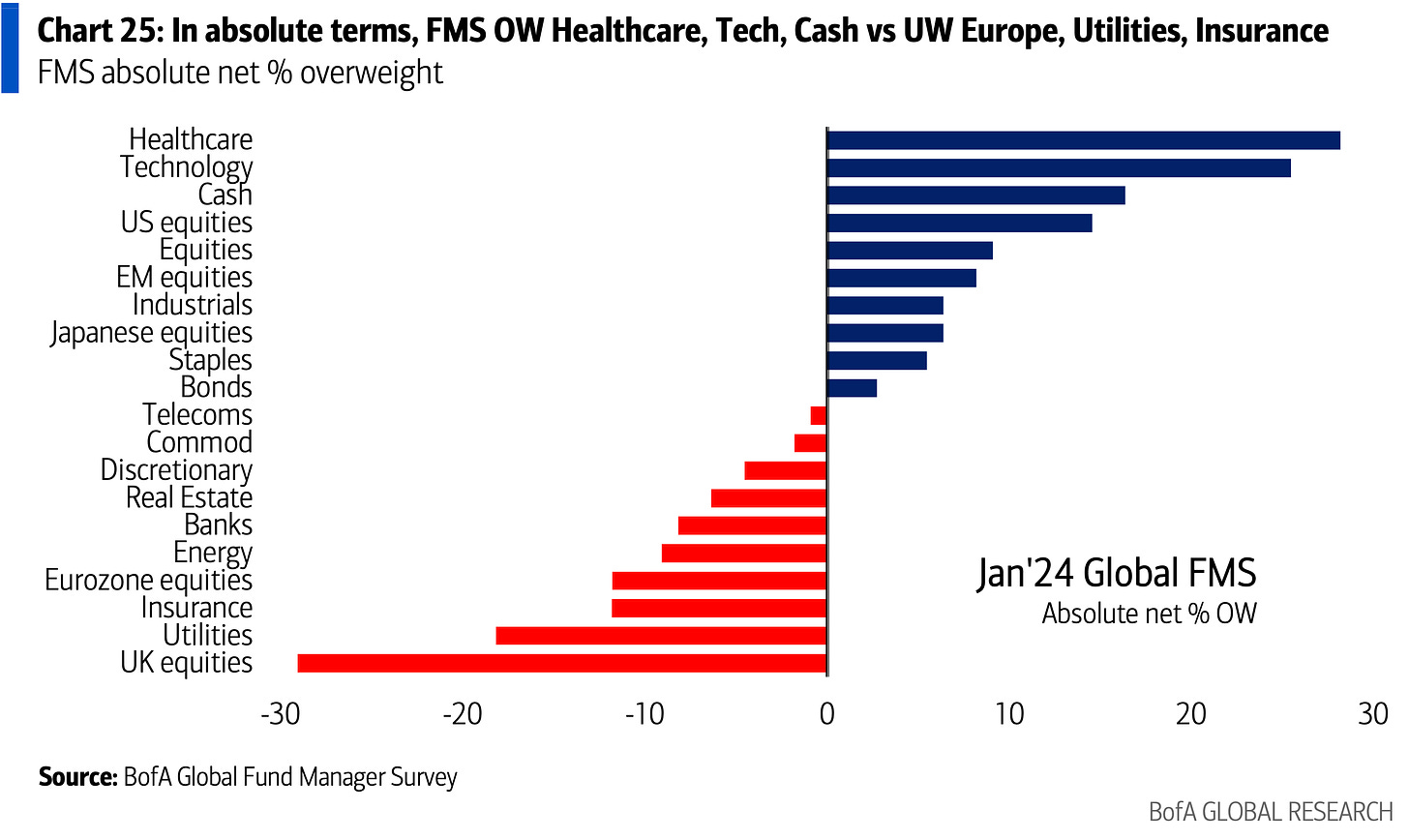

4. FMS positioning. FMS investors are most overweight Healthcare, Tech, Cash, and US stocks. They are most underweight UK stocks, Utilities, and Insurance.

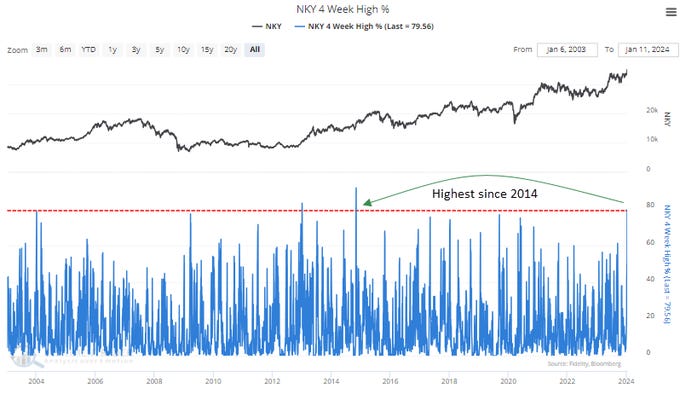

5. Japanese equities. "After consolidating for six months, the Nikkei 225 broke out this week to a 34-year high. Participation was spectacular, with more than 79% of index members registering a new 4-week high, reaching the highest level in almost a decade."

Thanks for reading!